Earnings summaries and quarterly performance for GOOG.

Research analysts who have asked questions during GOOG earnings calls.

Brian Nowak

Morgan Stanley

1 question for GOOG

Also covers: ABNB, AMZN, BKNG +8 more

DA

Douglas Anmuth

JPMorgan Chase & Co.

1 question for GOOG

Also covers: ABNB, AMZN, BKNG +17 more

Eric Sheridan

Goldman Sachs

1 question for GOOG

Also covers: ABNB, ACVA, AMZN +47 more

Mark Mahaney

Evercore ISI

1 question for GOOG

Also covers: ABNB, AMZN, BKNG +23 more

Michael Nathanson

MoffettNathanson

1 question for GOOG

Also covers: GOOGL, IPG, NFLX +4 more

Recent press releases and 8-K filings for GOOG.

Alphabet Reports Strong Q4 2025 Financial Results and Significant AI Investments

GOOG

Earnings

Guidance Update

New Projects/Investments

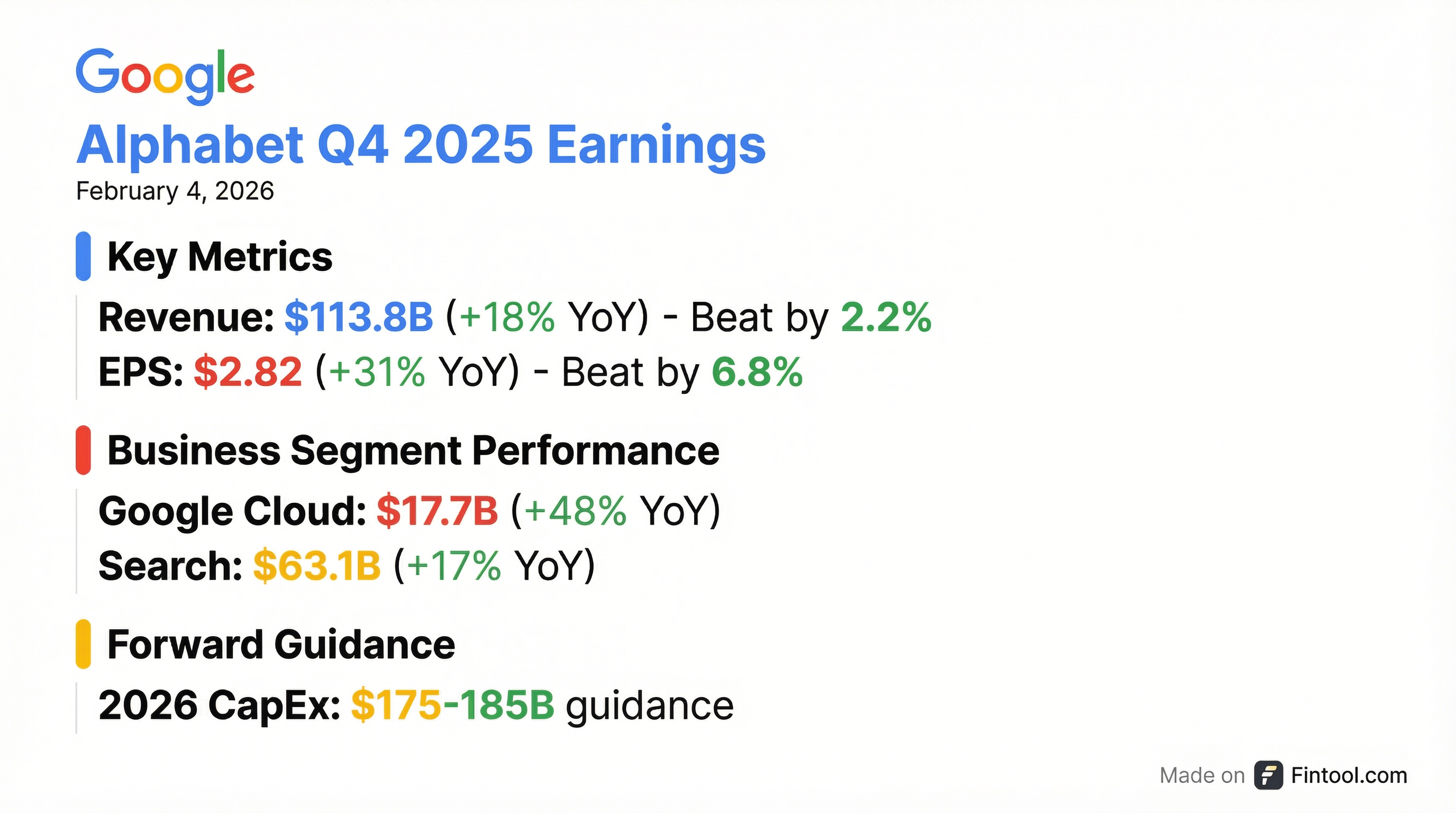

- Alphabet reported strong Q4 2025 results, with consolidated revenues up 18% to $113.8 billion, contributing to full-year 2025 revenues exceeding $400 billion.

- Growth was driven by key segments: Search revenues increased 17%, Cloud revenues accelerated 48% to an annual run rate over $70 billion, and YouTube's annual revenues surpassed $60 billion.

- Profitability was robust, with net income increasing 30% to $34.5 billion and EPS up 31% to $2.82 in Q4 2025.

- The company plans significant AI investments, projecting 2026 CapEx between $175 billion and $185 billion, and has seen strong adoption of AI products like Gemini Enterprise, with over 8 million paid seats sold.

- Alphabet generated record operating cash flow of $52.4 billion in Q4 2025 and returned capital to shareholders through $5.5 billion in share repurchases and $2.5 billion in dividend payments.

Feb 4, 2026, 9:30 PM

Alphabet Announces Strong Q4 and Full Year 2025 Financial Results

GOOG

Earnings

Revenue Acceleration/Inflection

- Alphabet's annual revenues exceeded $400 billion for the first time in fiscal year 2025, reaching $402,836 million, a 15% year-over-year increase.

- For Q4 2025, revenues grew 18% year-over-year to $113,828 million, with diluted EPS increasing 31% year-over-year to $2.82.

- Google Cloud revenue increased 48% year-over-year in Q4 2025, achieving an annualized revenue run-rate exceeding $70 billion, while Search revenue grew 17% year-over-year.

- Net income for Q4 2025 was $34,455 million, a 30% year-over-year increase, and the Trailing Twelve Months Free Cash Flow was $73,266 million.

Feb 4, 2026, 9:30 PM

Alphabet Reports Strong Q4 2025 Results Driven by AI and Cloud Growth

GOOG

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- Alphabet reported strong Q4 2025 consolidated revenues of $113.8 billion, an 18% increase year-over-year, with full-year 2025 revenues exceeding $400 billion for the first time.

- Google Cloud revenues accelerated significantly, growing 48% to $17.7 billion in Q4 2025, with its backlog increasing 55% quarter-over-quarter to $240 billion.

- The company's AI investments are driving growth, with the Gemini app reaching over 750 million monthly active users and 8 million paid seats of Gemini Enterprise sold.

- Alphabet anticipates 2026 CapEx investments to be in the range of $175 billion-$185 billion to meet customer demand and capitalize on AI opportunities.

- In Q4 2025, Alphabet returned capital to shareholders through $5.5 billion in share repurchases and $2.5 billion in dividend payments.

Feb 4, 2026, 9:30 PM

Alphabet Reports Strong Q4 2025 Results and Significant 2026 CapEx Guidance

GOOG

Earnings

Guidance Update

New Projects/Investments

- Alphabet achieved Q4 2025 consolidated revenues of $113.8 billion, an 18% increase year-over-year, contributing to annual revenues exceeding $400 billion for the first time. Net income rose 30% to $34.5 billion, and EPS increased 31% to $2.82.

- Revenue growth was primarily driven by Search and Other advertising revenues, which increased 17% to $63.1 billion, and Google Cloud revenues, which accelerated 48% to $17.7 billion. YouTube's annual revenues surpassed $60 billion.

- Google Cloud demonstrated strong performance, with operating income more than doubling year-over-year to $5.3 billion and an operating margin of 30.1%. The Cloud backlog grew 55% quarter-over-quarter to $240 billion.

- The company projects 2026 CapEx investments to be in the range of $175 billion-$185 billion, a significant increase from $91.4 billion in 2025, primarily for AI compute capacity and technical infrastructure.

Feb 4, 2026, 9:30 PM

Google's Amin Vahdat Discusses AI Infrastructure and Model Advancements

GOOG

New Projects/Investments

Product Launch

- Google's Gemini 3 is highlighted as state-of-the-art, marking a significant achievement in the company's three-plus-year journey in AI models.

- The company's full-stack approach is a key strength, involving the co-design of TPUs with DeepMind and integrating input from various Google services like search, ads, YouTube, and Cloud.

- TPUs are a Google Cloud Platform (GCP) offering, with Google also maintaining a deep partnership with NVIDIA for GPUs, focusing on specialized architectures to achieve 10x greater efficiency for specific workloads.

- Amin Vahdat notes that models are improving at an accelerated pace, feeling "twice as good" every 3-6 months, faster than Moore's Law, though challenges remain in areas like energy, supply chain, and memory prices.

Feb 3, 2026, 11:15 PM

Google's AI Infrastructure Chief Discusses Gemini, TPUs, and AI Market Dynamics

GOOG

New Projects/Investments

Revenue Acceleration/Inflection

- Amin Vahdat, Google's Chief Technologist for AI infrastructure, highlighted Gemini 3 as state-of-the-art and emphasized Google's full-stack approach in AI, including proprietary TPUs and a partnership with NVIDIA for GPUs on Google Cloud Platform (GCP).

- Vahdat noted that TPUs are exclusively a Google Cloud Platform (GCP) offering, with a focus on specialized solutions for customer problems.

- He expressed concerns regarding supply chain, energy, and memory prices, indicating that high memory prices could persist until the end of 2028.

- AI model capabilities are improving rapidly, feeling twice as good every 3-6 months, a pace faster than Moore's Law, driven by a competitive environment.

- Google is exploring innovative infrastructure solutions, such as data centers in space, which could offer benefits like 24/7 solar power and a 50% reduction in networking latency.

Feb 3, 2026, 11:15 PM

Alphabet Reports Strong Q3 2025 Earnings

GOOG

Earnings

Legal Proceedings

Revenue Acceleration/Inflection

- Alphabet reported revenues of $102,346 million for Q3 2025, marking a 16% year-over-year increase.

- Net income grew 33% to $34,979 million, with diluted EPS at $2.87, up 35% from Q3 2024.

- Income from operations was $31,228 million in Q3 2025, which included a $3.5 billion EC fine.

- The trailing twelve months free cash flow increased 32% year-over-year to $73,552 million as of Q3 2025.

Oct 29, 2025, 9:30 PM

Alphabet Reports Strong Q3 2025 Results with Record Revenue and Increased AI Adoption

GOOG

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- Alphabet achieved its first-ever $100 billion quarter in Q3 2025, with consolidated revenue reaching $102.3 billion, a 16% year-over-year increase. This led to a 33% rise in net income to $35 billion and a 35% increase in EPS to $2.87.

- All major segments contributed to growth, with Google Services revenue up 14% to $87.1 billion and Google Cloud revenue surging 34% to $15.2 billion. Cloud's operating income increased 85% to $3.6 billion, and its backlog grew 46% quarter-over-quarter to $155 billion.

- AI is a key driver, with the Gemini app now having over 650 million monthly active users and AI mode in Search reaching over 75 million daily active users. Revenue from products built on generative AI models grew over 200% year-over-year in Q3.

- The company returned $11.5 billion to shareholders via stock repurchases and $2.5 billion through dividends. Capital expenditure for 2025 is now projected to be between $91 billion and $93 billion, an increase from the previous estimate of $85 billion, with further significant increases expected in 2026.

Oct 29, 2025, 9:30 PM

Alphabet Reports Record Q3 2025 Revenue Driven by AI and Cloud Growth

GOOG

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- Alphabet achieved its first-ever $100 billion quarter, with consolidated revenue reaching $102.3 billion, a 16% year-over-year increase. Net income grew 33% to $35 billion, and earnings per share increased 35% to $2.87 for Q3 2025.

- Google Services revenue increased 14% to $87.1 billion, driven by Search and other advertising up 15% to $56.6 billion and YouTube advertising up 15% to $10.3 billion. Subscriptions, platforms, and devices revenue grew 21% to $12.9 billion, contributing to over 300 million paid subscriptions.

- Google Cloud revenue surged 34% to $15.2 billion, with operating income increasing 85% to $3.6 billion and operating margin expanding to 23.7% in Q3 2025. The Cloud backlog grew 46% quarter-over-quarter to $155 billion, driven by strong demand for enterprise AI.

- The company is significantly investing in AI, with CapEx for 2025 now projected between $91 billion and $93 billion, up from the previous estimate of $85 billion. AI is driving growth across Search (e.g., AI Max, AI overviews now scaled to over 2 billion users) and Cloud.

- Alphabet returned capital to shareholders through $11.5 billion in stock repurchases and $2.5 billion in dividend payments in Q3 2025. Operating income and margin were impacted by a $3.5 billion charge related to a European Commission fine.

Oct 29, 2025, 9:30 PM

Alphabet Reports Strong Q3 2025 Results Driven by AI and Cloud Growth

GOOG

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- Alphabet achieved its first-ever $100 billion quarter in Q3 2025, with consolidated revenue reaching $102.3 billion, a 16% year-over-year increase. Net income grew 33% to $35 billion, and earnings per share increased 35% to $2.87.

- AI is driving significant business results across the company, contributing to double-digit growth in major segments. AI Overviews and AI Mode are accelerating query growth in Search, and AI Max is the fastest-growing AI-powered Search Ads product.

- Google Cloud demonstrated strong momentum, with revenue increasing 34% to $15.2 billion in Q3 2025. The Cloud backlog grew 46% quarter-over-quarter to $155 billion, and revenue from generative AI models grew over 200% year-over-year.

- Google Services revenues increased 14% to $87.1 billion, driven by strong performance in Google Search, YouTube advertising, and subscriptions. YouTube advertising revenues grew 15% to $10.3 billion, and the company crossed 300 million paid subscriptions.

Oct 29, 2025, 9:30 PM

Quarterly earnings call transcripts for GOOG.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more