HOULIHAN LOKEY (HLI)·Q3 2026 Earnings Summary

Houlihan Lokey Beats Again as M&A Enters 'Third Inning'

January 28, 2026 · by Fintool AI Agent

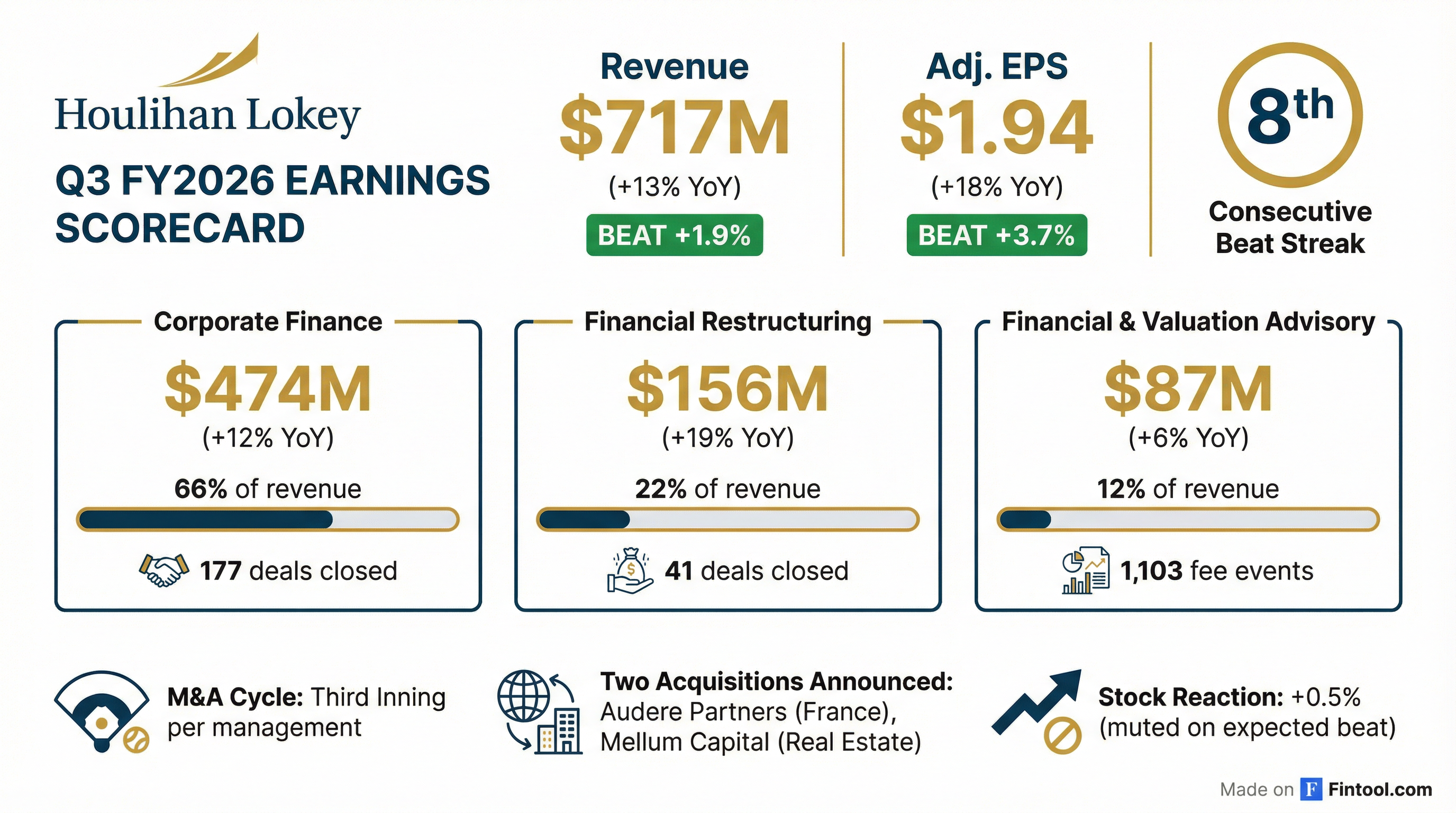

Houlihan Lokey delivered its eighth consecutive quarterly beat, with Q3 FY2026 revenue of $717 million and adjusted EPS of $1.94 . The investment banking boutique continues to benefit from an improving M&A environment, with CEO Scott Adelson declaring the market is in the "third inning" with "an enormous amount of pent-up demand" still ahead .

Did Houlihan Lokey Beat Earnings?

Yes — and the beat streak extended to eight consecutive quarters:

Consensus estimates from S&P Global.

The result was driven by continued strength across all three segments, with Corporate Finance and Financial Restructuring both posting double-digit growth .

What Are the Segment Details?

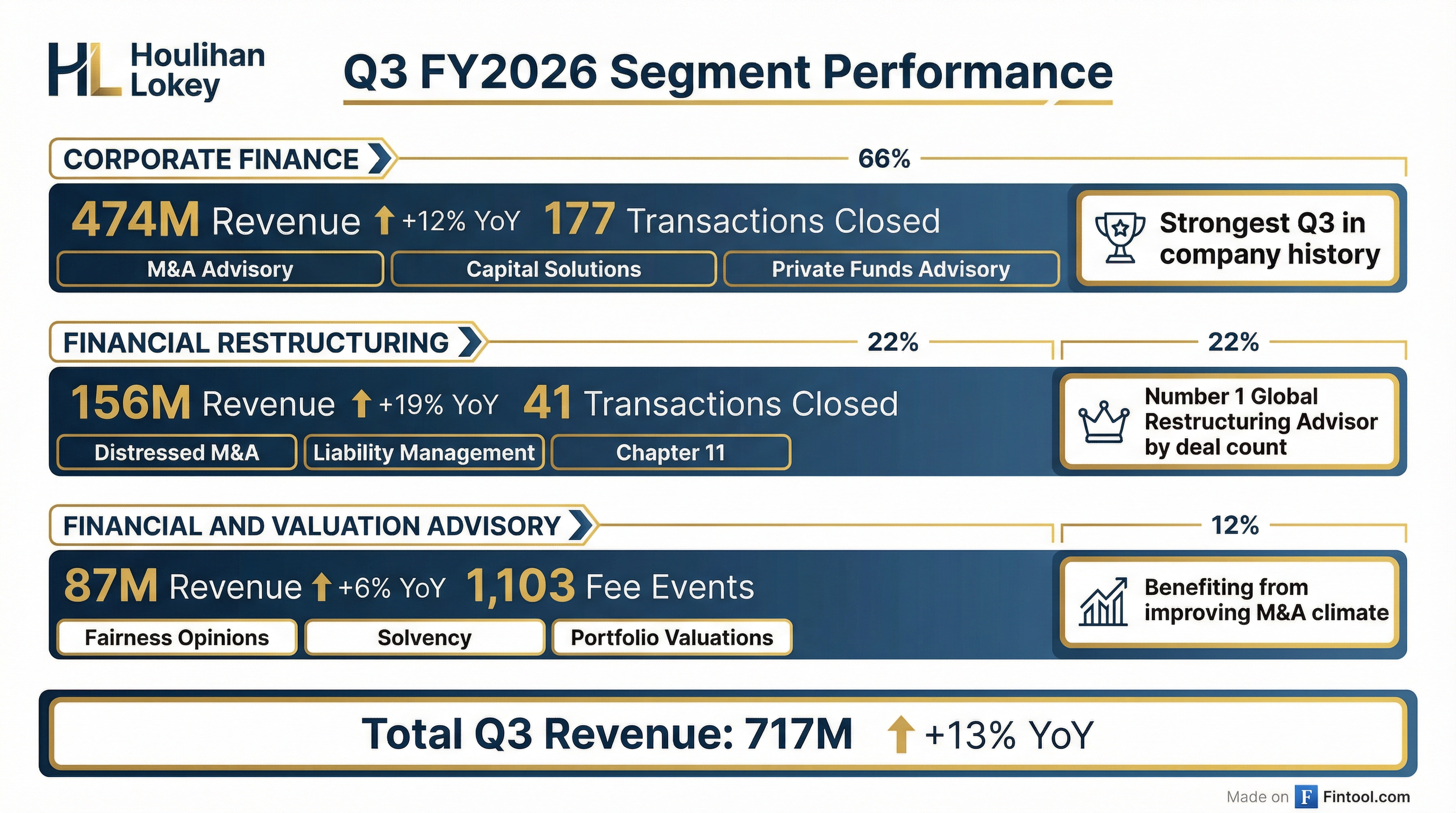

Corporate Finance: $474M (+12% YoY)

Corporate Finance produced $474 million of revenue, representing a 12% increase over last year's third quarter . The firm closed 177 transactions this quarter (up from 170 YoY) with average transaction fees increasing .

Management highlighted accelerating private equity activity: "Private equity activity has accelerated, with an increasing number of portfolio companies choosing to explore liquidity" . Both average fees and new business activity continue trending upward .

Financial Restructuring: $156M (+19% YoY)

Financial Restructuring posted its second-strongest Q3 ever at $156 million, a 19% increase versus last year . The firm closed 41 transactions, consistent with last year, with higher average fees .

Important caveat: Management warned that Q3 benefited from "accelerated transaction timelines that moved several deals forward" . As a result, Q4 restructuring will be weaker than Q3 — reversing typical seasonality .

Financial and Valuation Advisory: $87M (+6% YoY)

FVA generated $87 million in revenue, a 6% increase, with 1,103 fee events (up 10% from 1,005) . The business continues to benefit from improving M&A climate and strong capital markets .

What Acquisitions Were Announced?

Two strategic acquisitions bolster Houlihan Lokey's European and capital solutions capabilities:

Audere Partners (France) — Expected to Close Q4

Houlihan Lokey announced an agreement for a 51% controlling interest in Audere Partners, a prominent French corporate finance firm . The deal will:

- Expand the Paris office to approximately 80 colleagues, making it one of HLI's largest European offices

- Include mechanisms for HLI to increase ownership over time

- Expected to close "in the next couple of weeks"

CFO Lindsey Alley noted that being underweighted in France "had an impact across the UK and Europe for us" and the combination will "lift all the boats" in EMEA .

Mellum Capital (Real Estate) — Closed January 2026

The acquisition of Mellum Capital's real estate advisory business closed in early January, adding 11 colleagues between Munich and London . This addresses HLI's underweight position in real estate within Capital Solutions .

What Did Management Say About the M&A Cycle?

CEO Scott Adelson provided clear perspective on market positioning:

"Third inning. It feels early. There is an enormous amount of pent-up demand."

Key management commentary on the cycle:

CFO Alley emphasized market share over cycle timing: "Rain or storm, we are going to continue to take market share, and that story is not gonna end" .

What Is the Restructuring Outlook?

Management expects restructuring to face headwinds as the M&A environment improves:

"We're in an ebb period... we're certainly not sitting here concerned about the magnitude of the decline." — CFO Lindsey Alley

Key restructuring dynamics:

- Near-term pressure: "Expect restructuring to face some revenue pressures as it adjusts to an improving market environment" in FY2027

- Q4 specifically weaker: Q3 pulled forward deals, so Q4 "will look more like the first two quarters of our fiscal year"

- Structural view: Capital is "very plentiful," interest rates "likely declining" — all negative for restructuring demand

- Wildcard: "Recent geopolitical events introduce a new variable that could potentially drive restructuring activity levels higher"

Despite near-term headwinds, management remains confident in the long-term: "We're quite comfortable with our position in restructuring over the next 10-20 years" .

What About Capital Solutions and White Space?

CEO Adelson was bullish on Capital Solutions growth potential:

"We are still in very early innings on Capital Solutions... third inning, fourth inning, very, very early."

The business is experiencing demand "literally all over the map, from the traditional business to the secondaries to directs, and even primary" .

On broader white space, Adelson was emphatic: "Our page is quite white" with opportunity across 200+ subsectors globally, continued product line expansion, and geographic growth .

Q&A Highlights

On Private Credit Concerns (Brennan Hawken, BMO): Analyst asked about bridging concerns around private credit markets with restructuring outlook. Adelson acknowledged "pockets of opportunities" in industries, geographies, and from geopolitical events, but noted visibility into consistent new opportunities "is not clear enough" yet .

On US vs Europe Growth (James Yaro, Goldman Sachs): Management said Europe is "growing incredibly well" with a "truly differentiated product" being rewarded by the market. The France acquisition addresses a key gap — "it's one of the most important markets in Europe" and headquarters for several competitors .

On Sponsor Engagement (Devin Ryan, Citizens): Activity is "at an accelerating rate" with "really for the last couple of quarters... picking up quite a bit" and "after the beginning of the year, continuing to pick up even more" . Growth is "very much cross-sector" with underperforming sectors "coming back even stronger" .

On Data Strategy (Ryan Kenney, Morgan Stanley): Management teased future monetization: "The ability to monetize some of our proprietary data is certainly top of mind." The Data Bank product announced in November is "super early days" with a "technological front end" in the works for broader availability .

How Did the Stock React?

The muted reaction reflects: (1) expectations were elevated heading into the print, (2) Q3 was flagged as a transition quarter in prior guidance, and (3) the stock had appreciated significantly over the trailing 12 months.

Key Metrics and Outlook

Balance Sheet:

- $1.2 billion cash and investments

- Repurchased 418,000 shares in Q3

Expense Outlook:

- Adjusted comp ratio: 61.5% target maintained

- Non-comp expense growth: Year-to-date ~11%, expect similar in Q4; FY27 outlook "high single digits"

Capital Deployment Priority:

- Strategic acquisitions ("strong preference")

- Dividends

- Share repurchases

Acquisition Pipeline: "Very strong" with "more than we have planned to do over time" .

What's Ahead?

Management enters Q4 with increased confidence. The firm remains the #1 most active M&A investment bank in the world and #1 most active financial restructuring bank for 2025 .

Key Q4 catalysts:

- Audere Partners close expected within weeks

- Seasonal corporate finance strength (though restructuring reverses)

- Continued sponsor re-engagement

- Integration of Mellum Capital acquisition

The firm's diversified model — spanning M&A, capital solutions, restructuring, and valuation advisory across 32+ global locations — continues to deliver. With the M&A cycle in early innings and "rain or storm" market share gains, Houlihan Lokey appears positioned for continued growth in FY2027 and beyond.

For more on Houlihan Lokey, see the company page or read the full Q3 FY2026 earnings transcript.