Earnings summaries and quarterly performance for GSK.

Research analysts who have asked questions during GSK earnings calls.

James Gordon

JPMorgan Chase & Co.

6 questions for GSK

Simon Baker

Redburn Atlantic

5 questions for GSK

Steve Scala

Cowen

4 questions for GSK

Graham Parry

Bank of America Corporation

3 questions for GSK

Michael Leuchten

Jefferies

3 questions for GSK

Rajan Sharma

Goldman Sachs Group, Inc.

3 questions for GSK

Sachin Jain

Bank of America

3 questions for GSK

Emily Field

Barclays

2 questions for GSK

Kerry Holford

Berenberg

2 questions for GSK

Peter Verdult

Citigroup Inc.

2 questions for GSK

Peter Welford

Jefferies

2 questions for GSK

Richard Parkes

BNP Paribas Exane

2 questions for GSK

Jo Walton

UBS

1 question for GSK

Justin Smith

Bernstein

1 question for GSK

Mark Purcell

Morgan Stanley

1 question for GSK

Matthew Weston

UBS Group AG

1 question for GSK

Sarita Kapila

Morgan Stanley

1 question for GSK

Timothy Anderson

BofA Securities

1 question for GSK

Recent press releases and 8-K filings for GSK.

- GSK plc purchased 462,000 of its ordinary shares on February 23, 2026, through BNP Paribas SA.

- The volume-weighted average price paid per share for this transaction was 2,200.95p.

- This purchase is part of an existing buyback programme, and since February 17, 2026, the company has acquired a total of 2,229,000 ordinary shares.

- Following this transaction, GSK plc will hold 242,120,094 ordinary shares in treasury, representing 5.94% of the total voting rights.

- GSK plc purchased 470,000 ordinary shares of 31¼ pence each on 19 February 2026 through BNP Paribas SA.

- The prices paid per share ranged from a lowest of 2,217.00p to a highest of 2,264.00p, with a volume-weighted average price of 2,243.09p.

- These purchased shares will be held as Treasury shares, and following this transaction, GSK plc will hold 241,191,094 ordinary shares in treasury.

- The company now has 4,074,951,475 ordinary shares in issue (excluding Treasury shares), with the percentage of voting rights attributable to treasury shares being 5.92%.

- Since 17 February 2026, GSK plc has purchased a total of 1,300,000 ordinary shares as part of its existing buyback programme.

- GSK plc purchased 410,000 ordinary shares on 18 February 2026 through BNP Paribas SA as part of its existing buyback programme.

- The shares were acquired at a volume-weighted average price of 2,268.77p (GBp), with prices ranging from a low of 2,244.00p to a high of 2,281.00p.

- Following this transaction, GSK plc now holds 240,721,094 ordinary shares in treasury, representing 5.91% of the total voting rights.

- GSK announced new real-world effectiveness data for its Respiratory Syncytial Virus (RSV) vaccine, AREXVY, at RSVVW’26.

- A US retrospective cohort study showed an association with 75.6% vaccine effectiveness (VE) against RSV-related hospitalization in adults aged ≥60 years, with a median follow-up of 5.6 months post-vaccination.

- Further exploratory endpoints from the US study indicated an association with 63.1% VE against major adverse cardiovascular events (including heart attack and stroke) and 74.4% VE against severe chronic obstructive pulmonary disease (COPD) flare-ups during RSV-related hospitalization among adults aged ≥60 years.

- A separate nationwide cohort study conducted in Denmark observed 100% VE in preventing RSV-related hospitalizations in COPD patients aged ≥60 years.

- GSK plc announced the commencement of the fourth tranche of its £2 billion share buyback programme on February 17, 2026.

- This fourth tranche is for up to £0.45 billion and is expected to be completed by April 24, 2026.

- The overall programme, which began on February 24, 2025, aims to return excess capital to shareholders, reduce share capital, and is expected to enhance earnings per share.

- The first, second, and third tranches of the programme, totaling up to £0.7 billion, £0.45 billion, and £0.3 billion respectively, have been completed.

- GSK plc announced the European Commission has approved Exdensur (depemokimab) for the treatment of severe asthma with type 2 inflammation and chronic rhinosinusitis with nasal polyps (CRSwNP).

- Exdensur is the first and only ultra-long-acting biologic in the EU for these respiratory diseases, offering a twice-yearly dosing regimen.

- The approval is based on data from the SWIFT and ANCHOR phase III trials, which showed sustained efficacy and met primary or co-primary endpoints.

- This European approval follows recent marketing authorizations for Exdensur in the US for severe asthma and in the UK and Japan for both severe asthma and CRSwNP.

- ViiV Healthcare, majority-owned by GSK, will present new data at CROI 2026, highlighting its ultra long-acting HIV pipeline, including first-in-human data for VH184, a third-generation integrase inhibitor, and early data for capsid inhibitor VH499.

- The company will also share 12-month data for investigational lotivibart (N6LS) + cabotegravir long-acting, evaluating ultra long-acting dosing intervals, and provide updated clinical and real-world evidence for Cabenuva and cabotegravir long-acting for PrEP.

- An agreement was reached for Pfizer's economic interest in ViiV Healthcare to be replaced by an investment from Shionogi, with completion anticipated in Q1 2026.

- GSK announced on February 6, 2026, that the European Commission has approved Nucala (mepolizumab) as an add-on maintenance treatment for adults with uncontrolled chronic obstructive pulmonary disease (COPD) characterized by raised blood eosinophils.

- This approval makes Nucala the first and only monthly biologic in the EU evaluated in a wide COPD population with an eosinophilic phenotype.

- The approval is based on data from the MATINEE phase III trial, which showed a significant reduction in the annualised rate of moderate/severe exacerbations and those leading to emergency department visits and/or hospitalisations versus placebo.

- Nucala is already approved for COPD in the US, UK, and China, and for four other diseases in Europe.

| Metric | 2025 | 2033 | CAGR (2026-2033) |

|---|---|---|---|

| Human Vaccines Market Size (USD Billions) | 44.26 | 62.45 | 4.43% |

- The Human Vaccines Market is driven by increasing awareness of preventive healthcare, expansion of national immunization programs, rising cases of infectious and chronic diseases, and advancements in recombinant, conjugate, and mRNA-based vaccines.

- Key challenges for the market include high development costs, complex manufacturing processes, strict regulatory requirements, and cold chain dependence.

- mRNA vaccines are projected to be the fastest-growing type with a CAGR of 7.12% during 2026–2033, and HPV vaccines are expected to have the fastest CAGR of 7.34% through 2026–2033 among disease targets.

- GSK received FDA approval for Penmenvy, its 5-in-1 meningococcal vaccine, in February 2025, strengthening its position in bacterial vaccine innovation.

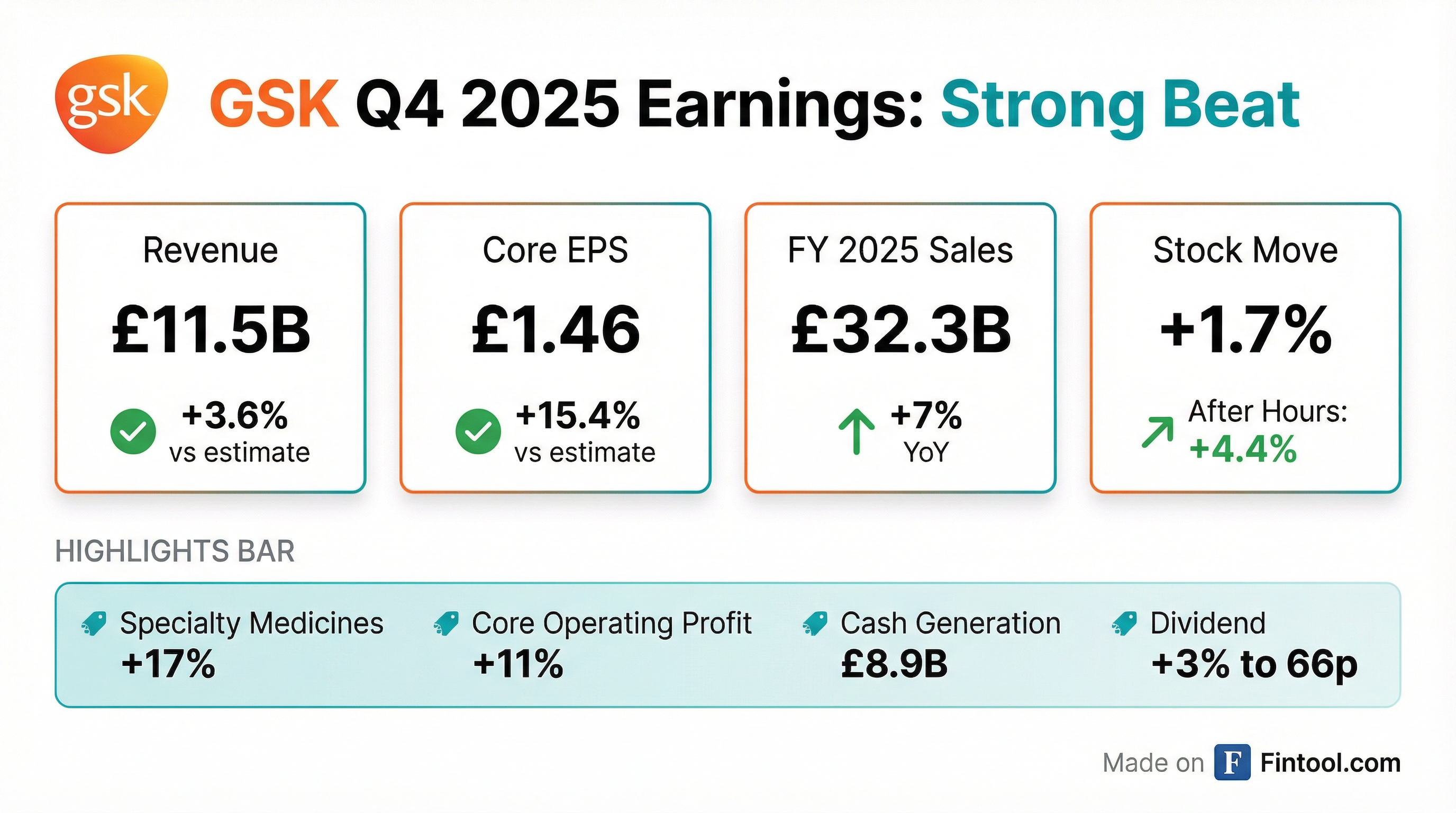

- GSK reported Total 2025 sales of £32.7 billion, an increase of 7% CER, driven by strong performance in Specialty Medicines (+17%) and Vaccines (+2%).

- Core operating profit grew by 11% and Core EPS increased by 12% in 2025, with cash generated from operations of £8.9 billion and free cash flow of £4.0 billion.

- The company declared a full-year 2025 dividend of 66p and expects 70p for full year 2026. Additionally, £1.4 billion of a £2 billion share buyback program has been executed.

- GSK achieved 5 major FDA approvals in 2025 and anticipates 2 new major product approvals in 2026, strengthening its R&D pipeline.

Fintool News

In-depth analysis and coverage of GSK.

Quarterly earnings call transcripts for GSK.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more