Hecla Mining's $310M Free Cash Flow Year Marks 'Transformational' 2025 as Stock Soars 600%

January 26, 2026 · by Fintool Agent

Hecla Mining delivered a message of transformation at its 2026 Investor Day in New York City today, unveiling results that CEO Rob Krcmarov called "the brightest outlook in our history." The 135-year-old silver miner generated $310 million in free cash flow in 2025—up from just $4 million the prior year—while slashing net debt by 94% and achieving a 12% return on invested capital.

The stock has responded accordingly: HL shares closed at $31.81, up 1.7% on the day and nearly 604% over the past year. That performance nearly quadruples the Global X Silver Miners ETF's 166% return over the same period—making Hecla the top performer among primary silver producers.

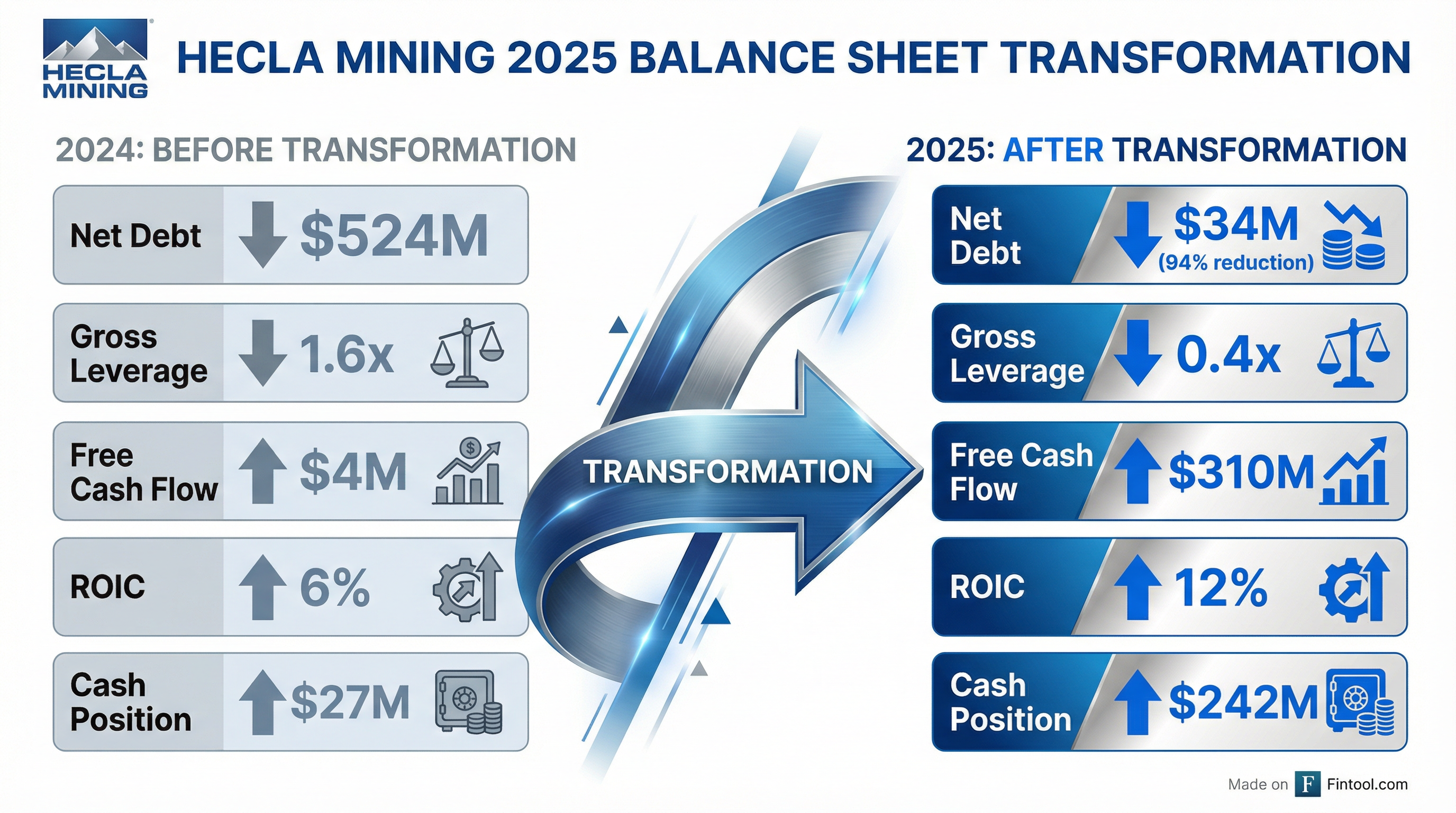

The Balance Sheet Transformation

The numbers tell a striking story. At the start of 2025, Hecla carried $524 million in net debt with a 1.6x gross leverage ratio. By year-end, net debt had collapsed to just $34 million with leverage at 0.4x.

"We haven't built this platform to manage decline or optimize mediocrity," Krcmarov told investors. "We've built it to grow our business."

| Metric | 2024 | 2025 | Change |

|---|---|---|---|

| Net Debt | $524M | $34M | -94% |

| Gross Leverage | 1.6x | 0.4x | -75% |

| Free Cash Flow | $4M | $310M | +7,650% |

| ROIC | 6% | 12% | +100% |

| Cash Position | $27M | $242M | +796% |

| Debt/Capitalization | 18% | 1.5% | -92% |

The cash flow surge was powered by operational execution across all four producing mines and favorable silver prices. Quarterly free cash flow built momentum throughout the year: $(18) million in Q1, $104 million in Q2, $90 million in Q3, and $135 million in Q4.

2025 Production: Top of Guidance Across the Board

Hecla met or exceeded guidance on every metric that mattered. Silver production hit 17.0 million ounces—at the top end of the 16.2-17.0 million ounce guidance range and up 5% year-over-year. Gold production reached 150,509 ounces, beating the top of guidance by 509 ounces.

The standout performer was Lucky Friday, which achieved record silver production of 5.3 million ounces—exceeding even the top of its guidance range. The Idaho mine has undergone a decade-long transformation using the Underhand Closed Bench (UCB) mining method, delivering 20% annualized ROIC and a 13% improvement in safety metrics.

| Mine | 2025 Silver (Moz) | YoY Change | Highlight |

|---|---|---|---|

| Greens Creek (Alaska) | 8.7 | +3% | 192% return since 2008 acquisition |

| Lucky Friday (Idaho) | 5.3 | +49%* | Record production |

| Keno Hill (Yukon) | 3.0 | +9% | 29 oz/ton average grade |

*vs. 2016 pre-UCB implementation

All-in sustaining costs came in at $11.23 per silver ounce—within the $11.00-$13.00 guidance range and supporting a 75% silver AISC margin, up from 54% in 2024.

2026 Guidance: Higher Costs, Record Exploration

Management set 2026 expectations with consolidated silver production guidance of 15.1-16.5 million ounces—below 2025's 17.0 million ounces as Keno Hill ramps and Casa Berardi transitions. Gold production is guided at 134-146 thousand ounces.

| 2026 Guidance | Range |

|---|---|

| Silver Production | 15.1-16.5 Moz |

| Gold Production | 134-146 Koz |

| Silver AISC | $15.00-$16.25/oz |

| Gold AISC | $2,150-$2,350/oz |

| Capital Spending | $255-$279M |

| Exploration | $55M |

The higher AISC guidance of $15.00-$16.25 (vs. $11.23 in 2025) reflects increased sustaining capital and the production mix shift. But Hecla's price assumptions of $50/oz silver and $4,000/oz gold for by-product credit calculations leave substantial margin.

The $55 million exploration budget is the real headline—nearly double 2025 spending and representing 4.5% of expected revenue. It's the largest exploration investment in company history.

Nevada: The Growth Catalyst

The exploration dollars are flowing to Nevada, where Hecla sees "the path to restart development decision by 2029-30." Three targets are getting the bulk of the $16 million Nevada allocation:

Midas: High-grade gold discoveries at the Pogo and Sinter Offset targets delivered visible gold and assays of 0.95 oz/ton gold over 2.2 feet including 6.42 oz/ton gold over 0.3 feet. The district already has a permitted 1,200 ton-per-day mill, tailings facility, and surface infrastructure—dramatically reducing the path to production.

Aurora: The company received its exploration permit Record of Decision in January 2026, unlocking one of the highest-grade historic gold districts in Nevada. Historic production averaged over 2 oz/ton gold, and Hecla has seven drill-ready targets with existing 600 ton-per-day permitted milling capacity on site.

Hollister: Part of the hub-and-spoke potential with Midas, leveraging existing infrastructure across a 30,000-acre district.

"We've proven we can execute on the difficult things," Krcmarov said. "What comes next is the rewarding part—taking this platform and using it to create genuine discovery-driven value and growth."

Capital Allocation: The 12% ROIC Threshold

Management outlined a disciplined capital allocation framework anchored by a 12% minimum ROIC threshold for new investments. M&A criteria are equally stringent: U.S. and Canada jurisdictions only, precious metals focus, clear competitive advantage, and 12-15% IRR with a pathway to ROIC thresholds.

The forward-looking ROIC profile depends heavily on metal prices. At $30 silver and $2,800 gold, consolidated ROIC averages just 3% through 2029. But at current prices of $50 silver and $3,500 gold, consolidated ROIC averages 10%—with Greens Creek alone delivering 55% and Lucky Friday at 22%.

Near-term goals include maintaining a $200 million-plus cash position and keeping gross leverage below 1.0x.

The Silver Thesis

Hecla is positioning itself as "The Premier Silver Company"—and backed it up with data. The company produced 37% of all U.S. silver in 2024, more than double the next producer (Teck at 7.3 million ounces).

Management emphasized the structural silver market deficit, now at ~790 million ounces cumulative since 2021. Industrial demand—driven by solar, EVs, and electronics—accounts for 60% of demand and is growing 10% annually. Solar demand alone grew 19% annually over five years.

"Primary silver companies trade at a premium to gold producers, attributable to the scarcity of silver," the presentation noted. "Historically, this premium has averaged 17%."

Hecla's differentiation:

- Jurisdictions: All operations in U.S. and Canada only

- Silver exposure: ~50% of revenue from silver vs. peer average of 20-30%

- Reserve life: Average 14+ years, double the industry average of 7 years

- Cost position: Greens Creek and Lucky Friday at the lower end of the silver cost curve

Ringing the Bell

The Investor Day coincided with Hecla's 135th anniversary as the oldest U.S.-listed mining company on the NYSE. Later today, management will ring the NYSE Closing Bell—a symbolic capstone to a transformational year.

The stock added to the S&P MidCap 400 in December 2025, reflecting institutional recognition of the turnaround. With 78% institutional ownership and coverage from 10 analysts (including BMO, RBC, TD Cowen, and Scotiabank), Hecla has never had more eyes on its story.

What to Watch

Near-term catalysts:

- Q4 2025 earnings (expected early February) with full-year financial details

- Aurora exploration results from 2026 drilling campaign

- Midas Pogo/Sinter follow-up drilling results

- Keno Hill ramp-up progress toward 440 TPD target

Key risks:

- Silver price volatility; guidance assumes $50/oz silver

- 2026 AISC guidance 35-45% higher than 2025 actuals

- Keno Hill operating challenges and permitting requirements

- Forward ROIC highly metal-price dependent

The bull case is straightforward: Hecla has transformed its balance sheet, generated sector-leading returns, and now has the financial flexibility to fund organic growth. The Nevada exploration program offers asymmetric upside with existing infrastructure reducing capex requirements.

The bear case centers on valuation: the stock trades at roughly 93x trailing earnings and analysts' 12-month price target of $11.14 implies 65% downside from current levels. The 2026 guidance assumes metal prices that may not hold, and ROIC collapses at lower price scenarios.

For now, Hecla has earned the "premier" label it's claiming. Whether the stock can sustain these levels depends on silver's structural bull case—and management's execution on the Nevada growth platform.