Earnings summaries and quarterly performance for FirstService.

Research analysts who have asked questions during FirstService earnings calls.

Daryl Young

Stifel

8 questions for FSV

Stephen MacLeod

BMO Capital Markets

8 questions for FSV

Tim James

TD Securities

5 questions for FSV

Himanshu Gupta

Scotiabank

4 questions for FSV

Stephen Sheldon

William Blair & Company

4 questions for FSV

Frederic Bastien

Raymond James

3 questions for FSV

Scott Fletcher

CIBC

3 questions for FSV

Erin Kyle

CIBC World Markets

2 questions for FSV

Sean Jack

Raymond James Financial

2 questions for FSV

Stephen Chelton

William Blair & Company L.L.C.

2 questions for FSV

Stephen Hardy Sheldon

William Blair & Company L.L.C.

2 questions for FSV

Recent press releases and 8-K filings for FSV.

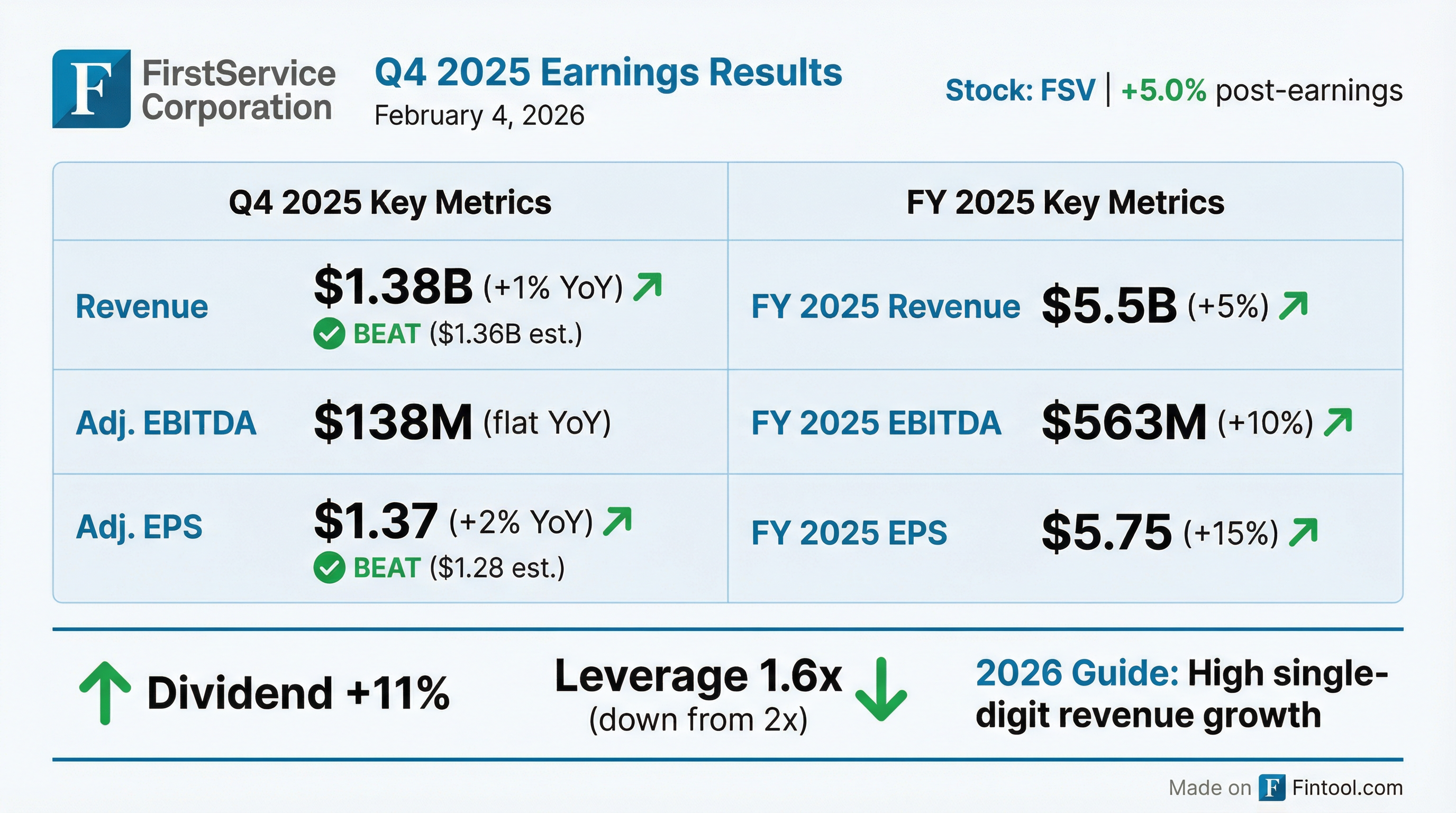

- FSV reported Q4 2025 revenues of $1.38 billion, up 1%, with EBITDA flat at $138 million and EPS up 2% to $1.37. For the full year 2025, revenues increased 5% to $5.5 billion, adjusted EBITDA rose 10% to $563 million, and adjusted EPS grew 15% to $5.75.

- For Q1 2026, the company forecasts consolidated revenue growth in the mid-single digit range and EBITDA roughly in line with Q1 2025. The full year 2026 outlook anticipates high single-digit year-over-year increases in revenue and EBITDA, with the consolidated EBITDA margin expected to be relatively flat compared to 2025's 10.2%.

- FirstService Residential achieved 8% revenue growth in Q4 2025 and 7% for the full year, including 4% organic growth. FirstService Brands' Q4 revenues were down 3% (7% organically) due to declines in restoration and roofing, partially offset by Century Fire's strong performance with over 10% revenue growth.

- The company announced an 11% dividend increase to $1.22 per share annually. In 2025, acquisition spending totaled $107 million, and year-end leverage stood at 1.6x net debt to Adjusted EBITDA, down from 2x in 2024.

FirstService (FSV) reported solid financial results for Q4 and the full year 2025. For Q4 2025, consolidated revenues were $1.38 billion, adjusted EBITDA was $138 million, and adjusted EPS was $1.37. For the full year 2025, consolidated revenues reached $5.5 billion, adjusted EBITDA was $563 million, and adjusted EPS was $5.75.

| Metric | Q4 2025 | FY 2025 |

|---|---|---|

| Revenues ($USD Millions) | $1,380 | $5,500 |

| Adjusted EBITDA ($USD Millions) | $138 | $563 |

| Adjusted EPS ($USD) | $1.37 | $5.75 |

For Q4 2025, FirstService Residential revenues were up 8% with 5% organic growth, while FirstService Brands revenues were down 3% with a 7% organic decline.

The company provided an outlook for Q1 and full-year 2026. For Q1 2026, revenue growth is expected to be in the mid-single digit range, with EBITDA roughly in line with Q1 2025. For the full year 2026, FSV anticipates high single-digit year-over-year increases in revenue and high single-digit EBITDA growth, with the consolidated EBITDA margin expected to be relatively flat compared to 2025's 10.2%.

| Metric | Q1 2026 | FY 2026 |

|---|---|---|

| Revenue Growth (YoY %) | Mid-single digit | High single-digit |

| EBITDA Growth (YoY %) | Roughly in line with Q1 2025 | High single-digit |

| Consolidated EBITDA Margin (YoY %) | N/A | Relatively flat compared to 10.2% in 2025 |

FSV announced an 11% dividend increase to $1.22 per share annually. Acquisition spending during 2025 totaled $107 million, and the company ended the year with a 1.6x net debt to Adjusted EBITDA and $970 million in liquidity.

| Metric | FY 2025 |

|---|---|

| Acquisition Spending ($USD Millions) | $107 |

| Dividend Increase (YoY %) | 11% |

| Annual Dividend Per Share ($USD) | $1.22 |

| Net Debt to Adjusted EBITDA (x) | 1.6 |

| Liquidity ($USD Millions) | $970 |

- FSV reported Q4 2025 consolidated revenues of $1.38 billion, an increase of 1% year-over-year, with adjusted EBITDA flat at $138 million and adjusted EPS up 2% to $1.37. For the full year 2025, consolidated revenues increased 5% to $5.5 billion, adjusted EBITDA grew 10% to $563 million (10.2% margin), and adjusted EPS rose 15% to $5.75.

- FirstService Residential saw Q4 2025 revenues increase 8% (with 5% organic growth), while FirstService Brands revenues declined 3% (with 7% organic decline) primarily due to weakness in restoration and roofing, partially offset by strong performance at Century Fire.

- For Q1 2026, consolidated revenue growth is forecast in the mid-single digit range, with high single-digit increases expected for subsequent quarters. Consolidated EBITDA for Q1 2026 is projected to be roughly in line with Q1 2025, with high single-digit growth anticipated for the full year, and the full-year EBITDA margin is expected to be relatively flat compared to 2025's 10.2%.

- The company announced an 11% dividend increase to $1.22 per share annually. Leverage at year-end 2025 was 1.6x net debt to Adjusted EBITDA, down from 2x at prior year-end, with $970 million in liquidity. M&A strategy remains focused on tuck-under acquisitions, with the company exercising patience due to high valuations.

- FirstService reported consolidated revenues of $1.38 billion for the fourth quarter of 2025, a 1% increase year-over-year, and $5.50 billion for the full year 2025, representing a 5% increase primarily driven by tuck-under acquisitions.

- Adjusted EBITDA for Q4 2025 was $137.6 million, in-line with the prior year, while full-year 2025 Adjusted EBITDA increased 10% to $562.8 million.

- Adjusted EPS grew 2% to $1.37 in Q4 2025 and 15% to $5.75 for the full year 2025.

- In segmented results, FirstService Residential's Q4 2025 revenues increased 8% to $563.1 million with 5% organic growth, whereas FirstService Brands' revenues decreased 3% to $820.3 million due to a 7% organic decline from reduced weather events and tempered roofing activity.

- CEO Scott Patterson highlighted that Q4 results met expectations, concluding a year of solid growth and strong earnings, and anticipates organic growth to return to long-term levels as market conditions normalize.

- FirstService reported consolidated revenues of $5.50 billion for the full year ended December 31, 2025, a 5% increase compared to the prior year, driven by recent tuck-under acquisitions.

- For the full year 2025, Adjusted EBITDA grew 10% to $562.8 million, and Adjusted EPS increased 15% to $5.75.

- In the fourth quarter of 2025, consolidated revenues were $1.38 billion, a 1% increase, with Adjusted EPS at $1.37, up 2% over the prior year quarter.

- FirstService Brands' revenues for the fourth quarter decreased by 3% to $820.3 million, primarily due to reduced weather events and tempered activity levels in restoration and roofing operations.

- FirstService Corporation reported consolidated revenues of $1.45 billion for the third quarter ended September 30, 2025, representing a 4% increase over the prior year quarter. For the nine months ended September 30, 2025, consolidated revenues grew 7% to $4.11 billion.

- Net earnings for Q3 2025 were $70.9 million, or $1.25 basic net earnings per common share, a decrease from $77.8 million ($1.34 basic EPS) in Q3 2024. Year-to-date net earnings increased to $140.4 million ($2.33 basic EPS) from $137.6 million ($2.27 basic EPS) in the prior year period.

- The FirstService Residential segment achieved an 8% revenue increase to $605.4 million in Q3 2025, including 5% organic growth. Conversely, the FirstService Brands segment revenues grew 1% to $842.1 million, but experienced a 4% organic decline due to reduced activity in restoration and roofing operations.

- During the nine months ended September 30, 2025, FirstService Corporation completed seven acquisitions for $96.4 million in cash consideration.

- FirstService Corporation reported Q3 2025 revenues of $1.45 billion, an increase of 4% year-over-year, with adjusted EBITDA rising 3% to $165 million and adjusted EPS up 8% to $1.76.

- Overall organic growth for the quarter was flat, as 5% organic growth in FirstService Residential and strong performance in Century Fire Protection were offset by organic declines in restoration and roofing platforms.

- The company anticipates mid-single-digit growth in consolidated annual revenues and high single-digit EBITDA growth, approaching 10%, for the full year 2025.

- Challenges in Q3 included a 7% year-over-year decline in restoration revenues due to mild weather and minimal storm activity, and an 8% organic decline in roofing revenues attributed to deferred commercial projects and reduced new construction. Q4 2025 restoration revenues are expected to be down about 20% year-over-year, and roofing revenues are projected to decline 10% or more organically.

- FirstService Corporation reported Q3 2025 revenues of $1.45 billion, an increase of 4% year-over-year, with adjusted EBITDA up 3% to $165 million and adjusted EPS up 8% to $1.76.

- FirstService Residential revenues grew 8% to $605 million with 5% organic growth, and Century Fire Protection revenues were up over 10%.

- Overall organic growth was flat due to declines in restoration and roofing platforms, with restoration revenues down 7% year-over-year and roofing organic revenues declining 8%.

- For the full year 2025, the company expects mid-single-digit growth in consolidated annual revenues and high single-digit growth, approaching 10%, in consolidated annual EBITDA.

- FirstService Corporation reported a strong Q4 2024, with revenues increasing 27% to $1.37 billion and Adjusted EBITDA growing 33% to $137.9 million. For the full year 2024, revenues were up 20% to $5.22 billion, with Adjusted EBITDA increasing 24% to $513.7 million, largely driven by the acquisition of Roofing Corp. of America.

- The FirstService Brands division's Q4 revenues surged 45%, with 16% organic growth primarily from its restoration segment, which benefited from $60 million in revenue from named storms. The FirstService Residential division's Q4 revenues grew 5% with 3% organic growth, impacted by budgetary pressures from rising costs.

- For full-year 2025, the company expects high-single-digit consolidated top-line growth, including mid-single-digit (4%-5%) organic growth, and anticipates consolidated EBITDA margin expansion.

- The company's balance sheet remains strong with 2 times net debt to adjusted EBITDA at year-end 2024, and it announced a 10% dividend increase to $1.10 per share annually. $212 million was spent on acquisitions in 2024, mainly for expanding the roofing platform.

Quarterly earnings call transcripts for FirstService.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more