Earnings summaries and quarterly performance for GRI Bio.

Executive leadership at GRI Bio.

Board of directors at GRI Bio.

Research analysts covering GRI Bio.

Recent press releases and 8-K filings for GRI.

GRI Bio Reiterates Full Year 2025 Financial Results and Provides Operational Updates

GRI

Earnings

Guidance Update

New Projects/Investments

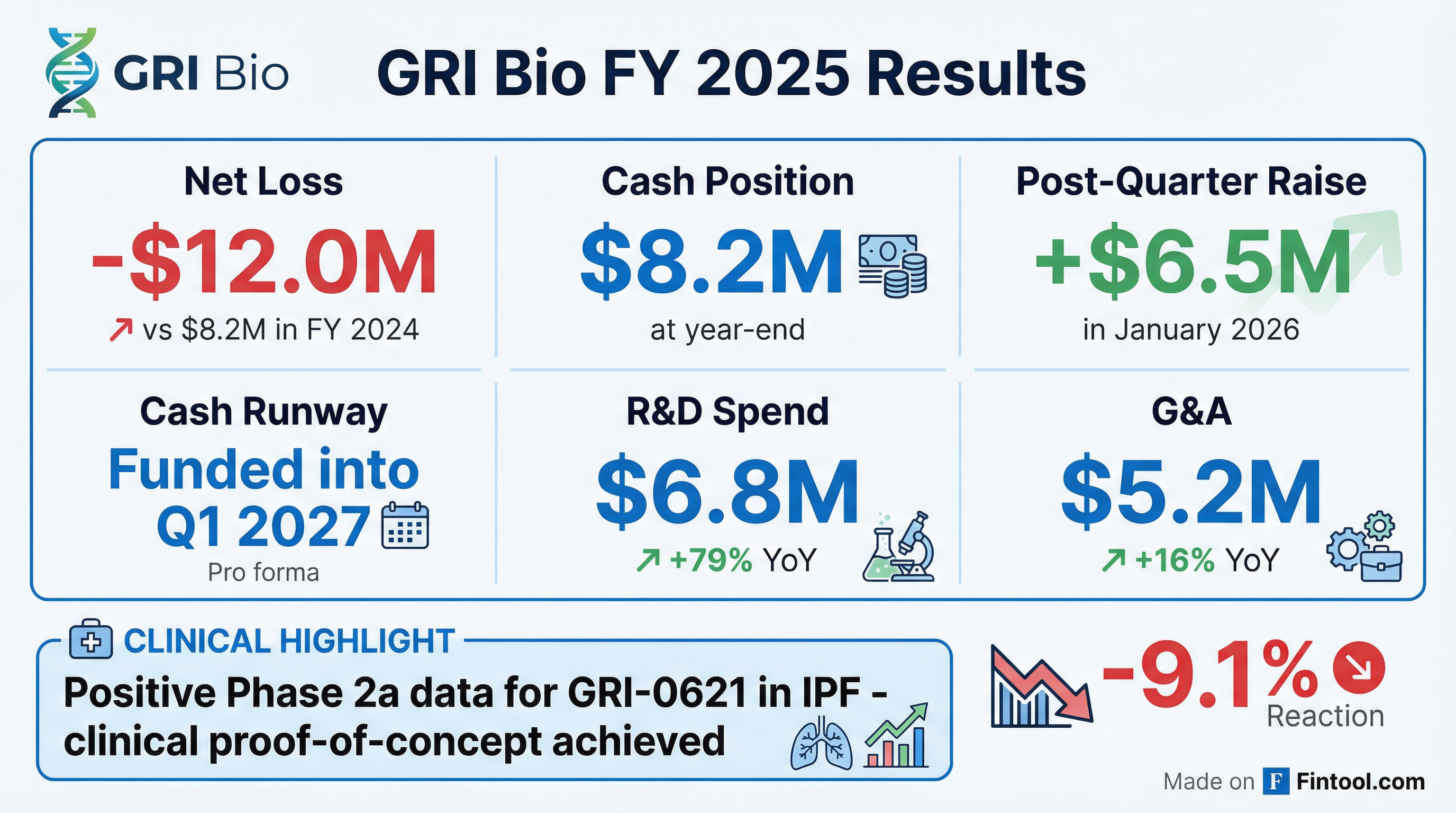

- GRI Bio reported $8.2 million in cash and cash equivalents as of December 31, 2025, and subsequently raised an additional $6.5 million in January 2026, which is expected to fund operations into Q1 2027.

- For the full year ended December 31, 2025, the company reported a net loss of $12 million, with research and development expenses increasing to $6.8 million.

- The company announced positive Phase 2a clinical data for GRI-0621 in idiopathic pulmonary fibrosis and is advancing GRI-0803 into IND-enabling studies for autoimmune indications.

3 days ago

GRI Bio Announces Positive Phase 2a Gene Expression Data for GRI-0621 in IPF

GRI

New Projects/Investments

- GRI Bio, Inc. announced additional positive data from its Phase 2a clinical study of GRI-0621 for Idiopathic Pulmonary Fibrosis (IPF) on January 28, 2026.

- The new RNA-sequencing gene expression data demonstrated significant improvement across genes associated with lung injury, fibrosis progression, and alveolar basement membrane and epithelial repair compared to placebo.

- These findings validate previous biomarker and clinical signals, suggesting a mechanism consistent with fibrosis resolution and active tissue repair.

- The Phase 2a study met its primary endpoint for favorable safety and tolerability and showed improvements in the exploratory endpoint of forced vital capacity (FVC).

- The data indicates GRI-0621 may offer a disease-modifying approach by promoting lung regeneration, differentiating it from current treatments.

Jan 28, 2026, 1:46 PM

GRI Bio Delivers Positive Phase 2a Gene Expression Data for IPF Treatment

GRI

New Projects/Investments

- GRI Bio announced additional positive data from its recently completed Phase 2a clinical study of GRI-0621 in Idiopathic Pulmonary Fibrosis (IPF) on January 28, 2026, strengthening potential clinical proof-of-concept.

- Newly reported RNA-sequencing differential gene expression data demonstrated significant improvement across genes associated with lung injury, fibrosis progression, and alveolar basement membrane and epithelial repair compared to placebo.

- These findings provide multi-layered evidence that GRI-0621 directly targets the biological drivers of fibrosis, supporting a mechanism consistent with fibrosis resolution and active tissue repair.

- The data also directly support basement membrane repair and AT2-to-AT1 epithelial cell transition, representing key hallmarks of true lung regeneration.

- The Phase 2a study met its primary endpoint for safety and tolerability and showed improvements on the exploratory endpoint of forced vital capacity (FVC), with twice as many GRI-0621-treated subjects experiencing no decline in FVC at 12 weeks compared to standard of care alone.

Jan 28, 2026, 1:45 PM

GRI Bio Announces Reverse Stock Split

GRI

Delisting/Listing Issues

Proxy Vote Outcomes

- GRI Bio announced a 1-for-28 reverse stock split of its common stock, which was approved by stockholders on January 15, 2026.

- The reverse split will become legally effective on January 23, 2026, with trading on a split-adjusted basis expected to commence on January 26, 2026, under the existing ticker symbol "GRI" and a new CUSIP 3622AW 502.

- This action is intended to increase the per share trading price to help the company regain compliance with Nasdaq's minimum bid price requirement.

- The number of outstanding common shares will be reduced from approximately 15,016,434 as of January 20, 2026, to approximately 536,301 post-split.

Jan 21, 2026, 9:01 PM

GRI Bio Stockholders Approve Reverse Stock Split

GRI

Proxy Vote Outcomes

Delisting/Listing Issues

- GRI Bio Inc. stockholders, with 48.16% of outstanding voting stock present, approved a proposal for a reverse stock split of the company's Common Stock at a ratio between 1 for 2 and 1 for 30. The Board of Directors will determine the exact ratio and has the discretion to abandon the amendment.

- An additional proposal to adjourn the special meeting, if necessary for further proxy solicitation, was also approved.

- The company expects to report the preliminary or final voting results on a Form 8-K within four business days after the meeting held on January 15, 2026.

Jan 15, 2026, 2:00 PM

GRI Bio Stockholders Approve Reverse Stock Split Proposal

GRI

Proxy Vote Outcomes

Delisting/Listing Issues

- GRI Bio Inc. stockholders approved an amendment to the Amended and Restated Certificate of Incorporation to effect a reverse stock split of the company's Common Stock.

- The approved reverse stock split ratio is within the range of not less than one for two and not greater than one for 30, with the exact ratio to be set by the Board of Directors.

- The Board of Directors retains the discretion to abandon the proposed amendment and not effect the reverse stock split.

- A quorum was present at the special meeting, with 4,874,725 shares (48.16% of outstanding voting stock) present in person or by proxy.

Jan 15, 2026, 2:00 PM

GRI Bio Stockholders Approve Reverse Stock Split

GRI

Proxy Vote Outcomes

- GRI Bio Inc. held a special meeting of stockholders on January 15, 2026, to vote on two proposals.

- Stockholders approved an amendment to the Amended and Restated Certificate of Incorporation to effect a reverse stock split of the company's Common Stock.

- The reverse stock split ratio will be set by the Board of Directors within a range of not less than 1 for 2 and not greater than 1 for 30.

- An additional proposal to adjourn the meeting, if necessary, was also approved.

- Preliminary results indicate that the requisite votes were cast in favor of both proposals, with final voting results expected to be reported on a Form 8-K within four business days.

Jan 15, 2026, 2:00 PM

GRI Bio Announces Additional Positive Phase 2a Data for GRI-0621 in IPF

GRI

New Projects/Investments

Delisting/Listing Issues

- GRI Bio, Inc. announced additional positive flow cytometry data from its Phase 2a clinical trial for GRI-0621 in treating Idiopathic Pulmonary Fibrosis (IPF), confirming a disease-modifying mechanism and reinforcing earlier signals of fibrosis resolution, lung repair, and improved lung function.

- The data specifically demonstrated iNKT inhibition and an immunomodulatory shift towards an anti-fibrotic profile, with increased T cell receptor expression and favorable cytokine changes in treated subjects.

- The Phase 2a study previously met its primary endpoint of safety and tolerability and showed improvements in forced vital capacity (FVC).

- As of January 8, 2026, following a public offering completed in December 2025, the company believes its stockholders' equity exceeds the minimum $2.5 million Nasdaq requirement.

Jan 8, 2026, 1:01 PM

GRI Bio Announces Closing of Public Offering

GRI

New Projects/Investments

- GRI Bio, Inc. announced the closing of its public offering on December 12, 2025, which generated approximately $8.0 million in aggregate gross proceeds before deducting fees and other offering expenses.

- The offering included 10,666,667 shares of common stock (or equivalents) and Series F warrants, at a combined public offering price of $0.75 per share. The Series F Warrants are immediately exercisable at $0.75 per share and could provide an additional $8.0 million if fully exercised.

- The company plans to use the net proceeds for product candidate development, working capital, and general corporate purposes. Following the offering, the stockholders' equity of the company exceeds $2.5 million.

Dec 12, 2025, 9:05 PM

GRI Bio Closes $8.0 Million Public Offering

GRI

New Projects/Investments

- GRI Bio, Inc. (NASDAQ: GRI) announced the closing of a public offering of 10,666,667 shares of common stock (or common stock equivalents) and Series F warrants to purchase up to 10,666,667 shares of common stock.

- The offering was priced at $0.75 per share (or per common stock equivalent) and accompanying Series F Warrant, generating approximately $8.0 million in aggregate gross proceeds for the company.

- The Series F Warrants have an exercise price of $0.75 per share, are immediately exercisable, and will expire on the fifth anniversary of their issuance, with potential for an additional $8.0 million in gross proceeds if fully exercised.

- The net proceeds from this offering are intended for product candidate development, working capital, and general corporate purposes.

Dec 12, 2025, 9:05 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more