GERMAN AMERICAN BANCORP (GABC)·Q4 2025 Earnings Summary

German American Bancorp Posts Record Quarter, Raises Dividend 7%

January 26, 2026 · by Fintool AI Agent

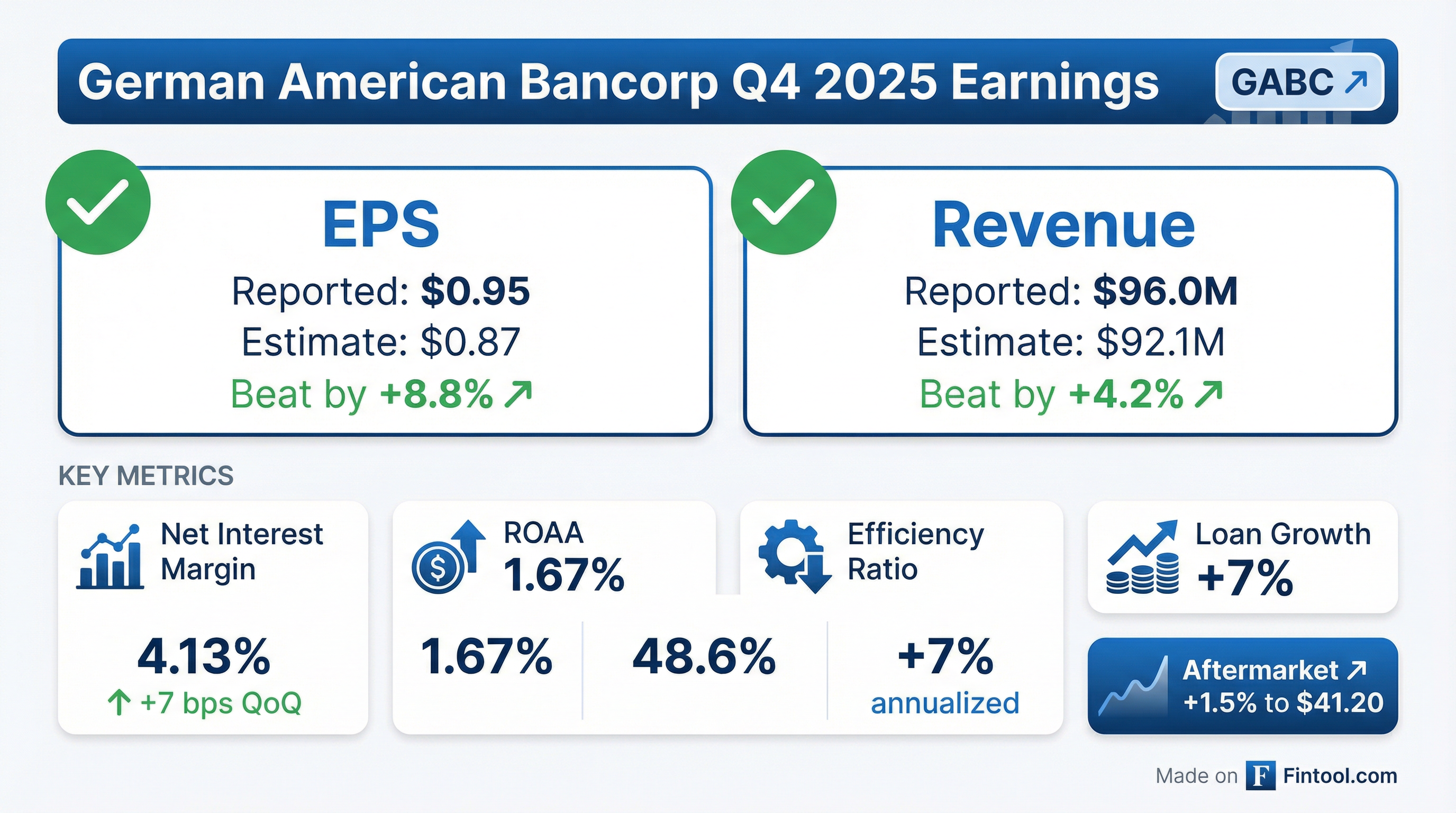

German American Bancorp (NASDAQ: GABC) delivered record quarterly earnings in Q4 2025, beating Wall Street estimates on both EPS and revenue. The Indiana-based regional bank reported diluted EPS of $0.95, crushing the consensus estimate of $0.87 by 8.8%. Revenue of $96.0 million topped the $92.1 million estimate by 4.2%, powered by continued net interest margin expansion to 4.13%.

The strong results prompted a 7% dividend increase — the 14th consecutive year of raised dividends — signaling management's confidence in the company's trajectory as it integrates the Heartland BancCorp acquisition.

Did German American Beat Earnings?

Yes — decisively. GABC beat on both top and bottom lines, posting record quarterly profit.

This was the company's fourth consecutive quarter of record or near-record earnings. The beat was driven by:

- Net interest margin expansion — NIM rose 7 bps sequentially to 4.13%, benefiting from lower funding costs as the Fed cut rates

- Loan growth — Loans grew 7% annualized, with strength across commercial, agricultural, and consumer categories

- Operating leverage — Efficiency ratio improved to 48.6%, reflecting strong cost discipline

What Changed From Last Quarter?

The sequential improvement shows continued positive momentum from the Heartland integration:

The most notable change was the 6.3% jump in tangible book value per share to $20.08, driven by retained earnings and improvement in accumulated other comprehensive income as rates stabilized.

How Did the Stock React?

GABC closed at $40.58 on the day of the release, up 0.5% in regular trading. In aftermarket trading, shares rose to $41.20, up approximately 1.5% from the close, suggesting the market viewed the results favorably.

The stock is up roughly 24% from its 52-week low of $32.75, reflecting growing confidence in the bank's earnings trajectory and integration execution.

Key Performance Metrics

German American delivered strong profitability metrics across the board:

The dramatic year-over-year improvement reflects both organic growth and the Heartland acquisition, which closed February 1, 2025, adding approximately $1.94 billion in assets and 20 banking offices in Ohio.

What Did Management Say?

CEO D. Neil Dauby struck an optimistic tone:

"We are extremely pleased to deliver yet another record quarterly earnings performance for the fourth quarter 2025 and for the year ended December 31, 2025. We have great positive momentum as we head into 2026 and are excited about the long-term potential in connection with a normalizing yield curve and our strong diversified organic growth footprint."

On the dividend increase:

"We remain excited and committed to the vitality and future growth of our Indiana, Kentucky and Ohio communities."

The 7% dividend hike to $0.31 per share marks the 14th consecutive year of increased dividends, payable February 20, 2026, to shareholders of record as of February 10, 2026.

Heartland Integration Update

The Heartland BancCorp acquisition continues to integrate "seamlessly" according to management. Key integration metrics:

The acquired loan portfolio contributed $15.6 million in discount accretion to interest income in 2025 (approximately 21 bps to NIM), which will decline over time as the discount amortizes.

Credit Quality: A Minor Watch Item

Non-performing assets ticked up to 0.35% of total assets from 0.28% in Q3 2025, primarily due to two acquired Heartland relationships that were adversely classified at acquisition and subsequently placed on non-accrual.

Management noted the elevated NPAs are largely from Heartland credits that were known at acquisition, representing approximately $18.6 million of the $29.5 million total. Net charge-offs remained minimal at just 4 basis points annualized.

Full Year 2025 Summary

For the full year 2025, German American reported:

The year-over-year EPS growth of 8% (GAAP) or 24% (adjusted) reflects the transformational impact of the Heartland acquisition combined with organic growth and favorable interest rate dynamics.

Capital & Balance Sheet

German American's capital position remains robust:

The company ended Q4 2025 with:

- Total Assets: $8.39 billion

- Total Loans: $5.88 billion (+7% annualized QoQ)

- Total Deposits: $6.99 billion

Loan Portfolio Composition

The loan portfolio remains well-diversified:

Loan growth in Q4 was broad-based, with C&I up 16% annualized, CRE up 5% annualized, and agricultural loans up 14% annualized (seasonal).

Forward Outlook

Management highlighted several tailwinds heading into 2026:

- Normalizing yield curve — Should support continued NIM expansion as deposit costs reprice lower

- Diversified organic growth — Strong loan pipelines across markets

- Integration synergies — Heartland operating costs should continue to optimize

- Capital deployment — Strong capital supports both dividend growth and potential M&A

The bank was also recognized as one of "America's Best Regional Banks in 2026" by Newsweek, reflecting its strong community presence and financial performance.

Key Risks to Monitor

- Credit deterioration — NPAs trending higher, though manageable and mostly from known acquired credits

- NIM compression risk — If Fed cuts more aggressively than expected, asset yields could fall faster than funding costs

- CRE concentration — 53% of loans in commercial real estate warrants monitoring given broader sector concerns

- Integration execution — Though proceeding well, core system conversions often present challenges

The Bottom Line

German American Bancorp delivered a clean beat in Q4 2025, with record quarterly earnings and strong execution on all fronts. The Heartland integration is tracking well, capital is building, and management raised the dividend for the 14th straight year.

At current prices around $40, the stock trades at roughly 2.0x tangible book value and 11x forward earnings — a premium to many regional bank peers, but arguably justified given the quality of the franchise and consistent execution.

Key numbers to remember:

- EPS: $0.95 (beat by 8.8%)

- NIM: 4.13% (expanding)

- ROATCE: 19.5%

- Dividend: +7%

- 21st consecutive year of double-digit ROE

For more details, see the full earnings release and company profile.