Earnings summaries and quarterly performance for HALOZYME THERAPEUTICS.

Executive leadership at HALOZYME THERAPEUTICS.

Board of directors at HALOZYME THERAPEUTICS.

Research analysts who have asked questions during HALOZYME THERAPEUTICS earnings calls.

Brendan Smith

Stifel, Nicolaus & Company, Incorporated

6 questions for HALO

Michael DiFiore

Evercore ISI

6 questions for HALO

Jason Butler

JMP Citizens

5 questions for HALO

Sean Laaman

Morgan Stanley & Co.

5 questions for HALO

Mohit Bansal

Wells Fargo & Company

4 questions for HALO

Corinne Johnson

Goldman Sachs

3 questions for HALO

Mitchell Kapoor

H.C. Wainwright & Co.

3 questions for HALO

David Risinger

Leerink Partners

2 questions for HALO

Jessica Fye

JPMorgan Chase & Co.

2 questions for HALO

Adam Ferrari

J.P. Morgan

1 question for HALO

Cerena Chen

Wells Fargo & Company

1 question for HALO

Daniel Smith

H.C. Wainwright & Co.

1 question for HALO

Karen Johnson

Goldman Sachs

1 question for HALO

Morgan Gryga

Morgan Stanley

1 question for HALO

Na Sun

JPMorgan Chase & Co.

1 question for HALO

Sadia Rahman

Wells Fargo

1 question for HALO

Recent press releases and 8-K filings for HALO.

- Halozyme expanded its drug delivery leadership in late 2025 by acquiring Surf Bio in December 2025 for $300 million upfront and Elektrofi (Hypercon™) in November 2025 for $750 million upfront, increasing its royalty-bearing SC Delivery Technologies from one to three.

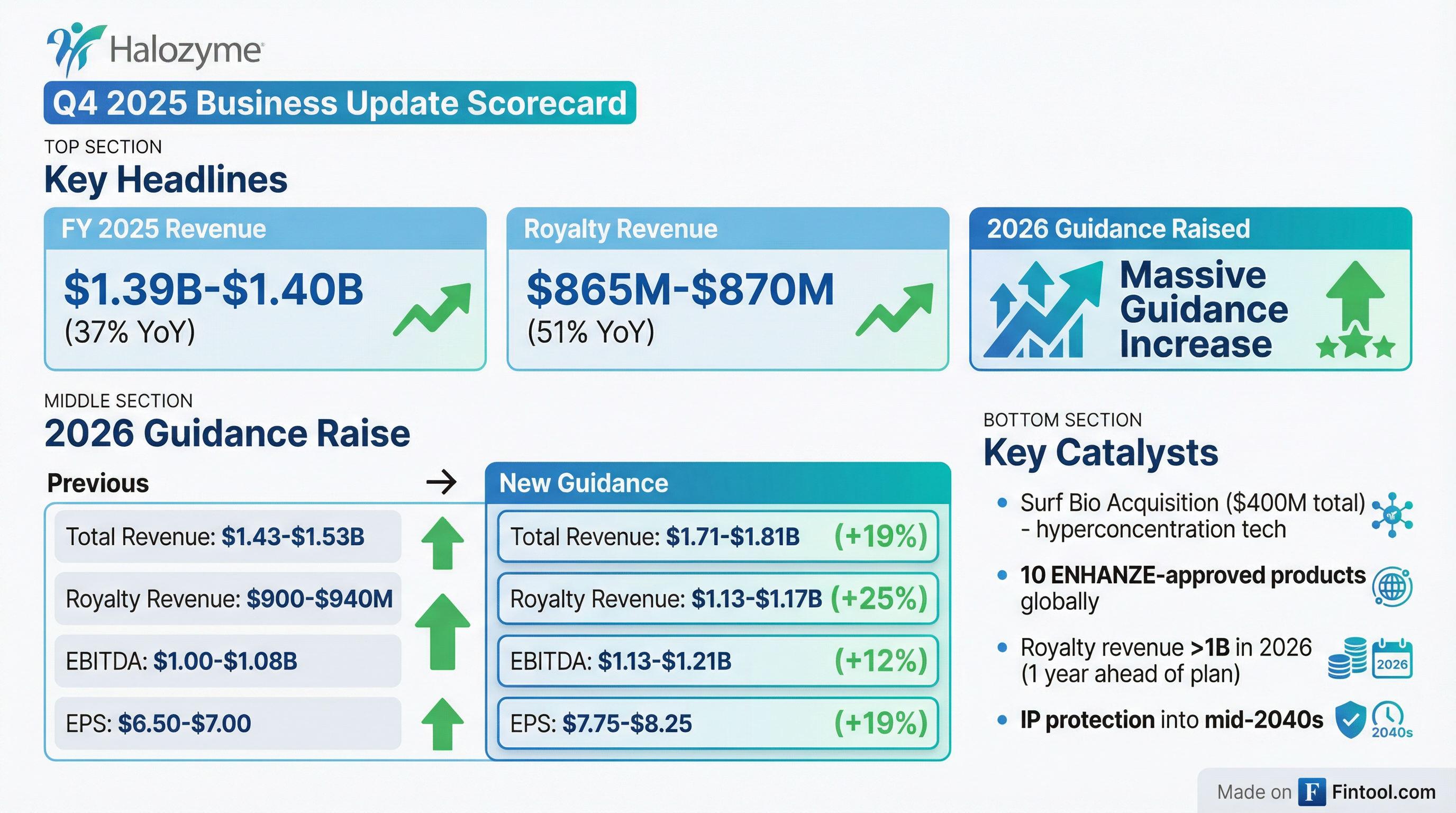

- The company raised its 2025 Total Revenue estimate to $1,385M – 1,400M and its 2026 Total Revenue guidance to $1,710M – 1,810M, driven by increased expectations for royalties and product sales.

- Halozyme also increased its 2026 Non-GAAP Diluted EPS guidance to $7.75 – 8.25 and projects Adjusted EBITDA to reach $1,125M – 1,205M in 2026, with strong growth continuing through 2028.

- For the period 2026-2028, the company projects a high-margin business model with Gross Margin >80%, Free Cash Flow as a % of Adjusted EBITDA >70%, and Operating Margin >60%.

- Halozyme acquired Elektrofi (Hypercon) in November 2025 and Surf Bio in late December 2025, expanding its portfolio to three subcutaneous delivery-enabling technologies, including ENHANZE.

- The company expects to exceed its 2025 total revenue guidance, projecting $1.385 billion-$1.4 billion, representing 36%-38% growth over 2024, predominantly driven by royalty revenue.

- Halozyme raised its 2026 guidance, projecting total revenue of $1.71 billion-$1.81 billion (a 23%-30% increase over the 2025 estimate) and non-GAAP diluted EPS of $7.75-$8.25.

- The company updated its 2026-2028 long-term guidance, projecting total revenue to exceed $2 billion in 2028 and non-GAAP diluted EPS of $10.50-$11.10 in 2028.

- Halozyme projects to exceed $1 billion in royalty revenues in 2026, one year earlier than its original projection.

- Halozyme provided preliminary 2025 revenue estimates and updated its 2026 to 2028 financial guidance.

- In late 2025, Halozyme acquired Elektrofi (Hypercon) in November and Surf Bio in December, adding two new long-duration IP subcutaneous delivery technologies with IP extending to the mid-2040s.

- The company projects 2025 total revenue of $1.385 billion-$1.4 billion and 2026 total revenue of $1.71 billion-$1.81 billion, with royalty revenue expected to exceed $1 billion in 2026.

- Halozyme's longer-term guidance for 2028 projects total revenue to exceed $2 billion, with royalty revenue between $1.46 billion-$1.51 billion and non-GAAP diluted EPS of $10.50-$11.10.

- The company anticipates signing 1 to 3 new ENHANZE licensing agreements in 2026 and projects Hypercon to deliver approximately $1 billion in royalty revenues by the mid-2030s.

- Halozyme exceeded its 2025 total revenue guidance with preliminary estimates of $1.385 billion-$1.4 billion and achieved its royalty revenue guidance of $865 million-$870 million.

- The company raised its 2026 guidance, projecting total revenue of $1.71 billion-$1.81 billion and royalty revenue of $1.13 billion-$1.17 billion, surpassing $1 billion in royalty revenues a year earlier than anticipated. Non-GAAP diluted EPS is projected at $7.75-$8.25.

- Longer-term guidance for 2028 was also raised, with total revenue expected to exceed $2 billion and non-GAAP EPS projected at $10.50-$11.10.

- Halozyme expanded its subcutaneous delivery technologies from one to three with the acquisition of Surf Bio in December 2025 and Elektrofi (Hypercon) in November 2025.

- The ENHANZE platform demonstrated strong momentum in 2025 with 10 globally approved blockbuster products, including DARZALEX FASPRO with $14.3 billion in sales and VYVGART Hytrulo with $4.15 billion in sales.

- Halozyme Therapeutics, Inc. updated its preliminary unaudited 2025 revenue estimates, projecting Total Revenue between $1,385 million and $1,400 million and Royalty Revenue between $865 million and $870 million.

- The company raised its 2026 financial guidance, increasing Total Revenue to a range of $1,710 million to $1,810 million, Royalty Revenue to $1,130 million to $1,170 million, Adjusted EBITDA to $1,125 million to $1,205 million, and non-GAAP Diluted EPS to $7.75 to $8.25.

- This updated 2026 guidance reflects year-over-year growth of 23% to 30% for total revenue and 30% to 35% for royalty revenue, with royalty revenue projected to exceed $1 billion one year earlier than previously expected.

- Halozyme expanded its drug delivery opportunity by acquiring Surf Bio in December 2025 for an upfront payment of $300 million and potential milestone payments up to $100 million.

- Halozyme Therapeutics updated its preliminary unaudited 2025 revenue estimates and raised its full-year 2026 financial guidance.

- For 2025, the company anticipates Total Revenue of $1,385 million to $1,400 million and Royalty Revenue of $865 million to $870 million.

- The 2026 guidance was raised, with Total Revenue projected at $1,710 million to $1,810 million, Royalty Revenue at $1,130 million to $1,170 million, Adjusted EBITDA at $1,125 million to $1,205 million, and non-GAAP Diluted EPS at $7.75 to $8.25.

- Halozyme also announced the acquisition of Surf Bio, Inc. in December 2025 for an upfront payment of $300 million and up to $100 million in milestone payments, enhancing its drug delivery technology portfolio.

- Halo Pharma is set to become a stand-alone drug product contract development and manufacturing organization (CDMO) following the divestiture of Noramco API related assets by SK Capital Partners to Siegfried.

- L. Lee Karras will assume the role of CEO of Halo Pharma once the transaction is complete.

- The company plans to launch a sterile CDMO business in the second half of 2026, which will include a state-of-the-art filling line for vials, syringes, and cartridges.

- This strategic move allows Halo Pharma to focus on drug product services in North America and expand into more complex manufacturing services.

- Halozyme Therapeutics (HALO) will host an Investor Conference Call on January 28, 2026, at 5:30 am PT / 8:30 am ET.

- During the call, the company will announce preliminary unaudited full year 2025 revenue results.

- Management will also provide updated financial guidance for the 2026-2028 period.

- Halozyme Therapeutics entered into a global collaboration and exclusive license agreement with Takeda in December 2025.

- The agreement provides Takeda with exclusive access to Halozyme's ENHANZE® drug delivery technology for use with vedolizumab (marketed globally as ENTYVIO).

- Under the terms, Halozyme will receive an upfront payment, potential future development and commercial milestone payments, and low-mid single digit royalties on sales of products containing vedolizumab in combination with ENHANZE®.

- This collaboration aims to enhance the patient experience and provide flexible treatment options for individuals with ulcerative colitis and Crohn's disease.

- Halozyme Therapeutics announced the U.S. FDA approval of Johnson & Johnson's RYBREVANT FASPRO™ (amivantamab and hyaluronidase-lpuj), which is co-formulated with Halozyme's ENHANZE® drug delivery technology.

- This approved product is the first and only subcutaneously (SC) administered targeted therapy for patients with EGFR-mutated locally advanced or metastatic non-small cell lung cancer (NSCLC).

- RYBREVANT FASPRO™ significantly reduces administration time from several hours to approximately five minutes and demonstrated an approximately fivefold reduction in administration-related reactions compared to intravenous delivery.

Fintool News

In-depth analysis and coverage of HALOZYME THERAPEUTICS.

Quarterly earnings call transcripts for HALOZYME THERAPEUTICS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more