HOME BANCORP (HBCP)·Q4 2025 Earnings Summary

Home Bancorp Beats Q4 2025 on Strong NIM, But Credit Quality Softens

January 27, 2026 · by Fintool AI Agent

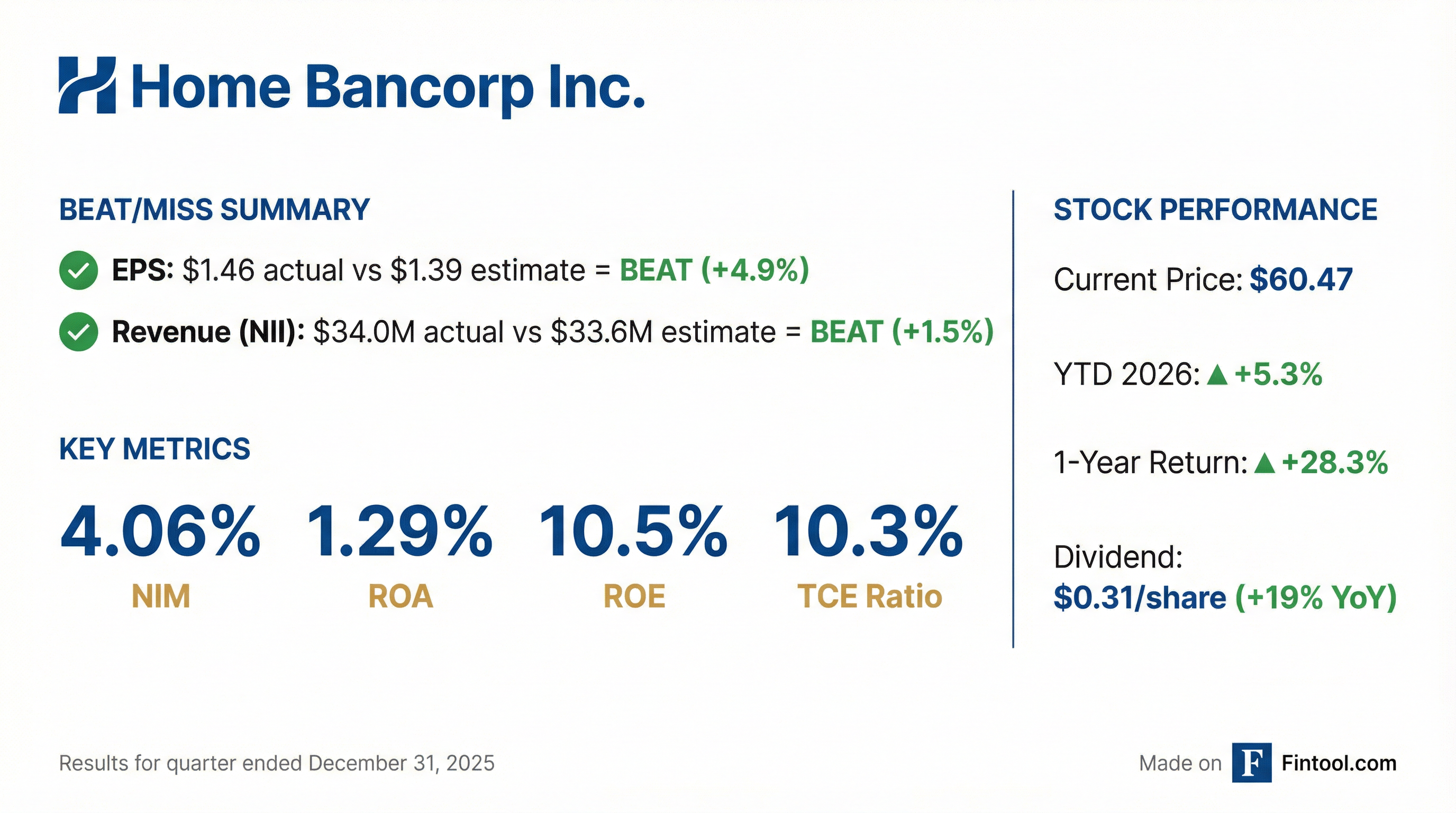

Home Bancorp (NASDAQ: HBCP), the Lafayette, Louisiana-based community bank holding company, delivered another EPS beat in Q4 2025, driven by resilient net interest margins despite a lower rate environment. However, rising nonperforming loans warrant monitoring as the bank navigates a more challenging credit cycle.

Did Home Bancorp Beat Earnings?

Yes — Home Bancorp beat on both EPS and net interest income, extending its streak of quarterly beats to eight consecutive quarters.

The EPS beat was driven by stable net interest margins and continued loan growth in the Houston market, partially offset by higher provisions and a seasonal uptick in noninterest expenses.

Quarterly EPS Trend

The Q4 sequential decline reflects seasonality and a tougher YoY comparison against Q3 2025's exceptional $1.59. Full-year 2025 EPS was $5.87, up from $4.55 in 2024 (+29%).

What Did Management Guide?

On the Q4 2025 earnings call, management provided forward-looking commentary across several key areas:

Net Interest Margin: CFO David Kirkley expects NIM to tick up to 4.10-4.15% throughout 2026, driven by deposit repricing tailwinds and new loan originations in the 7% range. December NIM already improved to 4.08%. Even in a scenario with 100 bps of additional rate cuts, management believes NIM will remain stable to current levels.

Loan Growth: CEO John Bordelon guided to mid-single digit loan growth for 2026, with potential upside in H2 if interest rates decline further. Payoffs and paydowns that pressured 2025 growth appear to be slowing.

Expense Outlook: Noninterest expenses expected at $22.5-23M in Q1, then increasing to $23.3-23.7M as annual raises take effect and new projects kick off.

Noninterest Income: Expected to range between $3.8M-$4M over the next several quarters.

What Changed From Last Quarter?

Positives

- NIM resilience: Net interest margin held at 4.06%, down only 4 bps from Q3's 4.10% despite rate cuts

- Deposit growth: Total deposits reached $2.97B, up 7% YoY, with demand deposits growing to 27% of the mix

- Capital strength: TCE ratio expanded to 10.3% from 9.3% a year ago

- TBV growth: Tangible book value per share increased 17% YoY to $44.84

- FHLB paydown: Reduced expensive FHLB advances from $176M to just $3M using deposit growth

Negatives

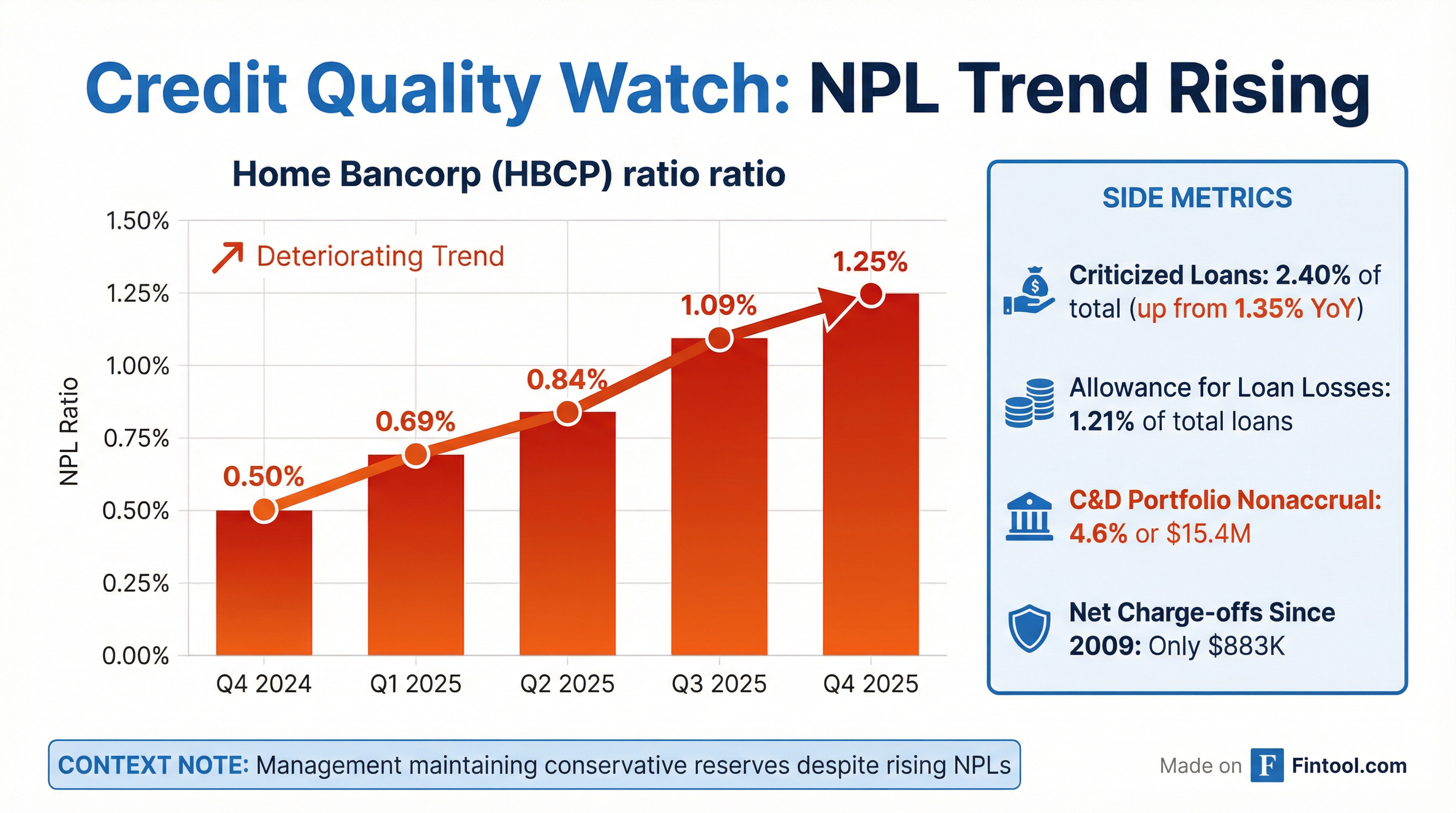

- Credit quality softening: NPLs rose to 1.25% from 0.50% a year ago

- Criticized loans expanding: Total criticized loans now 2.40% vs 1.35% in Q4 2024

- Loan growth slowed: Total loans of $2.74B were roughly flat sequentially

- C&D stress: Construction & development portfolio has 4.6% on nonaccrual ($15.4M)

How Did the Stock React?

Home Bancorp shares have been strong performers:

At $60.47, HBCP trades at 1.35x tangible book value and roughly 10x forward earnings — a modest premium to community bank peers, justified by consistent execution and strong capital returns.

What's Happening With Credit Quality?

This is the key watch item for Home Bancorp. While the bank has historically maintained pristine credit (only $883K in net charge-offs since 2009), the trend is clearly deteriorating:

Key observations:

- CRE office exposure is manageable: Non-medical office represents only 6.7% of total loans ($183.3M), with $5.9M in criticized balances in NOO Houston office

- Construction portfolio stress: C&D has $15.4M (4.6%) on nonaccrual, the largest problem area

- Reserves unchanged: Management has held ALL at 1.21% — not building reserves despite rising NPLs

Near-term resolution expected: On the earnings call, CFO Kirkley indicated approximately $5.5M of Houston properties should be resolved by February 3, 2026 — either through payoff, refinance, or foreclosure with quick sale. Management expressed confidence in the collateral values and guarantor strength, stating they don't expect material losses.

Management characterized the credit issues as "one-off circumstances" rather than economic-driven deterioration — including tenants moving out and developers not starting projects. Texas credits typically resolve faster (foreclosure in ~60 days), while Louisiana/Mississippi credits move more slowly.

Capital Returns Continue

Home Bancorp remains committed to returning capital through dividends and buybacks:

Q1 2026 dividend: $0.31 per share payable February 20, 2026 — up 19% YoY from $0.26.

Buyback capacity: Approximately 390,222 shares remaining under current authorization as of January 22, 2026.

Since 2019, Home Bancorp has repurchased 17% of shares outstanding while growing tangible book value per share at an 8.7% CAGR.

Is Home Bancorp Looking at M&A?

Yes — management is "very optimistic about 2026 M&A." With the stock now trading near 1.4x tangible book value, CEO Bordelon stated the bank has "the power to go out and maybe look for a little bit larger banks."

Target parameters:

- Deal size: Up to $1.5B in assets (roughly half HBCP's size or less)

- Geography: Likely within existing footprint (Louisiana, Mississippi, Houston)

- The bank has been in dialogue with potential targets for three years but was limited by elevated rates and balance sheet marks; now sees improved conditions

This represents a shift from 2023-2024 when management focused on smaller cash deals due to stock price constraints.

Texas Expansion Update

The Houston franchise continues to be a growth engine:

- Team size: 15 commercial bankers across 5 branches and 1 LPO

- Growth rate: Loans growing at 15% annually since 2022 market entry

- Portfolio share: Texas now represents 20% of total loans

Q1 2026 catalyst: A new full-service branch opening in Northwest Houston will replace the LPO, giving the 2023 hire team full branch capabilities — particularly important for deposit gathering.

Balance Sheet Snapshot

Loan portfolio composition (as of Dec 31, 2025):

- CRE Owner-Occupied: 26%

- 1-4 Family Mortgage: 18%

- CRE Non-Owner-Occupied: 17%

- C&I: 16%

- C&D: 12%

- Multifamily: 7%

- Home Equity: 3%

- Consumer: 1%

Geographic mix: Acadiana 28%, New Orleans 27%, Houston 20%, Northshore 13%, Baton Rouge 10%, Mississippi 2%

Interest Rate Sensitivity

Home Bancorp is moderately asset-sensitive with 43% of loans on variable rates:

In the current easing cycle, this positions HBCP for modest NIM compression, though the 4.06% Q4 NIM demonstrates resilience thus far.

Q&A Highlights

Key themes from the analyst Q&A:

On customer sentiment: "We're not hearing anything negative in any of our markets, especially with rates coming down... it's probably leaning a little more towards the positive side." — CEO John Bordelon

On SBA business: Management expects SBA volumes to pick up with lower rates but not substantially until rates decline further. The business has been slow since the Texan Bank acquisition.

On deposit competition: CFO Kirkley noted some competitors offering CD rates in the 4.25% range — outliers creating a wider spread than seen in the past 18 months. This is a headwind for NIM expansion.

On rate sensitivity: Even with 100 bps of rate cuts, management believes NIM will remain stable because deposit repricing benefits will offset loan yield compression.

Key Takeaways

What's working:

- Consistent EPS beats driven by disciplined NIM management

- Strong capital position (10.3% TCE) enabling continued buybacks

- Houston expansion providing growth offset to mature Louisiana markets

- Rising dividend (+19% YoY) demonstrates confidence

- M&A optionality — now positioned for larger deals with improved stock currency

What to watch:

- NPL trend acceleration — 150% increase YoY requires monitoring

- C&D portfolio stress with 4.6% on nonaccrual

- Reserve adequacy if credit deterioration continues

- Deposit cost trajectory as some competitors offer aggressive CD rates

Company Overview

Home Bancorp, Inc. (NASDAQ: HBCP) is the holding company for Home Bank, N.A., a national bank headquartered in Lafayette, Louisiana. Founded in 1908, the bank operates 43 branches across Southern Louisiana, Western Mississippi, and Houston, Texas.

Recent history:

- Six acquisitions since 2010, including Texan Bank in 2021 ($416M)

- IPO completed October 2008

- 49% institutional ownership, 12% insider/ESOP

Data sourced from Home Bancorp Q4 2025 Earnings Presentation and S&P Global estimates.