Earnings summaries and quarterly performance for GSK.

Research analysts who have asked questions during GSK earnings calls.

James Gordon

JPMorgan Chase & Co.

6 questions for GSK

Simon Baker

Redburn Atlantic

5 questions for GSK

Steve Scala

Cowen

4 questions for GSK

Graham Parry

Bank of America Corporation

3 questions for GSK

Michael Leuchten

Jefferies

3 questions for GSK

Rajan Sharma

Goldman Sachs Group, Inc.

3 questions for GSK

Sachin Jain

Bank of America

3 questions for GSK

Emily Field

Barclays

2 questions for GSK

Kerry Holford

Berenberg

2 questions for GSK

Peter Verdult

Citigroup Inc.

2 questions for GSK

Peter Welford

Jefferies

2 questions for GSK

Richard Parkes

BNP Paribas Exane

2 questions for GSK

Jo Walton

UBS

1 question for GSK

Justin Smith

Bernstein

1 question for GSK

Mark Purcell

Morgan Stanley

1 question for GSK

Matthew Weston

UBS Group AG

1 question for GSK

Sarita Kapila

Morgan Stanley

1 question for GSK

Timothy Anderson

BofA Securities

1 question for GSK

Recent press releases and 8-K filings for GSK.

- GSK announced on February 6, 2026, that the European Commission has approved Nucala (mepolizumab) as an add-on maintenance treatment for adults with uncontrolled chronic obstructive pulmonary disease (COPD) characterized by raised blood eosinophils.

- This approval makes Nucala the first and only monthly biologic in the EU evaluated in a wide COPD population with an eosinophilic phenotype.

- The approval is based on data from the MATINEE phase III trial, which showed a significant reduction in the annualised rate of moderate/severe exacerbations and those leading to emergency department visits and/or hospitalisations versus placebo.

- Nucala is already approved for COPD in the US, UK, and China, and for four other diseases in Europe.

| Metric | 2025 | 2033 | CAGR (2026-2033) |

|---|---|---|---|

| Human Vaccines Market Size (USD Billions) | 44.26 | 62.45 | 4.43% |

- The Human Vaccines Market is driven by increasing awareness of preventive healthcare, expansion of national immunization programs, rising cases of infectious and chronic diseases, and advancements in recombinant, conjugate, and mRNA-based vaccines.

- Key challenges for the market include high development costs, complex manufacturing processes, strict regulatory requirements, and cold chain dependence.

- mRNA vaccines are projected to be the fastest-growing type with a CAGR of 7.12% during 2026–2033, and HPV vaccines are expected to have the fastest CAGR of 7.34% through 2026–2033 among disease targets.

- GSK received FDA approval for Penmenvy, its 5-in-1 meningococcal vaccine, in February 2025, strengthening its position in bacterial vaccine innovation.

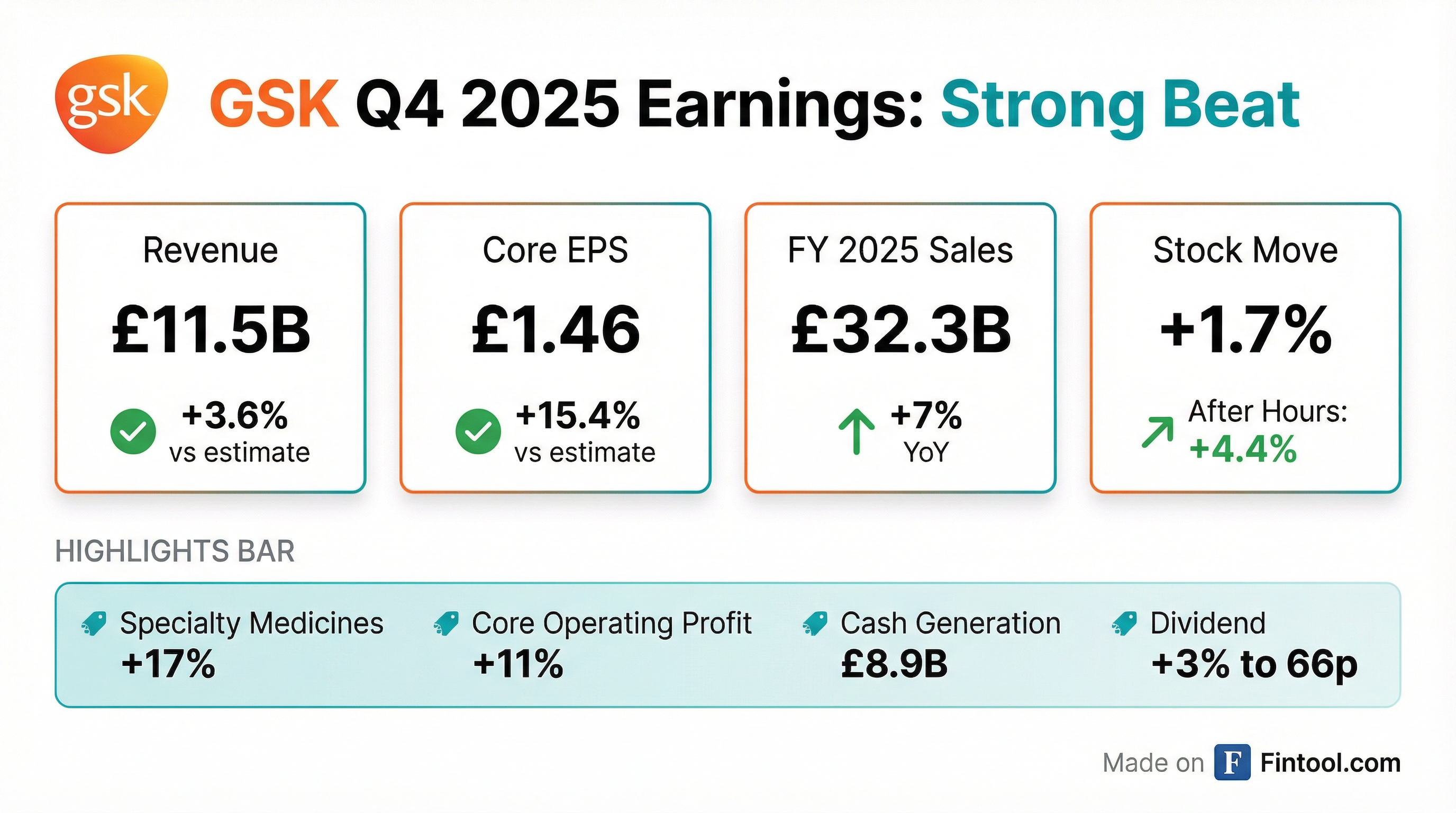

- GSK reported Total 2025 sales of £32.7 billion, an increase of 7% CER, driven by strong performance in Specialty Medicines (+17%) and Vaccines (+2%).

- Core operating profit grew by 11% and Core EPS increased by 12% in 2025, with cash generated from operations of £8.9 billion and free cash flow of £4.0 billion.

- The company declared a full-year 2025 dividend of 66p and expects 70p for full year 2026. Additionally, £1.4 billion of a £2 billion share buyback program has been executed.

- GSK achieved 5 major FDA approvals in 2025 and anticipates 2 new major product approvals in 2026, strengthening its R&D pipeline.

- GSK reported strong full year 2025 financial results, with sales increasing 7% to over GBP 32 billion, core operating profit up 11%, and EPS growing 12%.

- For 2026, the company expects sales growth of 3%-5%, core operating profit and core EPS growth of 7%-9%, and plans to pay a dividend of GBP 0.70 per share.

- In 2025, GSK achieved 5 FDA regulatory approvals and initiated 7 new pivotal trials, while also advancing its HIV long-acting treatment pipeline, including plans for a Q6M treatment regimen launch by 2028-2030.

- The company announced the acquisition of RAPT Therapeutics for Ozuriquibat, a Phase 2 asset for food allergy, and reaffirmed its commitment to the GBP 40 billion+ revenue target.

- GSK reported strong full-year 2025 results, with sales up 7% to over £32 billion, core operating profit up 11%, and EPS up 12%. Cash generation was £8.9 billion, supporting a 2p dividend upgrade to 66 pence.

- For 2026, the company guides for sales growth of 3%-5%, core operating profit and core EPS growth of 7%-9%, and a dividend of £0.70, a 6% increase.

- Growth in 2026 is expected to be driven by Specialty Medicines (low double-digit growth) and HIV (mid- to high single-digit growth).

- Strategic focus for 2026 includes maximizing launch products like Blenrep and Extensa, accelerating late-stage pipeline assets such as B7-H3 (Risres) and B7-H4 (MoRes), and continuing business development.

- The company deployed £4.5 billion in CapEx and business development and £4 billion in shareholder distributions, including repurchasing 93 million shares.

- GSK reported strong full-year 2025 results, with sales up 7% to over GBP 32 billion, core operating profit growing 11%, and EPS increasing 12%. This growth was primarily driven by Specialty Medicines, which rose 17%, and significant contributions from HIV products.

- For 2026, GSK provided guidance of 3%-5% sales growth, with core operating profit and core EPS both projected to grow 7%-9%, and a dividend of GBP 0.70 (a 6% increase).

- The company highlighted strong cash generation of GBP 8.9 billion and shareholder returns, including a share buyback of 93 million shares.

- Key pipeline and business development updates include the acquisition of RAPT Therapeutics for Ozuriquibat, a potential treatment for food allergy, and positive Phase 3 results for bepirovirsen in chronic hepatitis B.

- GSK plans to cut up to 350 research-and-development jobs across the US and UK as part of an R&D overhaul.

- Despite the job reductions, GSK increased R&D spending by approximately 90% to £6.4 billion in 2024 and plans to further raise investment while reallocating resources to priority programs.

- The company has signaled a multi-year commitment of roughly $30 billion for R&D and supply-chain infrastructure in the U.S..

- These changes are occurring as new chief executive Luke Miels prepares to present his first annual results.

- GSK has selected CareMed, an independent specialty pharmacy, as a partner for Exdensur (depemokimab).

- Exdensur is indicated for the add-on maintenance treatment of severe asthma characterized by an eosinophilic phenotype in adult and pediatric patients aged 12 years and older.

- It is the first and only ultra-long-acting biologic with twice yearly dosing due to its extended serum half-life.

- GSK's respiratory syncytial virus (RSV) vaccine, Arexvy, has received European Commission (EC) approval for expanded use in all adults aged 18 years and older.

- This approval significantly broadens the vaccine's market in Europe, as it was previously approved only for adults aged 60 years and above, and those aged 50-59 years at increased risk.

- The expanded indication addresses a substantial public health need, given that an average of 158,000 adults aged 18 and over are hospitalized due to RSV infections in the EU annually.

- The European Commission has approved GSK’s adjuvanted RSV vaccine Arexvy for use in all adults aged 18 and older across the EU, expanding previous authorizations that were limited to those 60+ and higher-risk 50–59 year olds.

- This broader indication allows for rollout to the full adult population in Europe, with GSK seeking similar label expansions in other markets including the US and Japan.

- Arexvy was the first RSV vaccine authorized in the European Economic Area specifically for the prevention of lower respiratory tract disease (LRTD) caused by RSV.

- Investors are monitoring how the wider label could affect demand and orders, with GSK's full-year and Q4 2025 results scheduled for Feb. 4 (07:00 GMT), where management is expected to discuss vaccine demand, sales figures, and the 2026 outlook.

Fintool News

In-depth analysis and coverage of GSK.

Quarterly earnings call transcripts for GSK.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more