Finward Bancorp (FNWD)·Q4 2025 Earnings Summary

Finward Bancorp Q4 2025: NIM Expansion Continues Despite Securities Loss

January 27, 2026 · by Fintool AI Agent

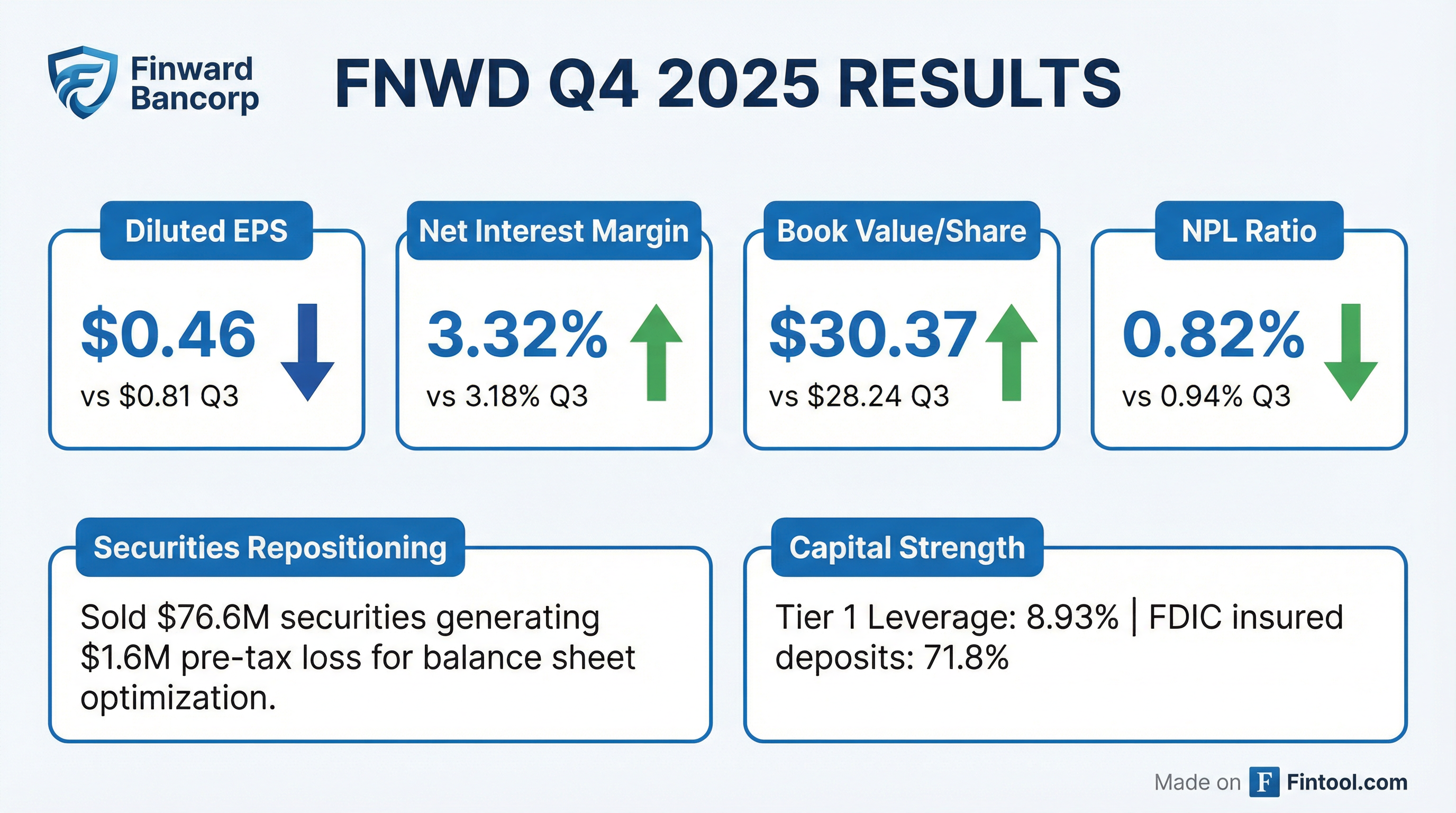

Finward Bancorp (NASDAQ: FNWD), the holding company for Peoples Bank, reported Q4 2025 net income of $2.0 million, or $0.46 per diluted share, down from $3.5 million ($0.81 per diluted share) in Q3 2025 . The sequential decline was primarily driven by a strategic securities repositioning that generated a $1.6 million pre-tax loss. However, underlying operational trends remained positive with net interest margin expanding for the fifth consecutive quarter.

What Were the Key Q4 2025 Metrics?

For full-year 2025, diluted EPS was $1.88 compared to $2.84 in 2024 .

Why Did EPS Decline Quarter-Over-Quarter?

The $0.35 sequential EPS decline was primarily driven by two factors:

1. Securities Repositioning ($1.6M Pre-Tax Loss) The bank sold $26.6 million in primarily municipal securities with an unadjusted book yield of 2.59%, generating a $1.6 million pre-tax loss . CEO Benjamin Bochnowski framed this as a strategic move to "optimize our balance sheet, reduce risk, increase net interest margin, and improve efficiency" .

2. Higher Operating Expenses Non-interest expense increased to 2.90% of average assets from 2.74% in Q3, driven by higher compensation, data processing, and occupancy costs .

Did Net Interest Margin Continue to Expand?

Yes. The tax-equivalent net interest margin expanded to 3.32%, up 14 basis points from Q3 and 53 basis points from Q4 2024 . This marks the fifth consecutive quarter of NIM expansion.

Key margin drivers:

- Loan yields increased to 5.64% from 5.49% QoQ, benefiting from repricing

- Deposit costs declined to 2.09% from 2.16% as Fed rate cuts flowed through

- Net interest spread widened to 2.80% from 2.66%

What Is the Credit Quality Outlook?

Credit metrics improved across the board:

Non-performing loans totaled $11.9 million, down $2.0 million (14.3%) from Q3 . Management noted they maintain "vigilant oversight of nonperforming loans through proactive relationship management" and have "no known credit exposures to non-depositary financial institutions" .

CRE Exposure: Commercial real estate totaled $555.6 million (38.3% of loans), with office exposure limited to $42.1 million (2.9% of total loans) .

How Is Capital Position?

The bank's capital position strengthened meaningfully:

Accumulated other comprehensive loss (AOCI) improved by $7.6 million to ($41.7 million), contributing to the book value increase . Excluding AOCI, tangible book value was $44.55, up from $44.16 in Q3 .

Dividend: The bank declared a $0.12 quarterly dividend, consistent with Q2 and Q3 2025 .

What Changed From Last Quarter?

Improved:

- NIM expansion accelerated (+14 bps vs +7 bps in Q3)

- NPL ratio declined meaningfully (0.82% vs 0.94%)

- Book value increased $2.13 to $40.37

- AOCI improved by $7.6 million

- No remaining brokered deposits

Deteriorated:

- EPS down 43% QoQ due to securities loss

- Efficiency ratio worsened to 89.50%

- Loan portfolio contracted 1.6% QoQ

- Deposit base declined $23.7 million (1.4%)

How Did the Stock React?

FNWD shares traded up 0.4% to $36.64 on earnings day. The muted reaction suggests the market looked through the one-time securities loss and focused on the underlying NIM expansion and credit quality improvement.

The stock trades at a slight premium to tangible book value ($34.92) but below GAAP book value ($40.37).

What Did Management Say About the Outlook?

CEO Benjamin Bochnowski struck an optimistic tone:

"Operational results were significantly stronger in 2025 than 2024, reflecting the execution of successful strategic initiatives that have strengthened our organization over that time. While we continue to aim higher, these results reflect the hard work our team has put in throughout the year."

"Actions taken in the fourth quarter are expected to further enhance our financial position... The current rate environment remains supportive of continued progress in operational results in 2026."

Key forward-looking points:

- Balance sheet optimization actions expected to enhance financial position

- Rate environment remains supportive for 2026

- Bank focused on identifying additional operating efficiencies and third-party expense reductions

What Are the Key Risks?

The 8-K highlighted several risk factors:

- Regulatory Oversight: The bank operates under a memorandum of understanding with the FDIC and Indiana DFI

- Dividend Restrictions: Cash dividends require prior regulatory approval under the MOU

- Interest Rate Sensitivity: Further rate changes could impact NIM trajectory

- CRE Concentration: 38% of loans in commercial real estate, though office exposure is limited

- Deposit Competition: Core deposits flat YoY amid competitive environment

Balance Sheet Summary

Liquidity: Available liquidity of $674 million including FHLB and Fed borrowing capacity . FDIC insured deposits represent 71.8% of total, with an additional 7.3% backed by the Indiana Public Deposit Insurance Fund .

Finward Bancorp is headquartered in Munster, Indiana and operates 26 Peoples Bank branches across Lake and Porter Counties in Northwest Indiana and Chicagoland .

Related Links: