Earnings summaries and quarterly performance for GRACO.

Executive leadership at GRACO.

Mark Sheahan

President and Chief Executive Officer

David Lowe

Chief Financial Officer and Treasurer

Joseph Humke

Executive Vice President, General Counsel and Corporate Secretary

Peter O'Shea

President, Global Industrial Division

Ronita Banerjee

Executive Vice President and Chief Human Resources Officer

Board of directors at GRACO.

Research analysts who have asked questions during GRACO earnings calls.

Andrew Buscaglia

BNP Paribas

9 questions for GGG

Deane Dray

RBC Capital Markets

9 questions for GGG

Matt Summerville

D.A. Davidson & Co.

9 questions for GGG

Saree Boroditsky

Jefferies

9 questions for GGG

Walter Liptak

Seaport Research Partners

8 questions for GGG

Jeffrey Hammond

KeyBanc Capital Markets

7 questions for GGG

Brad Hewitt

Wolfe Research, LLC

6 questions for GGG

Bryan Blair

Oppenheimer

6 questions for GGG

Mike Halloran

Robert W. Baird & Co. Incorporated

5 questions for GGG

Joe Ritchie

Goldman Sachs

4 questions for GGG

Michael Halloran

Baird

3 questions for GGG

Michael Moran

KeyBanc Capital Markets

2 questions for GGG

Joseph Ritchie

Goldman Sachs

1 question for GGG

Sam Coram

William Blair

1 question for GGG

Recent press releases and 8-K filings for GGG.

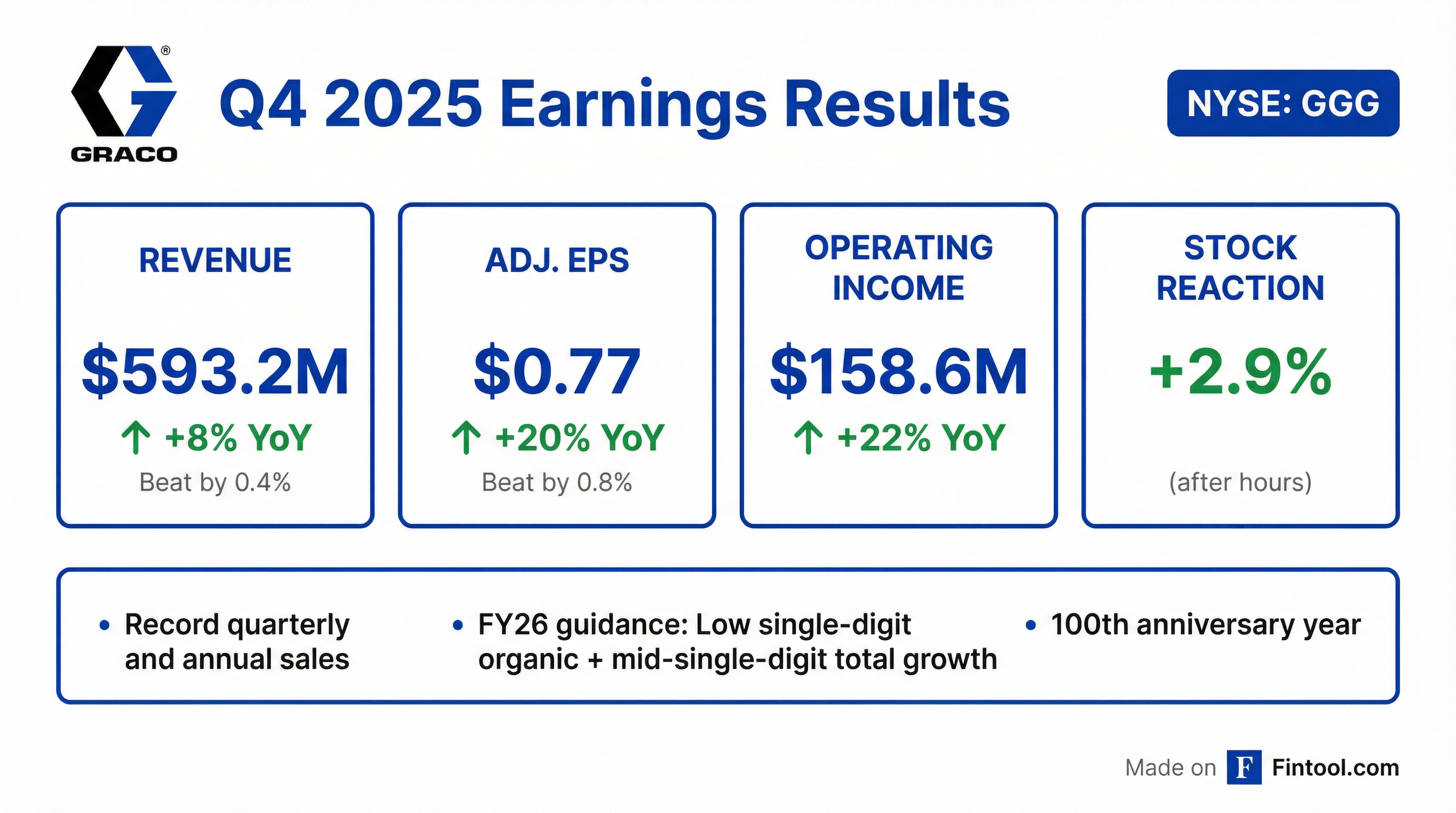

- GGG reported record sales for both the fourth quarter and the full year 2025, with Q4 sales up 8% and adjusted operating earnings increasing 15% to 27% of sales.

- The company generated $684 million in cash from operations for the year, an increase of 10%, and returned over $600 million to shareholders through dividends and share repurchases.

- For 2026, GGG projects low single-digit organic revenue growth on a constant currency basis, and mid-single digit growth after factoring in recent acquisitions, with an expected effective tax rate of 20%-21%.

- GGG continues its strategic acquisition focus, having successfully integrated COROB, Radia, and Color Service, which are expected to generate nearly $190 million in full-year revenue.

- Market conditions remain mixed, with improved performance in the Home Center channel and strong growth in the Industrial segment, while core construction markets are still sluggish and some Expansion Markets segments saw declines in Q4.

- Graco reported Q4 2025 sales of $593 million, an 8% increase year-over-year, with 2% organic growth, 4% from acquisitions, and 2% from currency translation. Adjusted non-GAAP net earnings for the quarter increased 20% to 77 cents per diluted share.

- For the full year 2025, operating cash flow increased 10% to $684 million , and the company ended the year with a net cash position of $600 million. Capital allocation included $423 million for share repurchases, $183 million for dividends, and $135 million for acquisitions.

- The company expects 2026 revenue growth to be low single-digit organically on a constant currency basis, and mid-single digit including recent acquisitions. Projected capital expenditures for 2026 are $90-$100 million, plus an additional $50 million for facility expansion.

- Recent acquisitions, including Corob, Radia, and Color Service, were successfully integrated and are expected to generate nearly $190 million in full-year revenue. The "One Graco" initiative contributed approximately $15 million in cost savings in 2025.

- Graco (GGG) reported Net Sales of $593.2 million in Q4 2025, an 8% increase from Q4 2024, with acquisitions contributing 4 percentage points and currency translation 2 percentage points. For the full year 2025, Net Sales reached $2236.6 million, up 6% from 2024.

- Diluted Net Earnings Per Share increased 25% to $0.79 in Q4 2025 and 9% to $3.08 for the full year 2025.

- Operating Earnings for Q4 2025 were $158.6 million, a 22% increase from Q4 2024, and $624.8 million for the full year 2025, up 10% from 2024.

- The company generated $684 million in cash from operations in 2025 and repurchased 5.1 million shares for $423 million.

- Graco anticipates low single-digit growth for 2026.

- Graco reported Q4 2025 sales of $593 million, an 8% increase year-over-year, driven by 4% from acquisitions, 2% from currency translation, and 2% organic growth. Net earnings rose 22% to $133 million, or 79 cents per diluted share.

- For the full year 2025, cash provided by operations increased 10% to $684 million, and inventory was reduced by $46 million to $336 million, reaching its lowest level since June 2021. The company concluded the year with a net cash position of $600 million.

- The company issued 2026 revenue guidance projecting low single-digit organic growth on a constant currency basis, expanding to mid-single digit growth when factoring in expected incremental sales from recent acquisitions. The anticipated effective tax rate for 2026 is 20%-21%.

- Graco successfully integrated the Corob, Radia, and Color Service acquisitions, which are collectively expected to contribute nearly $190 million in full-year revenue. The company maintains a strong acquisition pipeline with over 100 potential targets.

- Graco Inc. reported record net sales of $593.2 million for the fourth quarter ended December 26, 2025, an 8% increase from the prior year, and $2,236.6 million for the full year 2025, a 6% increase.

- Diluted net earnings per common share increased 25% to $0.79 for Q4 2025 and 9% to $3.08 for the full year 2025.

- Acquired operations were a significant contributor to growth, adding 4 percentage points to quarterly sales growth and 5 percentage points to annual sales growth.

- For 2026, Graco is initiating guidance for low single-digit organic sales growth on a constant-currency basis and mid-single-digit sales growth including acquisitions.

- Graco Inc. reported record quarterly and annual sales for the period ended December 26, 2025.

- Net sales for the fourth quarter increased 8% to $593.2 million, and for the full year 2025, they increased 6% to $2,236.6 million.

- Net earnings rose 22% to $132.5 million in the fourth quarter and 7% to $521.8 million for the full year.

- Diluted net earnings per common share increased 25% to $0.79 for Q4 2025 and 9% to $3.08 for FY 2025.

- For 2026, Graco is initiating guidance for low single-digit organic sales growth on a constant-currency basis and mid-single-digit sales growth including acquisitions.

- Graco Inc. has authorized a new share repurchase program for up to 15 million shares, adding to an existing authorization with nearly 8 million shares remaining.

- The company announced a 7.3% increase in its quarterly dividend to 29.5 cents per share, payable on February 4, 2026, to shareholders of record as of January 19, 2026.

- This increased dividend translates to an annualized dividend of $1.18 per share, yielding approximately 1.4% based on a stock price of $83.33 at the time of announcement.

- Graco demonstrates strong financial health with $2.19 billion in revenue, a 26.56% operating margin, and a low debt-to-equity ratio of 0.02.

- Newell Brands reported net sales of $1.8 billion for the third quarter of 2025, representing a 7.2% decline compared to the prior year period, with core sales decreasing by 7.4%.

- Diluted EPS for Q3 2025 was $0.05, an improvement from a diluted loss per share of $0.48 in the prior year period. Normalized diluted EPS increased to $0.17 from $0.16 in the prior year period.

- The company updated its full year 2025 outlook, forecasting net sales to decline between 5.0% and 4.5% and normalized EPS to range from $0.56 to $0.60.

- At the end of the third quarter of 2025, Newell Brands had $4.8 billion in debt outstanding and $229 million in cash and cash equivalents.

- Graco Inc. reported Q3 2025 revenue of $543.4 million, a 4.7-5% year-over-year increase primarily driven by recent acquisitions, but missed analyst expectations due to a 2% decline in organic sales amid softness in global construction markets.

- Adjusted earnings per share for the quarter came in at $0.73, slightly below consensus estimates, representing a 2.67% negative earnings surprise.

- The company's operating margin improved to 30.3% from 28.1% in the previous year, signaling better profitability despite revenue headwinds, with net earnings for the quarter at $122.8 million.

- Graco maintains strong financial health, indicated by a current ratio of 3.55 and a debt-to-equity ratio of 0.02, alongside a high Altman Z-Score of 17.66.

- Graco expects low single-digit organic growth for 2025 and continues to pursue strategic acquisitions, though its stock has underperformed the broader market year-to-date.

- Graco reported net sales of $543.4 million for the third quarter ended September 26, 2025, an increase of 5% year-over-year, driven by a 6 percentage point contribution from acquired operations which offset a 2% organic revenue decline.

- For the third quarter, net earnings increased 13% to $137.6 million, and diluted net earnings per common share rose 15% to $0.82. Adjusted net earnings were flat at $122.8 million, and adjusted diluted EPS increased 3% to $0.73.

- The gross profit margin rate remained flat in the third quarter due to price realization and favorable product/channel mix offsetting higher product costs and lower margins from acquired operations. Operating expenses decreased 5%, benefiting from a $14 million non-cash gain related to acquisition-related contingent consideration.

- Year-to-date, net sales increased 5% to $1,643.4 million, with net earnings up 3% to $389.4 million and diluted EPS up 5% to $2.30.

- The company expects to meet its full-year guidance of low single-digit sales growth on an organic, constant currency basis, supported by steady order rates and improved pricing actions.

Quarterly earnings call transcripts for GRACO.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more