Hecla Mining Rides Critical Minerals Wave: Three Projects Clear FAST-41 as Silver Hits $110

January 26, 2026 · by Fintool Agent

When the Trump administration declared war on permitting delays last March, Hecla Mining was ready. Today, the company unveiled results at its 2026 Investor Day showing it has emerged as the poster child for the critical minerals agenda—with three projects on the FAST-41 permitting dashboard and silver prices topping $110 an ounce for the first time in history.

"Silver's elevation to critical mineral status reflects its expanding role across defense, energy transition, and advanced technology sectors," Director of Government Affairs Mike Satre told investors at the New York Stock Exchange. "The political world these days is more complex and moving faster than ever, but there's no question that our industry is at an unprecedented inflection point."

The stock touched an all-time high of $34.17 intraday before retreating to close at $29.97, down 5.8% on profit-taking after a 600%+ run over the past year.

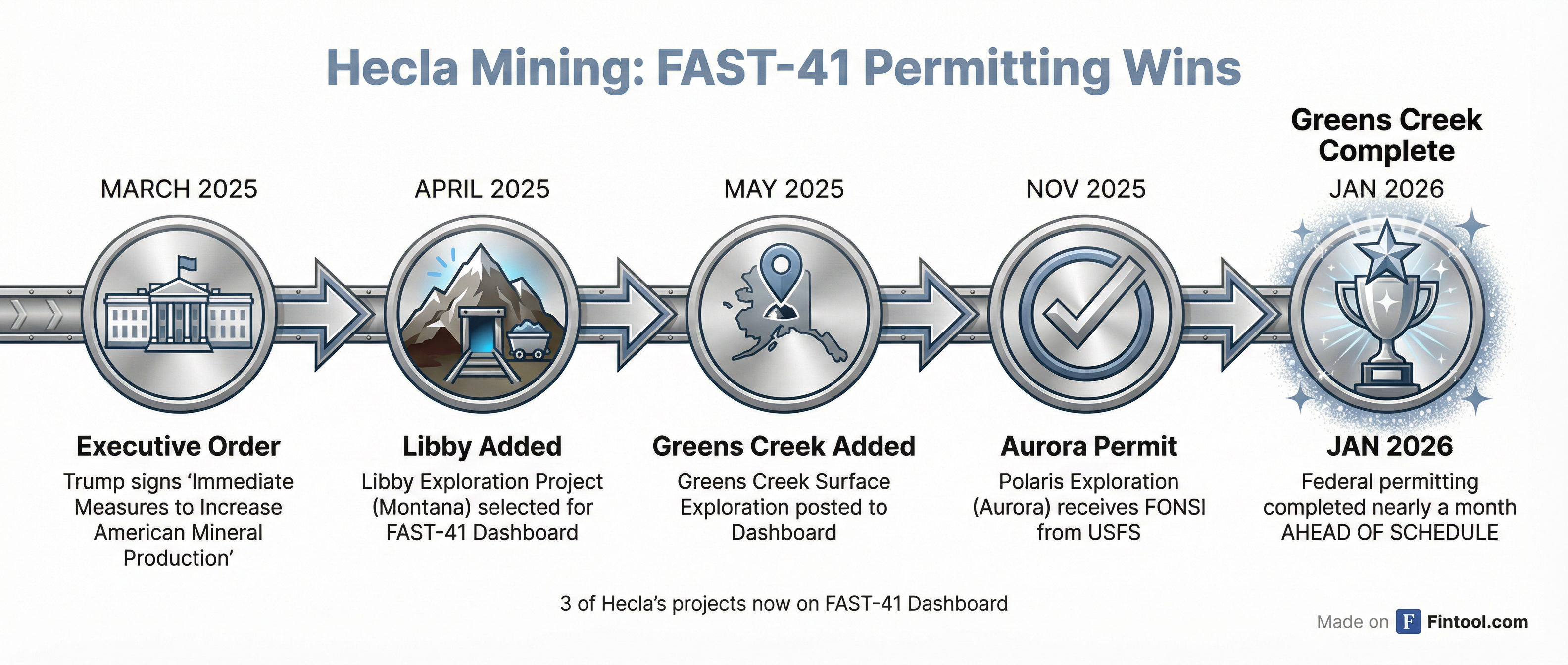

The FAST-41 Trifecta

Hecla now has more projects on the Federal Permitting Dashboard than any other primary silver producer. The company's government affairs team strategically placed three exploration projects on the FAST-41 transparency list in 2025—and all three have received favorable decisions within months:

| Project | Location | FAST-41 Added | Status |

|---|---|---|---|

| Libby Exploration | Montana | March 2025 | Five-year exploration permit in progress |

| Greens Creek Surface | Alaska | May 2025 | Completed Jan 8, 2026—nearly a month early |

| Aurora (Polaris) | Nevada | 2025 | FONSI received November 20, 2025 |

The Greens Creek approval is particularly notable. The Federal Permitting Council celebrated it as the latest FAST-41 transparency project to complete federal permitting, with Executive Director Emily Domenech crediting "FAST-41's interagency coordination and transparency" for moving domestic mineral production forward.

"The rapid approval by the U.S. Forest Service of this project demonstrates the Trump administration's recognition of Alaska's valuable storehouse of critical minerals," Senator Dan Sullivan said in a statement.

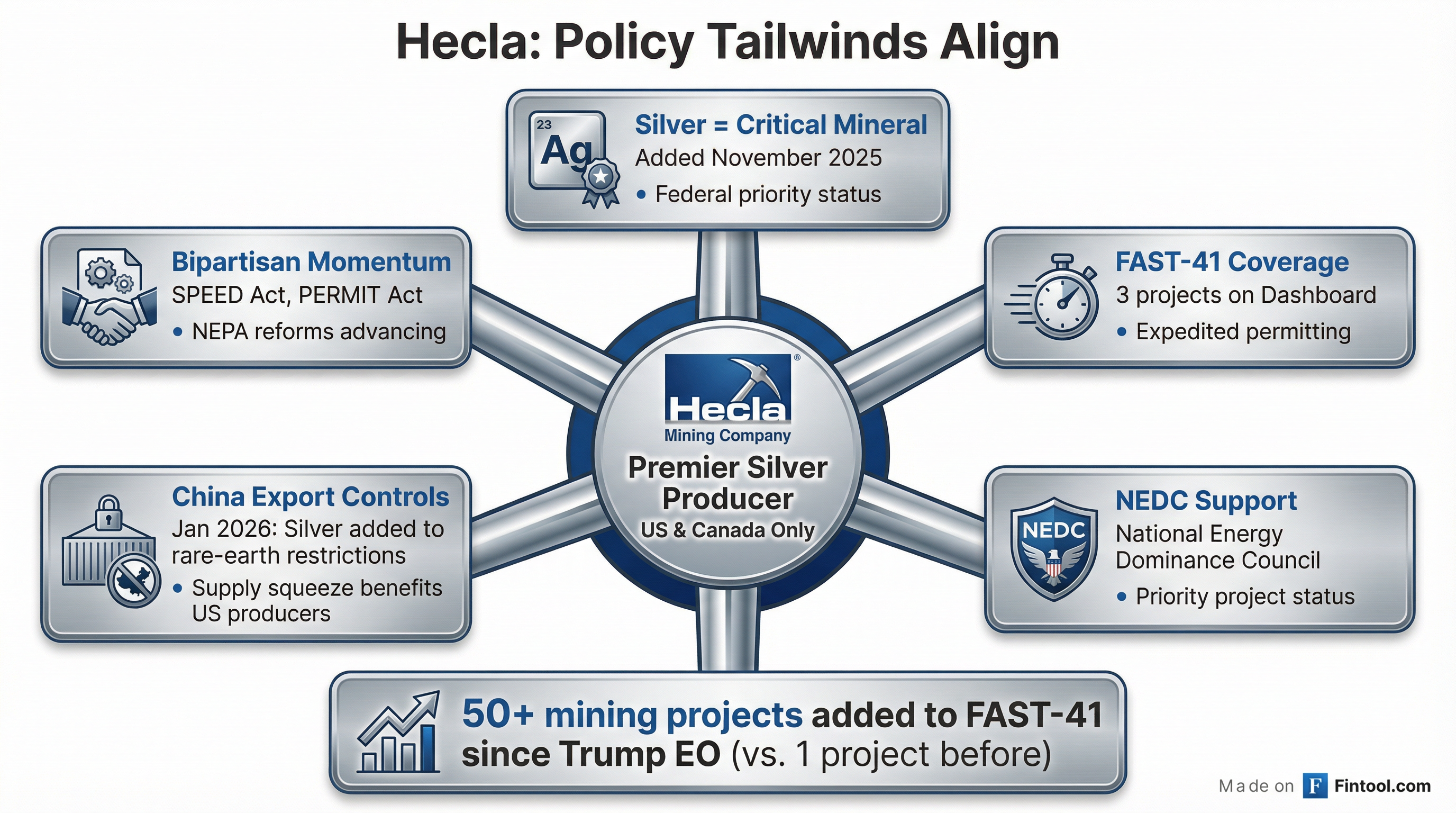

Silver's Strategic Upgrade

The policy tailwinds accelerated in November 2025 when the USGS added silver to the Critical Minerals List for the first time in history. The designation places silver alongside lithium, cobalt, rare earths, and uranium as materials "essential to US economic and national security."

The implications are substantial:

Federal Priority: Critical mineral designation drives government focus on securing domestic supply chains through enhanced permitting, subsidies, and strategic stockpiling.

FAST-41 Eligibility: Silver projects now qualify for the expedited permitting program that has grown from one mining project before the Trump administration to over 50 by fall 2025.

Investment Incentives: Production tax credits, research grants, and Defense Production Act investments now flow to silver producers.

Trade Protections: Section 232 investigations and potential tariffs or quotas become tools to reduce import dependence—particularly relevant given the US imports over 70% of its silver consumption.

The timing proved prescient. On January 1, 2026, China added silver to its rare-earth minerals export-control protocols, squeezing global supply further. Silver promptly surged to record highs.

The Jurisdictional Moat

Hecla's government affairs strategy hinges on a simple insight: when policy prioritizes domestic critical minerals, the only primary silver producer operating exclusively in Tier 1 jurisdictions wins.

"All of our operations are in Canada and the U.S.—predictability, rule of law," CEO Rob Krcmarov told investors. "As investors, you don't want to wake up and read in the newspapers that one of your revenue-producing assets has been nationalized, or that there's been some new surprise tax."

The contrast with peers is stark. Pan American Silver, the other major North American silver producer, operates in Mexico, Peru, Argentina, and Bolivia—jurisdictions where resource nationalism is intensifying. Mexico's proposed mining reforms target higher royalty rates. Peru is evaluating tax regime changes.

VP of Finance and Treasurer Anvita Patil emphasized the competitive positioning: "Hecla is the premier silver company... with four key advantages. First, our jurisdictional profile. All our operations are in the U.S. and Canada, and it matters in an increasingly geopolitical uncertainty that we all see. And it just doesn't stop there. Our growth pipeline is all in U.S. and Canada."

Policy Momentum Building

Satre outlined the regulatory landscape transformation at the Investor Day, detailing how Hecla has positioned itself at the center of the critical minerals policy push:

Executive Branch:

- Direct relationships with White House and agency leadership

- Drove placement of projects on FAST-41 list

- Worked with National Energy Dominance Council and Department of Interior to secure silver's critical mineral designation

Congressional:

- House Natural Resources Committee Chair Westerman led 11 members on a tour of Greens Creek in August 2025

- Regular meetings with both Republican and Democratic committee staff on permitting reform

- SPEED Act (NEPA reforms) and PERMIT Act (Clean Water Act reforms) have passed the House

State Level:

- Alaska statewide MOU with Permitting Council signed August 2025

- Yukon relationships with new Premier Currie Dixon—who declared mining "important to the future of the Yukon"

"We're not waiting for policy to happen, we're actively shaping it," Satre said. "This is strategic engagement at scale."

The Nevada Prize

The policy support extends to Hecla's growth pipeline, particularly the Nevada exploration district where the company is targeting a potential "fourth production center" within five years.

Aurora's recent permit approval is the opening move. The Polaris Exploration Project received a Finding of No Significant Impact (FONSI) from the US Forest Service on November 20, 2025, clearing the way for 2026 drilling in one of Nevada's highest-grade historic gold-silver districts.

"This approval marks a significant milestone in advancing our exploration strategy in one of Nevada's most prospective high-grade gold districts," VP of Exploration Kurt Allen said. The Aurora Mining District historically produced 1.9 million ounces of gold and 20 million ounces of silver at grades averaging 2.24 oz/ton gold.

The Midas project, where Hecla announced visible gold discoveries in November 2025, already has a permitted 1,200 ton-per-day mill and tailings facility in place—dramatically reducing the capital and time required to reach production.

"If we execute over the next 18-24 months, we could have material production within 5 years," Krcmarov said. "That transforms Hecla from a Greens Creek-anchored company into a true multi-district platform, all in premier, safe North American jurisdictions."

Market Dynamics

The policy tailwinds arrive as silver's fundamentals tighten. The market has logged five consecutive years of deficits, with cumulative shortfalls of ~800 million ounces since 2021.

Industrial demand—60% of the market—continues to grow at 10% annually, driven by solar panels (19% CAGR over five years), electric vehicles, semiconductors, and now AI data centers.

"When you are building systems that cannot fail, there is absolutely no substitute at all for silver's unique electrical properties, at scale," Patil said.

The supply response is constrained. Two-thirds of silver mine production comes as a by-product from copper, lead, zinc, and gold operations—meaning silver supply doesn't respond to silver prices.

Hecla's position as a primary silver producer—where silver is the main product, not a by-product—becomes increasingly valuable in this environment.

| Silver Market Snapshot | Value |

|---|---|

| Spot Price (Jan 26) | $113+ |

| Cumulative Deficit (2021-2025) | 800M oz |

| Industrial Demand Share | 60% |

| US Import Dependence | 70%+ |

| Hecla Share of US Production | 37% |

What to Watch

Near-term catalysts:

- Q4 2025 earnings with full-year financial details (expected early February)

- Aurora 2026 drilling results from high-priority targets

- Midas visible gold follow-up assays and step-out drilling

- Congressional progress on SPEED Act and PERMIT Act

Policy milestones:

- Additional projects added to FAST-41 dashboard

- Potential strategic stockpiling initiatives under critical mineral designation

- Trade measures addressing import dependence

Key risks:

- Silver price volatility at historically elevated levels

- 2026 guidance assumes $50/oz silver—current prices well above this

- Policy environment could shift with future administrations

- China's export controls remain a double-edged sword for global markets

The Policy Bet

Hecla's Investor Day message was unmistakable: this is a company positioning itself as the critical minerals policy play in precious metals.

"The path forward is clear," Krcmarov concluded. "Hecla's portfolio aligns perfectly with what the U.S. and Canadian governments have designated as strategic priorities, and regulatory barriers are being dismantled. Hecla is actively driving this transformation. This is the environment we've been building towards."

Whether the policy momentum sustains—and whether silver's record prices hold—will determine whether Hecla's 135-year-old franchise is entering its most valuable chapter yet.