Earnings summaries and quarterly performance for FIVE STAR BANCORP.

Executive leadership at FIVE STAR BANCORP.

James Beckwith

President and Chief Executive Officer

Brett Wait

Senior Vice President and Chief Information Officer

Don Kurtze

Executive Vice President and San Francisco Bay Area Region President

Heather Luck

Executive Vice President and Chief Financial Officer

John Dalton

Senior Vice President and Chief Credit Officer

Lydia Ramirez

Executive Vice President and Chief Operating Officer

Michael Lee

Senior Vice President and Chief Regulatory Officer

Michael Rizzo

Executive Vice President and Chief Banking Officer

Shelley Wetton

Senior Vice President and Chief Marketing Officer

Board of directors at FIVE STAR BANCORP.

David Nickum

Director

Donna Lucas

Director

Judson Riggs

Director

Kevin Ramos

Director

Larry Allbaugh

Director

Randall Reynoso

Vice Chair of the Board

Robert Perry-Smith

Chair of the Board

Shannon Deary-Bell

Director

Warren Kashiwagi

Director

Research analysts who have asked questions during FIVE STAR BANCORP earnings calls.

Andrew Terrell

Stephens Inc.

6 questions for FSBC

Gary Tenner

D.A. Davidson & Co.

5 questions for FSBC

David Feaster

Raymond James

4 questions for FSBC

Liam Coohill

Raymond James

1 question for FSBC

William Jones

Truist Securities

1 question for FSBC

Wood Lay

Keefe, Bruyette & Woods

1 question for FSBC

Woody Lay

Keefe, Bruyette & Woods (KBW)

1 question for FSBC

Recent press releases and 8-K filings for FSBC.

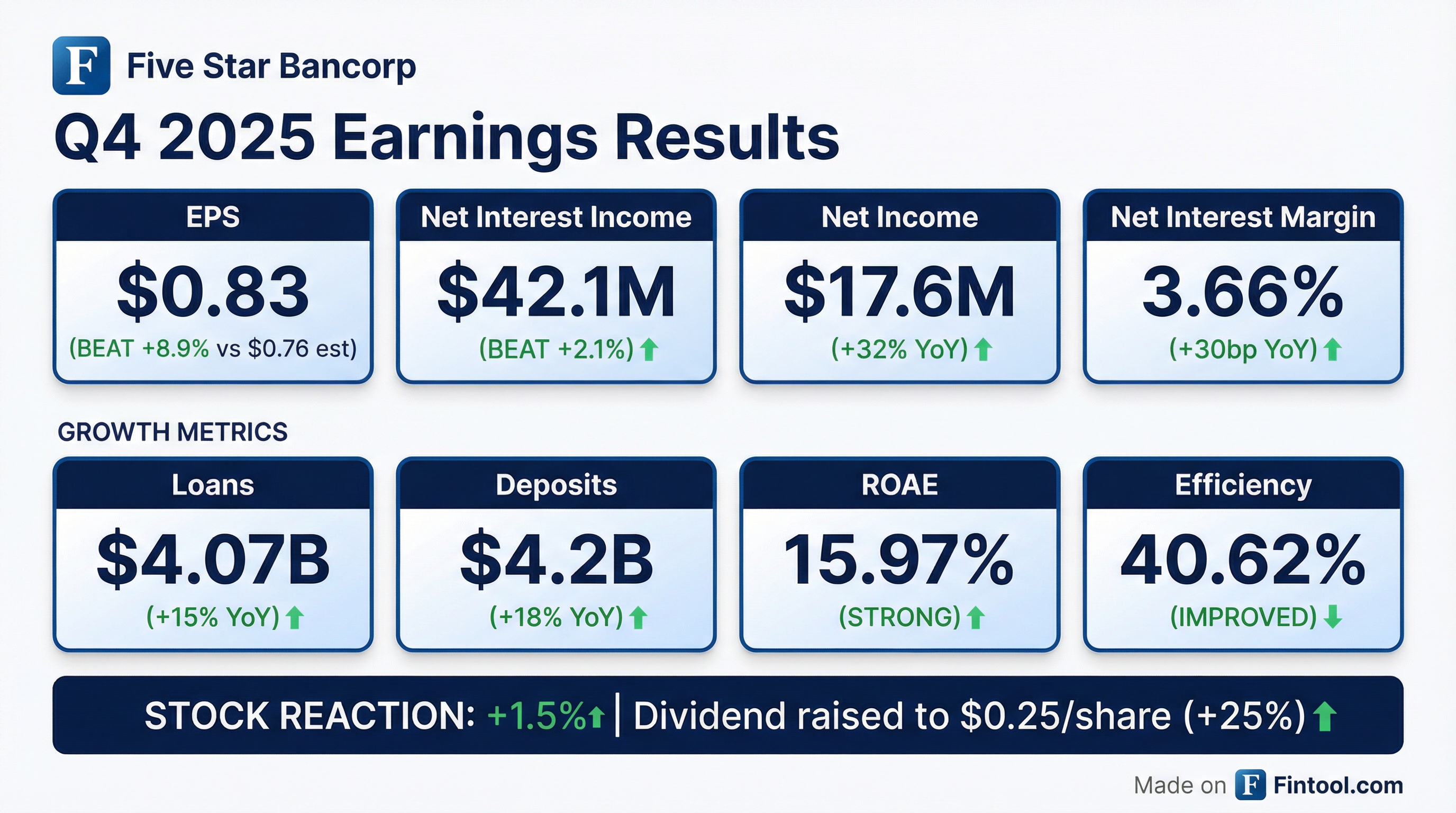

- Five Star Bancorp reported net income of $17.6 million and earnings per share of $0.83 for Q4 2025. For the full year 2025, net income reached $61.6 million, with earnings per share increasing 28% year-over-year to $2.90.

- The company achieved significant balance sheet growth in 2025, with total loans held for investment growing 15% and total deposits increasing 18%. Non-wholesale deposits grew by $738.1 million (25%), while wholesale deposits were reduced by $95 million (17%).

- For 2026, Five Star Bancorp projects 10% growth in both loans and deposits, and aims to eliminate its remaining $175 million in brokered deposits. The target for expenses as a percentage of average assets for 2026 is between 1.48% and 1.55%.

- Operational achievements in 2025 included expanding its footprint in the San Francisco Bay Area, growing its agribusiness vertical, and adding 10 new business development professionals. The company also increased its cash dividend by $0.05 per share to $0.25 per share.

- Five Star Bancorp achieved net income of $61.6 million for the year ended December 31, 2025, representing 35% year-over-year growth, with earnings per share increasing 28% to $2.90.

- In 2025, the company saw 15% growth in total loans held for investment and 18% growth in total deposits, significantly reducing wholesale deposits by 17% while increasing non-wholesale deposits by 25%.

- For 2026, the company projects 10% growth in both loans and deposits, aiming to eliminate $175 million in brokered deposits, and increased its quarterly cash dividend to $0.25 per share. Management believes 10% growth can be self-funded, but higher growth rates would require a capital event in 2027 or 2028.

- Five Star Bancorp reported strong financial results for Q4 2025, with net income of $17.6 million and EPS of $0.83, and for the full year 2025, with net income of $61.6 million and EPS of $2.90, representing a 28% increase year-over-year.

- The company achieved significant balance sheet growth in 2025, with total loans held for investment increasing by 15% and total deposits growing by 18%, while successfully reducing wholesale deposits by $95 million.

- The Board of Directors increased the quarterly cash dividend by $0.05 per share to a total of $0.25 per share for the quarter, payable on February 9th, 2026.

- For 2026, Five Star Bancorp projects 10% growth on both loans and deposits, with an expense target as a percentage of average assets between 148% and 155%. The company believes its current capital position can sustain this growth, but higher growth rates (15-20%) would necessitate a capital event in 2027 or 2028.

- Five Star Bancorp reported net income of $17.6 million for the three months ended December 31, 2025, an increase from $13.3 million in the prior year's quarter, and $61.6 million for the full year 2025, up from $45.7 million in 2024.

- Diluted earnings per common share rose to $0.83 for Q4 2025 from $0.63 in Q4 2024, and for the full year 2025, it was $2.90, an increase from $2.26 in 2024.

- The company's net interest margin improved to 3.66% for Q4 2025, compared to 3.36% in Q4 2024, and 3.55% for the full year 2025, up from 3.32% in 2024.

- Total deposits increased by $97.6 million (2.38%) to $4.201 billion and loans held for investment grew by $187.7 million (4.83%) to $4.075 billion during Q4 2025.

- Five Star Bancorp declared a cash dividend of $0.20 per share for Q3 2025, paid during Q4 2025, and an additional cash dividend of $0.25 per share on January 15, 2026, for Q4 2025.

- Five Star Bancorp reported net income of $17.6 million for the three months ended December 31, 2025, an increase from $13.3 million in the prior year period. For the full year ended December 31, 2025, net income was $61.6 million, up from $45.7 million in 2024.

- Basic earnings per common share were $0.83 for the fourth quarter of 2025 and $2.90 for the full year 2025.

- The company experienced significant growth in 2025, with total loans held for investment increasing by 15% to $4.07 billion and total deposits increasing by 18% to $4.20 billion as of December 31, 2025.

- Key performance metrics for the year ended December 31, 2025, included a Return on Average Assets (ROAA) of 1.41% and a Return on Average Equity (ROAE) of 14.74%. The net interest margin was 3.55% and the efficiency ratio decreased to 41.03% for the full year 2025.

- Five Star Bancorp announced an increase in its shareholder dividend for the quarter, reflecting strong financial performance.

- Five Star Bancorp announced the declaration of a cash dividend of $0.25 per share on its voting common stock for the fourth quarter.

- The dividend is expected to be paid on February 9, 2026, to shareholders of record as of February 2, 2026.

- This dividend represents an increase of $0.05 per share, which is the first increase since April 2023.

- Five Star Bancorp reported net income of $16.3 million and earnings per share of $0.77 for the third quarter of 2025, with a return on average assets of 1.44% and return on average equity of 15.35%. The net interest margin expanded three basis points to 3.56%, and the efficiency ratio was 40.13%.

- The company achieved significant balance sheet growth in Q3 2025, with loans held for investment growing by $129.2 million and total deposits increasing by $208.8 million. This growth was driven by a $359 million increase in non-wholesale deposits, while wholesale deposits decreased by $150.2 million, optimizing the funding base.

- Asset quality remains strong, with non-performing loans representing only five basis points of total loans held for investment, and the company remains well-capitalized with all capital ratios above regulatory thresholds. A $2.5 million provision for credit losses was recorded due to loan growth.

- Five Star Bancorp continues its strategic expansion, opening its ninth full-service office in Walnut Creek and growing its Bay Area deposits to $548.9 million. Management anticipates continued net interest margin expansion in a declining rate environment and projects 1%-2% absolute deposit growth for Q4 2025.

- Strong Q3 2025 Financial Performance: Five Star Bancorp reported net income of $16.3 million and earnings per share of $0.77 for Q3 2025, with a return on average assets of 1.44% and return on average equity of 15.35%. The net interest margin expanded three basis points to 3.56%, and the efficiency ratio was 40.13%.

- Significant Balance Sheet Growth and Deposit Optimization: Loans held for investment grew by $129.2 million, or 14% on an annualized basis, and total deposits increased by $208.8 million, or 21% on an annualized basis, during Q3 2025. Non-wholesale deposits increased by $359 million, while wholesale deposits decreased by $150.2 million, optimizing the funding base. Non-interest-bearing deposits remained consistent at 26% of total deposits as of September 30, 2025.

- Positive Net Interest Margin Outlook: The company anticipates net interest margin to expand by 1 to 3 basis points in Q4 2025. A 25 basis point rate cut is expected to result in approximately $850,000 of improvement over a full quarter , benefiting from the company's liability-sensitive position in a down-rate environment.

- Strategic Organic Growth and Expansion: Five Star Bancorp opened its ninth full-service office in Walnut Creek as part of its Bay Area expansion, which now includes 36 employees and $548.9 million in deposits as of September 30, 2025. The company continues to prioritize organic growth across various business segments and geographies, targeting a loan-to-deposit ratio of 95%.

- Five Star Bancorp reported a net income of $16.3 million and diluted earnings per common share of $0.77 for the three months ended September 30, 2025, marking an increase from $14.5 million and $0.68, respectively, in the prior quarter.

- The company demonstrated improved profitability with a Return on average assets (ROAA) of 1.44% and a Return on average equity (ROAE) of 15.35% for Q3 2025.

- Total loans held for investment increased by $129.2 million, or 3.44%, and total deposits increased by $208.8 million, or 5.36%, during the three months ended September 30, 2025.

- The net interest margin improved to 3.56% and the efficiency ratio decreased to 40.13% for the third quarter of 2025, compared to 3.53% and 41.03% in the previous quarter.

- The Board of Directors declared a cash dividend of $0.20 per share on October 16, 2025, which is expected to be paid on November 10, 2025.

- Five Star Bancorp announced the declaration of a cash dividend of $0.20 per share on its voting common stock for the third quarter.

- The dividend is expected to be paid on November 10, 2025, to shareholders of record as of November 3, 2025.

Quarterly earnings call transcripts for FIVE STAR BANCORP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more