HONDA MOTOR CO (HMC)·Q3 2026 Earnings Summary

Honda Reports Q3 FY2026: Auto Losses Mount as EV Headwinds and Tariffs Bite, Stock Falls 3%

February 10, 2026 · by Fintool AI Agent

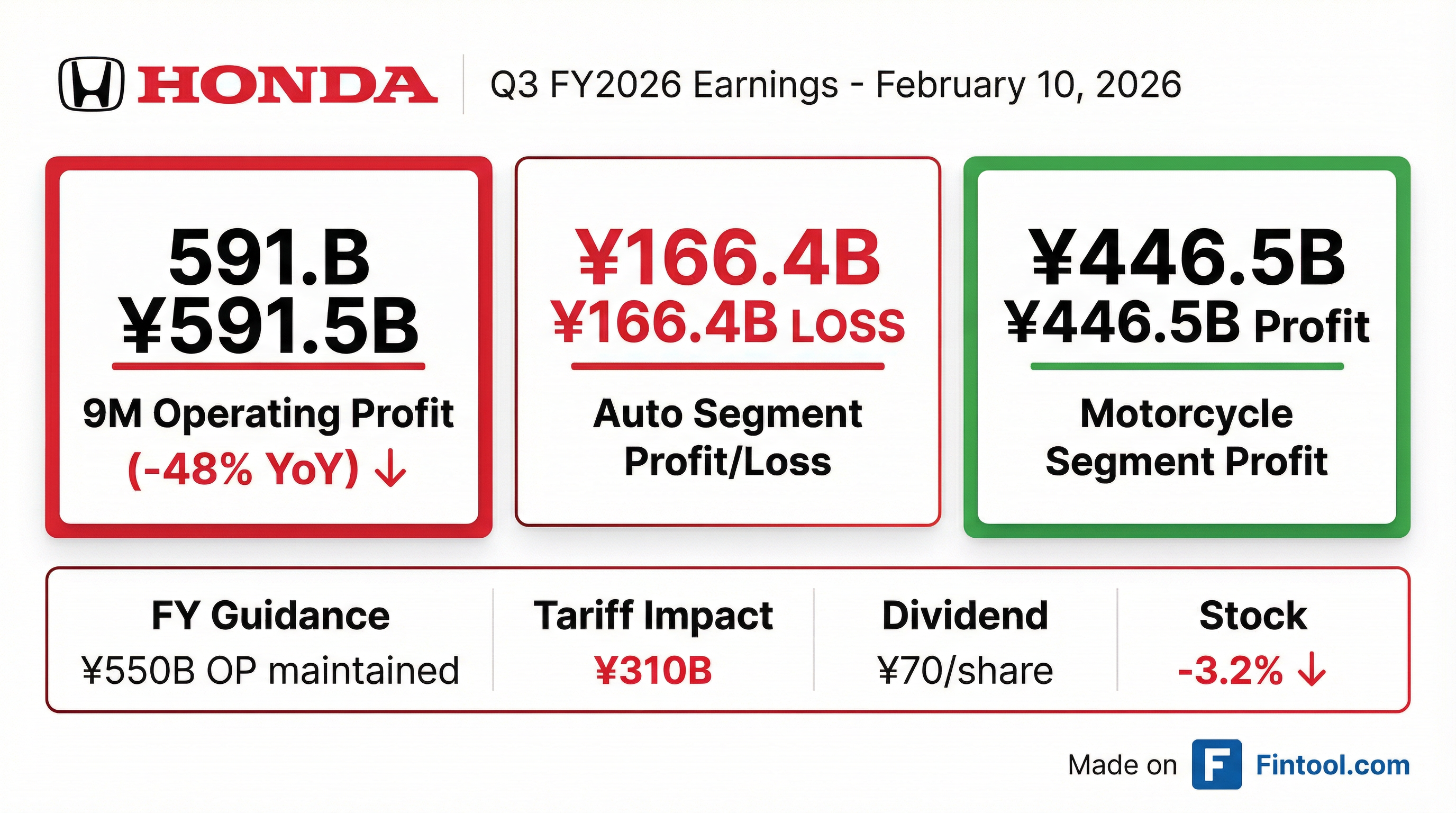

Honda Motor reported Q3 FY2026 results that underscore the difficult transition facing traditional automakers. While the motorcycle business delivered record performance, the automobile segment posted a ¥166.4 billion operating loss as one-time EV charges and tariff impacts overwhelmed results. The stock fell 3.2% to $31.76 on the news, with shares trading down from $32.82 at the prior close.

Did Honda Beat Earnings?

The results were mixed. Honda's 9-month cumulative operating profit of ¥591.5 billion was down 48% year-over-year, reflecting the heavy toll of EV-related expenses and tariff impacts.

Key Financial Highlights (9M FY2026):

Excluding one-time EV-related expenses (¥267.1B) and tariff impact (¥289.8B), operating profit would have been ¥1,148.5 billion—highlighting that the core ICE and hybrid business remains profitable.

What Drove the Auto Segment Loss?

The automobile segment's ¥166.4 billion operating loss reflects a perfect storm of headwinds:

Negative Factors:

- EV one-time charges: ¥267.1B related to product lineup reviews, development asset write-offs, and GM partnership adjustments

- Tariff impact: ¥279.5B gross impact on auto segment

- Semiconductor shortage: 110,000 units affected in North America, ¥150B impact

- R&D spending: ¥42.1B increase year-over-year

- FX headwinds: ¥62.9B negative impact

Positive Offsets:

- Price/cost improvements: ¥177.3B from effective price revisions

What Did Management Guide?

Honda maintained full-year guidance despite the challenging results:

Tariff Impact Improved: The full-year tariff impact forecast was reduced from ¥450B to ¥310B through cost recovery initiatives, local procurement expansion, and USMCA compliance efforts.

Management acknowledged that Q4 contains meaningful uncertainty, including ongoing GM partnership negotiations, potential further BEV write-offs, and increasing incentive requirements in North America.

What Changed From Last Quarter?

Several key developments marked a shift in Honda's strategic posture:

EV Strategy Under "Fundamental Review"

Management announced a dramatic reassessment of EV strategy, citing:

- North America: ACC tax credits invalidated, BEV demand dropping "dramatically"

- China: Local EV makers have superior UI/UX, pricing, and software; Honda "behind" competitors

- GM Partnership: Compensation negotiations ongoing, potential additional charges ahead

"For China, we have to go back to scratch and rebuild our strategies for EV... we do not have the established image of the business in the EV area over there." — Management

Pivot to Hybrid

Honda is doubling down on hybrid technology:

- Next-generation hybrid systems in development

- Next-generation ADAS for hybrid models

- Hybrid volume up ~5% in Q3 with lower incentive requirements

Supply Chain Risks Emerging

New risks beyond semiconductors:

- Rare earth metals: China export restrictions causing delays; no immediate supply problems but "very uncertain" outlook

- Memory chips: Early signs of supply constraints

- Response: Multi-sourcing initiatives, inventory building, government collaboration through JAMA

Motorcycle: The Bright Spot

The motorcycle segment delivered record performance:

Regional Strength: India and Brazil led growth, while Vietnam's ICE restrictions had "limited impact" versus expectations.

Key Drivers:

- Sales volume increase: +¥61.2B

- Price improvements: +¥48.6B

- R&D efficiency: +¥4.6B

Q&A Highlights

On Nissan Alliance: "We do not talk about integration at all now... we continue to discuss with Nissan [on] development costs, software, E&E architecture... however, not just Nissan—if we can expect a win-win result, we will consider other possibilities."

On North America Strategy: Management acknowledged competitors are not raising prices despite tariffs, forcing Honda to increase incentives. The company is exploring fleet sales—previously not a focus—to maintain volume.

On EV Impairments: Current write-offs relate to product lineup reviews and development assets, not CGU-level impairments. Further charges possible depending on GM negotiations and market conditions.

How Did the Stock React?

Honda shares fell 3.2% to $31.76 following the earnings release, trading near the lower end of its 52-week range of $24.56-$34.89.

Recent Performance:

- 1-Month: -2% (underperforming auto sector)

- YTD: +2.2%

- 52-Week: +6.9%

The muted stock reaction likely reflects that many headwinds were already priced in from Q2's disappointing results and ongoing EV/tariff concerns. The maintained guidance and improved tariff outlook may have limited further downside.

Capital Allocation

Honda announced the cancellation of 747 million treasury shares, reinforcing commitment to shareholder returns.

FY2026 Capital Priorities:

- Dividend: ¥70/share maintained (DOE-based policy)

- CapEx: Increased for LG Energy Solution battery JV facility acquisition

- R&D: ¥166B increase vs. prior year, under review for disciplined spending

Forward Catalysts

Near-Term (Q4 FY2026):

- GM partnership compensation resolution

- Q4 EV write-off determination

- Semiconductor recovery (Japan/China already recovering)

FY2027 and Beyond:

- Medium-to-long-term strategy review communication ("sometime during coming fiscal year")

- Next-generation hybrid system launches

- EV product lineup prioritization decisions

- Rare earth supply chain diversification progress

Key Takeaways

- Auto segment in crisis mode: ¥166B loss driven by EV charges and tariffs; profitability only visible when excluding ~¥557B in one-time items

- Motorcycle carries the company: Record profits provide crucial cash flow cushion during transition

- EV strategy pivoting: "Fundamental review" signals potential pullback from aggressive electrification timeline

- Hybrid is the bridge: Honda doubling down on hybrid as EV demand falters

- Supply chain diversifying: Rare earth, semiconductor, and memory chip risks driving multi-sourcing

- Guidance maintained but fragile: Q4 contains meaningful uncertainty from GM negotiations, incentives, and market conditions

For the full earnings call transcript, see Honda Q3 FY2026 Transcript. For company fundamentals and filings, visit Honda Research Page.