Earnings summaries and quarterly performance for HELIX ENERGY SOLUTIONS GROUP.

Executive leadership at HELIX ENERGY SOLUTIONS GROUP.

Board of directors at HELIX ENERGY SOLUTIONS GROUP.

Research analysts who have asked questions during HELIX ENERGY SOLUTIONS GROUP earnings calls.

James Schumm

TD Cowen

7 questions for HLX

Joshua Jayne

Daniel Energy Partners

7 questions for HLX

David Smith

Truist Securities

3 questions for HLX

Gregory Lewis

BTIG, LLC

3 questions for HLX

James Rollyson

Raymond James Financial, Inc.

3 questions for HLX

Ben Summers

BTIG, LLC

2 questions for HLX

Connor Jensen

Raymond James Financial, Inc.

2 questions for HLX

Connor Lynagh

Bernstein

2 questions for HLX

Greg Lewis

BTIG

2 questions for HLX

John Basler

Basler Capital Partners, LLC

2 questions for HLX

Jim Rollyson

Raymond James Financial

1 question for HLX

Recent press releases and 8-K filings for HLX.

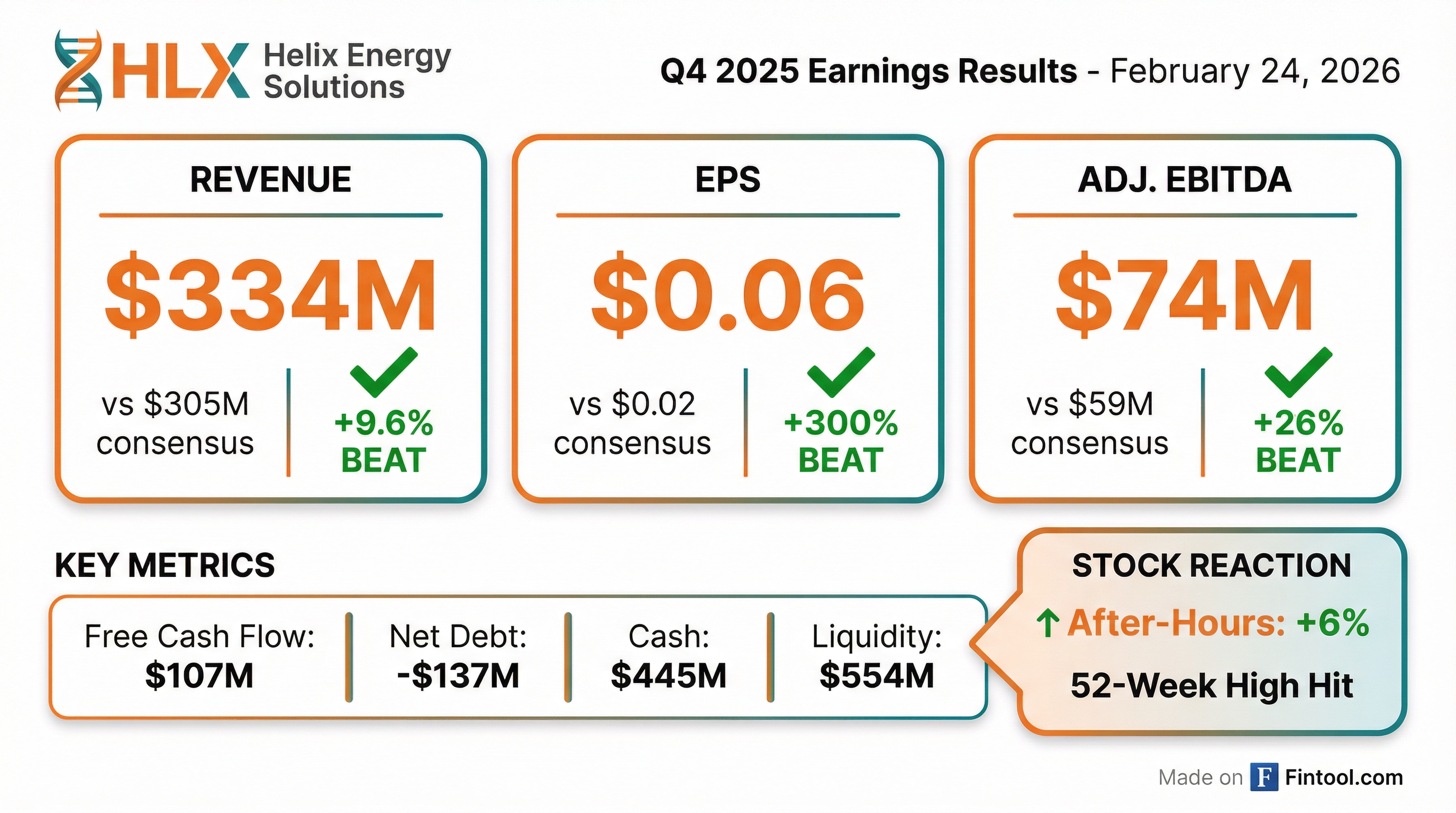

- Helix Energy Solutions Group reported net income of $8 million and $0.06 per diluted share for Q4 2025, with Adjusted EBITDA of $74 million and Free Cash Flow of $107 million. For the full year 2025, net income was $31 million and $0.21 per diluted share, with Adjusted EBITDA of $272 million and Free Cash Flow of $120 million.

- As of December 31, 2025, the company maintained a strong financial position with cash and cash equivalents of $445 million and liquidity of $554 million, alongside negative Net Debt of $137 million.

- Operational highlights include the successful transition of the Sea Helix 1 to a three-year Petrobras contract and securing a multi-year UK North Sea contract for riserless P&A operations, with the Seawell reactivated and commencing operations in February 2026. The company also entered into new contracts totaling approximately $600 million for 2026 and beyond during 2025.

- For 2026, Helix Energy Solutions Group forecasts revenues between $1,200 million and $1,400 million, Adjusted EBITDA between $230 million and $290 million, and Free Cash Flow between $100 million and $160 million.

- Helix Energy Solutions reported Q4 2025 revenues of $334 million and full-year 2025 revenues of $1.3 billion, with Adjusted EBITDA of $74 million for Q4 and $272 million for the full year.

- The company concluded 2025 with a strong balance sheet, including $445 million in cash and cash equivalents and negative net debt of $137 million as of December 31, 2025.

- For 2026, Helix provided guidance of revenue between $1.2 billion and $1.4 billion and Adjusted EBITDA between $230 million and $290 million, noting that EBITDA will be impacted by the Thunderhawk workover and Sea Helix 1 recertification.

- Management anticipates meaningful free cash flow generation in 2026, with the potential for the cash balance to approach $600 million by year-end.

- The robotics segment is expected to continue strong performance, and the North Sea well intervention market is anticipated to rebound, despite an overall soft macro outlook with ongoing uncertainties for 2026.

- Helix Energy Solutions Group reported Q4 2025 revenues of $334 million and full-year 2025 revenues of $1.3 billion, with Adjusted EBITDA of $74 million and $272 million respectively, and strong positive free cash flow for both periods. The company ended the year with $445 million in cash and cash equivalents.

- For 2026, the company provided guidance including revenue of $1.2 billion-$1.4 billion, EBITDA of $230 million-$290 million, and free cash flow of $100 million-$160 million. This guidance incorporates an estimated $40 million reduction in EBITDA due to a Thunderhawk workover in Q1 and a Sea Helix 1 recertification mid-year.

- Key operational areas include a strong robotics segment with a robust outlook and improving rates , and a strong Brazil market with long-term contracts for the SH1 and SH2. The North Sea well intervention market is rebounding, particularly in decommissioning , while the shallow water abandonment segment is expected to be competitive and flat to marginally down in 2026 before an anticipated stronger 2027.

- The company maintains a strong balance sheet with negative net debt and expects its cash balance to approach $600 million by the end of 2026, with management actively assessing M&A opportunities.

- Helix Energy Solutions reported Q4 2025 revenues of $334 million and Adjusted EBITDA of $74 million, contributing to full-year 2025 revenues of $1.3 billion and Adjusted EBITDA of $272 million. The company ended 2025 with $445 million in cash and cash equivalents and negative net debt of $137 million.

- Operational highlights for 2025 included the highest fourth-quarter earnings since 2013, improved results in the Gulf of America Shelf, successful transition of the Siem Helix 1 to a three-year Petrobras contract, and strong performance in the robotics segment. The Seawell was reactivated in January 2026.

- For 2026, the company anticipates a soft macro outlook but expects a stronger 2027. Key impacts on 2026 EBITDA include a 45-day dry dock for the Siem Helix 1 and the Thunderhawk intervention, totaling a $40 million negative impact. Despite this, Helix expects to generate meaningful free cash flow, potentially increasing its cash balance to $600 million by the end of 2026.

- Helix plans to continue its share repurchase program, targeting 25% of free cash flow.

- Helix Energy Solutions Group, Inc. reported net income of $8.3 million (or $0.06 per diluted share) for the fourth quarter 2025 and $30.8 million (or $0.21 per diluted share) for the full year 2025. Adjusted EBITDA was $73.9 million for Q4 2025 and $272.0 million for the full year 2025.

- Revenues for Q4 2025 were $334.162 million and $1,291.474 million for the full year 2025. The fourth quarter 2025 results included an $18.1 million non-cash impairment charge for certain oil and gas properties.

- As of December 31, 2025, the company maintained a strong financial position with cash and cash equivalents of $445.2 million and negative Net Debt of $137.2 million.

- For 2026, Helix forecasts revenues between $1,200 million and $1,400 million, Adjusted EBITDA between $230 million and $290 million, and Free Cash Flow between $100 million and $160 million.

- Helix reported net income of $8.3 million ($0.06 per diluted share) for the fourth quarter 2025, which included an $18.1 million non-cash impairment charge, and $30.8 million ($0.21 per diluted share) for the full year 2025.

- Adjusted EBITDA was $73.9 million for Q4 2025 and $272.0 million for the full year 2025, a decrease from $303.1 million in FY 2024.

- The company generated Free Cash Flow of $107.5 million in Q4 2025, contributing to $120.4 million for the full year 2025, and ended the year with a cash balance of $445.2 million and negative Net Debt of $137.2 million.

- Helix repurchased 4.6 million shares for approximately $30.2 million in 2025.

- Helix Energy Solutions Group, Inc. (HLX) has secured a multi-year contract for riserless plug and abandonment (P&A) operations.

- The contract involves up to 34 subsea wells in the UK North Sea and is scheduled to commence in 2026.

- Helix will utilize its owned assets, such as the Well Enhancer or the Seawell, and provide project management and engineering services for the integrated solution.

- Helix Energy Solutions Group, Inc. announced that Owen Kratz, President and Chief Executive Officer and a member of the Board of Directors, has informed the Board of his intention to retire.

- Mr. Kratz will continue to serve as CEO until the Board appoints a successor to ensure leadership continuity and a smooth transition.

- Mr. Kratz joined Helix (then Cal Dive International) in 1984 and was first appointed CEO in 1997.

- Helix Energy Solutions reported Q3 2025 revenues of $377 million, net income of $22 million, and Adjusted EBITDA of $104 million, marking its highest quarterly results since 2014.

- For the full year 2025, the company narrowed its EBITDA guidance to $240 million - $270 million and expects revenues between $1.23 billion and $1.29 billion.

- The Brazil and Robotics segments demonstrated strong performance in Q3 2025, with high vessel utilization and a robust outlook for Robotics extending into 2030.

- Despite the strong Q3, Q4 2025 operations are expected to be impacted by seasonal weather in the northern hemisphere, leading to anticipated schedule gaps for the Q4000 and the continued warm stacking of the Seawell.

- Helix Energy Solutions delivered its highest quarterly result since 2014 in Q3 2025, driven by strong performance in its robotics and Brazil segments.

- The company tightened its full-year 2025 guidance, forecasting revenues of $1.23 billion to $1.29 billion and EBITDA of $240 million to $270 million. Free cash flow is expected to be $100 million to $140 million, with capital expenditures maintained at $70 million to $80 million.

- The Seawell vessel remained warm stacked in the North Sea for Q3 2025 and is expected to continue for the remainder of the year due to market turmoil. The Q4000 vessel experienced schedule gaps in Q3 and will perform lower-revenue ROV support work before resuming well intervention in January 2026, with the company considering a West Africa campaign for 2026 to hedge utilization risk.

- The robotics segment had a strong quarter with high vessel utilization across trenching, ROV support, and site survey work, and a robust outlook through 2030. Brazil operations also showed strong utilization, with the Q7000 at 100% utilization for Shell and the Siem Helix 1 and 2 vessels highly utilized for Trident and Petrobras, respectively.

- For 2026, the company anticipates upward pressure on supply chain and labor costs and potential reduced rates due to competition in shallow water abandonment. Additionally, the Siem Helix 1 and 2 vessels are due for five-year special surveys, which will impact anticipated improvements.

Quarterly earnings call transcripts for HELIX ENERGY SOLUTIONS GROUP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more