Earnings summaries and quarterly performance for HECLA MINING CO/DE/.

Executive leadership at HECLA MINING CO/DE/.

Rob Krcmarov

President and Chief Executive Officer

David Sienko

Senior Vice President – General Counsel and Corporate Secretary

Michael Clary

Senior Vice President and Chief Administrative Officer

Robert Brown

Vice President – Corporate Development

Russell Lawlar

Senior Vice President and Chief Financial Officer

Board of directors at HECLA MINING CO/DE/.

Research analysts who have asked questions during HECLA MINING CO/DE/ earnings calls.

Heiko Ihle

H.C. Wainwright & Co.

6 questions for HL

John Tumazos

John Tumazos Very Independent Research

4 questions for HL

Joseph Reagor

ROTH Capital Partners

4 questions for HL

Alex Terentiew

National Bank Financial

3 questions for HL

Cosmos Chiu

CIBC World Markets

2 questions for HL

Kevin O'Halloran

BMO Capital Markets

2 questions for HL

Michael Parkin

National Bank Financial

2 questions for HL

Andrew Dusome

National Bank Financial, Inc.

1 question for HL

Dalton Baretto

Canaccord Genuity Group Inc.

1 question for HL

Henry Hearle

B. Riley Securities

1 question for HL

Michael Siperco

RBC Capital Markets

1 question for HL

Nick Giles

B. Riley Securities

1 question for HL

Sean Wondrack

Deutsche Bank

1 question for HL

Wayne Lam

TD Securities

1 question for HL

Recent press releases and 8-K filings for HL.

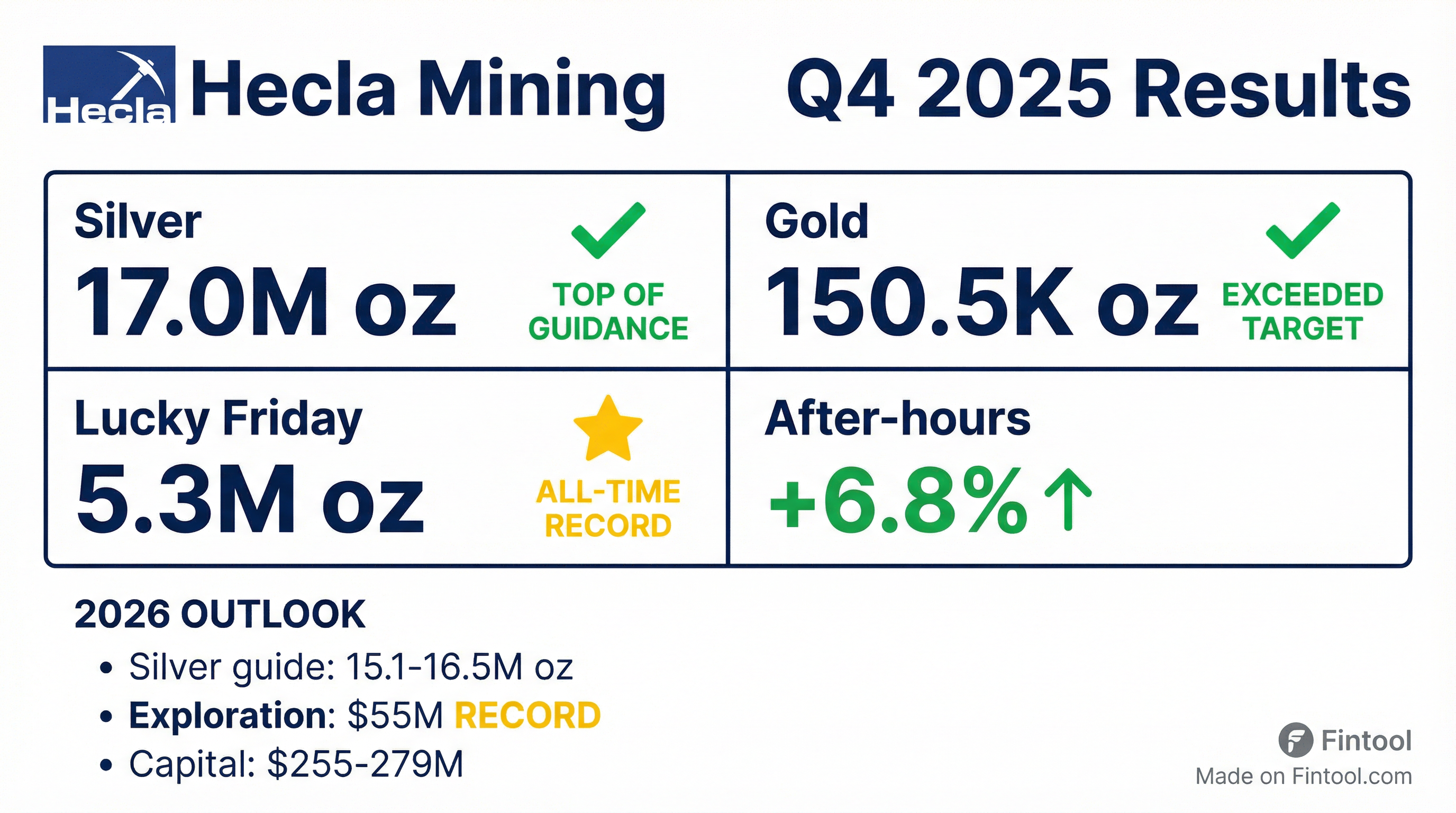

- Hecla Mining, the largest silver producer in the United States and Canada, reported 231 million ounces of silver reserves at year-end 2025.

- The company produced 17 million ounces of silver during 2025, with Greens Creek delivering 8.7 million ounces and Lucky Friday producing 5.3 million ounces.

- Hecla Mining plans to nearly double its exploration budget to $55 million in 2026.

- Hecla Mining Company reported record financial results for 2025, including $1.4 billion in revenue, $321 million in net income (or $0.49 per share), and $670 million in Adjusted EBITDA.

- The company achieved significant deleveraging, reducing total debt to $276 million and improving its gross debt to Adjusted EBITDA ratio to 0.4 times in 2025, with a goal to achieve a debt-free balance sheet within 2026.

- Operational highlights for 2025 included 17 million ounces of silver production and 150,000 ounces of gold production, with record silver production at Lucky Friday and Keno Hill achieving profitability.

- Hecla is strategically optimizing its portfolio with the pending sale of Casa Berardi, aiming to increase silver's contribution to approximately 73% of consolidated revenues and reinforce its position as a premier North American silver company.

- For 2026, the company projects silver production of 15.1-16.5 million ounces and is pursuing a credible pathway to 20 million ounces over the medium term through organic growth and exploration investments.

- Hecla Mining Company reported a transformational year in 2025, achieving record revenue of $1.4 billion, net income of $321 million or $0.49 per share, and Adjusted EBITDA of $670 million. The company significantly improved its financial position, with total debt declining to $276 million and a gross debt to Adjusted EBITDA ratio of 0.4 times, while generating $310 million in free cash flow.

- Strategically, Hecla is sharpening its focus on becoming the premier North American silver company, with the pending sale of the Casa Berardi gold mine expected to increase silver's contribution to consolidated revenues to approximately 73%. This strategic move, combined with strong financial performance, positions Hecla to achieve a debt-free balance sheet within 2026.

- In 2025, Hecla achieved the top end of silver production guidance at 17 million ounces and exceeded gold production guidance with 150,000 ounces, with Lucky Friday and Keno Hill delivering record silver production. The 2026 silver production outlook is 15.1-16.5 million ounces, with a credible pathway to 20 million ounces over the medium term through organic growth projects.

- Hecla reported a transformational 2025, achieving record revenue of $1.4 billion, net income of $321 million ($0.49 per share), and Adjusted EBITDA of $670 million. This led to substantial deleveraging, with total debt reduced to $276 million and a gross debt to Adjusted EBITDA ratio of 0.4 times.

- Operationally, the company met the high end of its silver production guidance with 17 million ounces and exceeded gold production guidance with 150,000 ounces in 2025.

- Strategically, Hecla is sharpening its focus on becoming the premier North American silver company, with the pending sale of Casa Berardi expected to increase silver's contribution to consolidated revenues to approximately 73%.

- The company provided a 2026 silver production outlook of 15.1-16.5 million ounces and aims for 20 million ounces over the medium term, supported by projects like Keno Hill ramp-up and potential Midas restart. Hecla plans to invest $45-55 million in 2026 exploration.

- Hecla Mining Co./DE/ reported record financial results for 2025, including over $1.4 billion in revenue, $321 million in net income, and $670 million in Adjusted EBITDA. The company also achieved substantial deleveraging, reducing total debt to $276 million and improving its gross debt to Adjusted EBITDA ratio to 0.4x.

- Operationally, Hecla achieved the top-end of its silver production guidance at 17.0 Moz and exceeded gold production guidance at 151 Koz in 2025. Lucky Friday achieved record silver production of 5.3 Moz, and Keno Hill recorded over 3.0 Moz of silver production, marking its first year of profitability and positive free cash flow under Hecla's ownership.

- Subsequent to year-end, Hecla announced a definitive agreement to sell its Casa Berardi operation for up to $593 million, with the transaction expected to close in Q1 2026. This divestiture aims to further solidify Hecla's position as the premier North American silver company and strengthen its balance sheet.

- For 2026, the company projects total silver production of 15.1-16.5 Moz and gold production of 51.0-55.0 Koz (excluding Casa Berardi Q1 2026). Exploration and pre-development spending is expected to nearly double to $55 million.

- Hecla Mining Company reported record full-year 2025 revenue of over $1.4 billion, a 53% increase, and record net income of $321 million, or $0.49 per share.

- The company achieved record Adjusted EBITDA of $670 million and significantly improved its financial position with a net leverage ratio of 0.1x (down from 1.6x) and $310 million in free cash flow.

- Operational performance for 2025 included 17.0 million ounces of silver produced and 151 thousand ounces of gold produced, both exceeding prior year figures and production guidance.

- A quarterly cash dividend of $0.00375 per share of common stock was declared, payable around March 24, 2026.

- For 2026, consolidated silver production is guided at 15.1 - 16.5 million ounces and gold production at 65.0 - 72.0 thousand ounces, with the sale of Casa Berardi expected to close in Q1 2026 impacting gold guidance.

- Hecla Mining Company reported record revenue of over $1.4 billion, a 53% increase, and record net income of $321 million ($0.49 per share) for the full year 2025.

- The company achieved record Adjusted EBITDA of $670 million and generated $563 million in cash flow from operations, with $310 million in free cash flow in 2025.

- Balance sheet strength improved significantly, with total debt reduced to $276 million and the net leverage ratio decreasing to 0.1x from 1.6x a year ago.

- Operational performance in 2025 included 17.0 million ounces of silver produced and 151 thousand ounces of gold produced, with Lucky Friday achieving record silver production and Keno Hill reaching its first year of profitability.

- The company is set to sell its Casa Berardi Mine for up to $593 million, with the transaction expected to close in the first quarter of 2026, and plans to nearly double exploration and pre-development spending to $55 million in 2026.

- Hecla reported year-end 2025 silver reserves of 231 million ounces and gold reserves of 2.0 million ounces.

- The company plans to nearly double its exploration and pre-development investment in 2026 to $55 million, up from $25.2 million (plus $2.5 million in pre-development) in 2025, with the goal of replacing or exceeding annual reserve depletion.

- Hecla announced an agreement on January 26, 2026, to sell its subsidiary Hecla Quebec Inc. (HQI), including the Casa Berardi mine, to Orezone Gold Corporation.

- In 2025, Greens Creek produced 8.7 million ounces of silver while growing its reserve base by 2.4 million ounces, and Lucky Friday produced a record 5.3 million ounces of silver.

- Hecla Mining Company (HL) has agreed to sell its subsidiary that owns the Casa Berardi operation in Quebec, Canada, to Orezone Gold Corporation for up to $593 million in total consideration.

- The transaction, announced on January 26, 2026, is expected to close in the first quarter of 2026.

- The total consideration includes $160 million in cash upon closing, approximately 65.7 million Orezone common shares valued at about $112 million, $80 million in deferred cash, and up to $241 million in contingent consideration.

- This sale aligns with Hecla's strategy to focus on its premier silver assets and is expected to strengthen the company's balance sheet and financial position, with proceeds deployed towards debt reduction and investments in growth initiatives at core silver assets like Keno Hill and Greens Creek.

- Orezone will acquire Hecla Quebec Inc., a wholly-owned subsidiary of Hecla Mining, which includes the Casa Berardi Mine and a portfolio of exploration assets in Quebec.

- The upfront consideration for the acquisition is $272 million, consisting of $160 million in initial cash and an equity issuance of 9.9% for $112 million.

- Additional considerations include $80 million in deferred cash payments and up to $240 million in contingent consideration, linked to gold prices and future production from specific open pits.

- The acquisition is expected to position Orezone as a diversified multi-asset gold producer in a tier-one mining jurisdiction, adding material scale, production, and free cash flow.

- Orezone's 2026 consolidated gold production is projected to be between 230,000-250,000 ounces, with a medium-term target of 350,000 ounces annually. The transaction is expected to close in Q1 2026.

Fintool News

In-depth analysis and coverage of HECLA MINING CO/DE/.

Hecla Mining Sells Casa Berardi Gold Mine to Orezone for $593M as Gold Hits $5,100 Record

Orezone CEO Reveals Casa Berardi Playbook: Underground Revival, 100K Meters of Drilling, and a Path to 350K Ounces

Hecla Mining Rides Critical Minerals Wave: Three Projects Clear FAST-41 as Silver Hits $110

Hecla Mining Exits Gold With $593M Casa Berardi Sale as Precious Metals Hit Record Highs

Hecla Mining's $310M Free Cash Flow Year Marks 'Transformational' 2025 as Stock Soars 600%

Quarterly earnings call transcripts for HECLA MINING CO/DE/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more