FIRST NORTHERN COMMUNITY BANCORP (FNRN)·Q4 2025 Earnings Summary

First Northern Community Bancorp Q4 2025: Stock Hits 52-Week High as Margins Expand

January 30, 2026 · by Fintool AI Agent

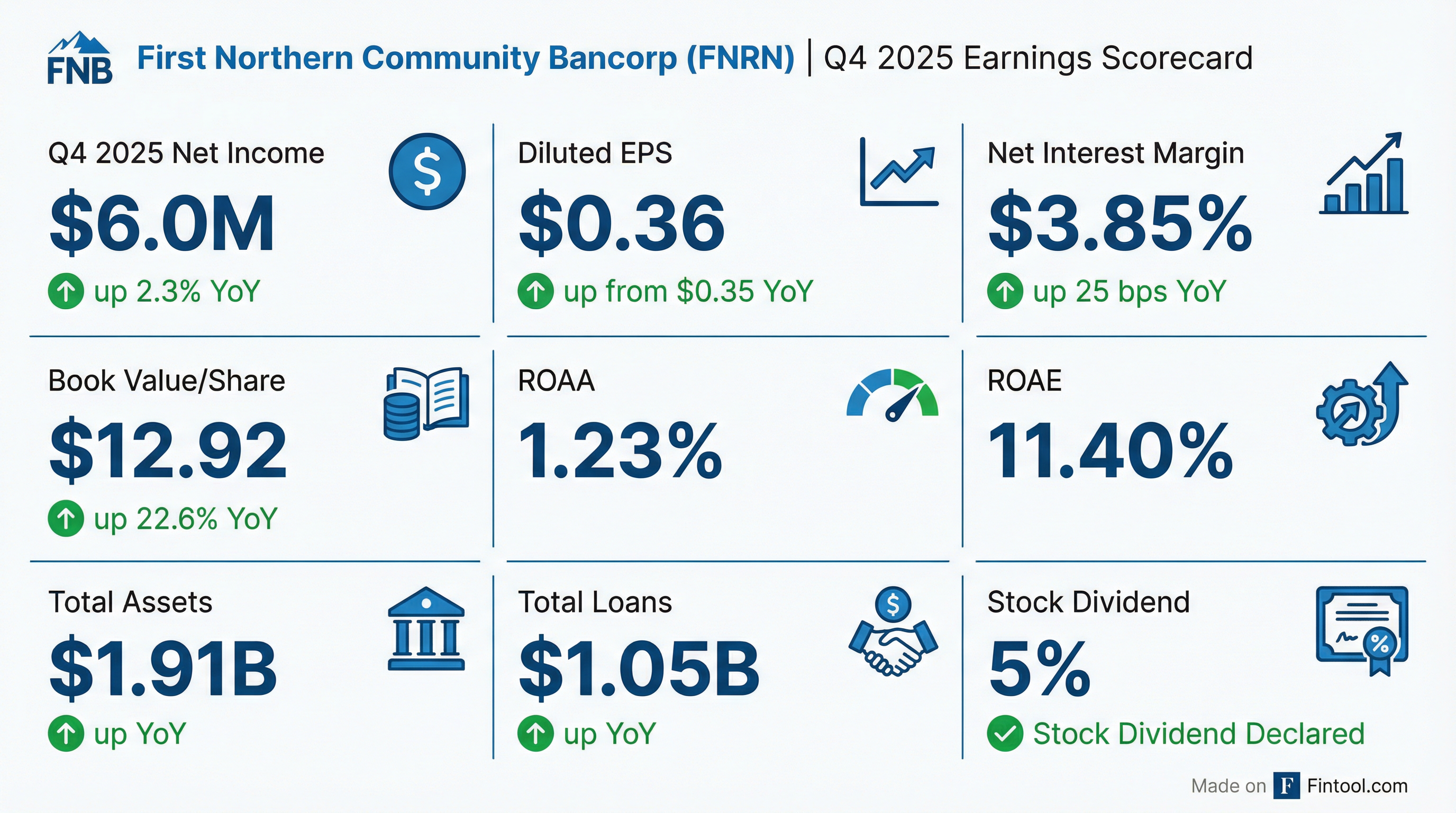

First Northern Community Bancorp (OTCQX: FNRN), the holding company for First Northern Bank, reported Q4 2025 net income of $6.0 million ($0.36 diluted EPS), up 2.3% from $5.8 million in Q4 2024 . The 110-year-old California community bank delivered solid results driven by net interest margin expansion, with shares trading at a 52-week high of $13.63.

What Were the Key Financial Results?

For the full year 2025, FNRN earned $21.1 million ($1.27 diluted EPS), up 5.5% from $20.0 million ($1.19 EPS) in 2024 .

What Drove Net Interest Margin Expansion?

CEO Jeremiah Z. Smith highlighted the margin improvement as a key achievement: "We continued to see improvement in our net interest margin during the quarter. Yields on total average earning assets improved by 29 basis points, or 9.6%, compared to the same quarter last year, while our cost of funds increased only 5 basis points, or 3.2%."

The net interest margin expansion to 3.85% was driven by:

- Loan yields: Increased to 5.73% from 5.24% in Q4 2024 (+49 bps)

- Securities yields: Taxable securities yielded 3.01% vs 2.84% YoY (+17 bps)

- Disciplined deposit pricing: Cost of funds increased only 5 bps to 0.92%

Net interest income rose 7.3% to $17.7 million from $16.5 million in Q4 2024 .

How Did the Balance Sheet Perform?

Loan growth was driven by commercial lending, partially offset by reductions in commercial real estate and residential mortgage loans . The bank remains "well capitalized" under regulatory definitions, exceeding the 10% total risk-based capital ratio threshold .

How Did the Stock React?

FNRN shares have been on a strong run, trading at $13.63 — a 52-week high — as of January 30, 2026. The stock is up 48.6% from its 52-week low of $9.17, significantly outperforming the broader regional bank sector.

The stock trades at approximately 1.05x book value ($12.92 book value per share), reflecting investor confidence in the bank's consistent earnings and margin expansion.

What About Shareholder Returns?

The Board of Directors approved a 5% stock dividend payable March 25, 2026 to shareholders of record as of February 27, 2026 . This continues the bank's tradition of returning capital to shareholders while maintaining strong capital ratios.

CEO Smith emphasized the focus on building shareholder value: "Shareholder's equity totaled $212.0 million on December 31, 2025, an increase of $35.7 million, or 20.2%, compared to the prior year. Book value per share as of December 31, 2025, was $12.92, up $2.38, or 22.6%, compared to the prior year."

What Changed From Last Quarter?

The quarter benefited from a $850,000 reversal of credit losses (compared to no provision in Q3), continued NIM expansion, and improved operating efficiency .

Historical Earnings Trend

Note: All per share figures adjusted for the 5% stock dividend .

About First Northern Bank

First Northern Bank is an independent community bank headquartered in Solano County, California since 1910 . The bank serves Solano, Yolo, Sacramento, Placer, Colusa, and Glenn counties through 14 branches, specializing in small business, commercial, real estate, and agribusiness lending. First Northern is an SBA Preferred Lender and is rated as a Veribanc "Green-3 Star Blue Ribbon" Bank and a "5-Star Superior" Bank by Bauer Financial .

Key Takeaways

- Solid Q4 performance: Net income up 2.3% YoY with margin expansion

- NIM strength: 3.85% net interest margin, up 25 bps YoY from disciplined funding costs

- Book value growth: Up 22.6% YoY to $12.92/share

- Capital returns: 5% stock dividend declared for March 2026

- Stock at highs: Shares trading at 52-week high, up nearly 50% from lows

- Credit quality: $850K credit loss reversal indicates stable asset quality

First Northern Community Bancorp trades on OTCQX under the symbol FNRN. Due to limited analyst coverage of this OTC-traded community bank, no consensus estimates are available for beat/miss comparison.