Earnings summaries and quarterly performance for GERMAN AMERICAN BANCORP.

Executive leadership at GERMAN AMERICAN BANCORP.

Neil Dauby

Chairman and Chief Executive Officer

Amy Jackson

Executive Vice President and Chief Administrative Officer

Bradley Arnett

Executive Vice President, Chief Legal Officer and Corporate Secretary

Bradley Rust

President and Chief Financial Officer

Clay Barrett

Executive Vice President and Chief Digital and Information Officer

Michael Beckwith

Executive Vice President and Chief Banking Officer

Scott Powell

Executive Vice President and Chief Credit Officer

Vicki Schuler

Senior Vice President and Controller (Principal Accounting Officer)

Board of directors at GERMAN AMERICAN BANCORP.

Angela Curry

Director

Christina Ryan

Director

Darren Root

Director

Diane Medley

Director

Jack Sheidler

Director

Jason Kelly

Director

Marc Fine

Director

Ronnie Stokes

Director

Scott McComb

Director

Susan Ellspermann

Director

Tyson Wagler

Director

Zachary Bawel

Lead Independent Director

Research analysts covering GERMAN AMERICAN BANCORP.

Recent press releases and 8-K filings for GABC.

- German American Bancorp, Inc. (GABC) reported total assets of $8,384 million and total deposits of $6,990 million as of December 31, 2025.

- For the full year 2025, the company achieved net income of $129,684 thousand and earnings per share of $3.52.

- GABC's net interest income for 2025 was $294,132 thousand, with a net interest margin (tax-equivalent) of 4.02%.

- The company has a history of financial growth, including fourteen consecutive years of increased dividends, with a $1.16 dividend per share for 2025.

- GABC operates 94 banking offices across Indiana, Kentucky, and Ohio, supported by approximately 1050 team members.

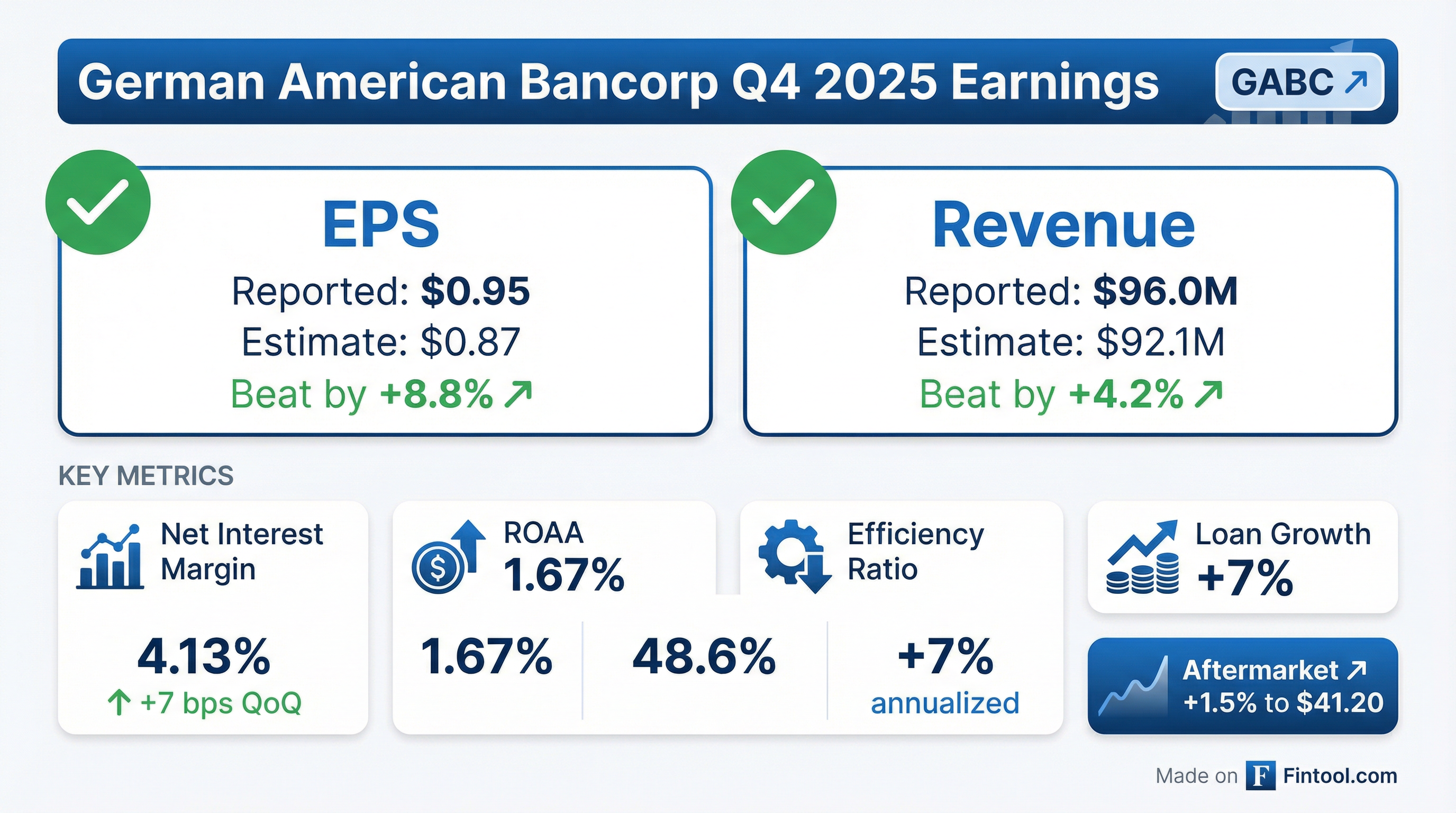

- German American Bancorp reported record fourth-quarter results for 2025, with net income of $35.7 million (approximately $0.95 per share) and adjusted EPS of $0.96, on revenue of approximately $96.0 million, representing a 47% year-over-year increase.

- For the full year 2025, the bank reported net income of $112.6 million (about $3.06 per share) and adjusted annual earnings of $129.7 million ($3.52 per share).

- The board approved a 7% increase in the regular quarterly cash dividend to $0.31 per share, payable February 20 to shareholders of record February 10.

- The company's Q4 adjusted EPS of $0.96 beat analyst consensus of $0.90, and revenue beat consensus by approximately 2.99%.

- Profitability metrics remained strong, with ROAA of ~1.67% and ROATCE of ~19.5%.

- German American Bancorp, Inc. (GABC) reported record earnings for the fourth quarter and full year 2025, with $0.95 per share (or $0.96 as adjusted) for Q4 2025 and $3.06 per share (or $3.52 as adjusted) for the full year.

- The company announced a 7% increase in its regular quarterly cash dividend to $0.31 per share, marking the 14th consecutive year of increased cash dividends.

- The Heartland Bank acquisition continued to integrate seamlessly, contributing to 7% annualized linked quarter loan growth and a $2.093 billion increase in total assets compared to December 31, 2024.

- For Q4 2025, GABC achieved a robust net interest margin of 4.13%, a return on average assets (ROAA) of 1.67%, and a low efficiency ratio of 48.6%.

- German American Bancorp (GABC) reported record net income for the fourth quarter of 2025 of $35.7 million, or $0.95 per share, and for the full year 2025 of $112.6 million, or $3.06 per share.

- The company announced a 7% increase in its regular quarterly cash dividend to $0.31 per share, marking the 14th consecutive year of increased cash dividends.

- The Heartland Bank acquisition contributed to significant growth, with total assets reaching $8.389 billion and total loans $5.884 billion at December 31, 2025.

- Key financial metrics for the fourth quarter of 2025 include a robust net interest margin of 4.13%, a strong return on average assets of 1.67%, and a low efficiency ratio of 48.6%.

- German American Bancorp, Inc. (GABC) will participate in the 2025 Hovde Group Financial Services Conference on November 6, 2025, with a presentation by its Chairman and CEO, and President and CFO.

- As of September 30, 2025, the company reported $8.4 billion in total banking assets and $7,015 million in total deposits.

- For the three months ended September 30, 2025, GABC's net income was $35,074 thousand, with a reported return on average assets of 1.68% and return on tangible equity of 21.14%.

- The company maintains strong regulatory capital levels, with a total capital ratio of 15.07% and a common Tier 1 capital ratio of 13.30% as of September 30, 2025.

- GABC operates 94 banking offices across Indiana, Kentucky, and Ohio, and manages $4.0 billion in investment and trust assets.

- German American Bancorp, Inc. (GABC) reported record earnings for the third quarter of 2025, reaching $35.1 million, or $0.94 per share.

- This represents an increase of approximately 12% on a per share basis from Q2 2025 and approximately 32% on a per share basis from Q3 2024.

- Key financial metrics for Q3 2025 included a 1.68% return on average assets, 13.0% return on average equity, and a 4.06% net interest margin.

- Total assets grew to $8.401 billion and total deposits increased to $7.014 billion at September 30, 2025, significantly influenced by the Heartland acquisition completed in Q1 2025.

- The Board of Directors declared a regular quarterly cash dividend of $0.29 per share, payable on November 20, 2025.

- German American Bancorp, Inc. (GABC) reported record earnings for the third quarter of 2025, with net income of $35.1 million, or $0.94 per share. This represents an increase of approximately 12% on a per share basis from the second quarter of 2025 and 32% on a per share basis from the third quarter of 2024.

- The company achieved strong financial metrics in Q3 2025, including a 1.68% return on average assets, a 13.0% return on average equity, and a 4.06% net interest margin. The efficiency ratio improved to 49.26%.

- Total assets reached $8.401 billion at September 30, 2025, an increase of $2.140 billion compared to September 30, 2024, largely attributable to the Heartland acquisition which closed on February 1, 2025.

- Total deposits increased 3.4% on an annualized linked quarter basis, with non-interest bearing accounts representing over 28% of total deposits at September 30, 2025. The total cost of deposits declined 6 basis points to 1.67% at September 30, 2025.

- The Board of Directors declared a regular quarterly cash dividend of $0.29 per share, payable on November 20, 2025, to shareholders of record as of November 10, 2025.

- German American Bancorp, Inc. (GABC) reported $8.3 billion in total banking assets and $3.8 billion in investment & trust assets under management as of June 30, 2025.

- The company operates 94 banking offices across Indiana, Kentucky, and Ohio.

- GABC has a history of superior financial performance, including thirteen consecutive years of increased dividends and double-digit return on equity for 20 consecutive fiscal years.

- For the six months ended June 30, 2025, the company reported net income of $59,345 thousand and earnings per share of $1.64.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more