Earnings summaries and quarterly performance for GENTEX.

Executive leadership at GENTEX.

Steve Downing

President and Chief Executive Officer

Kevin Nash

Vice President, Finance, Chief Financial Officer and Treasurer

Matt Chiodo

Chief Sales Officer and Senior Vice President, Sales

Neil Boehm

Chief Operations Officer and Chief Technology Officer

Scott Ryan

Vice President, General Counsel and Corporate Secretary

Board of directors at GENTEX.

Research analysts who have asked questions during GENTEX earnings calls.

Josh Nichols

B. Riley Financial

8 questions for GNTX

Luke Junk

Robert W. Baird & Co.

8 questions for GNTX

Joseph Spak

UBS Group AG

7 questions for GNTX

Ryan Brinkman

JPMorgan Chase & Co.

7 questions for GNTX

David Whiston

Morningstar, Inc.

6 questions for GNTX

Mark Delaney

The Goldman Sachs Group, Inc.

6 questions for GNTX

James Picariello

BNP Paribas

5 questions for GNTX

Jake Scholl

BNP Paribas

3 questions for GNTX

Ronald Jewsikow

Guggenheim Partners

3 questions for GNTX

Charles Sloan

Oak Family Advisors

1 question for GNTX

Joe Spak

UBS Group AG

1 question for GNTX

Ron Jewsikow

Guggenheim Securities, LLC

1 question for GNTX

Recent press releases and 8-K filings for GNTX.

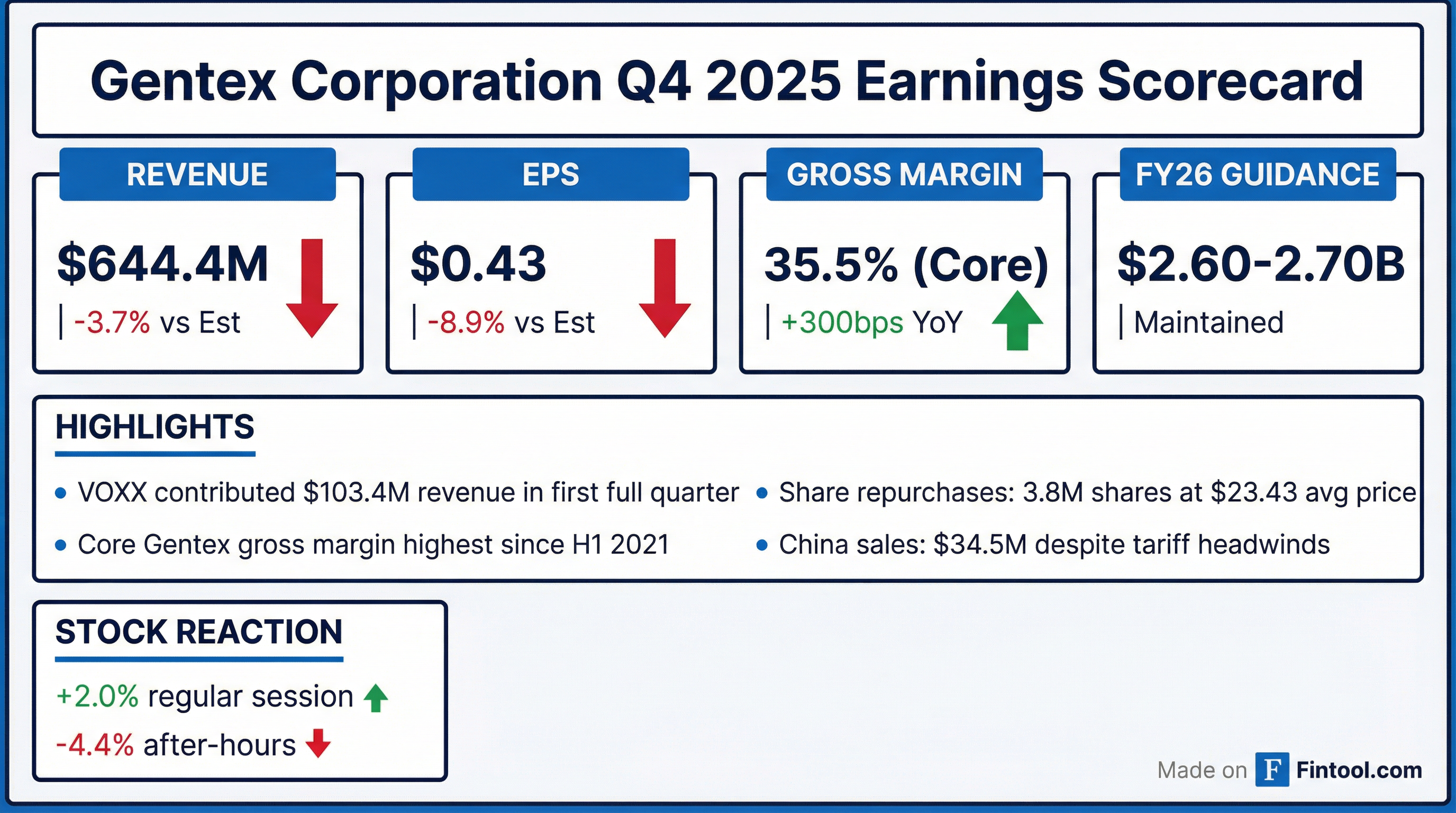

- For Q4 2025, Gentex reported consolidated Net Sales of $644.4 million and consolidated earnings per diluted share of $0.43.

- For the full year 2025, consolidated Net Sales reached $2.53 billion and consolidated earnings per diluted share were $1.74.

- In 2025, Gentex returned $425.9 million to shareholders, which included $319.0 million in share repurchases (13.6 million shares) and $106.9 million in dividends.

- The company provided 2026 consolidated revenue guidance of $2.6 - $2.7 billion and a 2027 revenue guide of $2.75 - $2.85 billion.

- Gentex reported Q4 2025 consolidated net sales of $644.4 million, an increase of 19% year-over-year, and diluted earnings per share (EPS) of $0.43. For the full year 2025, consolidated net sales were $2.53 billion and diluted EPS was $1.74.

- The company achieved a consolidated gross margin of 34.8% in Q4 2025 and 34.2% for the full year 2025, with the core Gentex gross margin reaching its highest level since the first half of 2021.

- Gentex provided 2026 consolidated revenue guidance of $2.6 billion to $2.7 billion and 2027 revenue guidance of $2.75 billion to $2.85 billion, with a 2026 consolidated gross margin forecast of 34% to 35%.

- The VOXX acquisition contributed $103.4 million to Q4 2025 revenue and $267.2 million for the nine-month period , with integration efforts expected to yield approximately $40 million per year in positive cash flow.

- In 2025, Gentex repurchased 13.6 million shares totaling $319 million , while facing continued headwinds in the China market due to tariffs, which resulted in a 33% decrease in sales into China for Q4 2025.

- Gentex reported Q4 2025 consolidated net sales of $644.4 million, a 19% increase year-over-year, with Vox contributing $103.4 million. For the full year 2025, consolidated net sales were $2.53 billion, up 10% from 2024. The Q4 diluted EPS was $0.43 and full-year EPS was $1.74.

- The company achieved a Q4 2025 consolidated gross margin of 34.8%, with the core Gentex gross margin at 35.5%, marking the highest gross margin since the first half of 2021. Full-year 2025 consolidated gross margin was 34.2%.

- For 2026, Gentex anticipates consolidated revenue between $2.6 billion and $2.7 billion and expects a gross margin of 34% to 35%. The company also began shipping driver monitoring systems to Volvo and Polestar in Q4 2025 and secured its first customer for dimmable sun visors, targeting H2 2027 shipments.

- Gentex reported Q4 2025 consolidated net sales of $644.4 million, a 19% increase year-over-year, and diluted earnings per share of $0.43. For the full year 2025, consolidated net sales reached $2.53 billion, up 10% from 2024, with diluted EPS of $1.74.

- The Vox acquisition contributed $103.4 million to Q4 2025 revenue and $267.2 million for the nine-month period, with integration efforts expected to generate approximately $40 million per year in positive cash flow.

- The company provided 2026 consolidated revenue guidance of $2.6 billion to $2.7 billion and 2027 revenue guidance of $2.75 billion to $2.85 billion.

- Gentex repurchased 13.6 million shares totaling $319 million in 2025 and launched driver monitoring systems for Volvo and Polestar in Q4 2025, with a first customer for dimmable visors targeting a second half of 2027 launch.

- For the fourth quarter of 2025, Gentex reported a 19% increase in consolidated net sales to $644.4 million, with diluted earnings per share rising to $0.43 compared to $0.39 in Q4 2024. Consolidated gross margin improved to 34.8% from 32.5% in Q4 2024.

- Consolidated net sales for the full calendar year 2025 grew 10% to $2.53 billion, while diluted earnings per share were $1.74.

- The VOXX acquisition, completed on April 1, 2025, contributed $103.4 million in revenue during Q4 2025 and $267.2 million for the full year 2025.

- Gentex returned $425.9 million to shareholders in 2025, a 35% increase from 2024, which included $319.0 million in share repurchases and $106.9 million in dividends.

- The company provided 2026 consolidated revenue guidance between $2.60 - $2.70 billion and 2027 revenue guidance between $2.75 - $2.85 billion.

- Gentex reported Q4 2025 consolidated net sales of $644.4 million and diluted earnings per share of $0.43. For the full year 2025, consolidated net sales reached $2.53 billion and diluted earnings per share were $1.74.

- The consolidated gross margin improved to 34.8% in Q4 2025, compared to 32.5% in Q4 2024, with core Gentex gross margin at 35.5%.

- The company returned $425.9 million to shareholders in 2025, including $319.0 million in share repurchases and $106.9 million in dividends.

- For 2026, Gentex forecasts consolidated revenue between $2.60 billion and $2.70 billion, with a gross margin of 34% to 35%. 2027 revenue is projected to be between $2.75 billion and $2.85 billion.

- Gentex Corporation's PURSUIT Helmet System has been selected by the US Naval Aircrew Systems program office (PMA-202) as the Next Generation Fixed Wing Helmet (NGFWH).

- The contract is a 5-year Indefinite Delivery, Indefinite Quantity (ID/IQ) agreement, anticipated to total approximately $22 million for over 5,000 NGFWH systems and associated spares.

- This selection solidifies Gentex's position as a global leader in advanced personal protection, with the PURSUIT system offering significant advancements in aircrew safety, comfort, and mission performance for various Navy fixed-wing aircraft.

- Gentex will unveil next-generation automotive technologies at CES 2026, including an enhanced Full Display Mirror with Dynamic View Assist, advanced mirror-integrated driver and in-cabin monitoring systems featuring cognitive state recognition, and an updated HomeLink car-to-home automation system with cloud-based garage door activation.

- The company is actively diversifying its product portfolio beyond automotive electronics, showcasing advances in smart home (PLACE), medical (eSight), access control (EyeLock, BioConnect), and premium audio (VOXX, Premium Audio Company, Klipsch, Onkyo) industries.

- Gentex's Full Display Mirror is currently available on over 140 different vehicles globally, and its HomeLink car-to-home automation system is installed in an estimated 110 million vehicles.

- The company has secured multiple contracts with OEM customers for its mirror-integrated driver and in-cabin monitoring system, driven by European Union General Safety Regulations and New Car Assessment Programs (NCAP) incentives.

- Gentex Corporation has secured the third one-year option period for its Advanced Combat Helmet Generation II (ACH Gen II) production contract with the Defense Logistics Agency (DLA).

- This option is valued at up to $38,376,425 and extends the contract through October 16, 2026, ensuring continued supply to the U.S. Army.

- The ACH Gen II helmet provides advanced ballistic protection with a 22% reduction in weight compared to the legacy system, enhancing comfort and agility for soldiers.

- Gentex maintains a strong financial position with no debt and $170 million in cash, holding an 85-89% market share in electrochromic mirrors and vision systems, predominantly in the automotive industry.

- The company recently acquired VOXX International Corporation, which had over $300 million in revenue and was acquired for just over $200 million; the VOXX business became profitable last quarter and is expected to generate $40-50 million in free cash flow within 18 months.

- Gentex is focused on margin expansion, currently achieving high 34s, low 35% gross margins, and is expanding into new markets such as aerospace (dimmable windows), fire protection (direct-to-consumer smart home products), and the medical space (E-Sight acquisition).

- The company faces headwinds from counterterrorism in the China market, impacting an anticipated $250 million in exports, and is navigating tariffs and supply chain disruptions by considering manufacturing footprint adjustments.

- Capital allocation prioritizes share repurchases when the stock is undervalued, alongside strategic, smaller technology-focused M&A, with recent aggressive share repurchases in the first half of the year.

Quarterly earnings call transcripts for GENTEX.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more