Earnings summaries and quarterly performance for HONDA MOTOR CO.

Research analysts who have asked questions during HONDA MOTOR CO earnings calls.

Inajima

Bloomberg

4 questions for HMC

Hans Greimel

Automotive News

3 questions for HMC

Nagae

TV Station (Unspecified)

3 questions for HMC

Narahashi

Yomiuri Newspapers

3 questions for HMC

Nishizono

NHK

3 questions for HMC

Okinaga

Nikkei Newspaper

3 questions for HMC

Yoko Yamaguchi

Toyo Keizai Magazine

3 questions for HMC

Daniel

Craig-Hallum

2 questions for HMC

Daniel

Reuters

2 questions for HMC

Okinada

Linde plc

2 questions for HMC

Nagae

TV Tokyo

1 question for HMC

Nakamura

Yomiuri Paper Estimate

1 question for HMC

Nakamura

Yomiuri Shimbun

1 question for HMC

Narahashi

The Yomiuri Shimbun

1 question for HMC

Nishizono

NHK (Japan Broadcasting Corporation)

1 question for HMC

Okinaga

Nikkei Inc.

1 question for HMC

Yokoyama

Tayo KSI

1 question for HMC

Yokoyama

Toyo Keizai Inc.

1 question for HMC

Yoko Yamaguchi

Toyo Keizai Inc.

1 question for HMC

Recent press releases and 8-K filings for HMC.

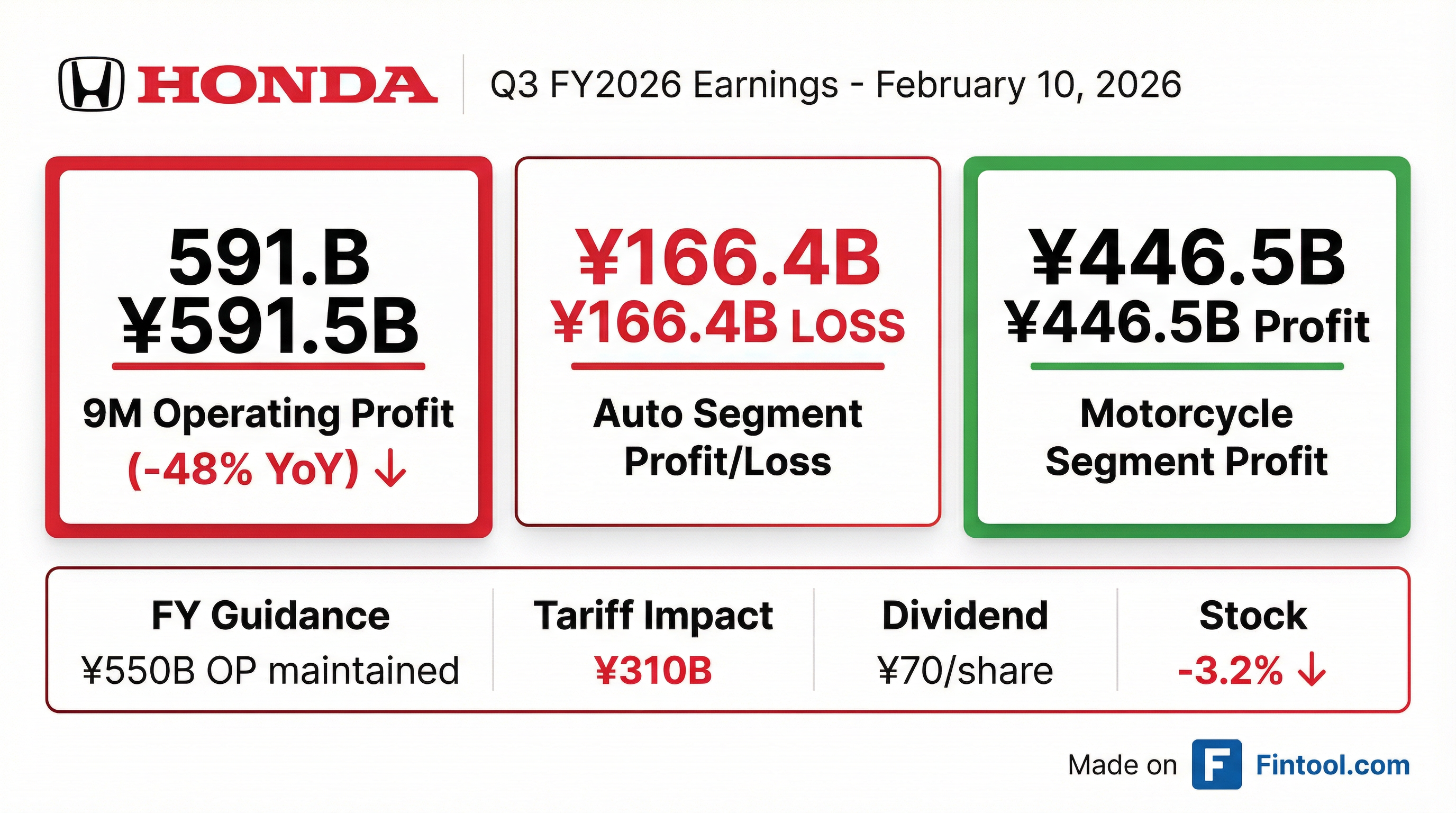

- Honda Motor Co., Ltd. reported a Q3 operating profit of 591.5 billion yen for the period ended December 31, 2025, driven by solid motorcycle sales, though automobile profits decreased due to tariffs and one-time EV expenses.

- The company maintained its FYE March 31, 2026 financial forecast, projecting an operating profit of 550.0 billion yen and profit for the year of 300.0 billion yen, citing a reduced tariff impact but intensified competition in Asian auto markets.

- Honda announced the cancellation of 747,000,000 shares of common stock, scheduled for February 27, 2026, which will result in 4,533,000,000 shares issued after the cancellation.

- Honda Motor Co., Ltd. reported a 48.1% decrease in operating profit to JPY 591,505 million and a 42.2% decrease in profit attributable to owners of the parent to JPY 465,437 million for the nine months ended December 31, 2025.

- The company revised its fiscal year ending March 31, 2026, forecast, projecting a 54.7% decrease in operating profit to JPY 550,000 million and a 64.1% decrease in profit attributable to owners of the parent to JPY 300,000 million.

- These financial declines are partly due to the impact of changes in the electric vehicle (EV) market environment, which led to JPY 279,364 million in losses and expenses across cost of sales, selling, general and administrative expenses, and research and development expenses for the nine months ended December 31, 2025. The global EV sales ratio target for 2030 has been revised down to 20% from 30%.

- Honda's Board of Directors resolved to cancel 747,000,000 shares of common stock, representing 14.1% of total issued shares, effective February 27, 2026, to improve capital structure efficiency.

- Honda Motor Co. reported a Q3 2026 operating profit of JPY 591.5 billion and profit attributable to the owner of the parent of JPY 465.4 billion, both lower than the same period last year.

- The company maintained its full-year forecast for FY March 2026, expecting an operating profit of JPY 550 billion and profit attributable to the owner of the parent of JPY 300 billion.

- Significant impacts on profitability include JPY 267.1 billion in one-time EV-related expenses in Q3 and a revised tariff impact of JPY 310 billion for the full year.

- Honda announced a full-year dividend forecast of 70 JPY per share and resolved to cancel 747 million treasury stocks.

- While automobile operations saw profit declines, motorcycle operations achieved record high unit sales and operating profit up to Q3. The company is also addressing supply risks for rare earth metals and reviewing its EV market strategy due to stagnated growth and increased competition.

- Honda Motor Co. reported an operating profit of JPY 591.5 billion for the third quarter of fiscal year ending March 2026, with the automobile business segment recording JPY 166.4 billion in losses.

- The full-year forecast for fiscal year ending March 2026 remains unchanged, with an anticipated operating profit of JPY 550 billion and profit for the year of JPY 300 billion.

- The decline in automobile operating profit was significantly impacted by JPY 267.1 billion in one-time EV-related expenses and JPY 289.8 billion from tariffs.

- Honda is conducting a fundamental review of its EV strategies due to a stagnated EV market in North America and China, with a full-year budget of approximately JPY 700 billion allocated for the BEV portion.

- The expected tariff impact for the fiscal year ending March 2026 has been reduced to JPY 310 billion from an initial forecast of JPY 450 billion, attributed to recovery plans.

- Honda Motor Co. reported an operating profit of JPY 591.5 billion and profit attributable to the owner of the parent of JPY 465.4 billion for the third quarter of the fiscal year ending March 2026.

- The company maintained its FY2026 operating profit forecast at JPY 550 billion and profit for the year at JPY 300 billion, despite significant Q3 impacts from one-time EV-related expenses of JPY 267.1 billion and tariffs of JPY 289.8 billion.

- The forecast for the tariff impact for FY2026 has been reduced to JPY 310 billion from an initial JPY 450 billion.

- For shareholder returns, Honda maintains its full-year dividend forecast of 70 JPY per share and resolved to cancel 747 million Treasury stocks.

- The company is revisiting its EV strategies due to a stagnated market and intensifying competition, including working to settle EV-related losses in North America within the current fiscal year.

- Honda is set to acquire approximately $2.9 billion of assets from its Ohio battery joint venture with LG Energy Solution, with the sale to a U.S. Honda unit expected to close by the end of February.

- The transaction, valued at about 4.2 trillion won in LGES filings, is intended to improve joint-venture operational efficiency and will not reduce LGES’s stake or dissolve the partnership.

- This acquisition signals Honda's strategic move to tighten control over EV supply amid a broader industry trend of cooling U.S. EV demand and retrenchment by other manufacturers.

- Production at the facility is anticipated to begin next year, with mass production planned for 2026.

- Mythic has raised $125 million in an oversubscribed funding round led by DCVC, with participation from investors including Honda Motors and Lockheed Martin.

- The company's Analog Processing Units (APUs) are designed to be 100x more energy-efficient than industry-standard GPUs, aiming to solve the significant energy consumption issue in AI.

- Mythic's APUs target the data center, automotive, robotics, and defense industries, offering substantial benefits in energy efficiency, cost, and latency.

- Under new leadership, Mythic has undergone a complete reinvention of its architecture, roadmap, software, and strategy.

- Honda Motor Co., Ltd. (HMC) has resolved to acquire an additional 21% equity interest in Astemo, Ltd. from Hitachi, Ltd., which will make Astemo a consolidated subsidiary.

- The acquisition involves 223,605 shares for a total acquisition price of 152.3 billion JPY.

- Following the transaction, Honda's shareholding in Astemo will increase from 40% to 61%, while Hitachi's will decrease from 40% to 19%, with JICC retaining 20%.

- The strategic purpose is to enhance Honda's software-defined vehicle (SDV) development capabilities and cost competitiveness, leading Astemo's transformation in the rapidly changing automotive industry.

- The share transfer agreement was signed on December 16, 2025, with execution anticipated during the first quarter of the fiscal year ending March 31, 2027.

- Honda Motor Co., Ltd. reported a 1.5% decrease in consolidated sales revenue to ¥10,632.6 billion and a 41.0% decrease in operating profit to ¥438.1 billion for the six months ended September 30, 2025, primarily due to negative foreign currency translation effects, EV market changes, and tariff impacts.

- The Automobile Business recorded an operating loss of ¥73.0 billion for the six months ended September 30, 2025, a decline of ¥331.0 billion from the prior year, largely due to the impact of changes in the electric vehicle (EV) market environment and tariff impacts.

- Honda has revised its global EV sales ratio target for 2030 to 20%, down from 30%, and recognized significant losses and expenses totaling ¥237,263 million (¥139,888 million in cost of sales, ¥8,130 million in selling, general and administrative expenses, and ¥89,245 million in research and development expenses) related to EV market changes and discontinued projects for the six months ended September 30, 2025.

- In contrast, the Motorcycle Business saw sales revenue increase by 6.1% to ¥1,920.7 billion and operating profit rise by 13.0% to ¥368.2 billion for the six months ended September 30, 2025.

- Cash and cash equivalents increased by ¥149.0 billion from March 31, 2025, to ¥4,677.8 billion as of September 30, 2025, with net cash provided by operating activities amounting to ¥365.8 billion.

- Honda Motor Co. cut its annual profit forecast by 21% to ¥550 billion ($3.6 billion) for the fiscal year ending March 2026, citing a semiconductor shortage and weakening demand in Asia.

- The company also reduced its global vehicle sales forecast to 3.34 million units and scaled back its electric vehicle (EV) target to 20% of global sales by 2030 from a previous 30%.

- Honda's automobile division posted an operating loss in the first half of the fiscal year, partly due to ¥224 billion in extraordinary EV-related expenses, with the semiconductor shortage expected to reduce operating profit by approximately ¥150 billion ($1 billion) this fiscal year.

Fintool News

In-depth analysis and coverage of HONDA MOTOR CO.

Quarterly earnings call transcripts for HONDA MOTOR CO.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more