HECLA MINING CO/DE/ (HL)·Q4 2025 Earnings Summary

Hecla Posts Record Year: $1.4B Revenue, 9x Earnings Growth, Near-Zero Debt

February 17, 2026 · by Fintool AI Agent

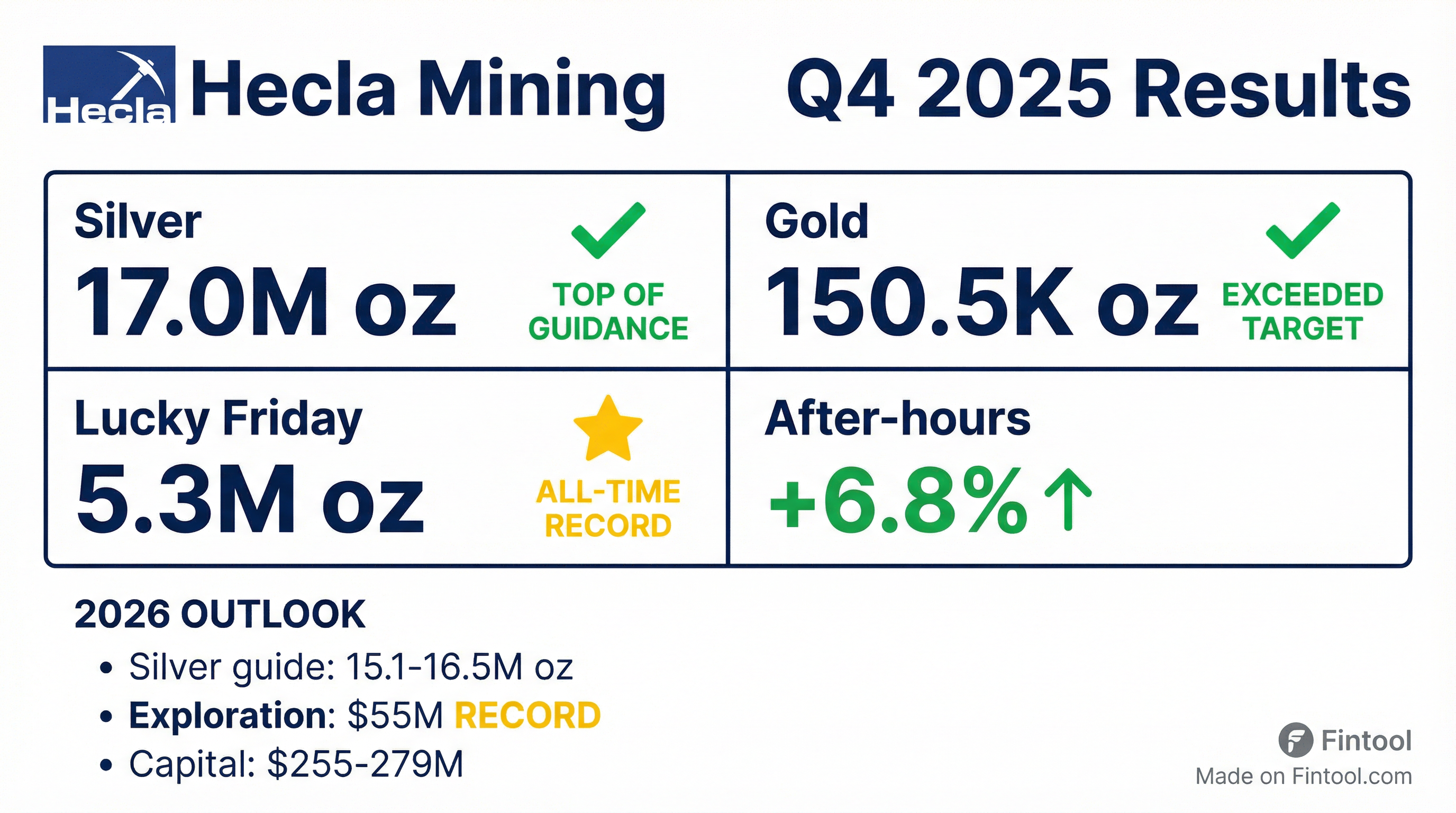

Hecla Mining (NYSE: HL) reported a transformational 2025, delivering record revenue of $1.4 billion (+53% YoY), net income of $321 million (up 9-fold), and free cash flow of $310 million versus just $4 million last year. The company slashed its net leverage ratio to 0.1x from 1.6x a year ago while announcing the sale of Casa Berardi for up to $593 million—positioning Hecla as North America's premier pure-play silver company.

Did Hecla Beat Earnings?

Hecla delivered record results across every key financial metric, with Q4 2025 capping a transformational year:

Q4 2025 Results:

Full Year 2025 Results:

The transformation was driven by higher realized precious metals prices (silver averaged $39.94/oz vs $28.24/oz prior year, gold $3,435/oz vs $2,387/oz) combined with 5%+ higher silver and gold production volumes.

What Changed From Last Quarter?

Balance Sheet Transformation

The most striking change: Hecla eliminated virtually all net debt in one year.

Casa Berardi Sale — Becoming a Pure-Play Silver Company

The company announced the sale of Casa Berardi to Orezone Gold for up to $593 million, expected to close Q1 2026. This divests Hecla's only Canadian gold mine and:

- Eliminates Quebec operational exposure

- Positions Hecla as "North America's premier silver company"

- Adds substantial cash to fund exploration and growth initiatives

- Simplifies the asset base to three silver-focused operations

Exploration Spending Nearly Doubles

Hecla is plowing cash flow back into growth, with exploration and pre-development spending nearly doubling to $55 million in 2026:

- Nevada (Midas, Hollister, Aurora): Budget nearly tripled

- Polaris Project: Received FONSI from U.S. Forest Service, exploration commencing 2026

- Greens Creek: Received authorization for surface exploration operations

What Did Management Guide?

2026 guidance reflects the Casa Berardi sale impact—gold production drops significantly while silver operations remain unchanged:

Production Guidance

Cost Guidance

Price assumptions: Gold $4,000/oz, Silver $50.00/oz for by-product calculations.

Capital Investment (Revised Down)

Total 2026 capital: $216-$238 million (revised from $255-$279M in January guidance due to Casa Berardi sale):

What Did Management Say?

CEO Rob Krcmarov emphasized the company's transformation and strategic pivot:

"2025 was a transformational year for Hecla with strong operational and financial results across a number of key metrics. Our balance sheet improved significantly and we are now well positioned to invest in value surfacing initiatives focused on our best-in-class project pipeline."

On becoming a pure-play silver company:

"The pending sale of Casa Berardi for up to $593 million, which is expected to close in the first quarter of this year, positions us as North America's premier silver company. With our strengthened balance sheet and cash position, we aim to nearly double our exploration and pre-development spending to $55 million in 2026."

How Did Each Mine Perform?

Silver Operations — All-Time Records

Greens Creek (Alaska):

- Produced 8.7M oz silver + 59K oz gold

- Cash cost: ($8.02)/oz, AISC: ($2.36)/oz — negative costs due to gold/zinc/lead credits

- Free cash flow: $256.3M (the cash cow)

Lucky Friday (Idaho):

- Record production: 5.3M oz silver, exceeding 5.1M oz guidance cap

- Cash cost: $8.66/oz, AISC: $21.98/oz

- Cooling project 79% complete, on track for mid-2026

Keno Hill (Yukon):

- First profitable year under Hecla ownership

- Record production: 3.0M oz silver

- Backfill plant completed and commissioning

Gold Operations

Casa Berardi (Quebec):

- Produced 91K oz gold (exceeding guidance)

- Free cash flow: $94.7M

- Sale pending for up to $593M

How Did the Stock React?

HL shares fell 6% on the earnings release to $21.24, reflecting "sell the news" after a massive multi-year run:

The stock had already surged 7% on the January preliminary production release, and roughly 600% from 2025 lows. The earnings selloff likely reflects profit-taking after an exceptional run rather than disappointment with results.

Dividend Declared

The Board declared a quarterly dividend of $0.00375 per common share, payable March 24, 2026, to shareholders of record March 9, 2026. Preferred stock holders receive $0.875 per share.

Key Risks and Watch Items

-

Metal Price Sensitivity: Guidance assumes $50 silver and $4,000 gold. At current prices, the company is highly profitable, but a sharp correction in precious metals would compress margins significantly.

-

Grade Normalization: 2026 guidance assumes lower grades at Greens Creek, which could pressure production.

-

Casa Berardi Closing Risk: The $593M sale is expected in Q1 2026 but subject to customary conditions.

-

Keno Hill Ramp: Not yet at commercial production (only 1 of 5 criteria met); excluded from cost metrics.

-

Capital Execution: Multiple concurrent projects (cooling, tailings, exploration) require disciplined execution.

-

Working Capital Build: Accounts receivable increased ~$143M due to elevated metal prices and concentrate shipment timing. Most collected in early 2026.

Forward Catalysts

Near-term (Q1-Q2 2026):

- Casa Berardi sale closing (~$593M proceeds)

- Lucky Friday cooling project completion (mid-2026)

- Q1 2026 earnings (first as pure-play silver)

Medium-term (2026-2027):

- Nevada exploration results (budget nearly tripled)

- Keno Hill reaching commercial production

- Greens Creek tailings expansion (extends life to 2045)

Secular:

- Silver supply/demand dynamics in energy transition

- Precious metals as inflation hedge

- Potential M&A optionality with strengthened balance sheet

This analysis is based on Hecla's Q4 2025 8-K filing dated February 17, 2026. Full financials are subject to final audit.

View Q4 2025 8-K Filing | HL Company Profile | Prior Quarter Earnings