Earnings summaries and quarterly performance for Finward Bancorp.

Executive leadership at Finward Bancorp.

Benjamin Bochnowski

President and Chief Executive Officer; Chief Executive Officer of Peoples Bank

Benjamin Schmitt

Executive Vice President, Chief Financial Officer and Treasurer

David Kwait

Senior Vice President, Chief Risk Officer, General Counsel and Secretary

Robert Lowry

Executive Vice President, Chief Operating Officer

Todd Scheub

Executive Vice President, Chief Revenue Officer; President of Peoples Bank

Board of directors at Finward Bancorp.

Amy Han

Director

Anthony Puntillo

Vice-Chairman of the Board

Carolyn Burke

Director

Danette Garza

Director

Jennifer Evans

Director

Joel Gorelick

Chairman of the Board

Martin Alwin

Director

Robert Johnson III

Director

Robert Youman

Director

Research analysts covering Finward Bancorp.

Recent press releases and 8-K filings for FNWD.

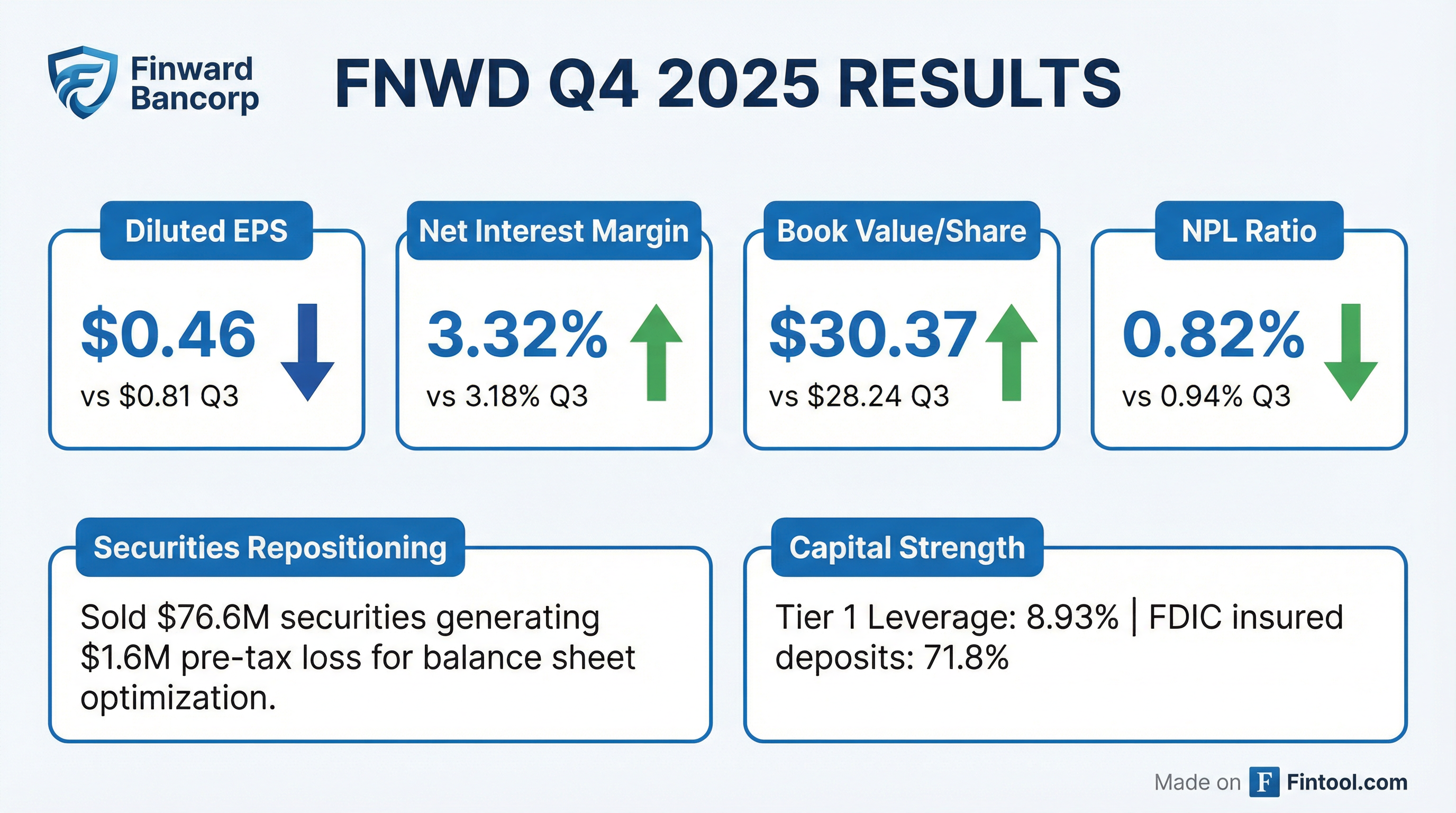

- Finward Bancorp reported net income available to common stockholders of $2.0 million, or $0.46 per diluted share, for the fourth quarter ended December 31, 2025, a decrease from $3.5 million, or $0.81 per diluted share, in the prior quarter.

- The company's net interest margin on a tax-equivalent basis increased to 3.32% for Q4 2025 from 3.18% in Q3 2025, while return on assets was 0.39% and return on equity was 4.66% for the quarter.

- CEO Benjamin Bochnowski stated that operational results were significantly stronger in 2025 than 2024, and actions taken in Q4, including a $26.6 million securities repositioning, are expected to enhance the financial position, despite resulting in a $1.6 million pre-tax reduction to Q4 results.

- The tangible book value per share (non-GAAP) increased to $34.92 at December 31, 2025, from $32.77 at September 30, 2025, and the Tier 1 leverage ratio improved to 8.93% from 8.77% over the same period.

- Finward Bancorp reported net income available to common stockholders of $2.0 million, or $0.46 per diluted share, for the quarter ended December 31, 2025, a decrease from $3.5 million, or $0.81 per diluted share, in the prior quarter, partly due to a $1.6 million pre-tax reduction from a securities repositioning.

- The company's net interest margin, tax-equivalent, improved to 3.32% for Q4 2025, up from 3.18% in Q3 2025, driven by increased loan yields and reduced deposit costs.

- Asset quality improved with non-performing loans decreasing by 14.3% to $11.9 million at December 31, 2025, and the ratio of non-performing loans to total loans falling to 0.82%.

- Total deposits decreased by 1.4% to $1.7 billion as of December 31, 2025, compared to September 30, 2025.

- Finward Bancorp reported net income available to common stockholders of $3.5 million, or $0.81 per diluted share, for the quarter ended September 30, 2025, a significant increase from $2.2 million, or $0.50 per diluted share, in the prior quarter ended June 30, 2025.

- The company achieved margin expansion, with the tax-equivalent net interest margin rising to 3.18% for Q3 2025 from 3.11% in Q2 2025. The efficiency ratio improved to 81.22% in Q3 2025 from 88.92% in Q2 2025, primarily due to lower non-interest expenses.

- Total deposits remained stable at $1.8 billion as of September 30, 2025, with non-interest-bearing deposits increasing by $9.1 million. The aggregate loan portfolio also remained stable at $1.5 billion.

- Non-performing loans saw a slight increase to $13.9 million at September 30, 2025, from $13.5 million at June 30, 2025, resulting in a non-performing loans to total loans ratio of 0.94%. The allowance for credit losses (ACL) on loans was $18.0 million, representing 1.22% of total loans receivable.

- Finward Bancorp reported net income available to common stockholders of $3.5 million, or $0.81 per diluted share, for the third quarter ended September 30, 2025, an increase from $2.2 million or $0.50 per diluted share in the prior quarter.

- Key performance ratios improved, with Return on Equity at 8.96% and the Efficiency Ratio at 81.22% for Q3 2025, compared to 5.66% and 88.92% respectively in Q2 2025.

- The net interest margin on a tax-equivalent basis expanded to 3.18% for the quarter ended September 30, 2025, up from 3.11% in the previous quarter, driven by increased loan yields.

- Deposits totaled $1.8 billion as of September 30, 2025, a slight increase of $4.2 million, and the Bancorp maintained $737 million in available liquidity.

- Non-performing loans increased slightly to $13.9 million (0.94% of total loans) at September 30, 2025, but the allowance for credit losses to non-performing loans remained robust at 129.4%.

- Finward Bancorp will present financial and other information to investors at the 2025 Stephens Banking Forum in Little Rock, Arkansas.

- As of June 30, 2025, the company reported Total Assets of $2,057 Million, Total Gross Loans of $1,484 Million, and Total Deposits of $1,755 Million.

- The tax-adjusted net interest margin (NIM) for the three months ended June 30, 2025, was 3.11%, an increase from 2.95% for the three months ended March 31, 2025.

- Total deposits increased by $4.5 million during the three months ended June 30, 2025, with 72% of deposits fully FDIC insured.

- The Bank's Tier 1 capital to adjusted average assets ratio was 8.69% at June 30, 2025, which is considered well capitalized by regulatory definition.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more