GENTEX (GNTX)·Q4 2025 Earnings Summary

Gentex Q4 2025: Revenue Misses as VOXX Integration Continues, But Margins Hit Multi-Year High

January 30, 2026 · by Fintool AI Agent

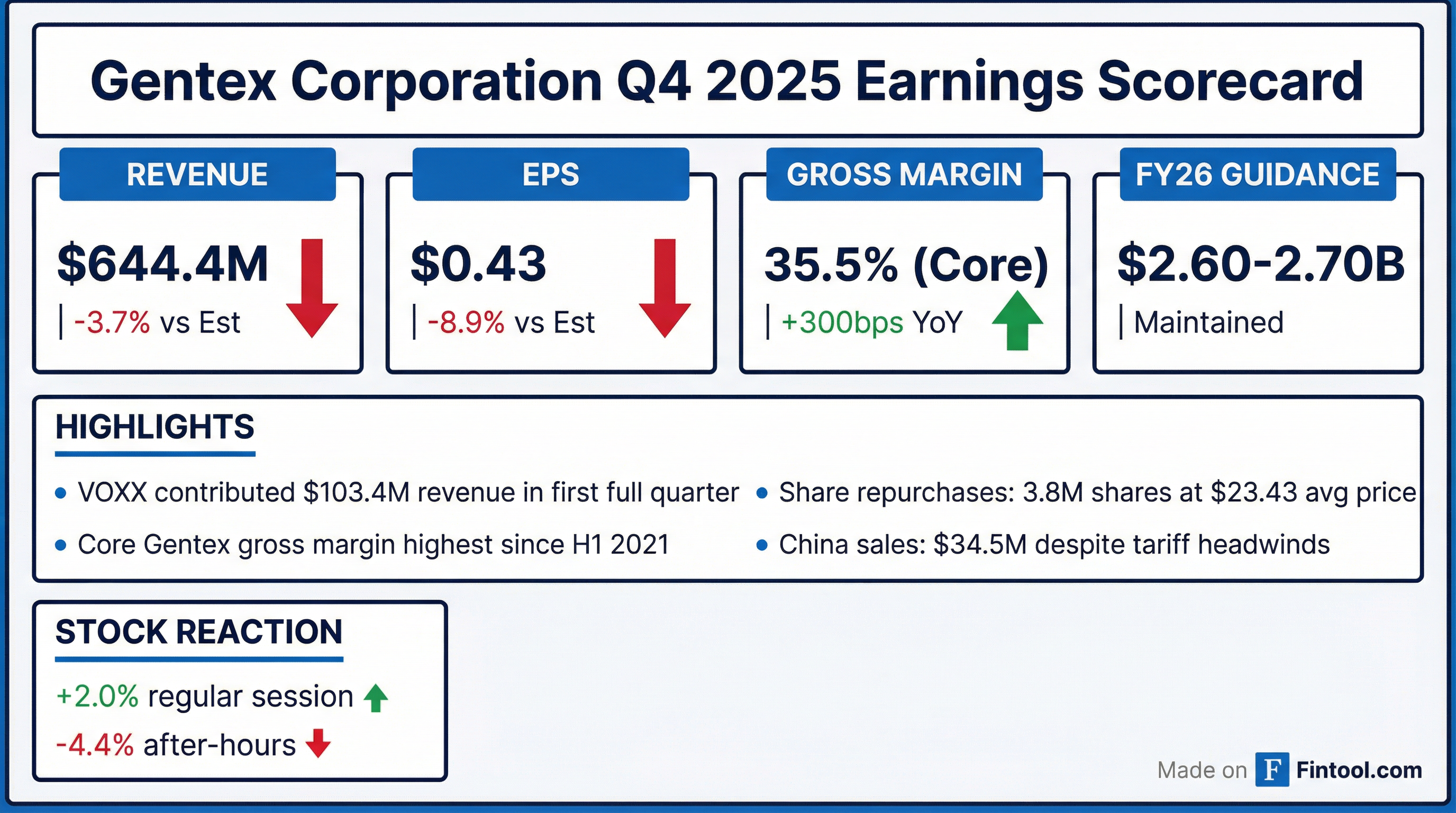

Gentex Corporation (NASDAQ: GNTX) reported Q4 2025 results that missed Wall Street estimates on both revenue and EPS, but delivered its highest core gross margin in nearly five years. The auto-dimming mirror supplier posted consolidated revenue of $644.4 million (-3.7% vs. consensus) and EPS of $0.43 (-8.9% vs. consensus), with weakness in China offsetting margin improvements and strong VOXX seasonal sales.

The stock gained 2% during the regular session but fell 4.4% in after-hours trading as investors digested the top-line miss and tempered guidance.

Did Gentex Beat Earnings This Quarter?

No — Gentex missed on both revenue and EPS despite strong margin performance.

Core Gentex revenue (excluding VOXX) was $541.0 million, essentially flat versus Q4 2024 despite a 2% decline in light vehicle production in the company's primary markets of North America, Europe, and Japan/Korea.

The gross margin story was the bright spot: core Gentex achieved 35.5% gross margin, up 300 basis points year-over-year and the highest quarterly margin since H1 2021.

What Drove the Revenue Miss?

China weakness and tariff headwinds offset strength in primary markets.

CEO Steve Downing highlighted the geographic divergence in his prepared remarks:

"Revenue in [our primary] regions grew approximately 3% quarter‑over‑quarter, compared to a 2% decline in light‑vehicle production, representing a five‑point outperformance relative to the underlying market. Sales into China totaled approximately $34.5 million for the quarter despite the impact from tariffs and counter-tariffs."

Revenue by Segment:

Auto-dimming mirror shipments declined 3% quarter-over-quarter to 10.46 million units, with both interior mirrors (-3%) and exterior mirrors (-3%) showing weakness.

How Did Margins Improve So Much?

Purchasing cost reductions, operational efficiencies, and favorable product mix — partially offset by 150bps of tariff headwind.

The 300 basis point improvement in core Gentex gross margin (32.5% → 35.5%) came from:

- Purchasing cost reductions — Multi-year procurement initiatives paying off

- Operational efficiencies — Manufacturing productivity gains

- Favorable product mix — Higher-content mirrors and new features

- Tariff drag of ~150bps — Net of recoveries from customers

Downing noted: "The steady improvement in gross margin reflects the Company's disciplined focus on cost control, productivity, and execution... Despite external headwinds."

What Did Management Guide?

2026: $2.60-2.70B revenue with 34-35% gross margin. Initial 2027 guidance: $2.75-2.85B.

Guidance is based on S&P Global Mobility's mid-January 2026 light vehicle production forecast:

2027 Revenue Bridge: Management broke down the expected 6% revenue growth:

- Core Gentex: 2-3% growth in 2026, accelerating in 2027

- DMS launches: Full-year revenue impact from Volvo, Polestar, plus two additional OEMs

- FDM growth: Continued expansion above market

- Dimmable visors: Initial revenue contribution by late 2027

- VOXX: ~5% organic growth on an annualized basis

What Changed From Last Quarter?

Margin momentum accelerated while revenue trends normalized after Q3's VOXX-driven beat.

The sequential decline in VOXX revenue reflects typical post-holiday seasonality after strong Q4 (which includes holiday-period demand for consumer electronics).

Capital Allocation: Aggressive Buybacks Continue

3.8M shares repurchased at $23.43 average — 35% more capital returned to shareholders in FY 2025.

The company has 35.9 million shares remaining under its repurchase authorization. At current prices (~$24), this represents potential additional buybacks of ~$860 million.

How Did the Stock React?

Mixed reaction: +2% during regular session, -4.4% after-hours.

The initial positive reaction likely reflected:

- Gross margin exceeding expectations at 35.5%

- Maintained 2026 guidance

- Strong capital return program

The after-hours selling appears driven by:

- Revenue miss of 3.7%

- EPS miss of 8.9%

- Cautious 2026 LVP outlook (-1% to -2% across all regions)

Key Q&A Highlights

On tariff recovery: Management noted tariffs reduced gross margin by approximately 150 basis points in Q4, net of customer recoveries. The company continues to work with OEM customers on pass-through agreements.

On 2026 cost headwinds: CEO Downing quantified the challenge: "If you look at the weighted average, you really only had about 6 months of the full weighted average of tariffs this year versus a full 12 months next year. Those two [commodities and tariffs] represent probably $45-50 million of headwinds when we start the beginning of the year."

On DRAM cost surge: COO Neil Boehm addressed supply chain concerns: "The pricing on RAM with these issues that popped up, gone through the roof on pretty much every version of that component... Some of these DRAM cost points are multiples of where they used to be." The company plans to negotiate cost recovery with OEM customers similar to prior chip shortages.

On VOXX integration: CEO Downing stated integration is "on track" with the company "aligning product strategies, furthering customer engagement, and pursuing operational synergies across the combined businesses." The VOXX cost improvement initiative is expected to yield approximately $40 million per year in positive cash flow. Based on Q4 annualized results, management noted they're "about halfway to 60% of the way there" on synergy targets.

On China: Sales into China totaled $34.5 million for Q4, down 33% YoY due to tariffs. When asked what's happening with lost business, CEO Downing explained: "It's probably a 2/3, 1/3 type scenario — two-thirds of the time, a domestic Chinese OEM is just dropping the technology. About a third of the time, they're using a local supplier." If tariff rates normalize, Gentex would be "right back in a good position to compete."

On Chinese OEMs expanding globally: Management confirmed that as Chinese OEMs set up factories outside China (where duty rates are more favorable), Gentex is well-positioned: "Most of those customers have worked with us in the past, and so as they look to expand footprint into other regions, we're absolutely on their list of suppliers."

On Tesla exposure: CEO Downing flagged Tesla as both a risk and opportunity: "We do have some pretty good exposure to Tesla as a customer... We've been a long-term partner with them and definitely have some upside risk on an OEM basis."

On European decontenting: Management acknowledged OEMs are eliminating features to cut costs, particularly passenger-side auto-dimming mirrors. "As OEMs struggle on their cost side, that's one of the things they do look at is feature elimination to try to save money."

On headcount: Restructuring is "90% complete" — the company is "really close to the right headcount" assuming sales continue on current trajectory.

Product Launch Updates

Driver Monitoring Systems (DMS): In Q4 2025, Gentex began shipping DMS to both Volvo and Polestar — the full system including cameras, LED emitters, processing, and Gentex-developed software. COO Boehm called it "an exceptional accomplishment." By mid-2026, the company expects to be in production with two additional OEMs.

Full Display Mirror (FDM): Shipped 3.19 million units in 2025, up 8% from 2.96 million in 2024. Management expects 200,000-400,000 additional units in 2026. The next-gen FDM with "Dynamic View Assist" was showcased at CES — featuring automatic view expansion at low speeds, digital tilt in reverse, and picture-in-picture for blind spots.

Dimmable Visors: Gentex secured its first production customer, with shipments targeted for H2 2027. "OEM interest in our dimmable visor technology has never been higher," said Boehm. Unlike large-area devices, visors use core electrochromic chemistry — enabling faster time-to-market.

Large-Area Devices (Sunroofs, Windows): Customer engagement remains strong, but commercialization is further out. Equipment for in-house wet coating capability is being installed and should be operational by late Q1/early Q2 2026, enabling production-quality film samples for customer demonstrations.

CES 2026: Gentex's largest CES presence ever with four distinct booths. The Premium Audio Company (Klipsch, Onkyo) celebrated Klipsch's 80th anniversary with new Fives, Sevens, and Nines powered speakers, Atlas hi-fi headphones, and new AV receivers. Products received 26 awards at the show.

Forward Catalysts

- VOXX synergy realization — $40M annual cash flow improvement target, currently ~50-60% achieved

- DMS expansion — Two additional OEMs by mid-2026, full-year revenue impact in 2027

- FDM growth — 200-400K incremental units in 2026, next-gen Dynamic View Assist launches

- Dimmable visor production — First customer production H2 2027

- Gross margin sustainability — Company achieved 35-36% target range, question is whether it holds given $45-50M commodity/tariff headwinds

- Tariff recovery negotiations — Ongoing customer discussions to recover 2025 tariff costs

Historical Beat/Miss Track Record

Gentex has had a mixed track record in 2025, with two beats and two misses on revenue. The Q4 miss continues a pattern of tariff-related weakness despite strong operational execution on margins.

Conference call held January 30, 2026 at 9:30 AM ET. View transcript

Full 8-K filing available at SEC.gov