Earnings summaries and quarterly performance for GENWORTH FINANCIAL.

Research analysts who have asked questions during GENWORTH FINANCIAL earnings calls.

Ryan Krueger

KBW

3 questions for GNW

Also covers: AFL, AMP, ASGN +14 more

BO

Brett Osetec

Unaffiliated Analyst

2 questions for GNW

Josh Esterov

CreditSights

2 questions for GNW

CD

Colin Devine

C. Devine & Associates

1 question for GNW

DS

Douglas Smith

Everest Group

1 question for GNW

PE

Peter Enderlin

MAZ Partners

1 question for GNW

Also covers: LSTA

Recent press releases and 8-K filings for GNW.

Genworth Financial Announces Q4 2025 Results and 2026 Outlook

GNW

Earnings

Guidance Update

New Projects/Investments

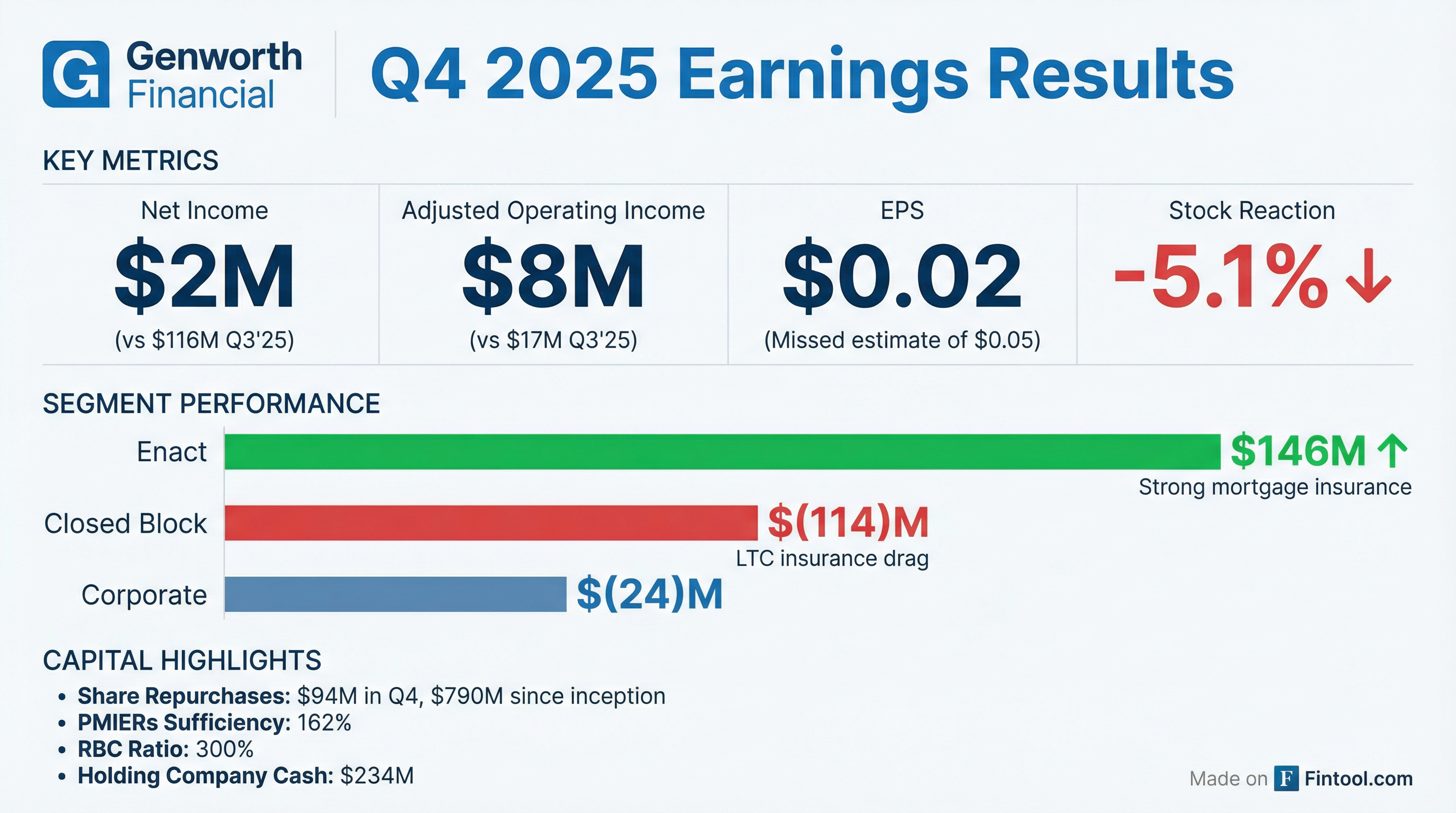

- Genworth Financial reported $2 million net income and $8 million Adjusted Operating Income for Q4 2025, with full-year 2025 Adjusted Operating Income reaching $144 million, primarily driven by strong performance from Enact.

- Enact contributed $407 million in cash to Genworth in 2025, fueling $245 million in share repurchases during the year, which have reduced shares outstanding by 24% since May 2022. The company expects to receive approximately $405 million from Enact and allocate $175 million to $225 million for share repurchases in 2026.

- CareScout, Genworth's long-term growth initiative, expanded its Quality Network to 790 home care providers and achieved 3,255 matches in 2025, exceeding its target. The new Care Assurance LTC insurance product launched in 40 states, and CareScout Services is projected to generate at least $25 million in revenue for 2026, with a target of 7,500 matches.

- The company secured $209 million in gross incremental LTC premium approvals in 2025, contributing to $34.5 billion in net present value from rate actions since 2012. The appeal hearing for the AXA litigation, which could result in approximately $750 million in recoveries, is scheduled for July 21-23, 2026.

4 days ago

Genworth Financial Reports Q4 and Full-Year 2025 Results, Provides 2026 Outlook

GNW

Earnings

Share Buyback

New Projects/Investments

- Genworth Financial reported Adjusted Operating Income of $8 million for Q4 2025 and $144 million for the full year 2025, primarily driven by Enact's strong performance.

- The company continued its capital return strategy, repurchasing $245 million of shares in 2025, which contributed to a 24% reduction in shares outstanding since May 2022. For 2026, Genworth expects to allocate between $175 million and $225 million to share repurchases.

- CareScout significantly expanded in 2025, achieving 3,255 matches (a 3x increase from 2024), acquiring Seniorly, and launching its Care Assurance LTC insurance product in 40 states. For 2026, CareScout Services targets approximately 7,500 matches and projects at least $25 million in revenue.

- An appeal hearing for the AXA litigation is scheduled for July 21-23, 2026, with potential recoveries of approximately $750 million if the favorable ruling is upheld.

4 days ago

Genworth Financial Reports Q4 2025 Results with $2M Net Income and Significant Share Repurchases

GNW

Earnings

Share Buyback

M&A

- Genworth Financial reported net income of $2 million and adjusted operating income of $8 million for Q4 2025.

- The Enact segment reported $146 million in adjusted operating income and distributed $127 million in capital returns to Genworth in Q4 2025. Enact also announced a new share repurchase program with authorization to purchase up to $500 million of common stock in February 2026.

- Genworth executed $94 million in share repurchases during Q4 2025, contributing to a program-to-date total of $790 million through December 31, 2025, which has led to a 23% reduction in shares outstanding since the program's inception.

- The company's holding company cash and liquid assets stood at $234 million at quarter-end.

- Strategic advancements included the acquisition of Seniorly to expand CareScout's presence and $100 million of gross incremental Long-Term Care (LTC) premium approvals in Q4 2025, contributing to an estimated ~$34.5 billion Net Present Value (NPV) achieved from LTC In-Force Actions (IFAs) since 2012.

4 days ago

Genworth Financial Reports Q4 and Full Year 2025 Results, Details Strategic Progress and 2026 Outlook

GNW

Earnings

Share Buyback

New Projects/Investments

- Genworth reported Adjusted Operating Income of $8 million for Q4 2025 and $144 million for the full year 2025, primarily driven by Enact's strong performance which contributed $146 million in Q4 and $558 million for the full year, partially offset by losses in the closed block.

- The company continued its capital allocation strategy, repurchasing $245 million of shares in 2025 and an additional $38 million through February 20, 2026, reducing shares outstanding by approximately 24% since May 2022. For 2026, Genworth expects to receive approximately $405 million from Enact and plans to allocate $175 million to $225 million to share repurchases.

- CareScout, Genworth's long-term growth strategy, launched its inaugural LTC insurance product, Care Assurance, in 40 states and acquired Seniorly in Q4 2025. CareScout Services ended 2025 with 3,255 matches and targets 7,500 matches and at least $25 million in revenue for 2026, with planned investments of $50 million-$55 million in CareScout Services for the year.

- Genworth secured $209 million in gross incremental LTC premium approvals for the full year 2025, contributing to $34.5 billion in net present value achieved through its Multi-Year Rate Action Plan since 2012. An appeal hearing for the AXA litigation is set for July 21-23, 2026, with potential recoveries of approximately $750 million if the ruling is upheld.

4 days ago

Genworth Financial Announces Fourth Quarter 2025 Results

GNW

Earnings

Share Buyback

M&A

- Genworth Financial reported net income of $2M and adjusted operating income of $8M for Q4 2025. For the full year 2025, net income was $223M ($0.54 per diluted share) and adjusted operating income was $144M ($0.35 per diluted share).

- The company executed $94M in share repurchases during Q4 2025, contributing to a total of $245M for 2025. Additionally, Enact distributed $127M in capital returns to Genworth and announced a new $500 million share repurchase program in February 2026.

- Strategic advancements included the launch of Care Assurance in 39 states and the acquisition of Seniorly, Inc. for $15M. The Enact segment delivered strong adjusted operating income of $146M in Q4 2025, maintaining a PMIERs sufficiency ratio of 162%.

- The legacy insurance companies maintained a strong RBC ratio of 300%, and the Genworth holding company held $234M in cash and liquid assets at quarter-end.

4 days ago

Genworth Financial Announces Fourth Quarter 2025 Results

GNW

Earnings

Share Buyback

M&A

- Genworth Financial reported net income of $2 million and adjusted operating income of $8 million for the fourth quarter of 2025, with full-year 2025 net income of $223 million and adjusted operating income of $144 million.

- The company executed $94 million in share repurchases during Q4 2025, contributing to a total of $790 million since the program's inception as of December 31, 2025.

- Enact reported adjusted operating income of $146 million in Q4 2025, distributed $127 million in capital returns to Genworth, and maintained a PMIERs sufficiency ratio of 162%.

- Strategic advancements included the acquisition of Seniorly, Inc. for $15 million and the expansion of the CareScout Quality Network, achieving over 95% home care coverage of the aged 65-plus census population in the United States.

- Genworth's holding company cash and liquid assets stood at $234 million at the end of Q4 2025.

4 days ago

Genworth Financial Reports Q4 2025 Results

GNW

Earnings

New Projects/Investments

- Genworth Financial reported fourth-quarter fiscal 2025 revenue of approximately $1.78 billion and a net profit of $2 million, reversing a year-earlier loss, with Non-GAAP EPS of $0.02.

- Excluding certain items, operating income for the quarter was $8 million ($0.02 per share), down from $15 million ($0.04 per share) in the prior year.

- Management emphasized strategic progress in expanding the CareScout platform and relying on Enact as a steady cash-flow engine.

- The company's earnings history indicates high short-term growth (227.3% one-year earnings growth) but longer-term declines (3-year earnings fell 12.3% and 5-year earnings fell 17.2%), highlighting volatility in profitability.

4 days ago

Genworth Financial Reports Q3 2025 Results, Highlights Enact Contributions and Share Repurchase Program

GNW

Earnings

Share Buyback

M&A

- Genworth Financial reported net income of $116 million and adjusted operating income of $17 million, or $0.04 per share, for Q3 2025, with Enact contributing $134 million to adjusted operating income.

- Enact returned $110 million in capital to Genworth in Q3, bringing the total to $1.2 billion since its 2021 IPO, and Genworth now expects to receive approximately $405 million from Enact for the full year 2025.

- The company authorized a new $350 million share repurchase program, repurchasing $76 million in Q3 at an average price of $8.44 per share, and anticipates full-year 2025 repurchases to be between $200 million and $225 million.

- The long-term care insurance segment reported an adjusted operating loss of $100 million in Q3 2025, primarily due to a $107 million pre-tax remeasurement loss from unfavorable experience, while the Multi-Year Rate Action Plan (MIRAP) has achieved $31.8 billion in net present value.

- CareScout expanded its network, acquired Seniorly for approximately $15 million , and launched Care Assurance, its standalone LTC insurance product, now approved in 37 states.

Nov 6, 2025, 3:00 PM

Genworth Reports Q3 2025 Financial Results and Strategic Progress

GNW

Earnings

Share Buyback

M&A

- Genworth reported net income of $116 million, or $0.28 per diluted share, and adjusted operating income of $17 million, or $0.04 per diluted share, for Q3 2025.

- The company received $110 million in capital returns from Enact and executed $76 million in share repurchases during Q3 2025, bringing program-to-date repurchases to $696 million through September 30, 2025.

- Genworth's holding company cash and liquid assets were $254 million at the end of Q3 2025.

- Strategic initiatives included the acquisition of Seniorly in October and the launch of Care Assurance, CareScout's inaugural standalone LTC product, also in October.

Nov 6, 2025, 3:00 PM

Genworth Financial Announces Third Quarter 2025 Results

GNW

Earnings

Share Buyback

New Projects/Investments

- Genworth Financial reported net income of $116 million, or $0.28 per diluted share, and adjusted operating income of $17 million, or $0.04 per diluted share, for the third quarter of 2025.

- The company announced a new $350 million share repurchase program and executed $76 million in share repurchases during the quarter.

- Strategic advancements include the acquisition of Seniorly in October, expanding CareScout into senior living communities, and the launch of Care Assurance, CareScout's inaugural standalone long-term care product.

- Enact, a segment of Genworth, reported $134 million in adjusted operating income and distributed $110 million in capital returns to Genworth.

Nov 5, 2025, 9:20 PM

Quarterly earnings call transcripts for GENWORTH FINANCIAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more