GRI Bio (GRI)·Q4 2025 Earnings Summary

GRI Bio Reports $12M FY 2025 Loss, Cash Runway Extended Into 2027 After January Raise

February 4, 2026 · by Fintool AI Agent

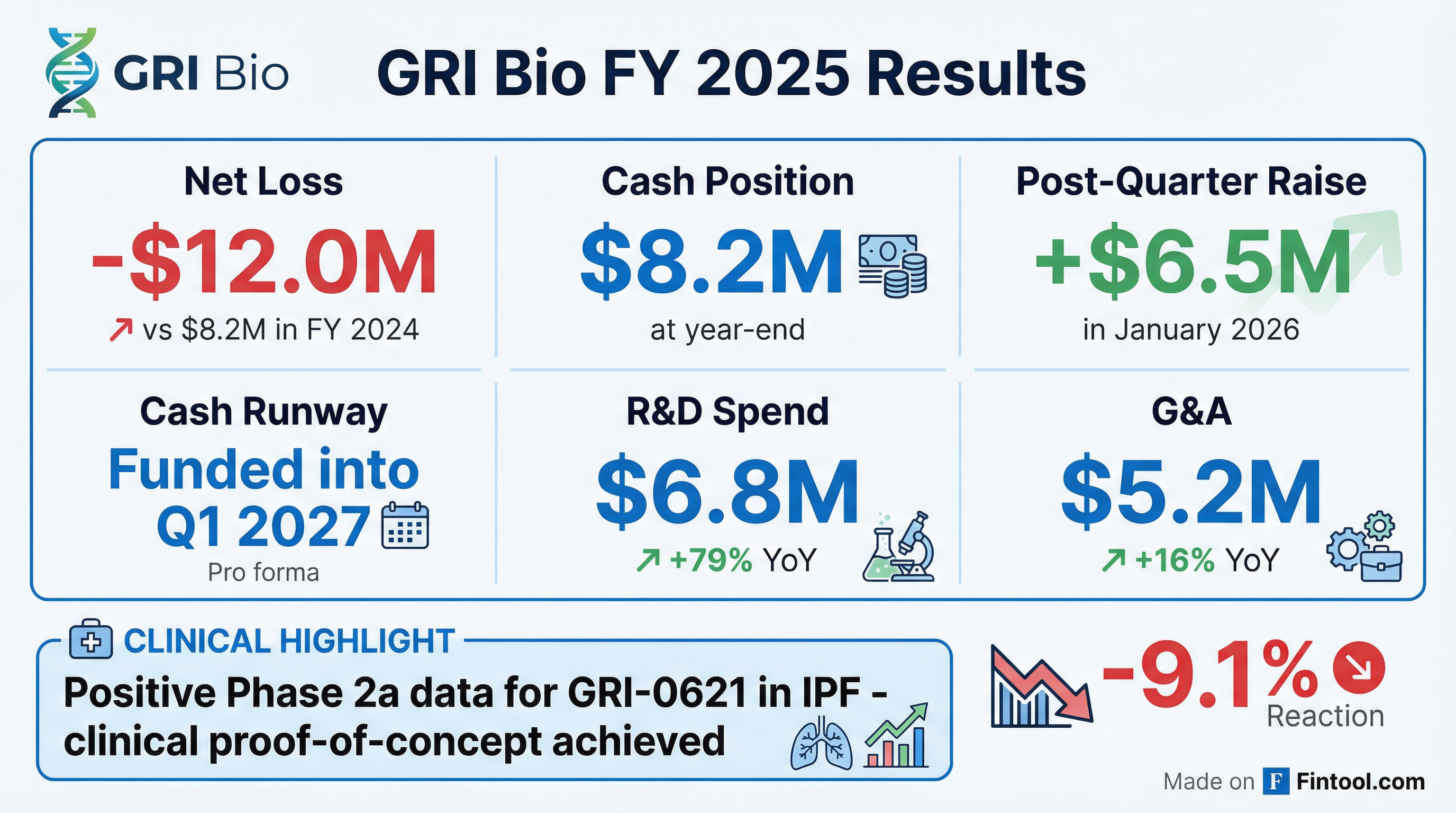

GRI Bio (NASDAQ: GRI) reiterated its FY 2025 financial results today, reporting a net loss of $12 million and $8.2 million in cash at year-end. The clinical-stage biotech, focused on inflammatory, fibrotic, and autoimmune diseases, strengthened its balance sheet with a $6.5 million At The Market offering in January 2026, extending its cash runway into Q1 2027.

Did GRI Bio Meet Expectations?

As a pre-revenue clinical-stage biotech, GRI Bio has no revenue to report. The company's key metrics center on cash management and clinical progress.

*Values retrieved from S&P Global

The higher net loss was driven primarily by a $3 million increase in R&D spending related to the Phase 2a clinical program for GRI-0621, along with $0.7 million in higher G&A costs from increased personnel expenses and stock-based compensation.

How Did the Stock React?

GRI shares fell 9.1% on the day to $2.60, continuing a steep decline from 52-week highs above $300. The stock has lost significant value as the company navigates the capital-intensive clinical development phase.

The micro-cap biotech (market cap ~$230K) trades near its 52-week low of $2.40, with the January capital raise providing critical runway extension.

What Did Management Say About Cash Runway?

CEO Marc Hertz emphasized capital discipline and clinical execution in the earnings announcement:

"In 2025, we prioritized disciplined clinical execution and balance sheet strength, delivering compelling clinical data from our lead IPF program which underscores the therapeutic differentiation of GRI-0621. Entering 2026 with a strong cash position, we are focused on advancing GRI-0621 in IPF, progressing GRI-0803 toward the clinic and executing our clinical strategy with capital discipline to drive long-term value creation."

Cash Position Summary:

- Year-end 2025: $8.2 million

- January 2026 raise: $6.5 million gross proceeds (ATM offering)

- Total raised Dec 2025 + Jan 2026: ~$14.5 million

- Runway: Funded into Q1 2027

Management noted that this runway estimate assumes "only initial preparatory activities for GRI-0621 as substantial additional capital or resources will be required to fund a Phase 2b clinical trial."

What Changed From Last Quarter?

Clinical Progress:

- Announced positive Phase 2a topline data from the completed study of GRI-0621 in idiopathic pulmonary fibrosis (IPF)

- Reported additional data demonstrating suppression of pro-fibrotic immune phenotypes, reinforcing clinical proof-of-concept

- Generated new RNA-sequencing gene expression data showing direct impact on the core biology of fibrosis and lung repair

Pipeline Expansion:

- Advanced plans to progress GRI-0803 into IND-enabling studies, expanding the pipeline into autoimmune disease

What Is GRI Bio's Pipeline?

GRI Bio is focused on modulating immune cells—specifically Natural Killer T (NKT) cells—to treat inflammatory, fibrotic, and autoimmune diseases.

The company has a library of over 500 proprietary compounds to fuel future pipeline development.

Key Risks Flagged by Management

The company highlighted several risk factors in its forward-looking statements:

- Capital requirements: Substantial additional funding needed for Phase 2b clinical trial of GRI-0621

- Nasdaq listing: Risk of inability to maintain listing on The Nasdaq Capital Market

- Clinical uncertainty: Later data may be inconsistent with Phase 2a observations

- Regulatory risk: Inability to obtain and maintain regulatory clearance or approval

- Competition: Other companies developing similar products and services

Forward Catalysts

2026 Focus Areas:

- Advance GRI-0621 in IPF (Phase 2b preparation)

- Progress GRI-0803 through IND-enabling studies

- Execute clinical strategy with capital discipline

- Potential additional financing as needed

Summary

GRI Bio's FY 2025 results reflect a clinical-stage biotech in active development mode: higher R&D spending to advance its lead IPF program, positive Phase 2a proof-of-concept data, and balance sheet management to extend runway. The key question for investors is whether the company can secure the capital needed for a Phase 2b trial while maintaining its Nasdaq listing.