GSK (GSK)·Q4 2025 Earnings Summary

GSK Q4 2025 Earnings: Strong Beat, Specialty Medicines Surge

February 4, 2026 · by Fintool AI Agent

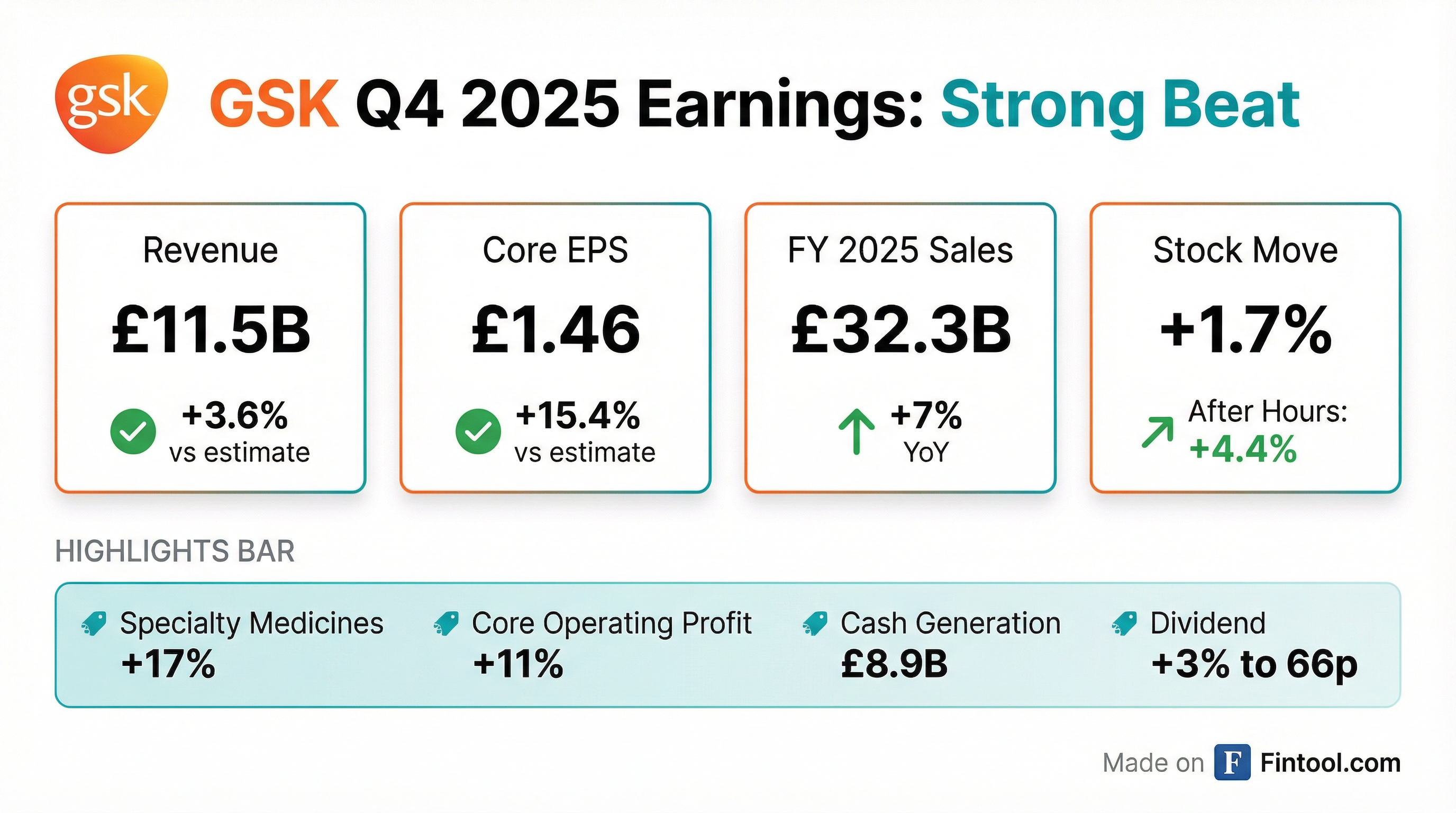

GSK delivered strong Q4 2025 results, beating consensus on both revenue and EPS as its Specialty Medicines portfolio accelerated growth. Full-year sales crossed £32 billion for the first time, up 7% year-over-year, while core operating profit grew 11% and EPS advanced 12%. The company raised its dividend and provided 2026 guidance calling for continued operating leverage.

Did GSK Beat Earnings?

GSK beat across all key metrics in Q4 2025:

*Values retrieved from S&P Global

For full-year 2025, GSK also exceeded expectations:

*Values retrieved from S&P Global. YoY growth from company reports.

What Drove the Beat?

Specialty Medicines: The Growth Engine (+17%)

Specialty Medicines continue to be GSK's standout performer, growing 17% in 2025 and expected to grow low double-digit in 2026.

Key launches for 2026 include Xzenta (6-monthly severe asthma biologic) and Blenrep (BCMA agent for multiple myeloma). Management noted Xzenta is now approved in the US, UK, and Japan, with market research showing 97% of patients would prefer or switch to a biologic with six-monthly dosing.

HIV: Long-Acting Transition Accelerating (+11%)

The HIV franchise delivered 11% growth in 2025, with the US up 14%.

- 75%+ of growth came from long-acting injectables, which now represent ~1/3 of US sales

- Cabenuva grew 42%, reaching >75% of US switches in Q4

- Apretude grew 62%, withstanding competitor launch impact

Management reaffirmed that twice-yearly treatment (Q6M) represents the most significant commercial opportunity and expects to select a regimen mid-2026, with Phase III start for Q4M treatment (Quattro study) this year and filing expected in 2027.

How Did the Stock React?

GSK shares rose 1.7% during regular trading on the earnings release, closing at $53.34. After-hours trading showed further gains, with the stock trading at $55.67 — up an additional 4.4% — suggesting the market is responding positively to the beat and 2026 outlook.

The stock is trading near its 52-week high of $53.38, reflecting significant momentum from the Zantac settlement resolution and specialty portfolio strength.

What Did Management Guide?

GSK provided 2026 guidance reflecting continued operating leverage:

Segment Expectations:

- Specialty Medicines: Low double-digit growth (including mid-to-high single-digit for HIV)

- Vaccines: Low single-digit decline to stable

- General Medicines: Low single-digit decline to stable

CFO Julie Brown noted operating profit growth will be heavily weighted to H2, reflecting £300M of charges taken in Q4 2025 and the annualization of the RSV settlement in Q2. Currency could be a -3% headwind on sales and -6% on operating profit if rates hold.

What Changed From Last Quarter?

Positive Developments:

-

Zantac Settlement Complete: GSK paid £1.9B in total, drawing a line under the matter. Cash generation was £8.9B, or >£10B excluding Zantac payments.

-

Share Buyback: 93M shares repurchased at average price of £14.73, with £0.6B remaining to complete in H1.

-

Pipeline Momentum: 5 FDA approvals and 7 new pivotal trial starts in 2025, including Xzenta approval and Phase III starts for efimostirmen (MASH), Risres (B7-H3 ADC in SCLC), and velsatinib (KIT inhibitor in GIST).

-

Hepatitis B Breakthrough: Positive results from BEWELL Phase III trials for bepirovirsen, with potential to become first-ever fixed course therapy with functional cure at significantly higher rates than standard of care.

Areas to Watch:

-

Shingrix US Headwinds: US immunization rates slowing; China partner managing inventory. Ex-US and China performance expected to be offset by these headwinds.

-

Arexvy Competition: RSV vaccine sales up only 2% for the year, with the company monitoring the evolving pediatric vaccine landscape.

-

Dolutegravir LOE: The glide path begins April 2028 in US and July 2029 in Europe, though management emphasized Q4M and Q6M launches will help offset erosion.

Key Management Quotes

CEO Luke Miels on 2026 Priorities:

"Products are the key in this business, and we need to be more product-centric. And to accelerate the pipeline, we need to have more scientific courage and be more agile to capitalize on opportunities when we see them."

Deborah Waterhouse (ViiV CEO) on HIV Opportunity:

"Q6M is clearly our biggest opportunity in treatment. We're very confident in the assets that we've got to choose from... The addressable market for Q2M is about 15% of patients. When we get to four, we get to 30% of patients, and then with Q6M in treatment, 50% of patients who would be very willing to take a long-acting injectable. That is a big chunk of the market."

Nina Mojas (Head of Global Product Strategy) on Xzenta Launch:

"Six-monthly dosing... there is a huge level of enthusiasm for long-acting six-monthly dosing, and that will hopefully translate into referential use of Xzenta over other agents."

Q&A Highlights

On COPD/Respiratory Strategy (James Gordon, Barclays): CSO Tony Wood explained the respiratory portfolio is stratified by eosinophil levels: high EO population (IL-5/Nucala/Xzenta), intermediate T2 (long-acting TSLP), and low T2 (IL-33). Management confirmed they've transferred all Nucala reps to Xzenta, with Nucala COPD being promoted by the legacy Trelegy team.

On Blenrep Launch (Simon Baker, Redburn): Nina Mojas noted the US launch is progressing with a focus on community oncologists, where 70% of patients are treated. Current usage is split ~50/50 between academic and community settings. The company has engaged 18,000 eye care professionals (vs. 5,000-6,000 at first launch) to enable REMS compliance and extended dosing intervals.

On £40B Revenue Target (James Gordon, Barclays): CFO Julie Brown confirmed the 2031 target includes IDRx and efimostirmen but does not include the recent RAPT Therapeutics acquisition (Ozuriquibat for food allergy).

Forward Catalysts

Key Takeaways

-

Clean Beat: Q4 revenue +3.6%, EPS +15.4% vs consensus — seventh consecutive quarter of growth.

-

Specialty Surge: 17% specialty growth driven by Benlysta, Nucala, and Jemperli. Expect low double-digit growth in 2026.

-

HIV Transformation: Long-acting now ~1/3 of US HIV sales. Q6M regimen selection mid-2026 with filing timeline into 2030s.

-

Zantac Behind Them: £1.9B paid, settlement complete. Cash generation >£10B ex-Zantac.

-

2026 Guidance Solid: 7-9% operating profit/EPS growth with dividend up 6% to 70p.

-

Pipeline Inflection: 10 pivotal starts planned for 2026, including 5+ ADC studies.

View the full Q4 2025 earnings transcript for complete management commentary.