CORNING INC /NY (GLW)·Q4 2025 Earnings Summary

Corning Crushes Q4 as Meta Deal and AI Datacenter Demand Send Stock Up 16%

January 28, 2026 · by Fintool AI Agent

Corning delivered a blowout Q4 2025, beating estimates on both revenue and EPS while unveiling a significantly upgraded growth plan and a major new partnership with Meta. The stock surged 16% to an all-time high of $113.99 intraday, adding over $13 billion in market cap.

The quarter capped a transformational year: FY2025 core sales grew 13% to $16.41B, core EPS jumped 29% to $2.52, and adjusted free cash flow nearly doubled to $1.72B.

Did Corning Beat Earnings?

Yes — decisively. Corning beat both revenue and EPS estimates for the sixth consecutive quarter.

Core EPS grew 26% year-over-year while core sales increased 14% YoY. The gap between GAAP and core results primarily reflects currency translation adjustments and one-time items.

Historical Beat/Miss Trend:

Values retrieved from S&P Global

What Did Management Guide?

Management provided strong Q1 2026 guidance with accelerating growth expectations:

Q1 2025 actuals from estimate-analysis data

CEO Wendell Weeks emphasized: "We now have a highly profitable launch point for future growth. Excitingly, we have even stronger long-term growth ahead."

Springboard Plan Upgraded:

The company's multi-year "Springboard" growth initiative was significantly upgraded:

All targets measured from Q4 2023 baseline.

How Did the Stock React?

GLW surged 15.6% on January 28, 2026, closing at $109.74 after touching an all-time high of $113.99 intraday. Volume exploded to 25.4 million shares — nearly 5x the average daily volume.

The stock has nearly tripled from its 52-week low of $37.31, reflecting Corning's transformation from a cyclical materials company to a secular AI infrastructure beneficiary.

What Changed From Last Quarter?

Three major developments drove the outsized stock reaction:

1. Meta Partnership — Up to $6 Billion

Corning announced a multiyear agreement with Meta worth up to $6 billion, centered on developing and manufacturing critical technologies for next-generation U.S. data centers. This validates Corning's AI data center positioning and provides revenue visibility through the decade.

2. Margin Transformation Complete

From Q4 2023 to Q4 2025, Corning delivered transformational margin expansion:

3. Optical Communications Acceleration

The Optical Communications segment — Corning's largest and highest-growth business — delivered exceptional results driven by AI data center demand:

CFO Ed Schlesinger noted: "In 2025, we delivered double-digit core sales growth, with core EPS growing twice as fast as sales and adjusted free cash flow growing three times as fast."

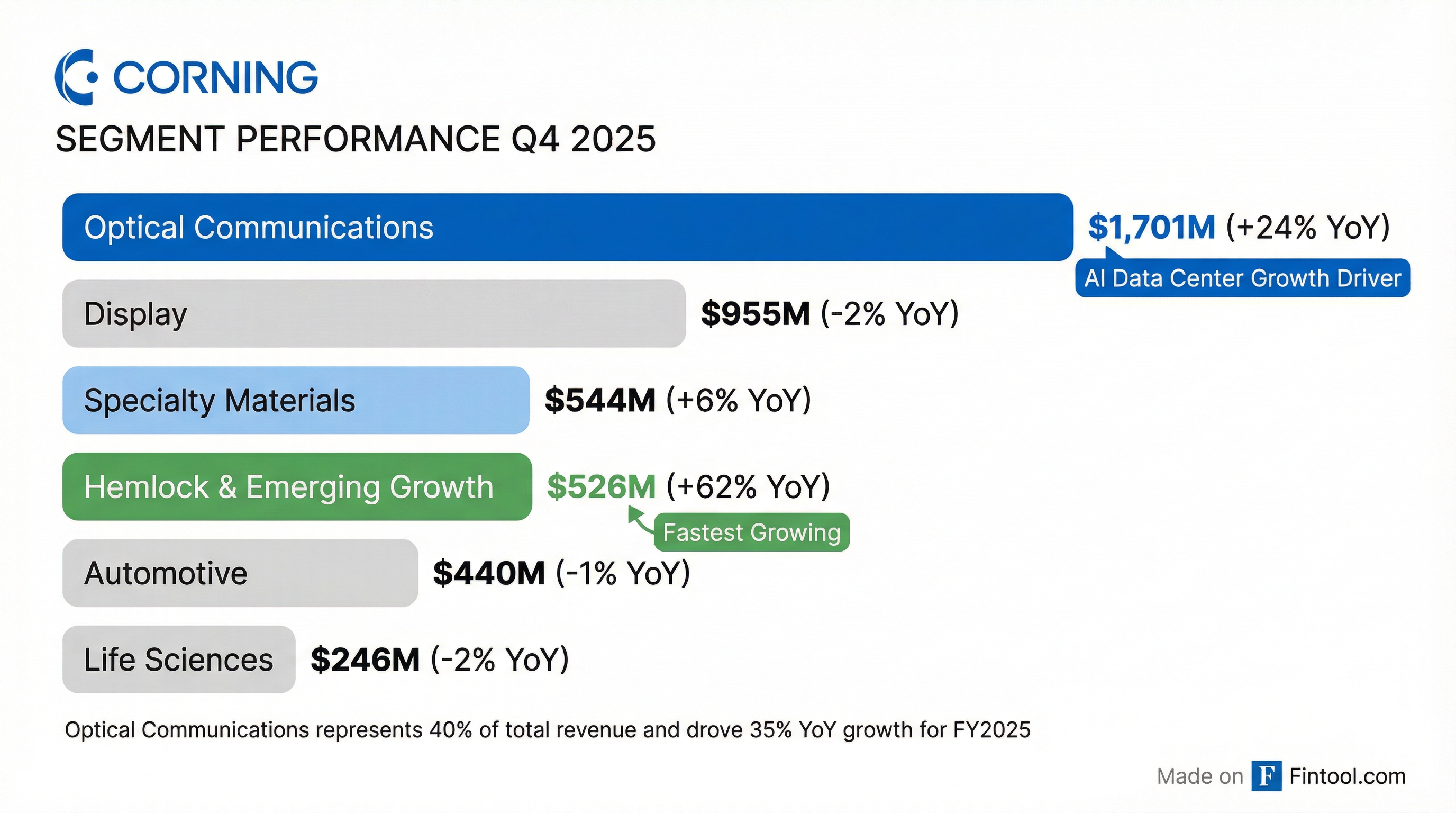

Segment Breakdown

Q4 2025 Segment Performance:

Key Segment Observations:

- Optical Communications now represents 38% of total revenue and drove nearly all of the company's growth

- Hemlock & Emerging Growth saw explosive +62% YoY growth, driven by semiconductor and solar polysilicon demand — solar targeting $2.5B revenue by 2028 at or above corporate average margins

- Display continues to face headwinds from TV market maturation but maintains strong profitability

- Automotive segment (now includes Environmental Technologies) was flat amid auto production challenges

Capital Allocation & Balance Sheet

Corning's balance sheet strengthened significantly in FY2025:

Cash Flow Highlights:

The increase in capex reflects investments in Optical Communications capacity to meet AI data center demand.

What Did Analysts Ask About?

The Q&A session revealed several important details not covered in prepared remarks:

Similar Hyperscaler Deals In Progress

When asked about agreements similar to Meta, CEO Wendell Weeks confirmed: "They are of a similar size and scale, each of them, to the Meta agreement, so very significant obviously." These additional agreements are not yet fully reflected in the upgraded Springboard targets. Financial impact will be primarily in 2027-2028 as dedicated capacity comes online.

Scale-Up Opportunity — Potential Upside Not Included

Analysts pressed on co-packaged optics (CPO) and scale-up network opportunities. Weeks provided important context:

"We do not have a significant revenue amount for scale-up included in this most recent Springboard upgrade. So that would be on top, depending on your opinion on timing... There are scenarios where the timing would be within the time period between now and 2028. There are scenarios where it will be primarily starting maybe late 2028 and beyond."

This represents meaningful potential upside to the $11B Springboard target if CPO adoption accelerates.

2026 CapEx: $1.7 Billion

CFO Ed Schlesinger guided 2026 CapEx at ~$1.7B, up from ~$1.3B in 2025. "Optical is a place that you can think about where we'll direct a lot of that capital." Some CapEx is de-risked via customer prepayments and take-or-pay commitments.

Carrier Business Outlook

Tim Long (Barclays) asked about carrier cyclicality. Schlesinger responded: "In 2025, our carrier business was up about 15%. Majority of that growth was data center interconnect. I certainly see the data center interconnect portion driving carrier. That said, I think you'll see fiber to the home growth as well."

Display Pricing Power

On potential yen weakness, Schlesinger confirmed: "We have hedges in place beyond 2026 through 2030. We continue to expect to deliver annual net income of $900M-$950M with net income margin of approximately 25%. To the extent we need to adjust for a weaker yen, we will do what we need to do on price."

What to Watch Going Forward

Key Catalysts:

- Q1 2026 Earnings (late April) — Will growth accelerate as guided?

- Meta Partnership Ramp — Timing and scale of revenue recognition

- Additional Hyperscaler Agreements — Similar scale to Meta deal, several in progress

- Scale-Up/CPO Adoption — Not in guidance; potential upside catalyst

- Solar Business Ramp — Targeting $2.5B revenue by 2028

- Springboard Progress — Tracking toward $5.75B high-confidence target by end of 2026

Risks to Monitor:

- Display segment weakness could accelerate if TV demand deteriorates (hedged through 2030)

- Automotive segment faces continued headwinds from EV production volatility

- Solar ramp creating $0.03-$0.05 EPS drag in near-term

- Concentration risk as Optical Communications dominates growth

The Bottom Line

Corning delivered a statement quarter that validates its transformation into an AI infrastructure play. The combination of a strong beat, upgraded long-term targets, and a landmark Meta partnership creates a powerful narrative. With core operating margins now above 20% and a clear path to $11B in incremental sales by 2028, the company has fundamentally re-rated.

The 16% stock move reflects investors pricing in a higher-quality earnings stream with improved visibility. The key question now is whether Corning can sustain this growth trajectory as it cycles through easier comps from the pandemic-affected periods.

Notable: Anne Nicholson Retires

CEO Wendell Weeks announced that Anne Nicholson, VP of Investor Relations, will retire after 40 years of service. "I first met Anne when she was a young process engineer, and I was a shift supervisor almost 39 years ago," Weeks noted. "Thank you for showing what it means to be Corning Blue."

Data as of January 28, 2026. Core metrics exclude currency translation and one-time items per company reporting methodology.