HANMI FINANCIAL (HAFC)·Q4 2025 Earnings Summary

Hanmi Financial Beats Q4 on NIM Expansion, Full-Year Earnings Up 22%

January 27, 2026 · by Fintool AI Agent

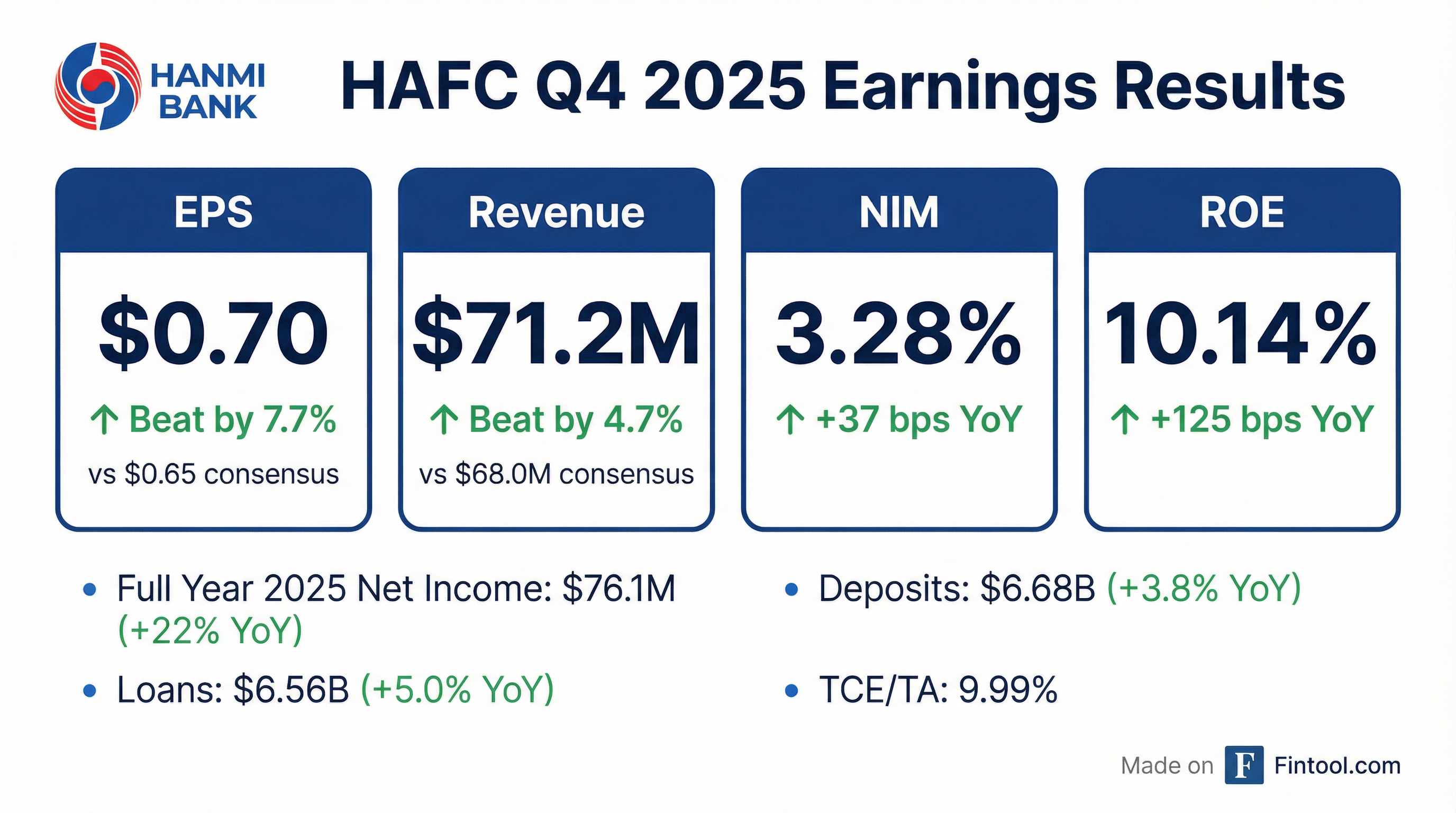

Hanmi Financial Corporation (NASDAQ: HAFC) reported Q4 2025 results that exceeded Street expectations, posting EPS of $0.70 versus the $0.65 consensus—a 7.7% beat. Revenue of $71.2 million topped the $68.0 million estimate by 4.7%. The community bank capped a strong 2025 with full-year earnings growth of 22%, driven by five consecutive quarters of net interest margin expansion.

The stock was essentially flat on the day, up 0.3% to $28.46, suggesting the market had partially priced in the margin improvement story heading into the print.

Did Hanmi Beat Earnings?

Yes, solidly. Q4 2025 marked another quarter of beats on both the top and bottom line:

The beat was powered by continued net interest margin expansion. NIM reached 3.28% in Q4—up 6 bps sequentially and up 37 bps year-over-year—as deposit repricing continued to benefit the bank while loan yields held relatively stable.

What Were the Key Financial Highlights?

Source: Company 8-K filed January 27, 2026

The sequential decline in net income (-3.7% QoQ) was primarily due to lower noninterest income, which fell $1.6 million from Q3. The drop reflected the absence of $0.9 million in BOLI death benefit claims and lower gains on residential mortgage loan sales.

How Did the Full Year 2025 Compare?

Hanmi's full-year results demonstrate the success of its relationship-driven banking model:

Full-year NIM expanded from 2.78% to 3.15%—a 37 bps improvement. Pre-provision net revenue growth of 31.5% highlights the bank's operating leverage from reduced funding costs and disciplined expense management.

What Did Management Say?

CEO Bonnie Lee struck an optimistic tone on the results and 2026 outlook:

"Hanmi delivered solid results in the fourth quarter, enabling us to finish 2025 with sustained momentum. We generated robust earnings growth of 22% for the year, driven by continued net interest margin expansion, healthy loan growth, and disciplined expense and credit management."

On growth initiatives:

"Investments in banking talent drove a 36% increase in loan production. The composition of our loan portfolio continues to evolve with C&I and residential mortgage loans increasing 25% and 10% for the year, respectively."

On the 2026 outlook:

"We are excited about the opportunities ahead in 2026 and beyond and believe we are well positioned to continue delivering on our growth strategy. Our balance sheet is strong, with ample liquidity and excellent capital ratios."

What Were the Key Q&A Takeaways?

On the Special Mention hospitality credit: The $55M loan downgrade is a senior credit with a strong sponsor and high liquidity. The property (in Southern California) is undergoing a Property Improvement Plan (PIP) ahead of World Cup and Olympics activities expected in the region. Management does not foresee loss probability on this credit and characterized the downgrade as "proactive monitoring."

On CD repricing tailwind: Over $900 million in CDs mature in Q1 2026 at 4.01%, followed by another ~$900 million in Q2 at 3.95%—totaling approximately $1.8 billion repricing in the first half at high-3s/low-4s rates. Management is targeting 3.5%-3.7% on retention, which would add meaningfully to NIM.

On January deposit costs (real-time update): As of the call date, interest-bearing deposit rates are already 15 bps lower than Q4 average, and savings/money market rates are 26 bps lower month-to-date—signaling continued margin tailwind into Q1.

On deposit competition: Competition remains intense. CD retention rate dropped from 90% to 80% as management chose not to match "irrational rates." Some smaller competitors are running CD promotions above 3.85%.

On 2026 expense outlook: Management expects mid-single-digit expense growth, consistent with the 4.6% increase in 2025. Healthcare costs are running above the 3% general inflation expectation.

On capital return: The board evaluates capital return quarterly. With shares trading above tangible book, buyback activity has been more restrained. Dividend review typically happens annually; management indicated they're at that mark now, evaluating 2026.

What's the Loan and Deposit Situation?

Loans: $6.56 billion, up 0.5% QoQ and 5.0% YoY. Q4 loan production was $374.8 million at a weighted average rate of 6.90%—44 bps above the 6.46% rate on payoffs, supporting spread income.

Deposits: $6.68 billion, down 1.3% QoQ but up 3.8% YoY. Noninterest-bearing deposits represented 30.2% of total deposits, demonstrating customer base stability.

USKC Initiative: A bright spot is the US-Korea Connect program—$862 million in loans (13% of portfolio) and $1 billion in deposits (15% of total, 16% of demand deposits). USKC deposits grew 24% YoY, supported by the Seoul representative office opened in Q4 2024.

Payoff dynamics: While loan production rose 36% YoY to $1.62B, payoffs and paydowns increased 13% YoY. Q4 production of $375M came in 34% below Q3's elevated level, but the weighted average rate on new production (6.90%) remains 44 bps above payoff rates.

What About Asset Quality?

Asset quality remained generally strong, though criticized loans increased notably:

Watch item: Criticized loans jumped to $97.0 million (1.48% of loans) from $45.4 million (0.69%) in Q3. The increase was driven by a $55.0 million hospitality loan downgraded to special mention status. On the call, management clarified this is a senior credit with a strong, highly liquid sponsor. The property is in Southern California undergoing a Property Improvement Plan ahead of World Cup and Olympics activity—management does not anticipate losses.

Net charge-offs were $1.6 million (0.10% annualized), primarily from equipment finance agreements. Credit loss expense was $1.9 million, down from $2.1 million in Q3.

How Did the Stock React?

The stock closed at $28.46, up 0.28% on the day—a muted reaction to otherwise solid results. This suggests the market had largely anticipated the NIM improvement and earnings beat.

Capital Return and Balance Sheet Strength

Hanmi returned $10.1 million to shareholders in Q4 via $8.1 million in dividends ($0.27/share) and $2.0 million in share repurchases (73,600 shares at $26.75 average).

The bank remains well-capitalized with ample room for continued shareholder returns. The dividend payout ratio for 2025 was 43.0% compared with 48.8% in 2024.

What Did Management Guide for 2026?

Management outlined four priorities for 2026 on the call:

Key NIM driver: With ~$1.8 billion of CDs repricing in H1 2026 from high-3s/low-4s down to 3.5-3.7%, continued NIM expansion appears likely if the Fed holds steady.

What Should Investors Watch Going Forward?

Positives:

- NIM expansion runway: ~$1.8B of CDs repricing in H1 2026 at 30-50 bps lower rates; January deposit costs already tracking 15-26 bps below Q4

- Loan production momentum: $1.62B in 2025 production (+36% YoY) with positive spread over payoffs

- Strong capital position enabling continued returns; dividend review underway

- Disciplined expense management (efficiency ratio improved from 60.3% in 2024 to 54.7% in 2025)

- USKC initiative traction: $862M loans, $1B deposits (+24% YoY), Seoul office contributing

Risks:

- Criticized loan increase: The $55M hospitality loan downgrade bears monitoring, though management sees no loss probability

- Deposit outflows: Q4 saw a 1.3% decline; CD retention dropped to 80% amid competitive pressures

- CRE concentration: 61% of loans remain in commercial real estate, with hospitality representing 21% of CRE

The Bottom Line

Hanmi Financial delivered a clean beat in Q4 2025, capping a transformational year with 22% earnings growth. The NIM expansion story remains intact, loan growth is tracking well, and capital returns are steady. The one blemish—rising criticized loans—warrants attention but appears contained for now. At ~11x trailing earnings and 1.1x tangible book, HAFC offers a reasonable entry point for investors seeking community bank exposure with margin tailwinds.

Related: HAFC Company Overview | Q4 2025 Earnings Call Transcript eking community bank exposure with margin tailwinds.

Related: HAFC Company Overview | Q4 2025 Earnings Call Transcript