Earnings summaries and quarterly performance for FIRST INDUSTRIAL REALTY TRUST.

Executive leadership at FIRST INDUSTRIAL REALTY TRUST.

Peter Baccile

President and Chief Executive Officer

Jennifer Matthews Rice

General Counsel and Secretary

Johannson Yap

Chief Investment Officer and Executive Vice President - West Region

Peter Schultz

Executive Vice President - East Region

Scott Musil

Chief Financial Officer

Board of directors at FIRST INDUSTRIAL REALTY TRUST.

Research analysts who have asked questions during FIRST INDUSTRIAL REALTY TRUST earnings calls.

Blaine Heck

Wells Fargo Securities

8 questions for FR

Brendan Lynch

Barclays

8 questions for FR

Caitlin Burrows

Goldman Sachs

8 questions for FR

Craig Mailman

Citigroup

8 questions for FR

Vikram Malhotra

Mizuho Financial Group, Inc.

8 questions for FR

Michael Mueller

JPMorgan Chase & Co.

6 questions for FR

Nicholas Thillman

Robert W. Baird & Co.

6 questions for FR

Todd Thomas

KeyBanc Capital Markets

6 questions for FR

Vince Tibone

Green Street

6 questions for FR

Michael Carroll

RBC Capital Markets

5 questions for FR

Robert Stevenson

Janney Montgomery Scott LLC

4 questions for FR

Greg McGinniss

Scotiabank

3 questions for FR

Ki Bin Kim

Truist Securities

3 questions for FR

Nicholas Yulico

Scotiabank

3 questions for FR

Richard Anderson

Wedbush Securities

3 questions for FR

Jessica Zheng

Green Street Advisors, LLC

2 questions for FR

Mike Mueller

JPMorgan Chase & Co.

2 questions for FR

Omotayo Okusanya

Deutsche Bank AG

2 questions for FR

Rich Anderson

Cantor Fitzgerald

2 questions for FR

Rob Stevenson

Janney Montgomery Scott

2 questions for FR

Viktor Fediv

Scotiabank

2 questions for FR

Teo Oksana

Deutsche Bank

1 question for FR

Recent press releases and 8-K filings for FR.

- Land & Buildings Investment Management has issued a letter detailing the need for change at First Industrial Realty Trust (FR), citing an insular boardroom culture and a persistent discount to its Net Asset Value (NAV) and closest peers.

- Land & Buildings estimates FR's NAV at $73 per share, suggesting approximately 20% additional upside to the current share price, while noting FR trades at a mid-6% implied cap rate compared to peers in the low 5% range.

- The activist investor highlights FR's underperformance against its proxy compensation peers, including a 17% underperformance over the trailing four-year period and 4% over the trailing three-year period.

- Land & Buildings urges FR's Board to take immediate steps, including committing to a plan to close the NAV discount, initiating a $500M–$1B asset disposition program with proceeds returned to shareholders, and has nominated its founder, Jonathan Litt, as a director candidate for the 2026 annual meeting.

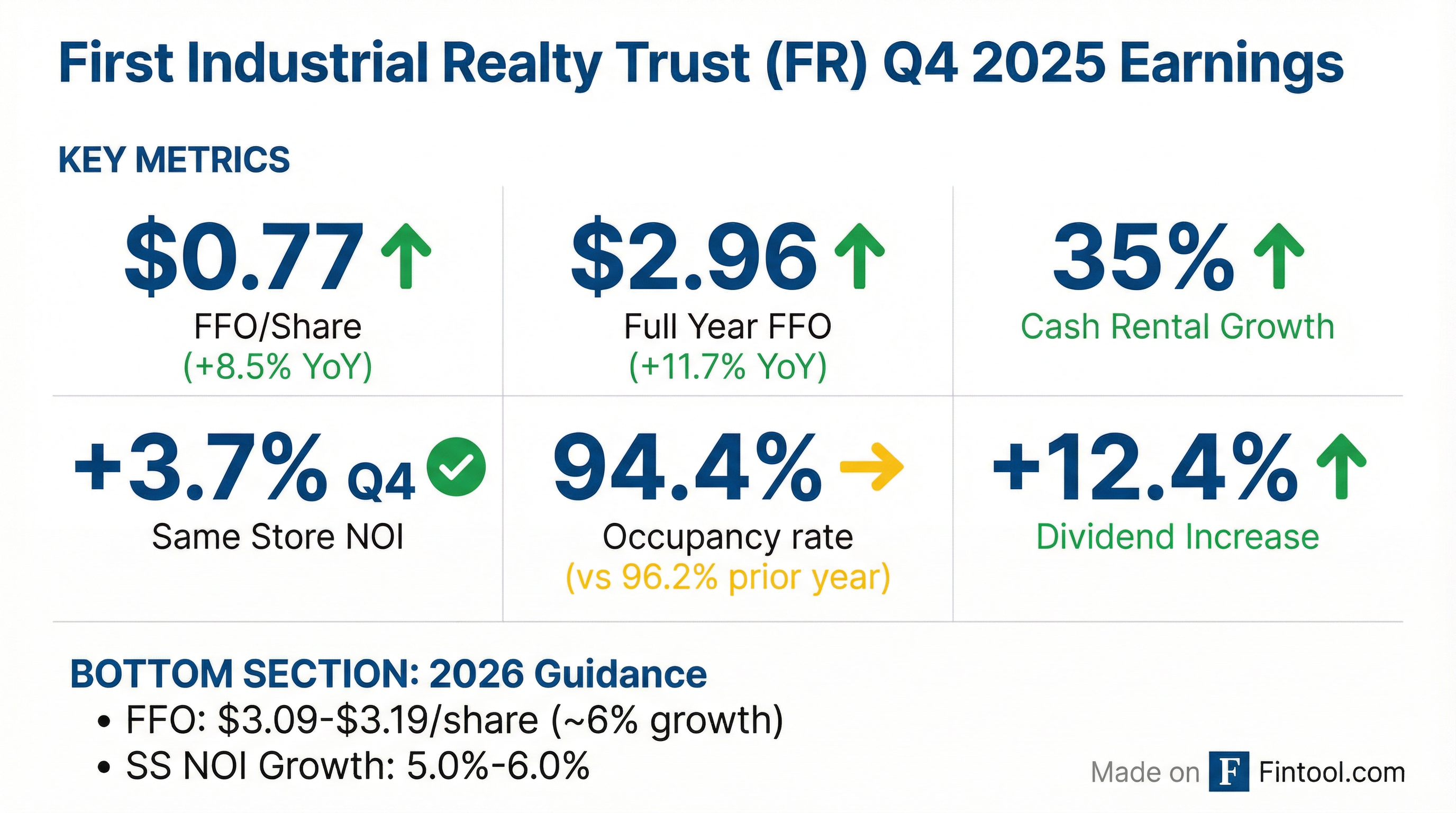

- FR reported Q4 2025 FFO (NAREIT) of $104,389 thousand and FY 2025 FFO (NAREIT) of $403,823 thousand, with FY 2025 EPS of $2.98.

- Operational performance for the full year 2025 included a 7.1% increase in Same Store NOI Cash Basis and 32.2% cash basis rent growth on new and renewal leases, with an in-service occupancy rate of 94.4% as of December 31, 2025.

- On January 22, 2026, the company refinanced its $425M TL and $300M TL (expanded to $375M TL), extending their maturity dates.

- For 2026, FR provided FFO (NAREIT) guidance of $3.09 to $3.19 per share/unit and projects Annual Same Store NOI Growth (Cash Basis) between 5.0% and 6.0%.

- First Industrial Realty Trust Inc. reported Q4 2025 NAREIT FFO of $0.77 per fully diluted share and full year 2025 FFO of $2.96 per fully diluted share, marking a 12% increase from 2024.

- For full year 2025, cash same-store NOI growth was 7.1% (excluding termination fees), and the cash rental rate increase on new and renewal leasing was 32%.

- The company provided initial 2026 guidance with a NAREIT FFO midpoint of $3.14 per share (range $3.09-$3.19) and full-year average cash same-store NOI growth of 5%-6%.

- The board declared a first quarter dividend of $0.50 per share, an increase of 12.4%, and the company refinanced two unsecured term loans.

- In-service occupancy finished Q4 2025 at 94.4%, and 45% of 2026 rollovers have been addressed with a 35% cash rental rate increase on new and renewal leasing.

- Q4 2025 NAREIT FFO was $0.77 per fully diluted share, contributing to a full-year 2025 FFO of $2.96 per fully diluted share, a 12% increase from 2024.

- The company issued initial 2026 NAREIT FFO guidance with a midpoint of $3.14 per share and projects full-year average cash same-store NOI growth of 5%-6%.

- First Industrial reported a 32% cash rental rate increase on new and renewal leasing for 2025 and expects 30%-40% cash rental rate growth for the full year 2026.

- In Q4 2025, the company acquired 1.085 million sq ft of properties for $156 million and declared a first quarter dividend of $0.50 per share, marking a 12.4% increase.

- First Industrial Realty Trust Inc. reported NAREIT FFO of $0.77 per fully diluted share for Q4 2025 and $2.96 per fully diluted share for the full year 2025, representing a 12% increase over 2024. Cash same-store NOI growth for the full year 2025, excluding termination fees, was 7.1%.

- The company provided initial guidance for 2026, with a NAREIT FFO midpoint of $3.14 per share (range of $3.09-$3.19 per share) and expected full-year average cash same-store NOI growth of 5%-6%.

- Operational highlights include a 32% cash rental rate increase on new and renewal leasing for 2025, with annual escalators for 2025 commencements at 3.7%. The company has already addressed 45% of its 2026 rollovers by square footage, with an overall cash rental rate increase for new and renewal leasing of 35%.

- In Q4 2025, First Industrial acquired a 968,000 sq ft building for $125 million from a joint venture that achieved an overall IRR of 90%, and a 117,000 sq ft facility for $31 million. The company is also breaking ground on two new development projects in Q1 2026 with a total investment of $70 million and a combined projected cash yield of approximately 7%.

- The board of directors declared a Q1 2026 dividend of $0.50 per share, an increase of 12.4%.

- First Industrial Realty Trust reported diluted EPS of $0.59 for Q4 2025 and $1.87 for the full year 2025, with diluted FFO of $0.77 per share/unit for Q4 2025 and $2.96 per share/unit for the full year 2025, marking an 11.7% growth from 2024.

- The company initiated its 2026 NAREIT FFO guidance at a range of $3.09 to $3.19 per share/unit, representing approximately 6% growth at the midpoint.

- The board of directors increased the First Quarter 2026 dividend to $0.50 per share, a 12.4% increase from the prior rate.

- For the full year 2025, Cash Same Store NOI grew by 7.1%, and cash rental rates on leases commencing in 2025 increased by 32%.

- Strategic activities include the Q4 2025 acquisition of a 968,000 square-foot building in Phoenix for $125 million and the commencement of two developments in Q1 2026 totaling 305,000 square feet with an estimated investment of $70 million.

- First Industrial Realty Trust reported full year 2025 FFO of $2.96 per share/unit, an 11.7% increase over 2024, and Q4 2025 FFO of $0.77 per share/unit.

- The company initiated 2026 NAREIT FFO guidance at a range of $3.09 to $3.19 per share/unit, representing approximately 6% growth at the midpoint, and increased the First Quarter 2026 dividend to $0.50 per share, a 12.4% increase.

- Operational performance included a 32% cash rental rate increase on leases commencing in 2025, 35% on leases signed to date commencing in 2026, and 7.1% Cash Same Store NOI growth for the full year 2025.

- Strategic activities included the acquisition of a 968,000 square-foot building for $125 million in Q4 2025 and the commencement of two developments totaling 305,000 square feet with an estimated investment of $70 million in 1Q26.

- First Industrial Realty Trust (FR) refinanced its $425 million unsecured term loan, establishing an initial maturity date of January 22, 2030, with interest-only payments at SOFR plus 85 basis points.

- The company also refinanced and expanded its $300 million term loan to $375 million, with an initial maturity date of January 22, 2029, also featuring interest-only payments at SOFR plus 85 basis points.

- In conjunction with these refinancings, the 10 basis point SOFR adjustment was eliminated from both new loans and an existing $200 million unsecured term loan.

- According to CFO Scott Musil, these refinancings provide capital to support the company's long-term growth.

- For Q3 2025, Total Revenues were $181,430 , while Net Income Available to Common Stockholders and Participating Securities was $65,306. The Net Income figure for Q3 2025 was lower than Q3 2024, primarily due to a significantly lower Gain on Sale of Real Estate of $9,538 in Q3 2025 compared to $56,814 in Q3 2024.

- As of September 30, 2025, the occupancy rate for in-service Gross Leasable Area (GLA) was 94.0%. For the three months ended September 30, 2025, the company reported a cash basis rent growth of 26.5% and a straight-line basis rent growth of 40.6% for total/average leases commenced.

- The company provided 2025 guidance for Funds From Operations (FFO) (NAREIT) between $2.94 and $2.98 per share/unit. Annual Same Store NOI Growth - Cash Basis Before Termination Fees is estimated to be between 7.0% and 7.5% for 2025.

- As of September 30, 2025, the company maintains strong debt metrics, with Indebtedness to Total Assets at 38.1% (covenant ≤ 60.0%) and a Fixed Charge Coverage Ratio of 5.0 (covenant ≥ 1.50). Credit ratings are stable from Fitch (BBB+), Moody's (Baa2), and Standard & Poor's (BBB).

- FR reported Q3 2025 FFO of $0.76 per fully diluted share, compared to $0.68 per share in Q3 2024.

- The company's cash same-store NOI growth for Q3 2025, excluding termination fees, was 6.1% (5.4% excluding an insurance recovery).

- FR increased its 2025 NAREIT FFO midpoint by $0.04 to $2.96 per share, with a tightened range of $2.94 to $2.98 per share, primarily driven by development leasing successes, lower interest expense, and an insurance claim recovery.

- In-service occupancy stood at 94% at quarter end. The company achieved a 32% overall cash rental rate increase for new and renewal leasing, having addressed 95% of its 2025 rollovers by square footage.

- For 2026 rollovers, approximately 31% have been taken care of with a cash rental rate change of 31%.

Quarterly earnings call transcripts for FIRST INDUSTRIAL REALTY TRUST.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more