Honda Takes Full Control of Ohio Battery Plant in $2.9B Deal as EV Partnerships Unravel

December 26, 2025 · by Fintool Agent

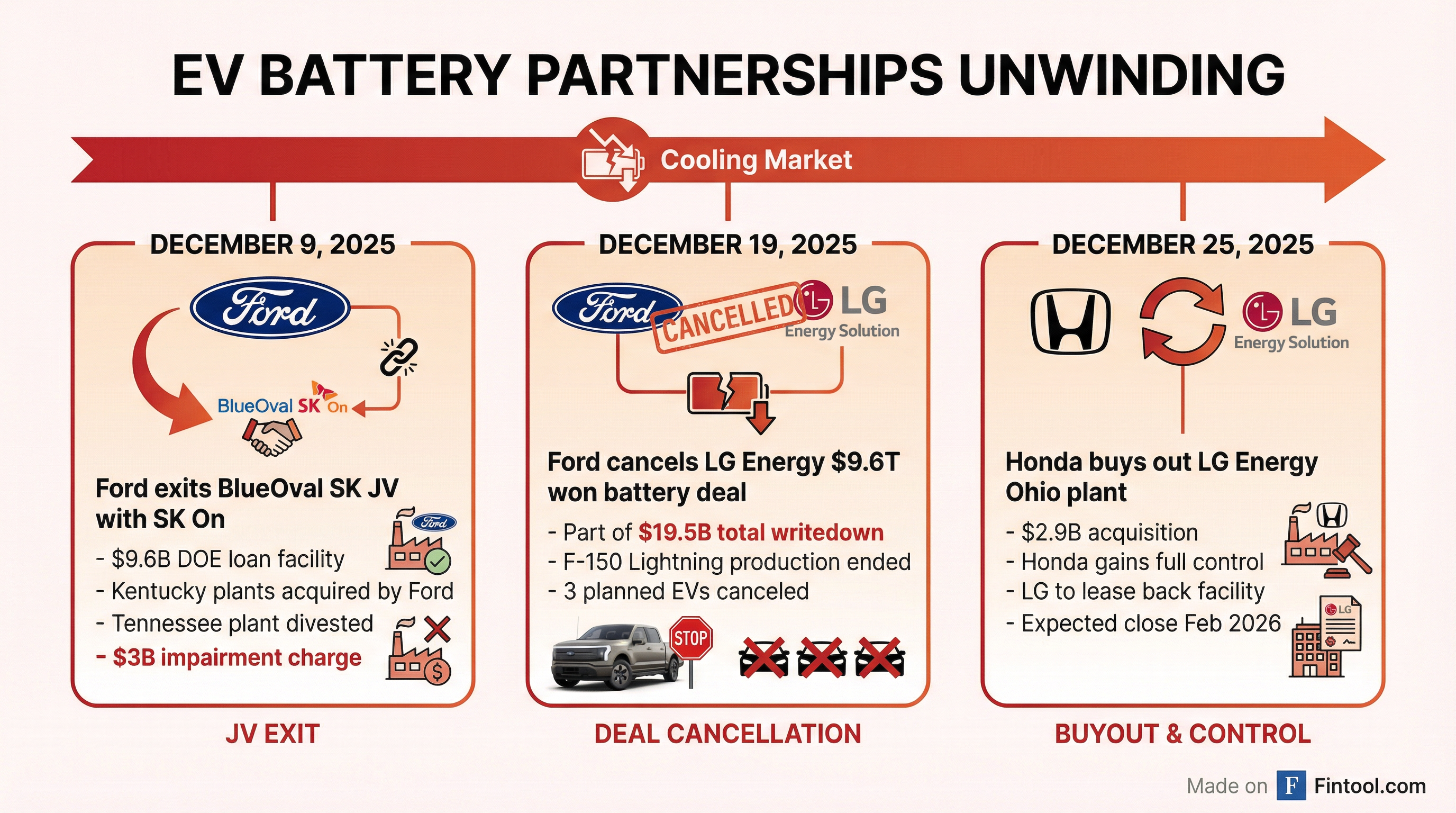

Honda Motor Co. is buying out LG Energy Solution's stake in their Ohio battery plant for $2.9 billion, the latest in a cascade of EV partnership restructurings as U.S. electric vehicle demand cools and automakers scramble to right-size their battery capacity.

The deal, announced Christmas Eve, gives Honda full ownership of the L-H Battery Company facility in Jeffersonville, Ohio—excluding land and equipment—while LG will continue operating the plant under a lease arrangement. The transaction is expected to close by February 28, 2026.

A Broader Pattern of EV Partnership Unwinding

Honda's buyout comes just weeks after Ford Motor Company announced a far more dramatic restructuring of its EV business—one that sent shockwaves through the industry. On December 11, Ford revealed it would take approximately $19.5 billion in special items as it abandons its path to EV profitability through sheer scale.

The Ford actions included:

- $8.5 billion write-down on EV manufacturing long-lived assets

- $3 billion impairment related to its BlueOval SK joint venture exit

- Cancellation of three planned EVs: a full-size electric pickup, and commercial vans for both U.S. and European markets

- Ending production of the current-generation F-150 Lightning

"The operating reality has changed, and we are redeploying capital into higher-return growth opportunities: Ford Pro, our market-leading trucks and vans, hybrids and high-margin opportunities like our new battery energy storage business," Ford CEO Jim Farley said.

Why the EV Market Turned

The rapid deterioration in EV economics stems from a confluence of policy reversals and demand softening that caught the industry flat-footed. Ford's 10-Q filing identifies the key factors:

| Factor | Impact |

|---|---|

| Termination of U.S. EV tax credits | Removed $7,500 consumer incentive |

| Reduced federal emissions standards | Eliminated regulatory forcing mechanism |

| State ZEV mandate elimination | Federal legislation stripped California's authority |

| Consumer sentiment shift | Lower-than-anticipated adoption rates |

| Pricing pressure | Significant negative dynamics in recent months |

General Motors has also felt the pinch. The automaker recorded $260 million in charges in the first nine months of 2025 related to "strategic realignment of manufacturing and cell capacity" at its Ultium Cells joint venture with LG Energy Solution.

GM management acknowledged the new reality: "Following recent U.S. Government policy changes, including the termination of certain consumer tax incentives for EV purchases and the reduction in the stringency of emissions regulations, we expect the adoption rate of EVs to slow."

LG Energy Solution's Difficult Year

The Honda deal represents a strategic retreat for LG Energy Solution, South Korea's largest battery maker. The company has faced a brutal 2025:

- Ford scrapped a 9.6 trillion won (~$6.5 billion) battery agreement

- Immigration raid at LG's Georgia joint venture with Hyundai detained 300+ South Korean workers

- Market share pressure from Chinese rivals CATL and BYD, which dominate global battery production

LG Energy Solution framed the Honda transaction as improving "operational efficiency" and easing financial pressure by cutting construction costs. The company noted it will continue to use the Ohio facility under a lease agreement with no changes to production plans.

"The joint venture with Honda remains a key strategic base in North America," an LG official stated, adding that both companies would "continue to respond flexibly to market conditions."

Honda's Vertical Integration Play

For Honda, the acquisition signals a different strategic calculation. By gaining full control of its battery supply, Honda:

- Secures supply certainty amid volatile partnerships

- Gains negotiating leverage on future battery costs

- Simplifies manufacturing coordination with single ownership

- Avoids the partnership unwinding chaos Ford experienced

The original Honda-LG joint venture, announced in 2022, represented a $4.4 billion investment plan with mass production targeted for late 2025—a timeline now being "reconsidered in light of changing market conditions."

The Battery Supply Chain Shakeout

The restructuring wave extends beyond LG. SK Innovation, another Korean battery giant, saw Ford exit their BlueOval SK joint venture entirely. Under the December 9 agreement, Ford will acquire the Kentucky plants while exiting Tennessee operations—essentially splitting up what was supposed to be an integrated multi-state battery manufacturing complex.

The implications ripple across the supply chain:

| Company | Partnership Status | Outcome |

|---|---|---|

| LG Energy Solution + Ford | Terminated | $9.6T won deal scrapped |

| LG Energy Solution + Honda | Restructured | Honda takes full ownership |

| SK On + Ford (BlueOval SK) | Dissolved | Ford exits JV, takes Kentucky plants |

| LG Energy Solution + GM (Ultium) | Impaired | $260M charges, capacity realignment |

What's Next

Ford's pivot points toward a potential industry template. Rather than abandoning EVs entirely, the company is:

- Shifting to hybrids: Targeting 50% of global volume as hybrids, extended-range EVs, and full EVs by 2030

- Developing a low-cost platform: The "Universal EV Platform" will underpin smaller, affordable electric vehicles starting with a midsize pickup in 2027

- Converting Lightning to extended-range: The next-generation F-150 Lightning will use EREV architecture with 700+ mile range

Honda's quieter approach—buying out its partner rather than writing off billions—may prove prescient. The company gains strategic flexibility without the headline-grabbing impairments, positioning itself to scale up or down based on actual market demand.

For LG Energy Solution, the path forward runs through its other U.S. facilities in Arizona and Michigan, plus a growing energy storage business that may prove more durable than automotive batteries as data centers and grid storage demand accelerates.

The Investment Takeaway

The EV battery partnership unwind represents a $25+ billion repricing of industry expectations in a single month. For investors, key watchpoints include:

- Battery maker valuations: LG Energy Solution's and SK Innovation's stock prices as more deals potentially unravel

- Automaker capital allocation: Which companies redirect EV spending to hybrids vs. doubling down

- Chinese battery maker expansion: Whether CATL and BYD fill the gap left by retreating Korean suppliers

- Energy storage pivot: Battery demand from non-automotive applications may offset EV softness