HALOZYME THERAPEUTICS (HALO)·Q4 2025 Earnings Summary

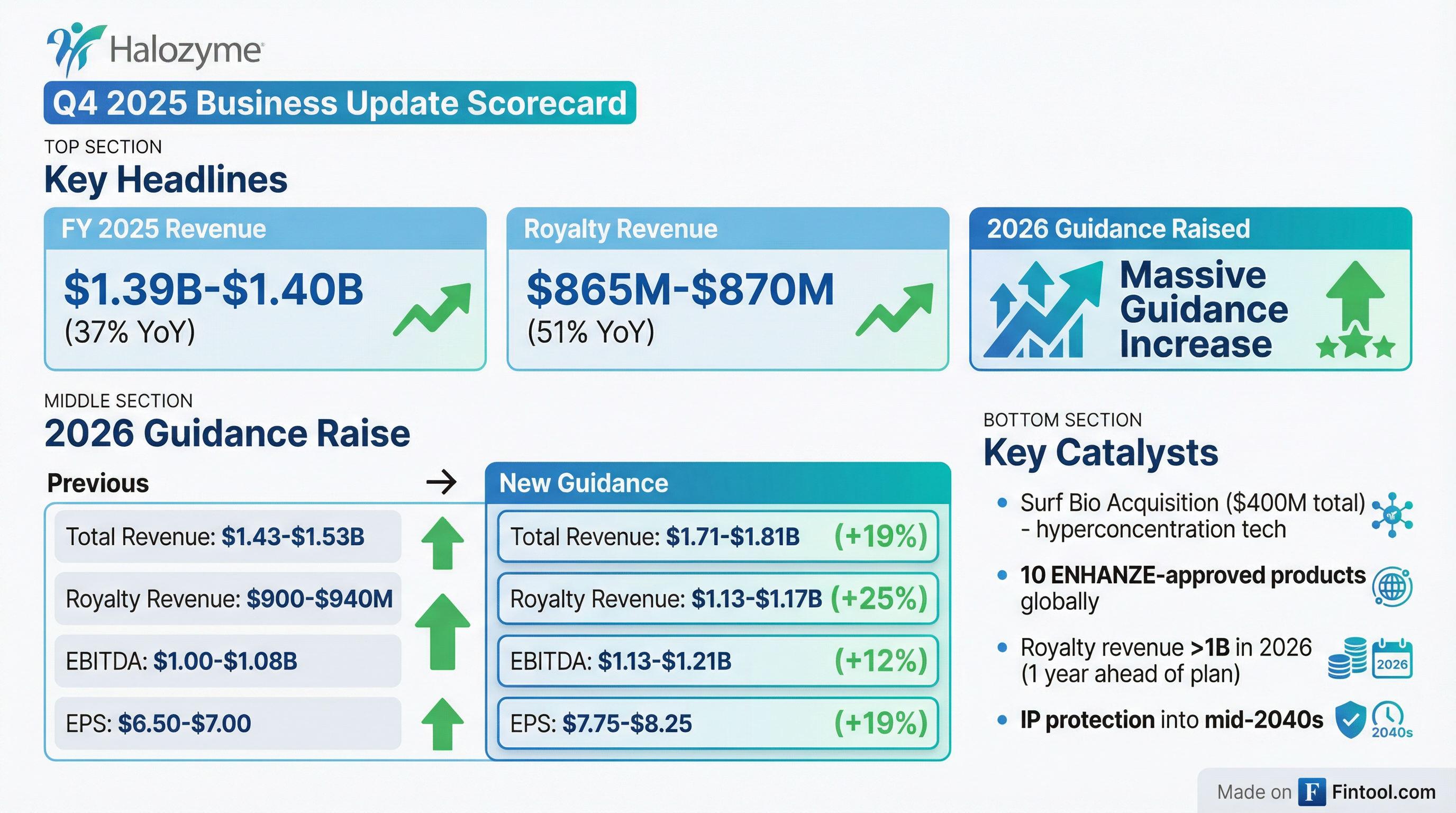

Halozyme Raises 2026 Guidance by 19% as Royalty Revenue Nears $1B Milestone

January 28, 2026 · by Fintool AI Agent

Halozyme Therapeutics (NASDAQ: HALO) delivered a blockbuster business update today, raising 2026 financial guidance across all metrics and announcing preliminary 2025 results that exceeded prior guidance. The company also revealed its acquisition of Surf Bio, expanding its drug delivery technology portfolio with hyperconcentration capabilities.

The stock closed at $70.22, up 0.5% on the day ahead of the announcement, with after-hours trading at $70.50. Shares are up 48% from their 52-week low of $47.50.

Did Halozyme Beat Expectations?

This is a pre-announcement and guidance update rather than full Q4 2025 results. However, the preliminary 2025 figures significantly exceeded the company's prior guidance:

Royalty revenue growth of 51-52% YoY demonstrates the "strength of our business model and the durable demand for ENHANZE-enabled products globally," according to CEO Dr. Helen Torley.

Beat/Miss Track Record

Halozyme has delivered consistent beats over the past 8 quarters:

*Values retrieved from S&P Global

Seven consecutive quarters of EPS beats and six consecutive quarters of revenue beats — a testament to management's conservative guidance philosophy.

What Did Management Guide for 2026?

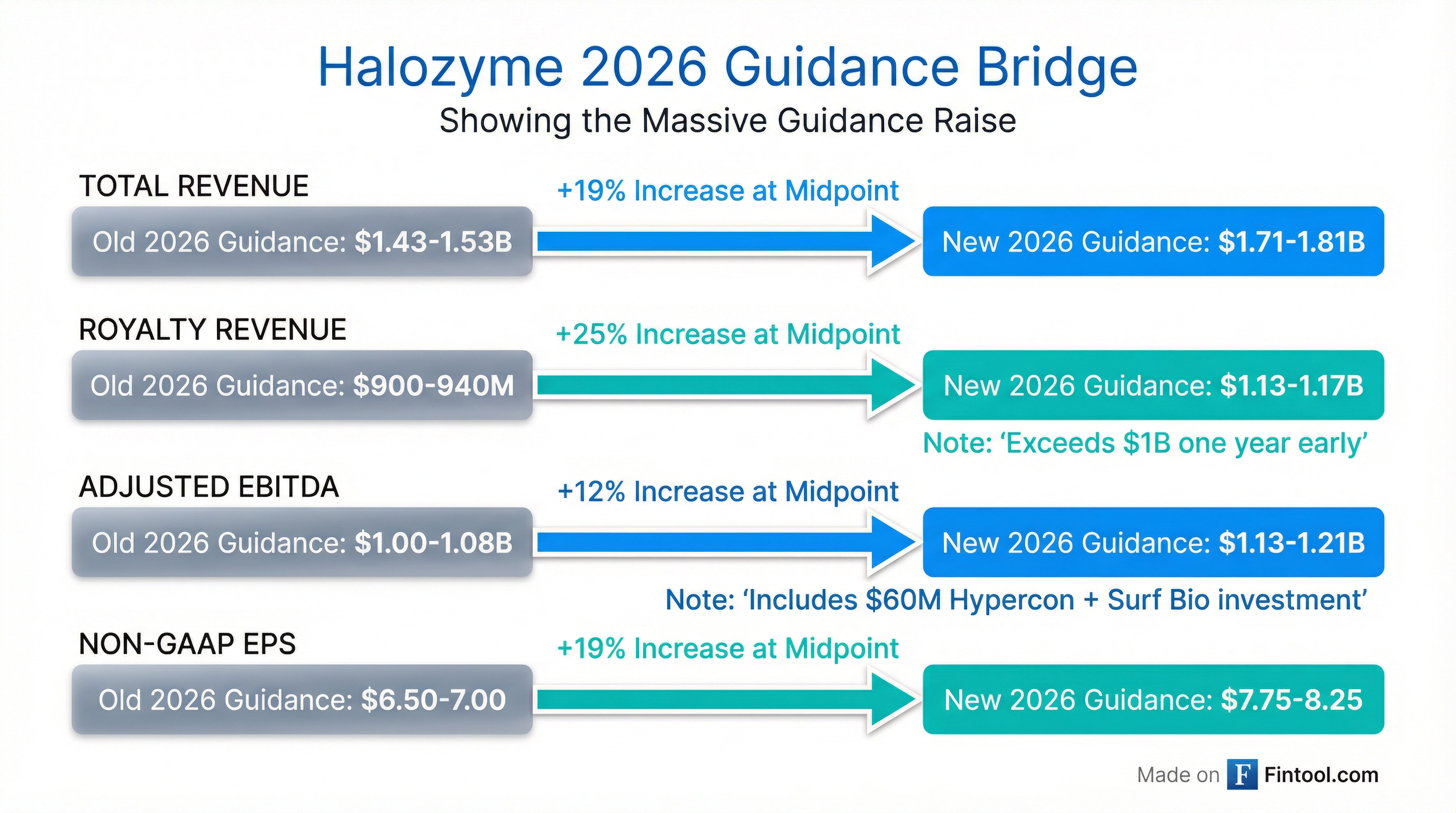

This is the headline: Halozyme raised 2026 guidance by 19% at the midpoint across revenue and EPS, a substantial upward revision that caught the Street's attention.

2026 Guidance Comparison

New Guidance vs. Street Consensus

*Values retrieved from S&P Global

*Note: The new EPS guidance range of $7.75-$8.25 brackets consensus at $8.21, with the high end above Street expectations.

Key driver: Royalty revenue is now projected to exceed $1 billion in 2026, growing 30-35% YoY — one year earlier than previously projected.

What Changed From Last Quarter?

1. Surf Bio Acquisition ($400M Total Consideration)

Halozyme acquired Surf Bio in December 2025 for $300 million upfront plus up to $100 million in development and regulatory milestone payments.

What Surf Bio brings:

- Hyperconcentration technology enabling formulations up to 500 mg/mL

- Proprietary excipient and spray-dry approach for subcutaneous delivery

- Long-duration IP protection into the mid-2040s

- Expands the pathway for at-home biologics administration

This follows the Elektrofi acquisition announced in October 2025 ($750M upfront + $150M milestones), which brought the Hypercon™ technology platform. Together, these acquisitions significantly broaden Halozyme's drug delivery portfolio beyond ENHANZE.

2. ENHANZE Momentum Continues

In 2025, the company:

- Signed 3 new ENHANZE collaboration and licensing agreements

- Added 1 new auto-injector commercial licensing and supply agreement

- Signed 2 auto-injector development agreements

- Partner Janssen gained global approvals for Rybrevant Faspro — the 10th ENHANZE-approved product

3. Guidance Absorbs $60M Investment

The new 2026 guidance includes approximately $60 million in incremental investment for Hypercon™ and Surf Bio that was not in prior guidance. Despite this additional spending, both EBITDA and EPS guidance increased significantly.

Key Management Quotes

"Our increased multi-year guidance reflects both the strength of our core ENHANZE business and the exceptional momentum we built in 2025. In 2025, we expect royalty revenue growth to exceed 50% year‑over‑year, a clear demonstration of the strength of our business model and the durable demand for ENHANZE‑enabled products globally."

— Dr. Helen Torley, President and CEO

"By the end of 2026, we project we will have 15 partner programs in development and have signed three or more new drug delivery licensing agreements... These drivers reinforce our confidence in delivering durable revenue growth well into the 2040s."

— Dr. Helen Torley

Financial Trends

Revenue Growth Acceleration

Margin Profile

*Values retrieved from S&P Global

EBITDA margins have expanded ~800bps from Q1 2024, reflecting the operating leverage inherent in Halozyme's royalty-driven business model.

How Did the Stock React?

*Values retrieved from S&P Global

The stock is trading at 8.5x consensus 2026 EPS ($8.21) and 4.9x consensus 2026 revenue ($1.69B), reflecting moderate valuation for a high-growth royalty business.

Forward Catalysts

Near-Term (2026):

- Q4 2025 and full-year 2025 results (expected Feb/March 2026)

- 3+ new drug delivery licensing agreements expected

- 15 partner programs in development by year-end

- Royalty revenue crossing $1B milestone

Medium-Term (2027-2030):

- Hypercon™ partner products entering clinical development

- First royalty revenues from Elektrofi partnerships (projected ~2030)

- Up to $275M in potential development/commercial milestones from Elektrofi partners

Long-Term:

- IP protection into mid-2040s across ENHANZE, Hypercon™, and Surf Bio platforms

- Management confidence in "durable revenue growth well into the 2040s"

Risks and Concerns

- Partner Concentration: Royalty revenue depends on partners' commercial execution and market share gains

- Acquisition Integration: $1.15B+ deployed on Elektrofi and Surf Bio requires successful technology commercialization

- Clinical Risk: Hypercon™ and Surf Bio technologies still require partner clinical validation

- Guidance Includes $60M New Investment: Higher OpEx from acquisitions, though offset by stronger top-line

Bottom Line

Halozyme delivered a powerful business update: 19% guidance raise, royalty revenue hitting $1B one year early, and strategic acquisitions extending the runway into the 2040s. With seven consecutive quarters of EPS beats, management has earned credibility for conservative guidance. The Surf Bio and Elektrofi acquisitions diversify the drug delivery portfolio beyond ENHANZE while maintaining the low-capital-intensity, royalty-centric model that investors value.

The key question is whether the Street will revise estimates higher to reflect the new guidance — current consensus of $8.21 EPS sits near the high end of the new $7.75-$8.25 range, suggesting potential upside if execution continues.

Related: