Earnings summaries and quarterly performance for GE Vernova.

Executive leadership at GE Vernova.

Board of directors at GE Vernova.

Research analysts who have asked questions during GE Vernova earnings calls.

Julian Mitchell

Barclays Investment Bank

9 questions for GEV

Mark W. Strouse

J.P. Morgan Chase & Co.

9 questions for GEV

Nigel Coe

Wolfe Research, LLC

7 questions for GEV

Amit Mehrotra

UBS

6 questions for GEV

Chris Dendrinos

RBC Capital Markets

6 questions for GEV

Joe Ritchie

Goldman Sachs

6 questions for GEV

Nicole DeBlase

BofA Securities

6 questions for GEV

Andrew Kaplowitz

Citigroup

5 questions for GEV

Andrew Obin

Bank of America

5 questions for GEV

David Arcaro

Morgan Stanley

4 questions for GEV

Nicole DeBlase

Deutsche Bank

4 questions for GEV

Andrew Percoco

Morgan Stanley

3 questions for GEV

Joseph Ritchie

Goldman Sachs

3 questions for GEV

Julien Dumoulin-Smith

Jefferies

3 questions for GEV

Moses Sutton

BNP Paribas

3 questions for GEV

Alexander Virgo

Bank of America Merrill Lynch

2 questions for GEV

Andy Kaplowitz

Citigroup Inc.

2 questions for GEV

Michael Blum

Wells Fargo & Company

2 questions for GEV

Recent press releases and 8-K filings for GEV.

- Maxim Power entered a reservation agreement with GE Vernova to hold a manufacturing slot for a 7HA.02 gas turbine and generator, targeting delivery by 2030.

- A non-refundable deposit is payable in 2026 and will be credited against the final purchase price under a definitive sales agreement to be negotiated.

- The turbine is earmarked for the permitted 400 MW Prairie Lights Power project near Grande Prairie, Alberta, with routine permitting amendments anticipated.

- Maxim expects up to $60 million CAD of project spending in 2026 and holds approximately $84 million CAD of liquidity (including $59 million unrestricted cash).

- In 2025, GE Vernova’s Onshore Wind booked 1.1 GW of repowering orders for US wind turbines

- Projects will deploy nacelles and drive trains built at its Pensacola, Florida facility, where 20% of workers are veterans

- All orders were booked in 2025 with commercial operation expected between 2026 and 2027

- GE Vernova’s Onshore Wind business has an installed base of approximately 59,000 turbines and 120 GW of capacity worldwide

- GE Vernova priced and issued $600 million of 4.250% Senior Notes due 2031, $1 billion of 4.875% Senior Notes due 2036, and $1 billion of 5.500% Senior Notes due 2056, settling on February 4, 2026.

- The notes were issued under a First Supplemental Indenture dated February 4, 2026, with The Bank of New York Mellon serving as trustee.

- Pricing terms include yields of 4.287% (2031 Notes at +45 bps), 4.929% (2036 Notes at +65 bps), and 5.693% (2056 Notes at +78 bps) versus benchmark Treasuries.

- Net proceeds are earmarked for general corporate purposes, including financing the acquisition of the remaining 50% stake in Prolec GE.

- Joint bookrunners were Citigroup, J.P. Morgan and Morgan Stanley, with several co-managers participating.

- GE Vernova completed the acquisition of the remaining 50% stake in Prolec GE for $5.275 billion, funded equally with cash and debt

- Prolec GE, with approximately 10,000 employees across seven manufacturing sites (five in the U.S.), is now consolidated into GE Vernova’s Electrification segment

- The deal is immediately accretive and is incorporated into GE Vernova’s 2026 financial guidance, supporting growth outlook through 2028

- Leadership remains unchanged as Ricardo Suarez stays on as Prolec GE CEO, reporting to Electrification segment CEO Philippe Piron

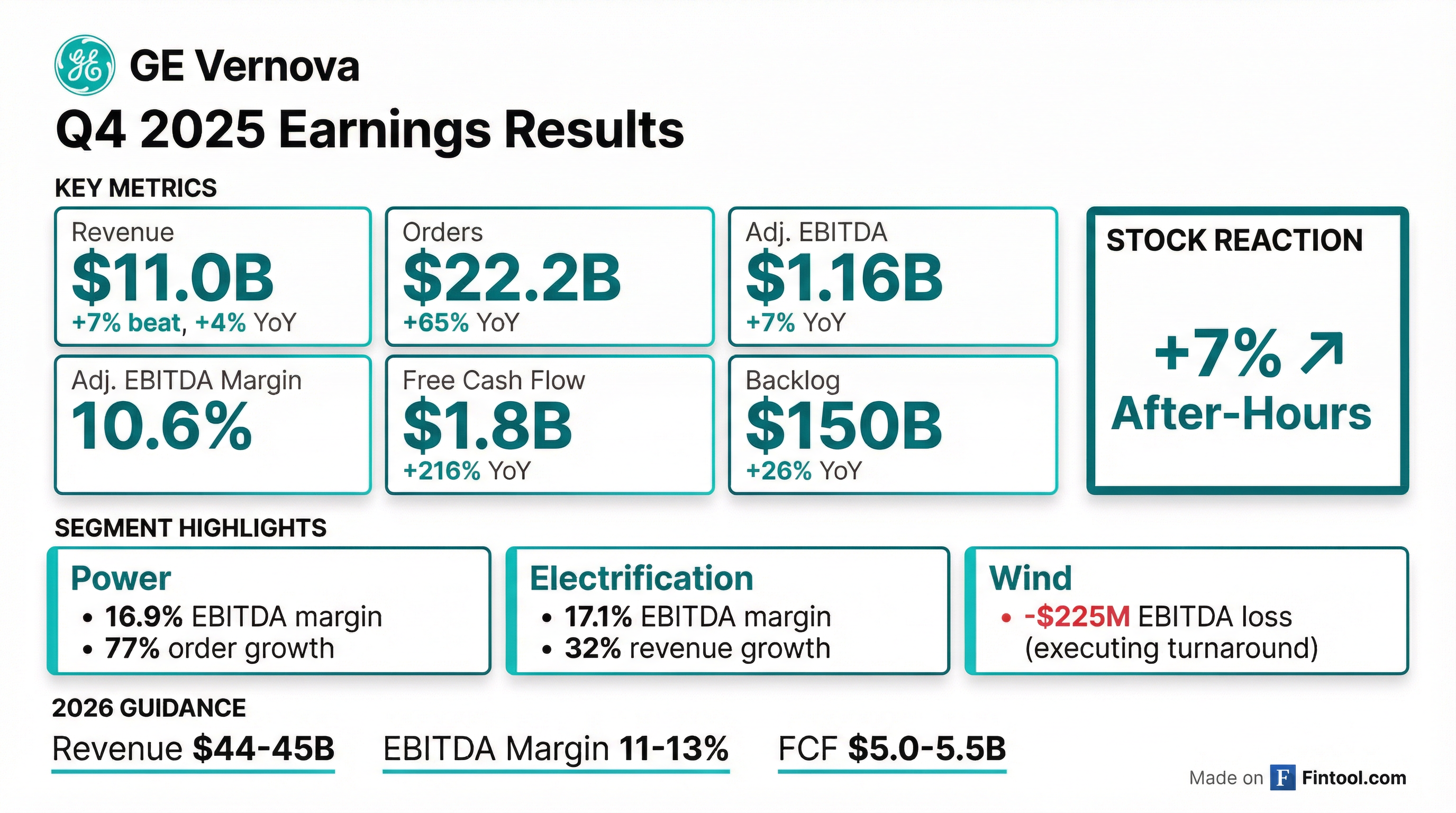

- In Q4, GE Vernova booked $22.2 B of orders (+65% yoy) and FY 2025 orders of $59 B (+34% yoy), driving total backlog up over 25% to $150 B (equipment $64 B, +50% yoy; services $86 B, +13% yoy)

- Revenue grew 2% in Q4 and 9% for FY to $38 B; Q4 adjusted EBITDA rose 6% yoy to $1.2 B (margin +30 bps); free cash flow was $1.8 B in Q4 and $3.7 B for FY

- Raised 2026 guidance to $44–45 B in revenue (from $41–42 B), adjusted EBITDA margin of 11–13%, and $5–5.5 B in free cash flow; assumes full-year Prolec GE ownership following Feb 2 closing

- Dividend for 2026 will be doubled vs 2025 and share buyback authorization increased to $10 B from $6 B

- Strong Q4 orders of $22.2 billion (up 65% YoY), boosting total backlog to $150 billion, +25% YoY.

- Revenue of +2% YoY in Q4 with adjusted EBITDA growth of 6% to $1.2 billion, margin expansion of 30 bps, and free cash flow of $1.8 billion.

- Approved Prolec GE acquisition, closing Feb 2, 2026, to contribute ~11 months of operations in 2026 and support electrification growth.

- Raised full-year 2026 guidance and updated 2028 targets to ≥$56 billion revenue and 20% EBITDA margin, reflecting Prolec GE integration.

- Booked $22.2 billion of orders in Q4 (+65% YoY, ~2× book-to-bill) and $59 billion for full-year 2025 (+34% YoY), lifting total backlog to $150 billion (+25% YoY).

- Delivered $38 billion of revenue in 2025 (+9% YoY), expanded adjusted EBITDA margin by 210 bps, and generated $3.7 billion of free cash flow.

- Ended the year with $9 billion of cash, returned $3.6 billion to shareholders (including repurchasing over 8 million shares), and secured investment-grade rating upgrades.

- Raised 2026 guidance to $44–45 billion in revenue (from $41–42 billion), adjusted EBITDA margin of 11–13%, and $5–5.5 billion of free cash flow; doubled dividend and boosted buyback authorization to $10 billion.

- Prolec GE acquisition approved to close on Feb 2, 2026, expected to add about $3 billion of revenue in 2026 and strengthen the Electrification segment.

- Orders surged 65% y/y to $22.2 B in Q4 (FY $59.3 B) and backlog expanded to $150.2 B, up $31.2 B from Q4 2024.

- Q4 revenue rose to $11.0 B (FY $38.1 B), while adjusted EBITDA reached $1.2 B with a margin of 10.6%, up 40 bps year-over-year.

- Free cash flow more than tripled to $1.8 B in Q4 and doubled to $3.7 B for FY 2025.

- Raised 2026 outlook: $44–45 B revenue (incl. Prolec GE), 11–13% adj. EBITDA margin, and $5.0–5.5 B free cash flow.

- Fourth-quarter orders of $22.2 B (+65% organically) drove revenue of $11.0 B (+4%), net income of $3.7 B (33.5% margin), adjusted EBITDA of $1.2 B, and free cash flow of $1.8 B.

- Full-year 2025 orders of $59.3 B (+34% organically) supported revenue of $38.1 B (+9%), net income of $4.9 B (12.8% margin), adjusted EBITDA of $3.2 B, and free cash flow of $3.7 B.

- 2026 guidance raised to revenue of $44–45 B (from $41–42 B), adjusted EBITDA margin of 11–13%, and free cash flow of $5.0–5.5 B.

- M&A update: GE Vernova will acquire the remaining 50% of Prolec GE for $5.275 B, expected to close on February 2, 2026.

- SageSure Holdings and GeoVera Nova closed the inaugural Meritage Re Ltd. Series 2026-1 catastrophe bond for $200 million, the first issuance from the newly formed Bermuda SPV

- The three-year bond provides US named storm coverage for SageSure’s carrier partners—GeoVera Insurance Company, GeoVera Specialty Insurance Company, and Safeport Insurance Company—and was priced significantly below initial guidance due to strong investor demand

- Swiss Re Capital Markets acted as sole structuring agent and bookrunner, reflecting market confidence in GeoVera Nova’s portfolio and SageSure’s underwriting capabilities

- The transaction diversifies GeoVera Nova’s reinsurance program and strengthens capacity in catastrophe-prone regions, supporting stable, reliable hurricane protection

Fintool News

In-depth analysis and coverage of GE Vernova.

Quarterly earnings call transcripts for GE Vernova.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more