First Northwest Bancorp (FNWB)·Q4 2025 Earnings Summary

First Northwest Bancorp Posts Turnaround Quarter as NIM Hits 3.00%

January 29, 2026 · by Fintool AI Agent

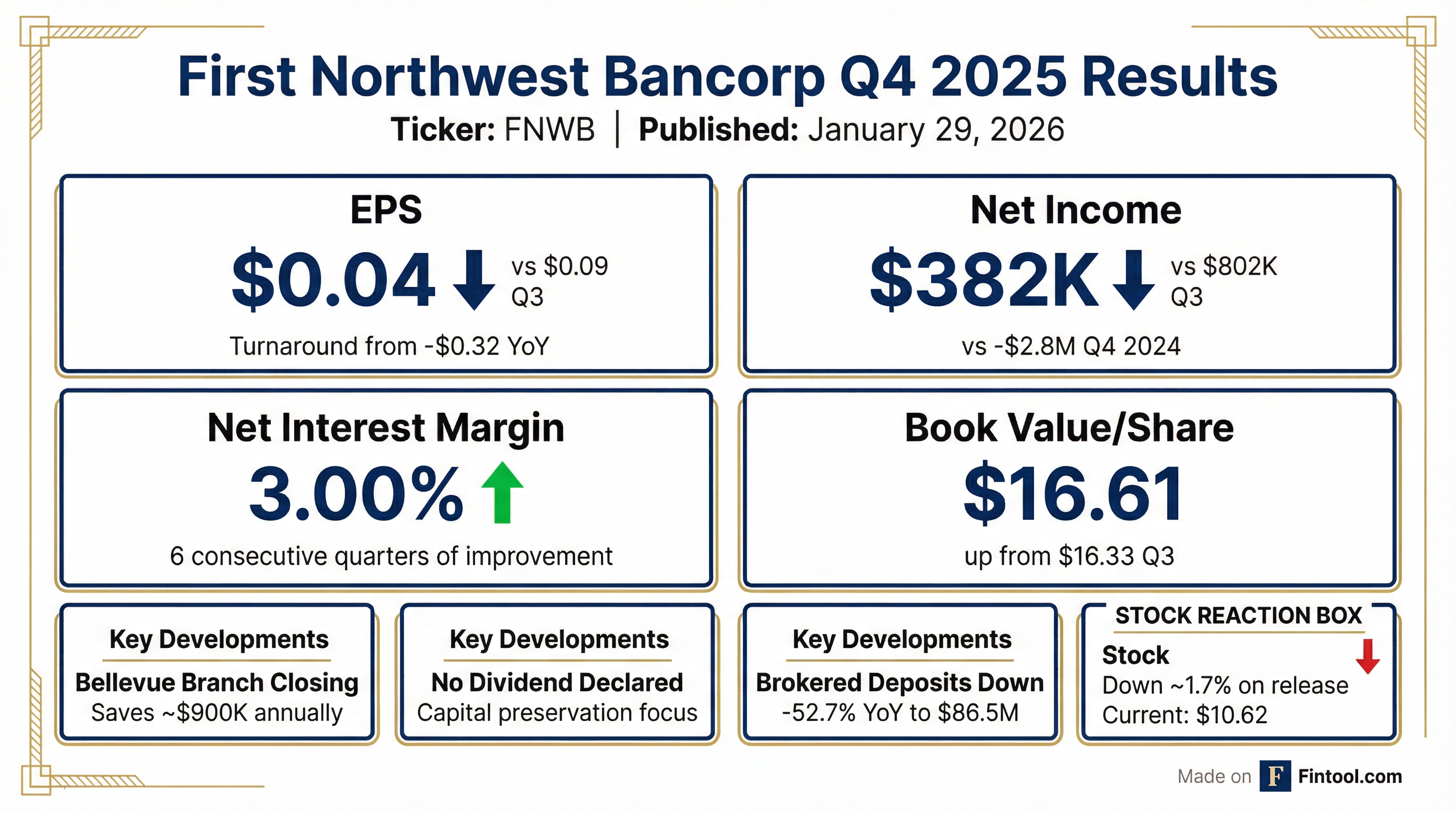

First Northwest Bancorp (FNWB) reported Q4 2025 net income of $382,000, or $0.04 per share, marking a dramatic turnaround from the $2.8 million loss ($0.32 loss per share) in Q4 2024 . While down sequentially from Q3 2025's $802,000 profit, the quarter showcased continued improvement in core fundamentals, particularly net interest margin, which hit 3.00%—the highest level in two years .

The Pacific Northwest-based community bank, which operates 17 locations in Washington state, also announced the closure of its Bellevue branch and suspended dividend payments as management focuses on positioning the company for sustainable profitability in 2026 .

Did First Northwest Beat Earnings?

With limited analyst coverage, direct beat/miss comparisons are unavailable. Here's what we know:

The year-over-year improvement is unmistakable: from a significant loss to modest profitability, with core metrics trending favorably.

What's Driving the Turnaround?

Net Interest Margin: Six Consecutive Quarters of Improvement

The headline story is margin expansion. NIM increased to 3.00% from 2.91% in Q3 2025, marking the sixth consecutive quarter of improvement . The total improvement over this period is 30 basis points.

What's driving NIM expansion:

- Lower deposit costs: Cost of total deposits dropped to 2.12% from 2.20% in Q3 as higher-rate CDs matured

- Rate cuts flowing through: Rates on selected deposit products were lowered following Fed rate cuts

- Brokered deposit reduction: Brokered CDs down $96.4M or 52.7% YoY to $86.5M

Strategic Cost Actions

Management announced the permanent closure of the Bellevue branch (effective April 30, 2026), expected to reduce annual operating expenses by approximately $900,000 .

CEO Curt Queyrouze framed it as adapting to customer behavior:

"Customer preferences continue to evolve, and we are seeing that, for this location, the use of online and mobile banking services continues to become more prevalent than in-person visits."

The quarter included $681,000 of one-time expenses related to this closure .

What Did Management Say About 2026?

CEO Curt Queyrouze struck an optimistic tone:

"As we enter 2026, we are building on momentum that began in 2025. Our focus is clear: to position First Fed as a high-performing bank by leveraging data to operate more efficiently, strengthening our core deposit base and generating high-quality, relationship-based loan growth."

Key strategic priorities:

- Data-driven efficiency improvements

- Core deposit growth (reducing reliance on brokered deposits)

- Relationship-based lending focus

What Are the Concerns?

Credit Quality Deterioration

Nonperforming loans increased $9.2 million to $22.6 million at quarter-end from $13.4 million in Q3 . Key drivers:

- A $6.3 million commercial real estate loan moved to nonaccrual

- Four commercial business loans totaling $4.7 million transitioned to nonaccrual

The ACLL to nonperforming loans ratio fell to 75% from 121% in Q3 , though management notes the commercial business loans are fully supported by collateral and SBA guarantees .

Ongoing Legal Matters

The bank continues to defend previously disclosed legal proceedings, including the Socotra REIT and 3|5|2 Capital matters . Positively, an insurance reimbursement of $1.7 million was received in Q4 to offset prior legal costs .

Sequential Earnings Decline

While profitable, net income fell 52% sequentially from Q3's $802,000 to $382,000 , reflecting:

- Higher provision expense of $466,000 vs. recapture of $620,000 in Q3

- Branch closure costs of $681,000

Capital Position and Dividend

The Board did not declare a dividend, citing "disciplined approach to capital management and commitment to maintaining a strong balance sheet" .

Capital ratios remain solid:

The bank remains well-capitalized with 846,123 shares remaining under its stock repurchase plan, though no repurchases occurred in Q4 .

How Did the Stock React?

FNWB shares opened at $10.80 on the earnings release and traded down to $10.62, a decline of approximately 1.7% on the day against a relatively stable regional bank sector.

Context on the stock:

- Current price: $10.62

- 52-week range: $6.05 - $12.10

- Book value per share: $16.61 (trading at 0.64x book)

- Market cap: ~$95M

The stock has rallied significantly from its 2024 lows around $6, up over 75% as the turnaround story has developed.

Balance Sheet Highlights

Deposit mix shift:

- Customer deposits shifted toward savings and money market accounts

- Brokered CDs fell sharply to $86.5M from $182.9M YoY

- FHLB advances increased $48.5M to $273.5M to offset deposit outflows

What to Watch Going Forward

- NIM sustainability: Can the bank maintain 3%+ NIM as rate cuts continue?

- Credit quality: Nonperforming loan trends need monitoring given Q4 increase

- Expense efficiency: Bellevue closure savings should begin flowing through in H2 2026

- Legal resolution: Settlement or favorable outcomes in pending litigation

- Dividend reinstatement: When will the Board feel comfortable resuming payouts?

Full Year 2025 Summary

The full year loss narrowed significantly as credit provisions moderated from the elevated 2024 levels.

Company: First Northwest Bancorp | Q4 2025 8-K Filing