Honda Profit Plunges 61% as EV Writedowns and Trump Tariffs Crush Auto Division

February 10, 2026 · by Fintool Agent

Honda Motor posted a 61% plunge in third-quarter operating profit on Tuesday, missing analyst estimates as U.S. tariffs and electric vehicle restructuring costs pushed the company's automobile business into operating loss territory — the latest evidence that the global EV transition is proving far more costly than automakers anticipated.

The Japanese automaker reported Q3 FY2026 operating profit of ¥153.4 billion ($987 million), down from ¥397 billion a year earlier and below the ¥174.5 billion consensus estimate from LSEG. The quarter marked Honda's fourth consecutive year-over-year profit decline.

"Our current challenge is to build a lean operating structure that can respond flexibly to changes in the business environment," Executive Vice President Noriya Kaihara said at the earnings briefing.

The Damage: ¥557 Billion in Headwinds

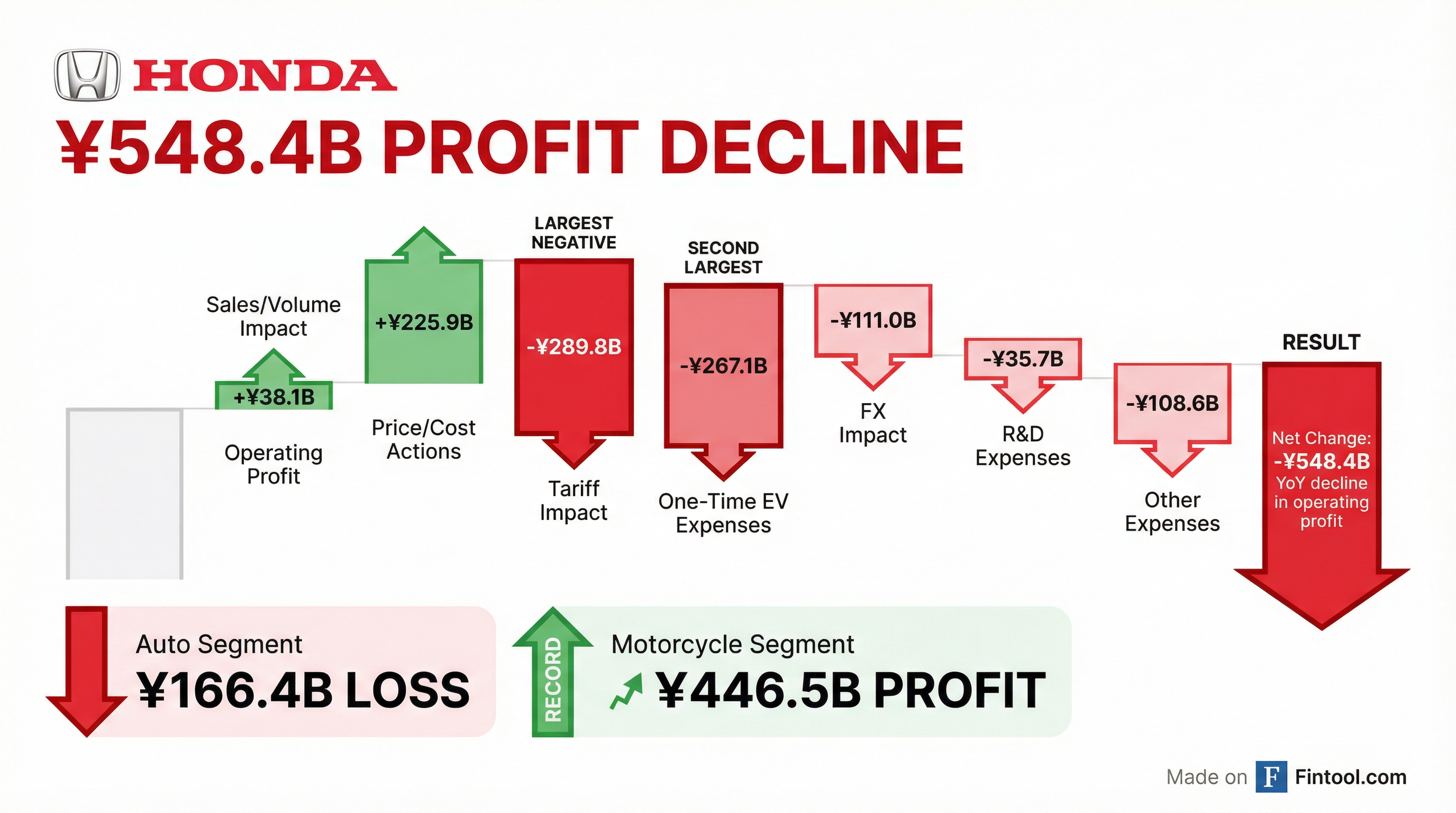

Honda's results tell a story of a company caught between policy shocks and a rapidly shifting competitive landscape. For the nine months ending December 2025, operating profit was ¥591.5 billion — down ¥548.4 billion from the year-earlier period.

The company quantified the pain in stark terms:

| Factor | 9-Month Impact |

|---|---|

| One-Time EV-Related Expenses | -¥267.1B |

| U.S. Tariff Impact | -¥289.8B |

| FX Effects | -¥111.0B |

| Operating Expenses | -¥108.6B |

| R&D Investment | -¥35.7B |

| Price/Cost Actions | +¥225.9B |

| Sales/Mix | +¥38.1B |

The combined EV and tariff impact of nearly ¥557 billion completely overwhelmed Honda's pricing power and cost reduction efforts. Excluding these one-time items, operating profit would have been ¥1.148 trillion — more than double the reported figure.

Auto Division in the Red, Motorcycles at Record Highs

The divergence between Honda's business segments was dramatic. The automobile division posted an operating loss of ¥166.4 billion for the nine-month period, while motorcycles achieved record-high unit sales and operating profit of ¥446.5 billion.

| Segment | Operating Profit (9M) |

|---|---|

| Motorcycles | ¥446.5B (record) |

| Financial Services | ¥218.0B |

| Power Products | -¥6.5B |

| Automobiles | -¥166.4B |

For automobiles, the breakdown was brutal: tariffs alone drained ¥279.5 billion from the segment, while EV-related charges consumed ¥267.1 billion. The segment also faced headwinds from semiconductor shortages that disrupted production in North America, Japan, and China.

EV Strategy Under Fundamental Review

Honda's management signaled that a wholesale rethink of the company's electric vehicle strategy is underway. CFO Eiji Fujimura disclosed that EV-related losses are tracking toward ¥700 billion for the full year, including ¥290 billion in asset writedowns and ¥400 billion in R&D charges.

The company is grappling with:

- North America: EV demand has "turned sharply negative" as consumer tax incentives were terminated, cutting operating profit by nearly ¥270 billion for the nine-month period

- China: Local EV manufacturers have established insurmountable leads in pricing, software, and user experience. "We do not have the established image of the business in the EV area over there," management admitted.

- GM Partnership: Ongoing negotiations with General Motors over compensation related to their EV collaboration could result in additional charges.

"We need to conduct a fundamental review of our strategies to rebuild our competitive strength," Kaihara stated. "We will communicate our review of fundamental medium- to long-term strategy at an appropriate timing, sometime during the coming fiscal year."

Industry-Wide EV Reckoning

Honda is far from alone in absorbing massive EV-related losses. The results underscore a broader industry retreat from aggressive electrification targets:

| Automaker | Recent EV Charges | Details |

|---|---|---|

| GM | $7.6B | Q3-Q4 2025 charges including BrightDrop shutdown, Orion Assembly conversion |

| Stellantis | €22.2B | Announced last week as it scales back EV ambitions |

| Ford | Billions | Ongoing EV division losses exceeding $5B annually |

| Honda | ¥700B ($4.5B) | Full-year FY2026 estimate |

GM's CFO Paul Jacobson noted that the company expects "material but significantly smaller" EV-related charges going forward as it completes negotiations with suppliers and addresses regulatory changes.

Tariff Relief, But Not Enough

One relative bright spot: Honda's tariff exposure is proving more manageable than initially feared. The company now expects a ¥310 billion full-year tariff impact, down from ¥450 billion forecast at the start of the fiscal year.

The improvement came from a combination of go-to-market actions, expanded local procurement in the U.S., and better USMCA compliance. However, management cautioned that tariff mitigation will remain an ongoing challenge.

"The ¥310 billion tariff impact cannot be recovered just immediately next fiscal year. So we want to closely monitor the costs," Fujimura said. "We might proceed with more expanding of our local procurement and try to control costs more closely."

New Supply Chain Risks Emerge

Beyond tariffs and EVs, Honda flagged emerging risks around rare earth metals and memory chips — critical components for both EVs and advanced driver assistance systems.

"We are beginning to see signs of supply risk for other materials such as rare earth metals and memories, and we will closely monitor the situation and take actions as needed," Kaihara warned.

Chinese export restrictions on rare earth metals are creating uncertainty. While exports are still flowing, processing times have become unpredictable. Honda acknowledged it has limited options: holding additional inventory and ensuring timely export permit applications. Longer-term solutions like rare-earth-free components require extended development timelines.

Full-Year Guidance Maintained

Despite the headwinds, Honda maintained its full-year operating profit forecast of ¥550 billion, unchanged from prior guidance. The company expects:

- Motorcycle unit sales: 21.3 million (record target maintained)

- Automobile unit sales: 3.34 million (unchanged)

- Operating profit: ¥550 billion (down 54.7% YoY)

- Dividend: ¥70 per share (unchanged)

The company also announced it will cancel 747 million treasury shares.

Management acknowledged the guidance embeds significant risk. Q4 upside from favorable currency (the yen has weakened further against assumptions) and reduced tariff impact could be offset by:

- Additional EV losses in North America

- GM compensation negotiations

- Increased incentive spending as competitors intensify pricing pressure

- Potential residual value losses on leases in the financial services business

What to Watch

Near-Term Catalysts:

- FY2027 guidance (expected May 2026) — will reveal depth of EV strategy reset

- GM partnership resolution — potential additional charges

- U.S. tariff policy evolution under current administration

- China market strategy update

Structural Questions:

- Can Honda's hybrid dominance offset EV market weakness?

- Will the Nissan alliance discussions produce meaningful cost savings?

- How quickly can Honda restructure its China operations?

Honda's motorcycle and financial services businesses provide a cash flow cushion that peers lack. But the core auto business faces a pivotal moment: the company must balance the continued investment required to stay competitive in EVs against the reality that returns remain deeply negative. Management's promised strategy update will be the most important communication Honda has delivered in years.

Related

- Honda Motor — Company Profile

- Toyota Motor — Peer Analysis

- General Motors — EV Strategy Comparison

- Ford Motor — EV Division Performance

- Stellantis — European EV Challenges