Earnings summaries and quarterly performance for HANMI FINANCIAL.

Executive leadership at HANMI FINANCIAL.

Bonita I. Lee

President and Chief Executive Officer

Anthony Kim

Senior Executive Vice President and Chief Banking Officer

Joseph Pangrazio

Senior Vice President and Chief Accounting Officer

Matthew D. Fuhr

Executive Vice President and Chief Credit Officer

Michael Du

Executive Vice President and Chief Risk Officer

Romolo C. Santarosa

Senior Executive Vice President and Chief Financial Officer

Board of directors at HANMI FINANCIAL.

Christie K. Chu

Director

Christine P. Ball

Director

Daniel J. Medici

Director

David L. Rosenblum

Vice Chairman of the Board

Gideon Yu

Director

Gloria J. Lee

Director

Harry H. Chung

Director

James A. Marasco

Director

John J. Ahn

Chairman of the Board

Michael M. Yang

Director

Thomas J. Williams

Director

Research analysts who have asked questions during HANMI FINANCIAL earnings calls.

Kelly Motta

Keefe, Bruyette & Woods

6 questions for HAFC

Gary Tenner

D.A. Davidson & Co.

4 questions for HAFC

Matthew Clark

Piper Sandler

3 questions for HAFC

Adam Butler

Piper Sandler

2 questions for HAFC

Ahmad Hasan

D.A. Davidson & Co.

2 questions for HAFC

Matthew Erdner

JonesTrading Institutional Services

2 questions for HAFC

Adam Kroll

Piper Sandler Companies

1 question for HAFC

Recent press releases and 8-K filings for HAFC.

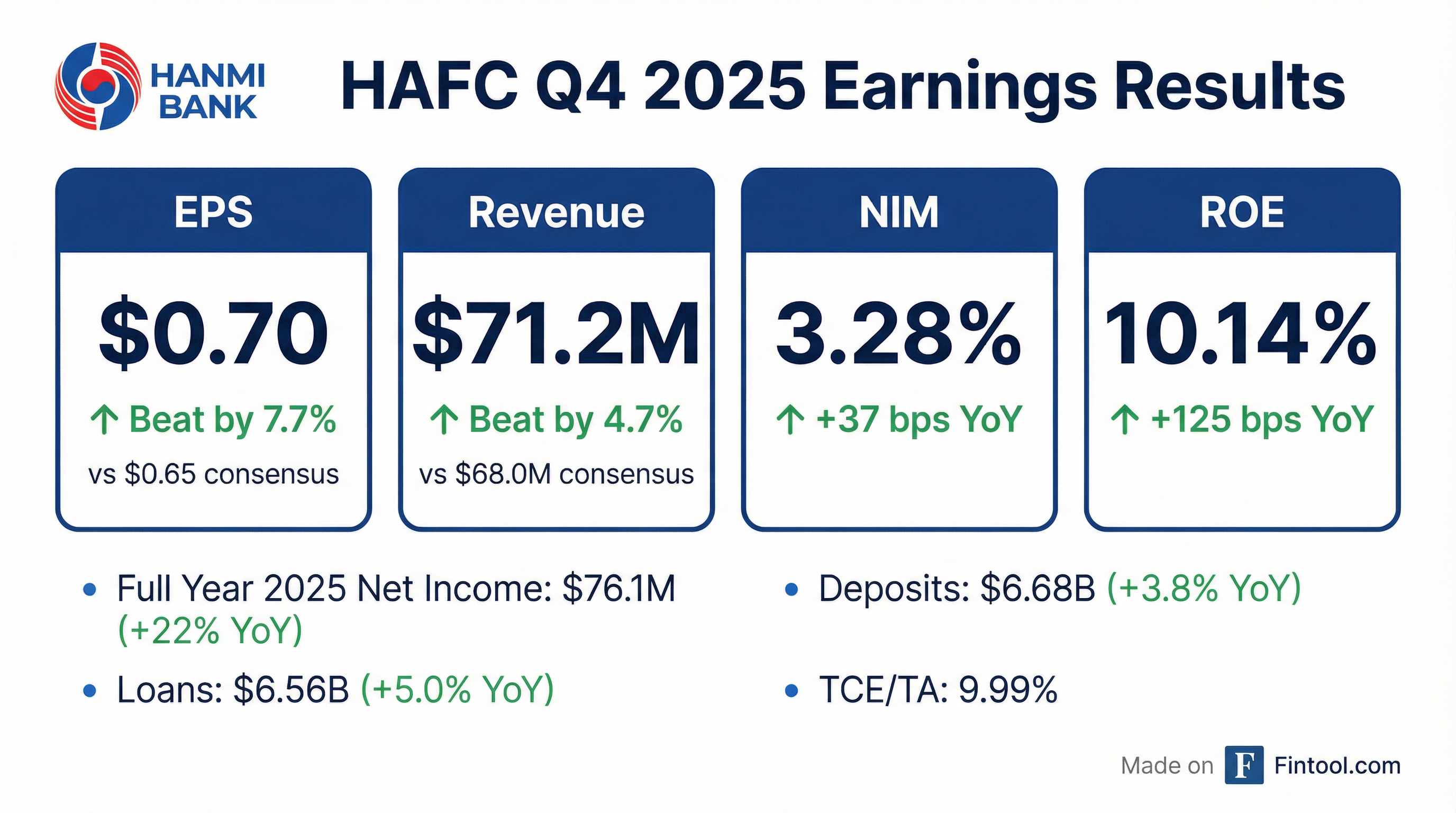

- Hanmi Financial Corp (HAFC) reported net income of $21.2 million and diluted EPS of $0.70 for Q4 2025.

- The company's net interest income was $62.9 million with a net interest margin (NIM) of 3.28% for Q4 2025.

- Loans receivable increased to $6.56 billion, and deposits were $6.68 billion at December 31, 2025.

- Asset quality remained strong, with nonperforming assets to total assets at 0.26% and nonperforming loans to total loans at 0.28% for Q4 2025.

- Tangible common equity to tangible assets (TCE/TA) was 9.99%, and tangible book value per share (TBVPS) increased to $26.27 at the end of Q4 2025, with the company returning $10.1 million to shareholders through share repurchases and dividends.

- Hanmi Financial Corporation declared a cash dividend of $0.28 per share for the 2026 first quarter, marking a 4% increase from the prior quarter.

- The dividend is scheduled for payment on February 25, 2026, to stockholders of record as of February 9, 2026.

- The company expanded its existing share repurchase authorization by 1.5 million shares, increasing the total capacity to approximately 2.3 million shares, which represents 7.8% of shares outstanding as of December 31, 2025.

- Hanmi Financial Corporation reported net income of $21.2 million, or $0.70 per diluted share, for Q4 2025, and $76.1 million, or $2.51 per diluted share, for the full year 2025, representing a 22% increase in full-year net income.

- For the full year 2025, the company achieved 5% loan growth and 3.8% deposit growth, with net interest margin expanding by 37 basis points for the year and six basis points to 3.28% in Q4 2025.

- Asset quality remained strong, with non-performing assets at 0.26% of total assets and allowance for credit losses at 1.07% of total loans as of Q4 2025.

- The company returned $42 million of capital to shareholders in 2025 through $9 million in share repurchases and $33 million in dividends, and tangible common equity per share increased 2.5% to $26.27.

- For 2026, Hanmi expects low to mid-single-digit loan growth, continued deposit growth, and anticipates mid-single-digit expense growth.

- Hanmi Financial Corporation (HAFC) reported net income of $21.2 million, or $0.70 per diluted share, for Q4 2025, and $76.1 million, or $2.51 per diluted share, for the full year 2025, marking a 22% increase year-over-year.

- For the full year 2025, HAFC achieved 5% loan growth totaling $312 million and expanded its net interest margin by 37 basis points, reaching 3.28% in Q4 2025. Deposits grew by 3.8% in 2025, with non-interest-bearing deposits remaining at approximately 30% of total bank deposits.

- The company demonstrated disciplined expense management, improving its efficiency ratio to 54.7% for the full year 2025, and returned $42 million of capital to shareholders through share repurchases and dividends.

- Looking ahead to 2026, HAFC expects low to mid-single-digit loan growth, continued deposit growth, and ongoing net interest margin expansion.

- Hanmi Financial Corporation (HAFC) reported Q4 2025 net income of $21.2 million, or $0.70 per diluted share, contributing to a full-year 2025 net income of $76.1 million, or $2.51 per diluted share, which is a 22% increase year-over-year.

- For the full year 2025, the company achieved 5% loan growth and 3.8% deposit growth, with the net interest margin expanding by 37 basis points year-over-year to 3.28% in Q4 2025.

- HAFC returned $42 million to shareholders in 2025, comprising $9 million in share repurchases and $33 million in dividends. In Q4 2025, 73,600 shares were repurchased at an average price of $26.75.

- For 2026, the company expects low to mid-single-digit loan growth, continued deposit growth, and disciplined expense management with an anticipated mid-single-digit increase in expenses.

- Hanmi Financial Corporation reported net income of $21.2 million, or $0.70 per diluted share, for the fourth quarter of 2025, compared to $22.1 million, or $0.73 per diluted share, in the third quarter of 2025.

- For the full year 2025, net income was $76.1 million, or $2.51 per diluted share, representing a 22% increase from $62.2 million, or $2.05 per diluted share, in 2024.

- Key profitability metrics for Q4 2025 included a return on average assets of 1.07%, a return on average equity of 10.14%, and a net interest margin of 3.28%.

- The company's loans receivable increased to $6.56 billion by December 31, 2025, up 0.5% from the prior quarter, with asset quality remaining strong as nonperforming loans represented 0.28% of total loans.

- Hanmi returned $10.1 million of capital to shareholders in Q4 2025 through share repurchases and dividends, maintaining a strong capital position with a tangible common equity to tangible assets ratio of 9.99%.

- Hanmi Financial Corporation reported net income of $21.2 million or $0.70 per diluted share for the fourth quarter of 2025, a slight decrease from $22.1 million or $0.73 per diluted share in the third quarter of 2025.

- For the full year 2025, net income was $76.1 million or $2.51 per diluted share, representing a 22% increase compared to $62.2 million or $2.05 per diluted share in 2024.

- The company achieved net interest margin expansion to 3.28% in Q4 2025, up six basis points from the prior quarter, driven by lower interest expense on interest-bearing deposits.

- Loans receivable increased to $6.56 billion by December 31, 2025, up 0.5% from the prior quarter, and nonperforming loans improved to 0.28% of total loans.

- Hanmi returned $10.1 million of capital to shareholders in Q4 2025 through share repurchases and dividends, maintaining a strong tangible common equity to tangible assets ratio of 9.99%.

- Hanmi Financial Corp. reported strong third quarter 2025 financial results, with net income of $22.1 million and diluted earnings per share of $0.73.

- The company's loans receivable increased 3.5% quarter-over-quarter to $6.53 billion, and deposits grew 0.6% to $6.77 billion as of September 30, 2025.

- Asset quality improved, with nonperforming assets decreasing 17.7% from the previous quarter to $21.4 million, representing 0.27% of total assets as of September 30, 2025.

- Capital remained strong, with a tangible common equity to tangible assets ratio of 9.80% and a common equity tier 1 capital ratio of 12.01% as of September 30, 2025.

- Hanmi also repurchased 199,698 common shares at a weighted average price of $23.45 during the third quarter of 2025.

- Hanmi Financial Corporation reported net income of $22.1 million, or $0.73 per diluted share, for the third quarter of 2025, compared to $15.1 million and $0.50, respectively, in the second quarter. The net interest margin expanded by 15 basis points to 3.22%.

- Total loans increased to $6.53 billion, a 3.5% linked-quarter increase, driven by a 73% increase in loan production to $571 million. Deposits also increased by 0.6% in the third quarter, or 2.2% annualized.

- Asset quality improved, with credit loss expense decreasing by $5.5 million to $2.1 million in Q3 2025, and the company recognized $500,000 in net loan recoveries compared to net loan charge-offs of $11.4 million in the prior quarter. The efficiency ratio declined to a two-year low of 52.65%.

- The company repurchased 199,698 common shares at a weighted average price of $23.45 during the quarter. HAFC is positioned to maintain momentum, with a revised full-year loan growth forecast in the mid-single-digit range, an increase from its previous low to mid-single-digit guidance.

- Hanmi Financial Corporation reported net income of $22.1 million and diluted EPS of $0.73 for Q3 2025, significantly up from $15.1 million and $0.50, respectively, in the prior quarter.

- Total loans increased 3.5% linked-quarter to $6.53 billion, with loan production surging 73% to $571 million.

- The net interest margin expanded by 15 basis points to 3.22%, attributed to higher loan yields and reduced funding costs.

- Asset quality improved with a credit loss expense of $2.1 million, down from $7.6 million in Q2 2025, and the company recorded net loan recoveries of $500,000.

- The efficiency ratio reached a two-year low of 52.65%, and the company repurchased 199,698 common shares at a weighted average price of $23.45 during the quarter.

Quarterly earnings call transcripts for HANMI FINANCIAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more