Earnings summaries and quarterly performance for GOODYEAR TIRE & RUBBER CO /OH/.

Executive leadership at GOODYEAR TIRE & RUBBER CO /OH/.

Mark W. Stewart

Chief Executive Officer and President

Christina L. Zamarro

Executive Vice President and Chief Financial Officer

Christopher P. Helsel

Senior Vice President and Chief Technology Officer

David E. Phillips

Senior Vice President and General Counsel

Mamatha Chamarthi

Senior Vice President and Chief Digital Officer

Will Roland

Senior Vice President and Chief Marketing Officer

Board of directors at GOODYEAR TIRE & RUBBER CO /OH/.

Hera Siu

Director

James A. Firestone

Director

Jason J. Winkler

Director

John E. McGlade

Director

Joseph R. Hinrichs

Director

Karla R. Lewis

Director

Laurette T. Koellner

Chairman of the Board

Max H. Mitchell

Director

Michael R. Wessel

Director

Norma B. Clayton

Director

Roger J. Wood

Director

Werner Geissler

Director

Research analysts who have asked questions during GOODYEAR TIRE & RUBBER CO /OH/ earnings calls.

Emmanuel Rosner

Wolfe Research

6 questions for GT

James Picariello

BNP Paribas

5 questions for GT

Ryan Brinkman

JPMorgan Chase & Co.

5 questions for GT

Itay Michaeli

TD Cowen

4 questions for GT

James Mulholland

Deutsche Bank

3 questions for GT

John Healy

Northcoast Research

3 questions for GT

Ross MacDonald

Morgan Stanley

3 questions for GT

Douglas Karson

Bank of America

2 questions for GT

Edison Yu

Deutsche Bank

1 question for GT

Jake Scholl

BNP Paribas

1 question for GT

James Lohan

Deutsche Bank

1 question for GT

Wesley Brooks

HSBC

1 question for GT

Recent press releases and 8-K filings for GT.

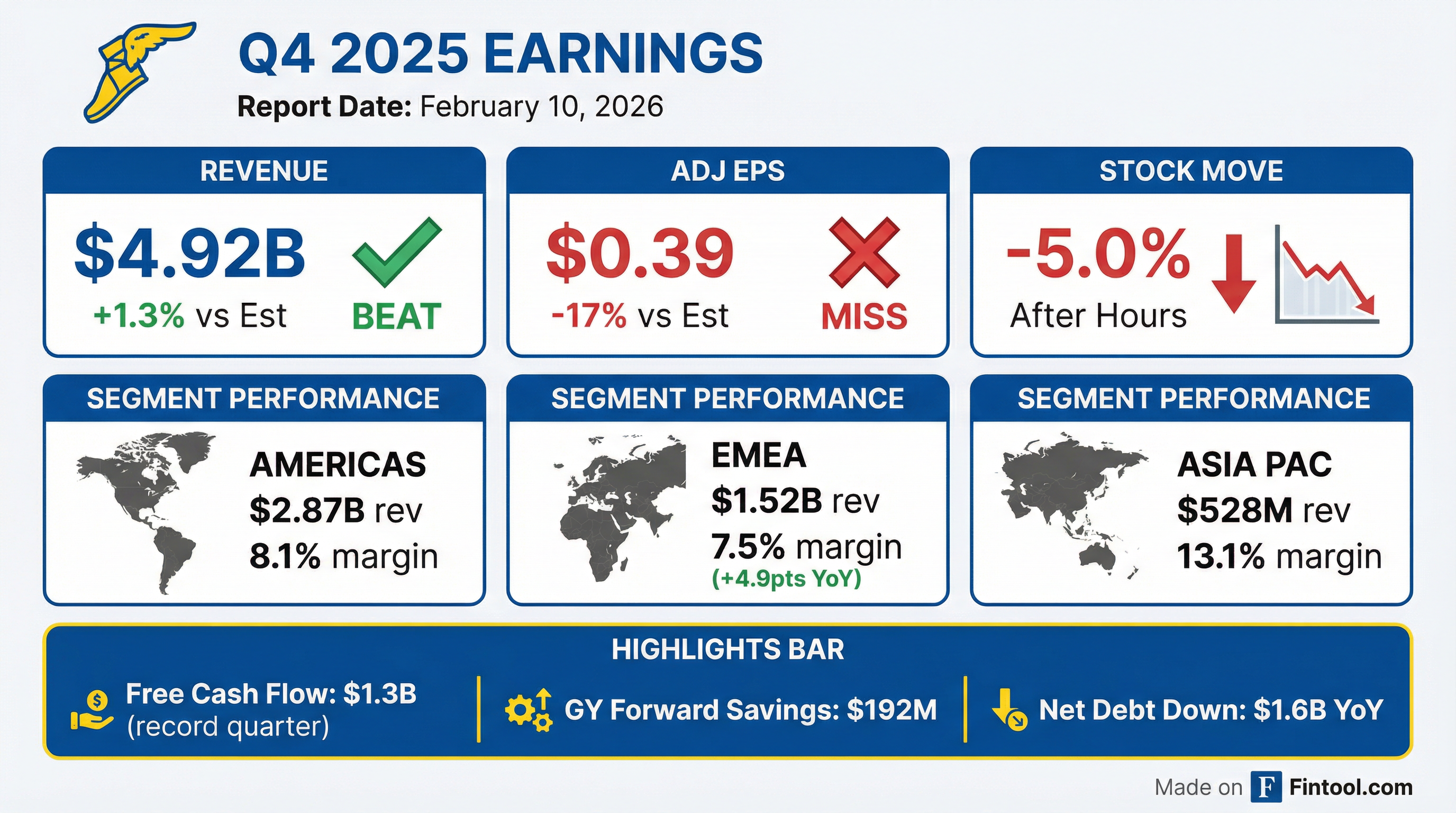

- Goodyear reported strong Q4 2025 financial results, with revenue of $4.9 billion, segment operating income (SOI) of $416 million, and an 8.5% SOI margin, which is the highest in over 7 years. The company also generated over $1.3 billion in free cash flow and completed three major asset sales in 2025, reducing net debt by $1.6 billion year-over-year.

- The Goodyear Forward program has delivered $1.5 billion of run rate benefits to date, with $772 million in benefits for the full year 2025, exceeding initial P&L targets by over $150 million. The program is projected to contribute $300 million in benefits for the full year 2026.

- For Q1 2026, the company anticipates continued market volatility, expecting volume to be down approximately 10% due to factors like lower consumer replacement volume and weak commercial truck trends.

- Regarding European tariffs, the anti-dumping investigation on consumer tires from China is now expected to conclude in July 2026, with anticipated duties ranging from 41% to 104%.

- Goodyear reported Q4 2025 sales of $4.9 billion, segment operating income of $416 million, and non-GAAP earnings per share of $0.39, while generating over $1.3 billion in free cash flow.

- The Goodyear Forward transformation delivered $192 million in benefits for Q4 2025, reaching $772 million for the full year, surpassing initial P&L targets.

- For Q1 2026, volume is projected to decrease by approximately 10%, primarily driven by lower US consumer replacement, with anticipated headwinds from unabsorbed overhead offset by benefits from price mix and raw material costs.

- The company is focused on premium product expansion, with 1,700 new products planned for 2026, and is navigating continued market volatility including delays in EU tariff decisions and elevated channel inventory.

- Goodyear reported Net Sales of $4,917 million for Q4 2025, a slight decrease of 0.6% year-over-year.

- Segment Operating Income for Q4 2025 increased by 8.9% year-over-year to $416 million, reflecting an 18% organic increase.

- The company generated Free Cash Flow of $1,335 million in Q4 2025, a $308 million increase year-over-year, marking one of its strongest quarters for cash generation.

- Adjusted Earnings Per Share (EPS) for Q4 2025 was $0.39, an increase of $0.01 year-over-year.

- The Goodyear Forward transformation plan contributed $192 million in benefits in Q4 2025, totaling approximately $775 million for the full year 2025, with an additional $300 million expected in 2026.

- Goodyear reported strong Q4 2025 financial results, with revenue of $4.9 billion and segment operating income (SOI) of $416 million, representing the highest SOI and SOI margin (8.5%) in over 7 years.

- The company generated over $1.3 billion in free cash flow in Q4 2025, contributing to a $1.6 billion reduction in net debt year-over-year, aided by three major asset sales in 2025.

- The "Goodyear Forward" program delivered $772 million in benefits for full year 2025, exceeding initial P&L targets, and is projected to provide $300 million in benefits for full year 2026.

- For Q1 2026, the company anticipates volume to decline approximately 10%, leading to a significantly affected SOI due to weak industry conditions, high channel inventories, and extreme weather.

- Despite near-term volatility, Goodyear expects year-on-year organic growth of approximately 10% on its adjusted 2025 SOI base of $815 million for the full year 2026, alongside a forecast for slightly positive free cash flow.

- Goodyear reported Q4 2025 net sales of $4.9 billion, which were flat compared to 2024, and full-year 2025 net sales of $18.3 billion.

- For Q4 2025, the company achieved Goodyear net income of $105 million ($0.36 per share) and adjusted net income of $113 million ($0.39 per share).

- Full-year 2025 resulted in a Goodyear net loss of $1.7 billion (($5.99) per share), primarily due to a $1.5 billion non-cash deferred tax asset valuation allowance and a $674 million non-cash goodwill impairment charge. However, adjusted net income for the full year was $136 million ($0.47 per share).

- Segment operating income for Q4 2025 was $416 million, with an 8.5% segment operating margin, marking the highest in over seven years. The Goodyear Forward plan delivered $192 million of benefits in Q4 2025, contributing to $1.25 billion in cumulative segment operating income benefits since inception.

- The Goodyear Tire & Rubber Company reported Q4 2025 net sales of $4.9 billion, flat from 2024, and full-year 2025 net sales of $18.3 billion, a decrease from $18.9 billion in 2024.

- For Q4 2025, net income was $105 million ($0.36 per share), with adjusted net income of $113 million ($0.39 per share). For the full year 2025, the company reported a net loss of $1.7 billion ($-5.99 per share), but adjusted net income was $136 million ($0.47 per share).

- Segment operating income for Q4 2025 increased 9% to $416 million from a year ago, marking the highest segment operating income and margin achieved in over seven years. However, full-year 2025 segment operating income was $1.1 billion, down from $1.3 billion in the prior year.

- The Goodyear Forward program delivered $192 million of benefits in Q4 2025, accumulating $1.25 billion in cumulative segment operating income benefits since inception, exceeding its original commitment. The company also generated $2.3 billion in proceeds from divestitures and other asset sales in 2025, primarily used to reduce debt.

- Goodyear reported Q3 2025 revenue of $4.6 billion and segment operating income of $287 million, with a net loss of $2.2 billion primarily due to non-cash items, and adjusted earnings per share of $0.28.

- The company completed its planned divestitures, including the chemicals business, resulting in a pro forma debt decline of approximately $1.5 billion in Q3 2025.

- Goodyear Forward initiatives contributed a $185 million benefit in Q3 2025 and are projected to provide $180 million in Q4, with at least $250 million in carryover cost benefits expected for 2026.

- For Q4 2025, the company anticipates a meaningful sequential increase in segment operating income, though global volume is expected to be down about 4%.

- Preliminary 2026 outlook includes a $200 million benefit from raw material costs, an inflation headwind of $200-$225 million, and a reduction in interest expense to approximately $425 million.

- Goodyear reported Net Sales of $4,645 million for Q3 2025, a 3.7% decrease year-over-year, and Segment Operating Income of $287 million, down 17.1% from the prior year. Adjusted Earnings Per Share for the quarter was $0.28.

- The company completed all planned divestitures, including the Chemical business sale, resulting in $2.2 billion in full-year divestiture proceeds. This contributed to a $1.5 billion reduction in total debt compared to the prior year, with pro forma total debt standing at $7,496 million as of September 30, 2025.

- Benefits from the Goodyear Forward plan reached $185 million in Q3 2025, with $580 million in additional Segment Operating Income benefit achieved during the first nine months of 2025. The annualized run rate target for Goodyear Forward benefits was increased to $1.5 billion.

- Free Cash Flow for Q3 2025 was ($181) million, representing an improvement of $159 million compared to Q3 2024.

- Goodyear reported Q3 2025 sales of $4.6 billion, a 3.7% decrease from last year, with a net loss of $2.2 billion primarily due to non-cash, non-recurring items, and adjusted earnings per share of $0.28.

- Segment Operating Income (SOI) for Q3 2025 was $287 million, benefiting from $185 million from the Goodyear Forward program and a $100 million price mix benefit, partly offset by an $81 million raw material headwind and a $90 million headwind from lower tire unit volume and factory utilization.

- The company reduced its debt by approximately $1.5 billion pro forma for the Chemicals transaction and expects to generate significant free cash flow in Q4 2025.

- For 2026, Goodyear anticipates at least $250 million in Goodyear Forward carryover cost benefits, a $200 million benefit from raw materials at current spot rates, and a $100 million benefit from flow-through pricing, while expecting headwinds of $200 million to $225 million from inflation and $150 million to $160 million from tariff carryover costs.

- Market conditions include a decline of over 30% in heavy truck builds in the U.S. and elevated imports, with excess consumer replacement channel inventory expected to clear by the end of Q4 2025, while commercial channel inventory digestion is projected to extend into 2026.

- Goodyear reported Q3 2025 net sales of $4.6 billion and a net loss of $2.2 billion ($7.62 per share), which included significant non-cash charges of a $1.4 billion deferred tax asset valuation allowance and a $674 million goodwill impairment.

- The company's adjusted net income for Q3 2025 was $82 million, with adjusted earnings per share of $0.28.

- On October 31, 2025, Goodyear completed the sale of its Chemical business for a purchase price of $650 million, receiving approximately $580 million in cash proceeds.

- This divestiture completes all planned asset sales under the Goodyear Forward program, with total proceeds from divestitures reaching approximately $2.2 billion, which will be used for debt reduction. The Goodyear Forward plan also delivered $185 million in segment operating income benefits during Q3 2025 and is expected to achieve $1.5 billion in annualized run-rate benefits by year-end 2025.

Quarterly earnings call transcripts for GOODYEAR TIRE & RUBBER CO /OH/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more