Orezone CEO Reveals Casa Berardi Playbook: Underground Revival, 100K Meters of Drilling, and a Path to 350K Ounces

January 26, 2026 · by Fintool Agent

Orezone Gold Corporation just transformed from a single-mine West African producer into a diversified mid-tier gold company spanning two continents—and CEO Patrick Downey wasted no time laying out exactly how he plans to squeeze value from his new Canadian asset.

On a conference call Monday afternoon following the announcement of Orezone's $593 million acquisition of Hecla Mining's Casa Berardi gold mine, Downey outlined an aggressive operational pivot: revive high-grade underground mining, launch an 80,000-100,000 meter annual drill program, and push the combined company toward 350,000 ounces of annual production—all while avoiding the five-year operational pause Hecla had planned for the property.

Investors responded emphatically. Orezone shares (TSX: ORE) surged 17% to C$2.80, adding roughly C$170 million in market capitalization.

The Deal at a Glance

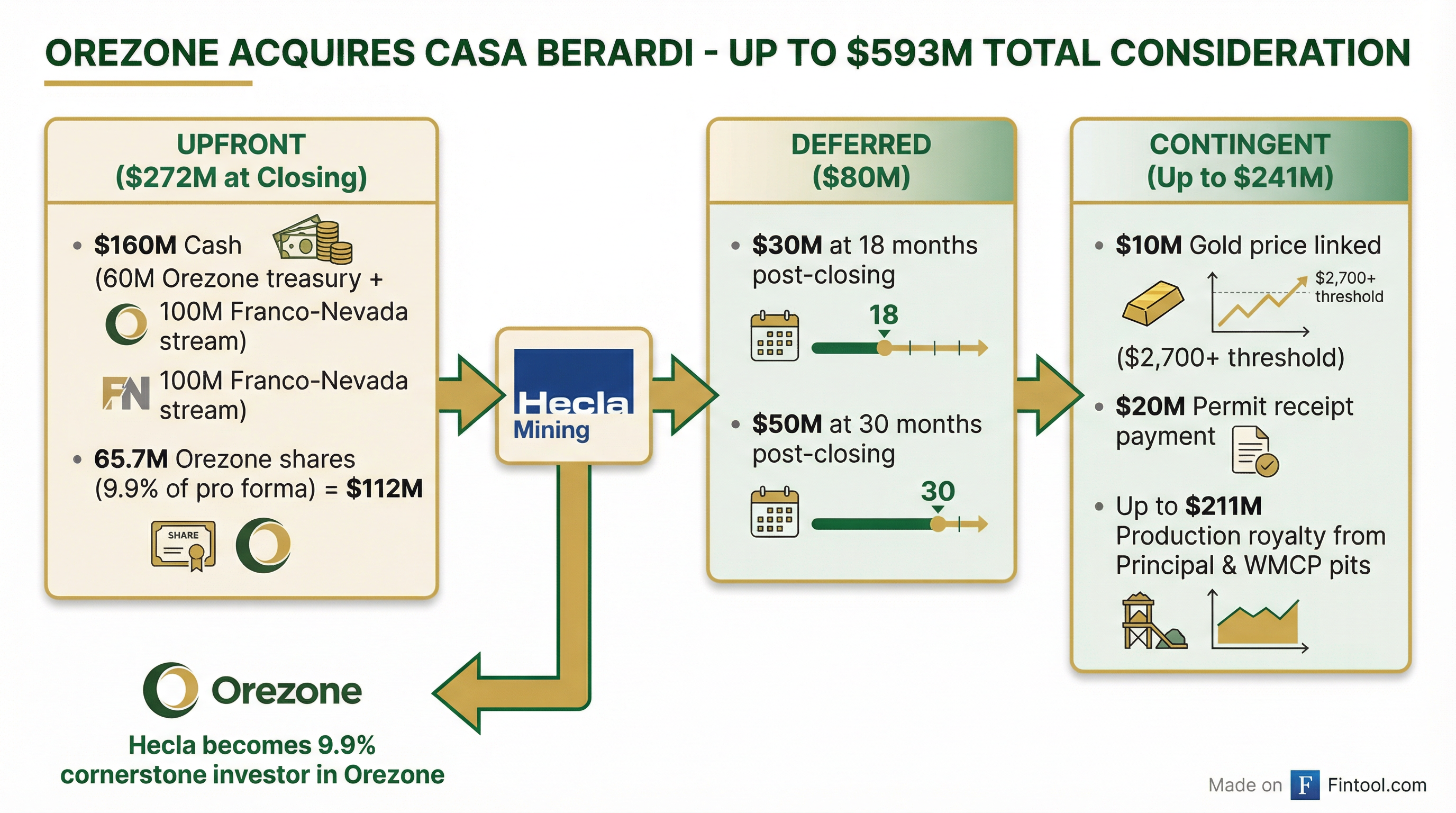

Orezone is acquiring Hecla Quebec Inc.—a wholly-owned Hecla subsidiary—for total consideration of up to $593 million, structured across three payment tiers:

| Component | Value | Timing |

|---|---|---|

| Cash at Closing | $160M | Q1 2026 |

| Orezone Equity (9.9%) | $112M | At closing |

| Deferred Cash | $80M | $30M at 18 months, $50M at 30 months |

| Contingent Consideration | Up to $241M | |

| - Gold Price-Linked | $10M | At gold >$2,700/oz |

| - Permit Receipt | $20M | Upon Principal/WMCP pit approval |

| - Production Payments | Up to $211M | Linked to open pit production |

| Total Potential | $593M |

The $160 million cash payment comes from $60 million of Orezone's treasury and a $100 million streaming agreement with Franco-nevada, which will receive 1,625 ounces of gold quarterly for five years, transitioning to 5% of Casa Berardi production thereafter.

"We really want to welcome Hecla as a cornerstone investor who will go along with us throughout this acquisition," Downey said, noting that Hecla's 9.9% equity stake aligns the seller's interests with execution success.

From West Africa to Quebec: The Diversification Thesis

The acquisition marks a strategic pivot for Orezone, whose entire production currently flows from the Bomboré Mine in Burkina Faso—a jurisdiction that, despite strong operational performance, carries political risk that weighs on valuation.

Casa Berardi sits in Quebec's Abitibi mining district, a region Downey called "one of the best in the world," alongside operations from Agnico Eagle, IAMGOLD, Gold Fields, Alamos, and Eldorado Gold.

The jurisdictional advantages are tangible:

- Paved highway access 95 km from La Sarre, with daily employee commutes

- Hydro-Québec grid power delivering low-cost electricity

- Established skilled workforce with deep institutional knowledge

- 30+ year operating history with proven resource continuity

"This is a tier-one jurisdiction where you've got Agnico, IAMGOLD, Gold Fields, Alamos, Eldorado," Downey emphasized. "Very, very large land package of 19,500 hectares covering 37 km of strike along the Casa Berardi Fault."

The Combined Production Profile

Post-closing, Orezone becomes a dual-asset producer with immediate scale:

| Operation | 2026 Production Guidance | Reserves | M&I Resources | Land Package |

|---|---|---|---|---|

| Bomboré (Burkina Faso) | 170,000-185,000 oz | 2.4M oz | 2.1M oz | 13,000 ha |

| Casa Berardi (Quebec) | 83,000-91,000 oz | 1.3M oz | 2.1M oz | 56,000 ha |

| Combined | 230,000-250,000 oz | 3.7M oz | 4.2M oz | 69,000 ha |

The medium-term target is 350,000 ounces annually—achievable, Downey argued, through Bomboré's Stage 2 hard rock expansion (which will lift that mine to 230,000-250,000 oz/year) combined with grade improvements at Casa Berardi.

"We expect to do that very quickly," Downey said. "Our target in the next 2-3 years is to be a 350,000 ounce a year producer with two very, very well-established operations."

The Operational Playbook: Fixing What Hecla Left Behind

The most substantive portion of Downey's presentation detailed Orezone's plan to reverse years of underinvestment in Casa Berardi's underground operations.

The Problem

Under Hecla's ownership, operations shifted toward open pit mining beginning in 2017, resulting in "reduced focus in underground exploration and development," according to Downey. Head grades declined from historic levels above 7 grams per ton to the current mill feed, and underground reserve replacement lagged.

Hecla's 2024 technical disclosures—prepared at $1,900 gold—projected open pit mining would end in 2026, with underground operations and stockpile processing continuing only through 2027. The WMCP and Principal open pits, containing over 1 million ounces of reserves, wouldn't begin production until 2033 after a five-year permitting pause.

Orezone's Solution

Downey flatly rejected the pause scenario. "We've gone through all of this with the Franco-Nevada technical team," he said. "We've rebuilt most of that underground mine inventory within our system."

The turnaround plan rests on four pillars:

1. Underground Revival

- Restart the East Mine underground, which hosts "very high grades"

- Target the 900,000 ounces of M&I resources grading 6.13 g/t—material that becomes highly economic at $2,500+ gold

- Re-establish a high-grade stope inventory targeting +7 g/t mill feed

2. Aggressive Exploration

- Ramp drilling to 80,000-100,000 meters annually within six months

- Target the "multiple plunging zones of significantly higher grade"—ore shoots exceeding 15 grams per ton that Downey noted are "not spotty" but "very continuous"

- Exploit depth potential: Casa Berardi's deepest workings reach only ~1.5 km, versus 3+ km depths at Red Lake, LaRonde, Westwood, and Macassa

3. Open Pit Extension

- Extend F-160 pit life by revisiting reserves at current gold prices ($1,900 reserve cutoff is stale)

- At $2,100 gold, the F-160 pit adds 2-3 years of additional production

4. Process Improvements

- Add flash flotation to address preg-robbing graphite near the Casa Berardi Fault

- Target recovery improvements from the current 88% baseline

- Implement process automation upgrades

The Valuation Re-Rate Thesis

Downey made an explicit case for multiple expansion, noting Orezone's current metrics:

| Metric | Orezone (Pro Forma) |

|---|---|

| P/NAV | 0.47x |

| EV/EBITDA | 1.55x |

"Excellent re-rate potential in our global peer comparisons," he argued, pointing to comparable transactions involving non-core Canadian asset acquisitions:

- Discovery Mining (Porcupine Complex from Newmont): Significant shareholder returns, Franco-Nevada-backed

- Orla Mining (Musselwhite Mine): 352% return post-acquisition

- Newcrest (Coffee Project, Yukon): Strong performance following Newmont divestiture

"The recent Canadian non-core acquisitions have generated significant returns, outperforming gold and the GDXJ," Downey said. "And we expect and hope the same with this acquisition."

Analyst Q&A: No Production Gap Needed

The sole analyst question—from Jeremy Hoy of Canaccord Genuity—zeroed in on the key operational risk: Can Orezone actually bridge the production gap that Hecla's plan implied?

"Am I right that you guys don't think you need to pause processing, that you can extend the underground mine life and really sustain existing production levels throughout that period?" Hoy asked.

"Yes, that is the case," Downey confirmed.

The confidence stems from multiple factors:

- Nearly 900,000 oz of M&I underground resources near existing infrastructure

- F-160 pit extension potential adding 2-3 years at $2,100 gold

- A 6-7 year runway developed jointly with Franco-Nevada's technical team

On exploration funding: "With the current gold price, Casa will be self-funding," Downey noted. "If you're doing 100,000 meters a year, you're looking at, at the outside, $15 million. And that's easily funded out of the operations cash flow."

On Bomboré impact: "Not at all. Bomboré was always self-funding next year anyway. At current spot prices, Bomboré after taxes, after royalties, after the government takes its dividend and whatever, will be well north of $200 million free cash flow on Bomboré alone."

The Franco-Nevada Endorsement

The streaming deal with Franco-Nevada carries significance beyond financing. The royalty giant—which maintains the industry's deepest technical due diligence team—effectively validated Orezone's operational thesis.

"We are delighted to partner with Orezone in this transformative transaction," Franco-Nevada CEO Paul Brink said in a separate statement. "Patrick and the Orezone team have an excellent track record operating and developing mines and we look forward to their future success as they advance Casa Berardi's next chapter."

The stream structure—fixed deliveries for five years transitioning to percentage royalties—provides Franco-Nevada with predictable near-term cash flow while retaining upside if Orezone's exploration and development efforts succeed.

What to Watch

Near-term catalysts:

- Q1 2026: Transaction closing expected

- H1 2026: New mine plan and potential updated reserves at current gold prices

- 6 months: Exploration ramp-up progress toward 80,000-100,000 meters/year

Execution milestones:

- East Mine underground restart and grade improvements

- F-160 pit life extension studies

- Mill recovery improvements above 88% baseline

Key risks:

- Gold price retreat from record levels affecting economics and contingent payments

- Exploration drilling fails to replace reserves at target grades

- Permitting delays on Principal and WMCP open pits extending beyond 2033

- Burkina Faso political risk affecting Bomboré cash flows needed to support company-level growth

The acquisition positions Orezone at a pivotal moment: at current gold prices exceeding $5,000 per ounce, the company's combined operations could generate substantial free cash flow. Whether management can execute the Casa Berardi turnaround—reviving high-grade underground mining while maintaining production continuity—will determine if the valuation re-rate Downey promised actually materializes.