Earnings summaries and quarterly performance for Green Plains.

Executive leadership at Green Plains.

Chris Osowski

Executive Vice President – Operations and Technology

Imre Havasi

Senior Vice President – Head of Trading and Commercial Operations

Jamie Herbert

Chief Human Resource Officer

Michelle Mapes

Interim Principal Executive Officer, Chief Legal and Administration Officer and Corporate Secretary

Philip Boggs

Chief Financial Officer

Board of directors at Green Plains.

Research analysts who have asked questions during Green Plains earnings calls.

Matthew Blair

Tudor, Pickering, Holt & Co.

7 questions for GPRE

Andrew Strelzik

BMO Capital Markets

6 questions for GPRE

Craig Irwin

ROTH Capital Partners

6 questions for GPRE

Eric Stine

Craig-Hallum Capital Group LLC

6 questions for GPRE

Kristen Owen

Oppenheimer & Co. Inc.

6 questions for GPRE

Salvator Tiano

Bank of America

6 questions for GPRE

Pooran Sharma

Stephens Inc.

5 questions for GPRE

Laurence Alexander

Jefferies

3 questions for GPRE

Saumya Jain

UBS

3 questions for GPRE

Jordan Levy

Truist Securities

2 questions for GPRE

Adam Shepherd

Stephens Inc.

1 question for GPRE

Ben Onofrio

BMO Capital Markets

1 question for GPRE

Chengxi Jiang

Jefferies

1 question for GPRE

David Driscoll

DD Research

1 question for GPRE

Henry Roberts

Truist Securities

1 question for GPRE

Kevin Estok

Jefferies

1 question for GPRE

King Safon

Bank of America Corporation

1 question for GPRE

Recent press releases and 8-K filings for GPRE.

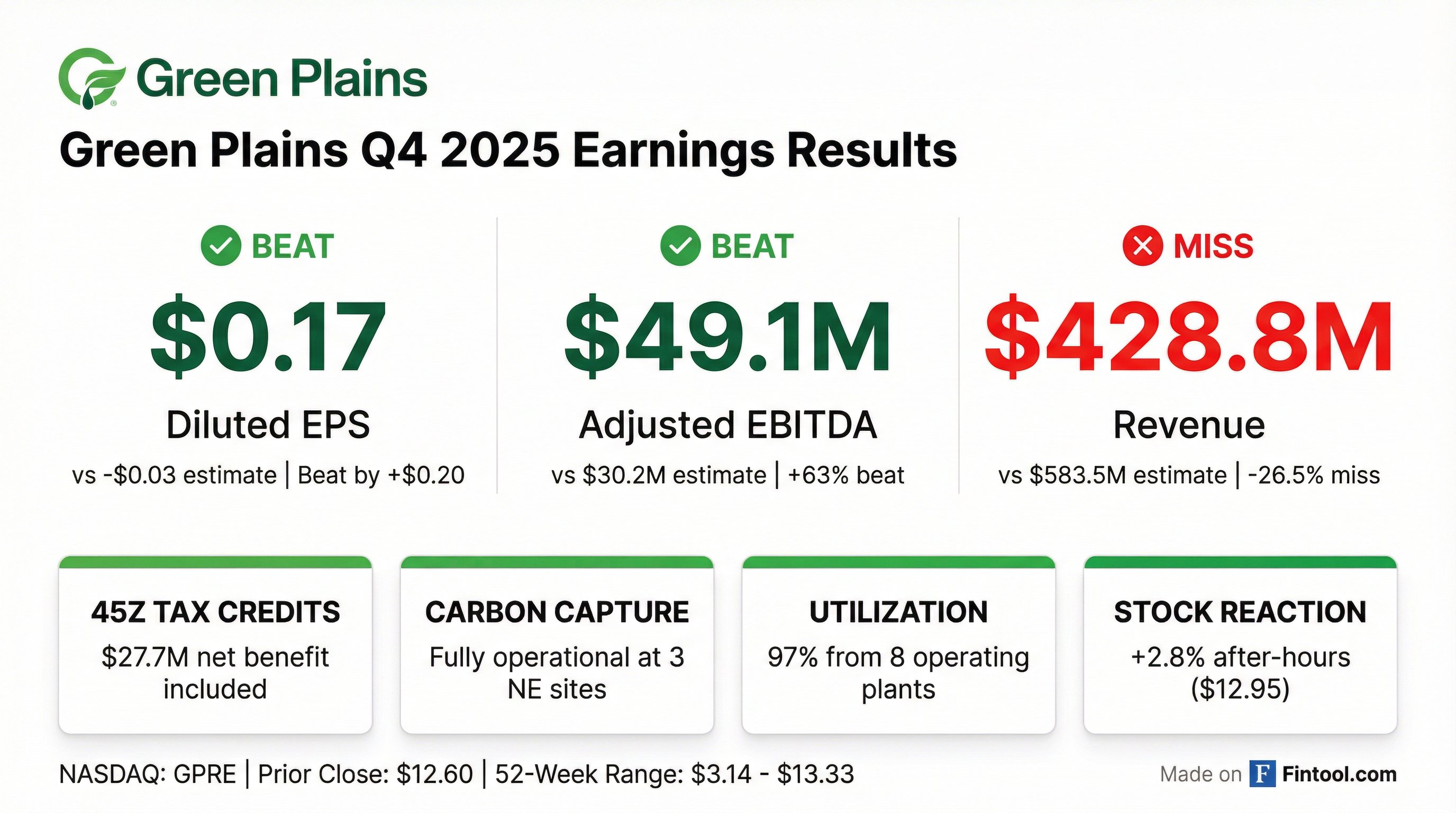

- Green Plains reported Net Income attributable to Green Plains of $11.9 million and diluted EPS of $0.17 for Q4 2025.

- The company generated $428.8 million in Revenue and $49.1 million in Adjusted EBITDA during Q4 2025.

- Operational highlights for the quarter included 178.8 million gallons of ethanol production and a consolidated ethanol crush margin of $44.4 million.

- Green Plains is advancing its low-carbon intensity platform, with Advantage Nebraska projected to offer over $150 million in Adjusted EBITDA opportunity in 2026 and over $38 million in 45Z generation expected from remaining facilities. All plants are on track to qualify for 45Z credits in 2026.

- Green Plains reported Q4 2025 net income attributable to Green Plains of $11.9 million, or $0.17 per diluted share, a significant improvement from a net loss of $54.9 million (or -$0.86 per diluted share) in Q4 2024.

- Adjusted EBITDA for Q4 2025 was $49.1 million, compared to -$18.2 million in Q4 2024, reflecting operational improvements and the initial stages of their carbon monetization strategy.

- The company's stated production capacity (excluding Fairmont) increased by 10% to 730 million gallons per year, and CO2 compression equipment is now fully operational at three Nebraska plants, capturing over 90% of CO2.

- Green Plains expects at least $188 million of adjusted EBITDA from carbon alone in 2026, driven by the 45Z production tax credit and voluntary credits.

- The company refinanced the majority of its 2027 convertible notes through a new $200 million convertible note due in 2030 and used $30 million from that transaction to repurchase approximately 2.9 million shares of stock.

- Green Plains Inc. reported Q4 2025 net income attributable to Green Plains of $11.9 million, or $0.17 per diluted share, a significant improvement from a net loss in Q4 2024, with adjusted EBITDA reaching $49.1 million.

- The company increased its stated production capacity to 730 million gallons per year, a 10% increase over previously stated capacity, and expects at least $188 million in adjusted EBITDA from carbon opportunities in 2026.

- Green Plains refinanced the majority of its 2027 convertible notes through a new $200 million convertible note due in 2030 and used $30 million from that transaction to repurchase approximately 2.9 million shares of stock.

- The 45Z Clean Fuel Production Tax Credit generated $27.7 million in Q4 2025, and the company anticipates a consolidated SG&A run rate in the low $90 million range for 2026, an improvement of more than $25 million compared to 2024.

- Green Plains Inc. reported a net income of $11.9 million ($0.17 per diluted share) for Q4 2025, a significant improvement from a net loss of $54.9 million (-$0.86 per diluted share) in Q4 2024.

- Adjusted EBITDA for Q4 2025 was $49.1 million, compared to -$18.2 million in Q4 2024, with $27.7 million generated from the 45Z Clean Fuel Production Tax Credit.

- The company increased its stated production capacity (excluding Fairmont) to 730 million gallons per year, a 10% increase, and its CO2 compression equipment at three Nebraska plants is now fully operational, with carbon capture active.

- For 2026, Green Plains expects at least $188 million in adjusted EBITDA from carbon initiatives and anticipates a consolidated SG&A run rate in the low $90 million range, an improvement of over $25 million compared to 2024.

- Green Plains refinanced the majority of its 2027 convertible notes with a new $200 million convertible note due in 2030 and repurchased approximately 2.9 million shares of stock.

- Green Plains Inc. reported a net income attributable to Green Plains of $11.9 million, or $0.17 per diluted share, for Q4 2025, a significant improvement compared to a net loss of $(54.9) million, or $(0.86) per diluted share, in Q4 2024.

- Adjusted EBITDA for Q4 2025 was $49.1 million, which included $23.4 million in 45Z production tax credit value, contrasting with $(18.2) million in Q4 2024.

- The company anticipates generating at least $188 million of 45Z-related Adjusted EBITDA in 2026.

- In Q4 2025, carbon capture facilities became fully operational at the Central City, Wood River, and York, Nebraska facilities, and the company achieved 97% utilization from its eight operating ethanol plants.

- As of December 31, 2025, Green Plains held $230.1 million in total cash and cash equivalents, and restricted cash, with $399.5 million in total debt outstanding.

- Green Plains reported net income attributable to the company of $11.9 million, or $0.17 per diluted share, and Adjusted EBITDA of $49.1 million for the fourth quarter of 2025, significantly improving from a net loss of $54.9 million and Adjusted EBITDA of $(18.2) million in the same period of 2024.

- Revenues for the fourth quarter of 2025 were $428.8 million, a decrease from $584.0 million for the same period in 2024, primarily due to lower ethanol volumes sold.

- The company's Q4 2025 results included $27.7 million of 45Z production tax credit value recorded as an income tax benefit, and Green Plains anticipates generating at least $188 million of 45Z-related Adjusted EBITDA in 2026.

- Key operational and strategic actions in 2025 included carbon capture facilities becoming fully operational at three Nebraska facilities, a $200 million convertible note exchange to enhance financial flexibility, and the sale of the Obion plant for $170 million which was used to eliminate $130.7 million in junior mezzanine debt.

- As of December 31, 2025, Green Plains maintained $230.1 million in total cash and cash equivalents, and restricted cash, with total debt outstanding of $399.5 million.

- Green Plains Inc. (GPRE) has achieved a significant milestone by successfully capturing, transporting, and permanently sequestering biogenic carbon dioxide from all three of its Nebraska facilities (Central City, Wood River, and York) in Wyoming, in collaboration with Tallgrass.

- The company reported receiving its first 45Z clean fuel production credit payment of approximately $14 million, representing a portion of its 2025 production tax credits, with additional payments for the remaining 2025 tax credits anticipated in the first quarter of 2026.

- As of September year-to-date, Green Plains had already recorded approximately $26.5 million in 45Z value generated prior to activating its carbon capture systems.

- Green Plains is undergoing a multi-year operational and financial transformation, focusing on operational excellence, continuous improvement, and becoming a low-cost, low-carbon intensity biofuel producer.

- The company recorded $26.5 million in 45Z tax credits year-to-date (Q1-Q3) from its Advantage Nebraska facilities, with an additional $15 million-$25 million expected in Q4. All non-Nebraska plants are expected to qualify for 45Z starting January 1.

- Green Plains recently refinanced a portion of its 2027 convertible debt into 2030 notes, including a $30 million cash raise, resulting in approximately 6% net dilution. A carbon capture project costing $130 million will add to debt, bringing the total company debt to around $500 million.

- Operational efficiency improvements led to 101% utilization in the quarter, and the company guides to a full company SG&A run rate in the low $90 million range.

- Capital allocation priorities include maintaining asset health with $15 million-$25 million in annual maintenance CapEx, further reducing carbon intensity scores, and evaluating shareholder returns.

- Green Plains recorded $26.5 million in 45Z tax credits year-to-date in Q3 and anticipates an additional $15 million-$25 million in Q4, driven by efficient plant operations and renewable energy credits.

- The company refinanced a portion of its 2027 convertible debt into 2030 notes, resulting in approximately 6% net dilution after a $30 million share buyback, to provide financial runway.

- Operational improvements led to 101% capacity utilization in the quarter, and the company expects to update baseline capacity figures soon.

- The total carbon capture project cost is approximately $130 million, with $117 million converting to debt financed at roughly 9% over 12 years, increasing total company debt to about $500 million.

- Annual maintenance capital expenditure is projected to be between $15 million and $25 million, with Q3 CapEx at $4 million and Q4 expected between $5 million and $10 million.

- Green Plains recorded $26.5 million in 45Z tax credits year-to-date through Q3 2025 and expects an additional $15 million-$25 million in Q4 2025, with all non-Nebraska plants anticipated to qualify for 45Z starting January 1, 2026.

- The company refinanced a portion of its 2027 convertible debt into 2030 notes, raised $30 million in cash, and bought back $30 million worth of shares to buffer dilution, resulting in a net dilution of approximately 6%.

- Operational improvements led to 101% capacity utilization in the quarter, driven by fermentation enhancements and reduced downtime, with plans to update baseline capacity figures.

- Management anticipates strong ethanol export demand, projected to exceed 2 billion gallons this year and grow by a couple hundred million gallons in 2026, primarily from Canada, the EU, the U.K., and India.

- Future capital priorities include annual maintenance CapEx of $15 million-$25 million, further reducing Carbon Intensity (CI) scores, and evaluating shareholder returns such as stock buybacks or debt reduction.

Quarterly earnings call transcripts for Green Plains.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more