FIVE STAR BANCORP (FSBC)·Q4 2025 Earnings Summary

Five Star Bancorp Beats on EPS, NIM Expansion, and Raises Dividend 25%

January 27, 2026 · by Fintool AI Agent

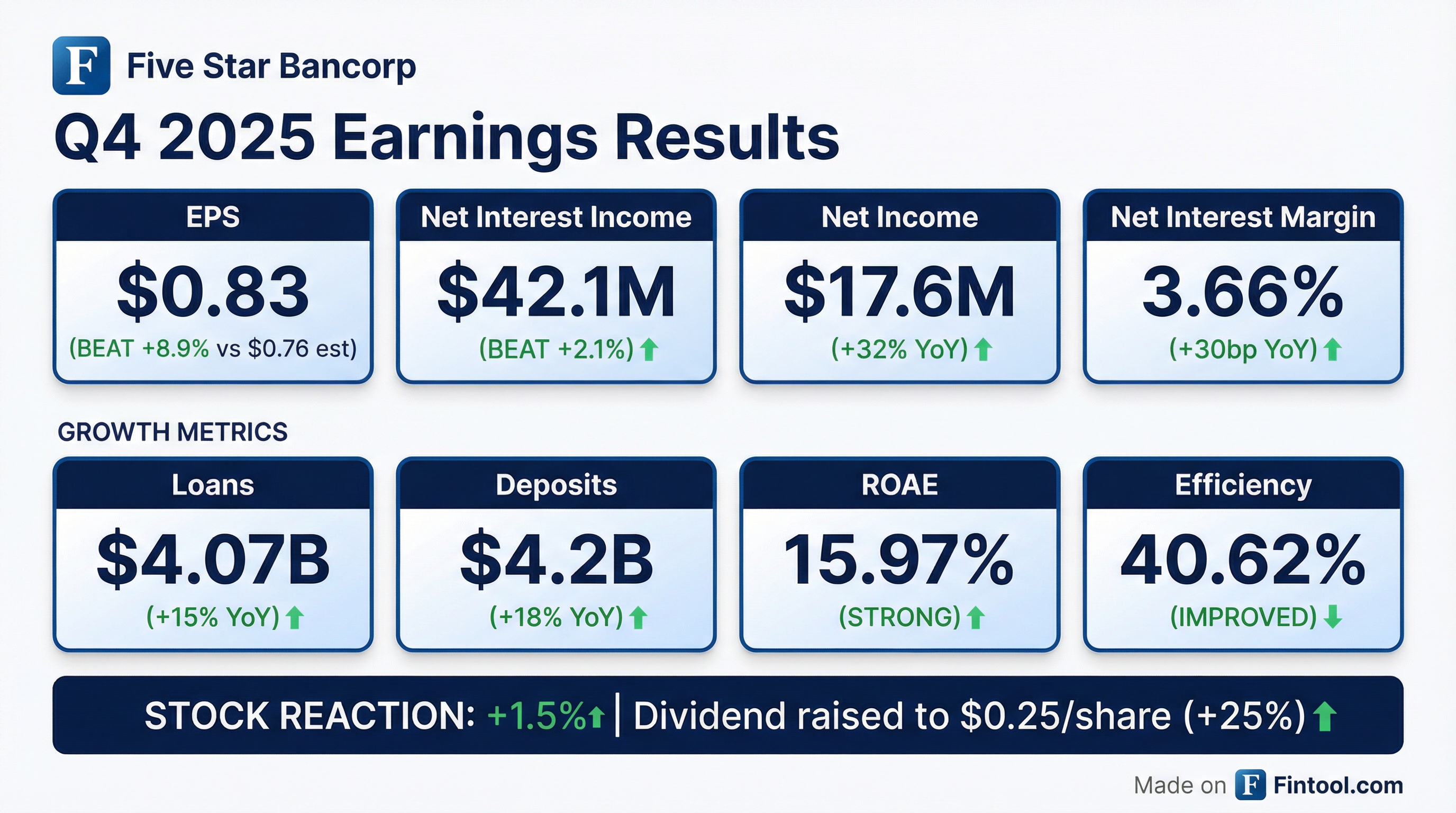

Five Star Bancorp delivered another strong quarter, beating consensus on both EPS and net interest income while announcing a 25% dividend increase. The California community bank reported Q4 2025 EPS of $0.83, beating the $0.76 estimate by 8.9%, driven by continued NIM expansion and robust loan growth.

This marks 8 consecutive quarters of EPS beats for Five Star—a testament to management's ability to grow the franchise while maintaining disciplined underwriting and expense control.

Did Five Star Bancorp Beat Earnings?

Yes—on both metrics.

Net income of $17.6 million represented a 32% increase from $13.3 million in Q4 2024 and a 7.9% sequential increase from $16.3 million in Q3 2025.

Full year 2025 delivered $61.6 million in net income versus $45.7 million in 2024—a 35% increase—with EPS of $2.90 versus $2.26 in the prior year.

What Drove the Beat?

Net Interest Margin Expansion

NIM expanded to 3.66% in Q4 2025—up 10bp sequentially and 30bp year-over-year.

The improvement came from both sides of the balance sheet:

- Loan yield held steady at 6.09% despite Fed rate cuts, supported by a shift toward higher-yielding commercial real estate loans

- Cost of deposits fell 21bp sequentially to 2.23% as the bank repriced deposits lower following Fed cuts

Exceptional Organic Growth

CEO James Beckwith highlighted that non-wholesale deposits grew $738 million (25%) while wholesale deposits actually declined $95 million (17%), indicating the growth is relationship-driven rather than rate-chasing.

Operating Efficiency

The efficiency ratio improved to 40.62% in Q4 2025 and 41.03% for full year 2025, down from 43.19% in 2024.

Non-interest expense grew 21.9% YoY, but this was driven by intentional investments in growth—headcount increased 13.7% as the bank added business development officers and expanded into the San Francisco Bay Area.

What Did Management Say?

CEO James Beckwith struck a confident tone:

"We proudly look back on 2025 as an outstanding year of achievement... In 2025, Five Star Bank achieved year-over-year growth in total loans and total deposits. Total loans held for investment increased by $542.2 million, or 15%, and total deposits increased by $643.1 million, or 18%."

On strategic priorities for 2026:

"As we look ahead to 2026, we believe that managing expenses and executing on conservative underwriting practices will continue to be foundational to our success."

The bank announced it will continue building out its verticals—manufactured housing, faith-based lending, government, nonprofits—while expanding the San Francisco Bay Area presence following the Walnut Creek office opening.

Dividend Increased 25%

The Board declared a $0.25/share quarterly dividend, up from $0.20—a 25% increase.

- Record date: February 2, 2026

- Payment date: February 9, 2026

- Annualized yield: ~2.6% at current price

This continues a pattern of dividend growth as the bank returns capital to shareholders while maintaining strong capital ratios.

Credit Quality: Still Clean

Nonperforming loans ticked up slightly due to two faith-based real estate loans entering nonperforming status, but overall credit remains pristine.

The allowance for credit losses increased to $44.4 million from $37.8 million at year-end 2024, primarily due to loan growth and the annual CECL model refresh.

Capital Position

The bank remains well above regulatory minimums with no short-term borrowings and $2.3 billion in total liquidity.

How Did the Stock React?

FSBC shares rose +1.5% to $38.80 on the day of the earnings release, trading near 52-week highs of $40.31.

The muted reaction likely reflects that the beat was largely in line with recent quarters—investors have come to expect consistent execution from this management team.

What Changed From Last Quarter?

The key changes: NIM expansion accelerated, loan growth picked up, and the dividend got raised. Efficiency ratio ticked slightly higher but remains excellent for a growing community bank.

Key Risks and Concerns

-

CRE Concentration: 81% of loans are commercial real estate, with manufactured housing communities (31%) and RV parks (12%) as top categories. While LTVs are conservative (49% weighted average), the concentration is notable.

-

Geographic Concentration: 57% of real estate loans are in California, though the bank has been diversifying nationally.

-

Rate Sensitivity: 74% of loans are floating or adjustable rate, which benefited the bank in a rising rate environment but could compress NIM if rates fall further.

-

Substandard Loans Rising: Loans rated substandard increased from $2.6M to $22.3M YoY, primarily due to one borrower with a special purpose CRE loan experiencing financial difficulty.

What Did Management Guide for 2026?

Management set clear expectations for moderation after an exceptional 2025:

CEO James Beckwith was candid about the step-down:

"Don't think we're going to be able to do what we did in 2025... That's just asking a lot. So we're projecting on both sides of the balance sheet at 10% growth as we roll into 2026. If we can achieve that, which is really quite substantial, we're happy with that."

Key headwinds to watch:

-

Brokered deposit elimination: The bank aims to eliminate all $175M in brokered deposits, meaning core deposits need to grow ~13% to hit the 10% total deposit target

-

2021 loan repricing: Significant volume of 5-year reset loans from 2021 (originated at 4-handle rates) will reprice in 2026. Management expects about half to refinance into agency loans for better terms

-

Payoff pressure: Expecting elevated payoffs similar to Q4 levels, requiring harder origination efforts to hit net growth targets

Q&A Highlights

On deposit competition (the "secret sauce"):

"Our secret sauce is the fact that we've got 42 business development folks. That's their job—to bring in core deposit and core relationships into the bank. We feel that's our competitive advantage."

On loan pricing pressure:

"If we're going toe-to-toe with folks on an owner-occupied real estate and line of credit for an operating entity, it can be very competitive. You could see spreads as low as 200 over, 205 over, and at prime or prime minus a quarter even for their operating line."

However, niche verticals (MHC, RV parks) still command 275-350bp spreads over the 5-year due to limited competition.

On capital needs:

CFO Heather Luck noted the bank can self-fund 10% growth through 2030 even with the elevated dividend. But if growth accelerates to 15-20%, a capital raise would likely be needed in 2027-2028.

On geographic expansion:

The bank is not yet on the Peninsula or South Bay—areas of interest for future expansion, though competition for seasoned bankers has "bid up" salaries.

Forward Catalysts

- Continued NIM expansion if deposit costs reprice faster than loan yields

- Bay Area expansion following Walnut Creek office opening—Peninsula/South Bay next

- Agribusiness vertical expansion announced in 2025

- Brokered deposit elimination improving funding mix and reducing wholesale reliance

- Potential dividend increases as earnings continue to grow

Bottom Line

Five Star Bancorp delivered another clean quarter—beating on both lines, expanding NIM, growing the franchise, and raising the dividend. The 8-quarter EPS beat streak and consistent 14-15% ROAE demonstrate management's ability to execute.

The stock trades at roughly 1.9x tangible book ($20.87 TBV per share) and ~13x forward earnings—reasonable for a bank growing loans 15%+ annually with pristine credit. The main risk remains CRE concentration in a higher-for-longer rate environment.

Five Star Bancorp will host an earnings call on January 27, 2026 at 1:00 PM ET. Webcast link

Related Links: