Earnings summaries and quarterly performance for First Northwest Bancorp.

Executive leadership at First Northwest Bancorp.

Board of directors at First Northwest Bancorp.

CH

Cindy H. Finnie

Detailed

Chair of the Board

DD

Dana D. Behar

Detailed

Director

GS

Gabriel S. Galanda

Detailed

Director

JA

Johanna A. Bartee

Detailed

Director

LA

Lynn A. Terwoerds

Detailed

Director

NJ

Norman J. Tonina, Jr.

Detailed

Director

SP

Sean P. Brennan

Detailed

Director

SG

Sherilyn G. Anderson

Detailed

Vice Chair of the Board

Research analysts covering First Northwest Bancorp.

Recent press releases and 8-K filings for FNWB.

First Northwest Bancorp Announces Fourth Quarter 2025 Results

FNWB

Earnings

Demand Weakening

Dividends

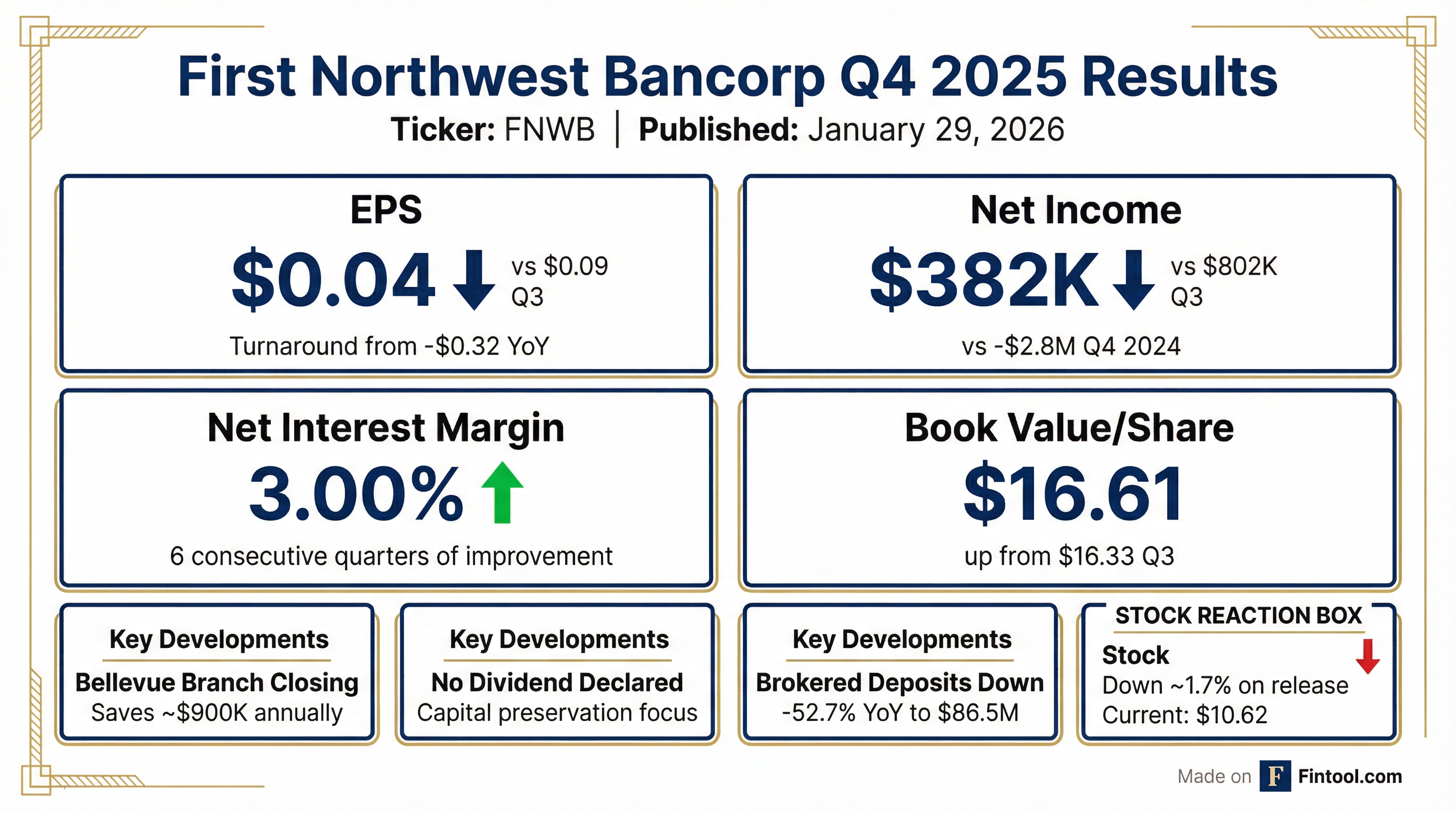

- First Northwest Bancorp reported net income of $382,000 and basic and diluted income per share of $0.04 for the fourth quarter of 2025.

- Total deposits decreased by $54.2 million to $1.6 billion at December 31, 2025, compared to September 30, 2025, with brokered deposits decreasing by $17.9 million (17.1%) to $86.5 million at December 31, 2025.

- Nonperforming loans increased by $9.2 million to $22.6 million at December 31, 2025, from $13.4 million at September 30, 2025.

- The company will permanently close its Bellevue branch on April 30, 2026, which is expected to reduce future annual operating expenses by approximately $900,000.

- The Board of Directors did not declare a dividend for the current quarter.

Jan 29, 2026, 4:09 PM

First Northwest Bancorp Announces Third Quarter 2025 Results

FNWB

Earnings

Dividends

Management Change

- First Northwest Bancorp reported net income of $802,000 and basic and diluted income per share of $0.09 for the third quarter of 2025, compared to net income of $3.7 million and EPS of $0.42 in the second quarter of 2025, and a net loss of $2.0 million and loss per share of $0.23 for the third quarter of 2024.

- The Board of Directors elected not to declare a dividend for the third quarter of 2025 as part of a prudent approach to capital management.

- The company's net interest margin increased to 2.91% for the third quarter of 2025, up from 2.83% in the preceding quarter and 2.70% in the third quarter of 2024, marking five consecutive quarters of improvement.

- First Fed's risk-based capital ratios improved to 13.7% for the third quarter of 2025, compared to 13.1% in the second quarter of 2025 and 13.4% for the third quarter of 2024.

- Noninterest expense increased by $4.6 million to $17.4 million for the third quarter of 2025, primarily due to $1.1 million in nonrecurring executive transition costs and a $1.6 million increase in legal fees over the preceding quarter.

Oct 27, 2025, 3:41 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more