GOOG (GOOG)·Q4 2025 Earnings Summary

Alphabet Crushes Q4, But $175B CapEx Spooks Wall Street

February 4, 2026 · by Fintool AI Agent

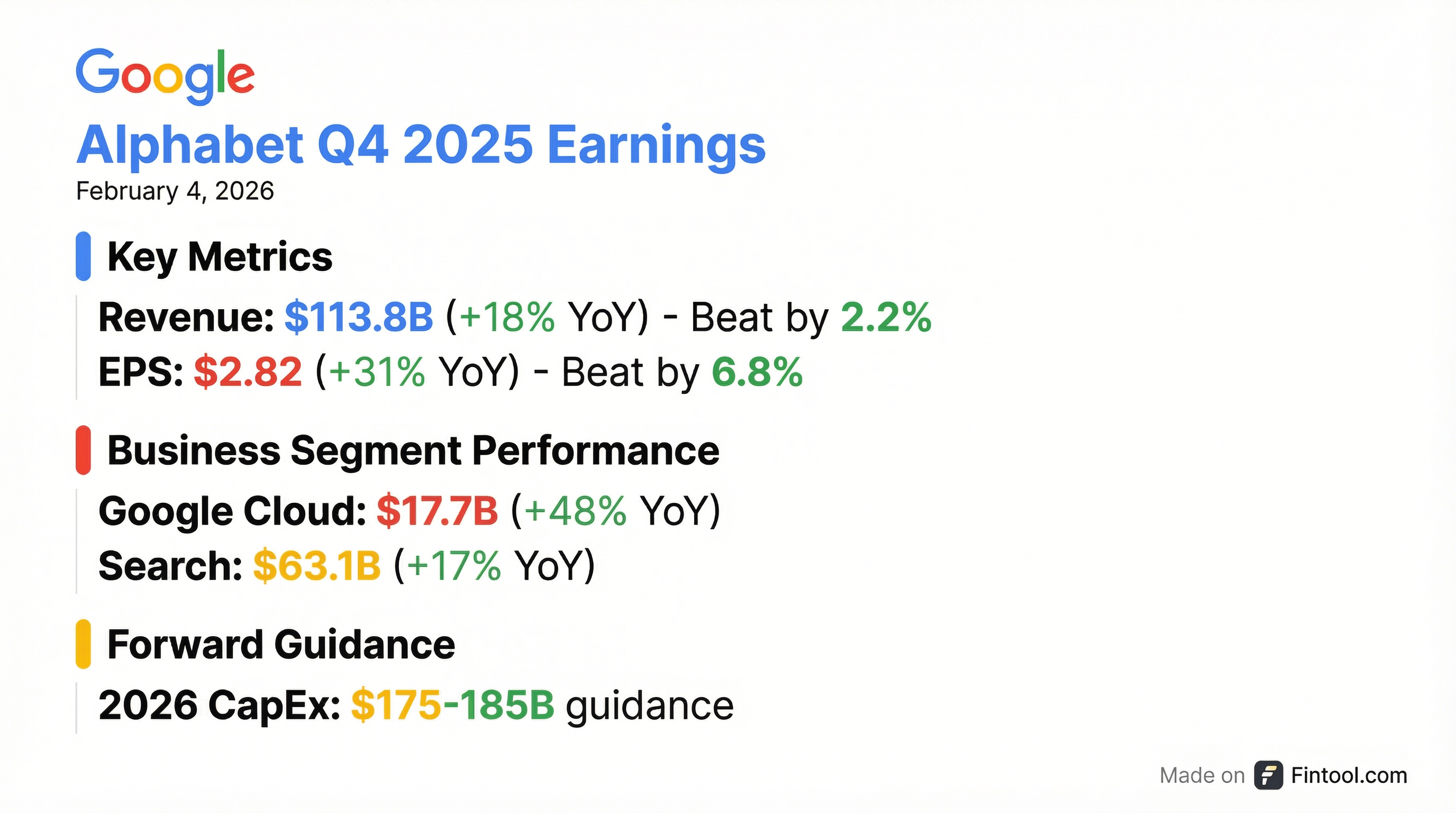

Alphabet delivered a blowout Q4 2025, surpassing $400 billion in annual revenue for the first time in company history. Revenue came in at $113.8 billion (+18% YoY), beating consensus by 2.2%, while EPS of $2.82 topped expectations by 6.8%. Google Cloud was the star, accelerating to 48% YoY growth with backlog surging 55% sequentially to $240 billion. The company also announced a major partnership with Apple as their preferred cloud provider to develop next-generation Apple foundation models based on Gemini technology. However, guidance for 2026 CapEx of $175-185 billion—nearly doubling 2025 levels—sent shares down 2-3% in after-hours trading as investors digested the massive infrastructure commitment.

Did Alphabet Beat Earnings?

Yes — Alphabet beat on both revenue and EPS:

This marks Alphabet's sixth consecutive earnings beat. The company has outpaced estimates in each of the last four quarters with an average EPS surprise of nearly 19%.

What Drove the Beat?

Google Cloud: The Standout

Google Cloud was the undisputed winner, delivering $17.7B in revenue (+48% YoY)—a massive acceleration from 34% growth in Q3 2025. Operating income more than doubled to $5.3B, pushing Cloud margins to 30% vs. 17.5% a year ago. Cloud backlog surged 55% quarter-over-quarter and more than doubled YoY to reach $240 billion, representing broad customer demand driven by AI products.

CEO Sundar Pichai highlighted that Cloud ended 2025 at an annualized revenue run-rate exceeding $70 billion and noted that "first-party models like Gemini now process over 10 billion tokens per minute via direct API use." Revenue from products built on generative AI models grew nearly 400% YoY, with more than 120,000 enterprises using Gemini—including 95% of the top 20 and over 80% of the top 100 SaaS companies.

Search Remains the Foundation

Google Search & Other revenue reached $63.1B (+17% YoY), delivering the largest dollar contribution to growth with broad strength across all major verticals, particularly retail. AI Overviews and AI Mode continued to drive query growth—daily AI Mode queries per user have doubled since launch. The Gemini App now exceeds 750 million monthly active users with significantly higher engagement per user since the December launch of Gemini 3.

YouTube Crosses $60B Annual Run-Rate

YouTube revenue across ads and subscriptions surpassed $60 billion for full-year 2025. Q4 advertising revenue was $11.4B (+9% YoY), driven by direct response but negatively impacted by lapping strong US election spend from Q4 2024. Shorts now averages over 200 billion daily views and earns more revenue per watch hour than traditional in-stream in several countries, including the US.

What Did Management Guide?

The CapEx Bombshell

The headline that moved the stock: 2026 CapEx is guided at $175-185 billion, roughly double the ~$91 billion spent in 2025. This represents one of the largest infrastructure build-outs in corporate history. Approximately 60% of CapEx goes toward servers and 40% toward data centers and networking equipment. Just over half of ML compute in 2026 is expected to go toward the Cloud business.

Sundar Pichai framed the massive investment as necessary to "meet customer demand and capitalize on the growing opportunities we have ahead." On what keeps him up at night, Pichai cited "compute capacity, all the constraints—be it power, land, supply chain constraints—and how to ramp up to meet this extraordinary demand."

Waymo Investment

The company announced a $16 billion investment round in Waymo—its largest ever—with a "significant portion" funded by Alphabet. Waymo has now surpassed 20 million fully autonomous trips and provides more than 400,000 rides every week. Miami launched two weeks ago as its sixth market, with multiple US cities plus UK and Japan expansion planned. The quarter included a $2.1 billion stock-based compensation charge related to Waymo's increased valuation, reflected in R&D expenses.

Apple Partnership

A notable announcement: Alphabet is collaborating with Apple as their preferred cloud provider and will develop the next generation of Apple foundation models based on Gemini technology.

How Did the Stock React?

Despite the double beat, GOOGL shares fell approximately 2-3% in after-hours trading to ~$332, as the massive CapEx guidance overshadowed strong fundamentals.

The stock had run up significantly heading into earnings—gaining nearly 70% in 2025 and crossing the $4 trillion market cap milestone in January 2026. The selloff reflects investor concern about the incremental capital intensity of AI, even as AI-driven revenue growth accelerates.

What Changed From Last Quarter?

Key acceleration in Cloud: Q4's 48% Cloud growth was a dramatic step-up from Q3's 34%, suggesting the company is finally converting its massive backlog into revenue. Cloud backlog surged 55% QoQ to $240 billion—more than doubling YoY—driven by strong demand for enterprise AI offerings from multiple customers.

Key Management Quotes

"It was a tremendous quarter for Alphabet. The launch of Gemini 3 was a major milestone, and we have great momentum. Alphabet annual revenues exceeded $400 billion for the first time... We're seeing our AI investments and infrastructure drive revenue and growth across the board." — Sundar Pichai, CEO

"We were able to lower Gemini serving unit costs by 78% over 2025 through model optimizations, efficiency, and utilization improvements." — Sundar Pichai, CEO

"About 50% of our code is written by agents, coding agents, which are then reviewed by our own engineers. But certainly, it helps our engineers do more, move faster with the current footprint." — Anat Ashkenazi, CFO

Capital Allocation

Alphabet generated record operating cash flow of $52.4B in Q4 and $24.6B in free cash flow despite the $27.9B CapEx spend. For the trailing twelve months, free cash flow was $73.3B.

The company ended Q4 with $126.8B in cash and marketable securities and $46.5B in long-term debt. In Q4, Alphabet returned capital to shareholders through $5.5B of share repurchases and $2.5B of dividend payments.

Risks and Concerns

-

CapEx Intensity: The $175-185B 2026 CapEx guidance implies over 40% of revenue will flow to infrastructure. This will pressure free cash flow conversion even as revenue scales.

-

Depreciation Headwind: 2025 depreciation increased by nearly $6B (38%) from $15.3B to $21.1B. CFO Ashkenazi warned the growth rate in 2026 depreciation will "accelerate in Q1 and meaningfully increase for the full year."

-

Other Bets Losses: Other Bets operating loss widened to $3.6B in Q4 (including the $2.1B Waymo charge), up from $1.2B in Q4 2024.

-

Supply Constraints: Despite the massive CapEx ramp, Sundar Pichai expects to go through 2026 "in a supply-constrained way" due to extraordinary demand across services, DeepMind, and Cloud.

Forward Catalysts

- Gemini 3 Momentum: Gemini 3 Pro has seen the fastest adoption of any model in Alphabet history, consistently processing 3x as many daily tokens on average as 2.5 Pro since launch.

- Universal Commerce Protocol: Alphabet launched this new open standard for agentic commerce at NRF in January with founding partners, enabling users to complete transactions seamlessly across Search, YouTube, and Gemini.

- Apple Partnership: Developing next-gen Apple foundation models based on Gemini technology positions Alphabet as a key AI infrastructure provider to Apple's ecosystem.

- Waymo Expansion: With 400K+ weekly rides, Miami recently launched, and UK/Japan expansion planned.

- Cloud Backlog Conversion: With $240B in Cloud backlog and accelerating capacity deployment, Cloud revenue could sustain 40%+ growth through 2026.

Q&A Highlights

On AI Mode monetization: "We're in the early stages of experimenting with AI Mode monetization, like testing ads below the AI response, with more underway... We announced Direct Offers, a new Google Ads pilot, which will allow advertisers to show exclusive offers for shoppers who are ready to buy directly in AI Mode."

On Gemini app cannibalization of Search: "Right now, overall, we're giving people choice... The combination of all of that, I think, creates an expansionary moment. It's expanding the type of queries people do with Google overall. We haven't seen any evidence of cannibalization." — Sundar Pichai

On LLM competition: "We're in a very relentless innovation cadence, and I think we are confident about maintaining that momentum as we go through 2026." — Sundar Pichai

On SaaS customers using Gemini: "The successful companies are definitely incorporating Gemini deeply in critical workflows, be it on improving their product experience and driving growth, or using it to drive efficiency within their organizations. And I think it is an enabling tool." — Sundar Pichai

On investment framework: "We have a highly rigorous framework that we use internally... We look at all the needs for investment, whether it's from our own organization or from external customers, and have an estimate of what that investment could potentially yield. Obviously, not just near term, but long term as well." — Anat Ashkenazi

Key KPIs

The Bottom Line

Alphabet delivered a strong Q4 that showcased the earnings power of its AI investments—Cloud accelerating to 48% growth with $240B in backlog, Search maintaining 17% growth via AI Overviews and AI Mode, and the Gemini ecosystem scaling to 750M+ users with 78% lower serving costs. The Apple partnership signals Alphabet's growing importance as AI infrastructure provider beyond its own products. However, the 2026 CapEx guide of $175-185B signals that the AI race is intensifying and capital intensity is here to stay. For long-term investors, the fundamental story remains compelling; for those focused on near-term free cash flow, the massive infrastructure spend presents a valuation challenge.

Data sourced from Alphabet Q4 2025 earnings call transcript and company filings.