Earnings summaries and quarterly performance for Stellantis.

Research analysts who have asked questions during Stellantis earnings calls.

José Asumendi

JPMorgan Chase & Co.

11 questions for STLA

Philippe Houchois

Jefferies

11 questions for STLA

Thomas Besson

Kepler Cheuvreux

11 questions for STLA

Horst Schneider

Bank of America

10 questions for STLA

Michael Foundoukidis

ODDO BHF

7 questions for STLA

Patrick Hummel

UBS Group AG

7 questions for STLA

Emmanuel Rosner

Wolfe Research

6 questions for STLA

Stuart Pearson

Exane BNP Paribas

5 questions for STLA

Henning Cosman

Barclays PLC

4 questions for STLA

Christian Frenes

Goldman Sachs

3 questions for STLA

Itay Michaeli

TD Cowen

3 questions for STLA

Stephen Reitman

Bernstein

3 questions for STLA

Harald Hendrikse

Citi

2 questions for STLA

Henning Kosman

Barclays

2 questions for STLA

Martino De Ambroggi

Equita

2 questions for STLA

Michael Tyndall

HSBC

2 questions for STLA

Tom Narayan

RBC Capital Markets

2 questions for STLA

Christopher French

Goldman Sachs

1 question for STLA

Mike Tyndall

HSBC Holdings plc

1 question for STLA

Recent press releases and 8-K filings for STLA.

- Stellantis N.V. reported a net loss of €22,332 million for the year ended December 31, 2025, a significant decline from a net profit of €5,520 million in the prior year.

- The company's net revenues decreased to €153,508 million for FY 2025, down from €156,878 million in FY 2024.

- Operating income shifted from a profit of €3,687 million in FY 2024 to an operating loss of €26,254 million in FY 2025.

- Research and development costs increased to €11,145 million in FY 2025, more than double the €5,784 million reported in FY 2024.

- Stellantis N.V. reported Net revenues of €153.5 billion for Full Year 2025, a 2% decrease compared to 2024, primarily due to FX headwinds and H1 2025 net pricing declines.

- The company posted a Net loss of €22.3 billion for FY 2025, driven by €25.4 billion of unusual charges related to a strategic shift. This resulted in an Adjusted operating loss of €842 million and negative Industrial free cash flows of €4.5 billion.

- The second half of 2025 showed initial improvements, with Net revenues increasing 10% year-over-year and Industrial free cash flows improving by 73% compared to H2 2024.

- To preserve a strong balance sheet, the Board authorized the suspension of the 2026 dividend and the issuance of up to €5 billion of hybrid bonds.

- Stellantis affirmed its 2026 financial guidance, expecting progressive improvements in Net revenues, Adjusted Operating Income margin, and Industrial free cash flows.

- Stellantis reported net revenues of EUR 153 billion, a 2% decrease year-over-year, and a negative 0.5% Adjusted Operating Income (AOI) margin for full year 2025. The company recorded a net loss of EUR 22 billion, primarily due to strategic shifts and U.S. regulatory changes, with industrial free cash flow outflows of EUR 4.5 billion.

- The second half of 2025 showed a return to top-line growth, with net revenues increasing 10%. Industrial free cash flow improved 50% sequentially in H2 2025 to negative EUR 1.5 billion, driven by strong performance in North America, where shipments rose 39% and revenues increased 31%.

- For 2026, Stellantis confirmed its financial guidance, forecasting mid-single digit revenue growth and expecting North America and Europe to achieve positive AOI. The company anticipates industrial free cash flow to turn positive in 2026 and 2027 and is investing $13 billion over four years in the U.S. for market expansion and product renewal.

- Stellantis reported full year 2025 net revenues of EUR 153 billion, a 2% decrease year-over-year, with an AOI margin of negative 0.5% and a net loss of EUR 22 billion.

- The company experienced a return to top-line growth in H2 2025, with net revenues increasing 10% and industrial free cash flow improving 50% sequentially to negative EUR 1.5 billion.

- Stellantis confirmed its 2026 financial guidance, anticipating industrial free cash flow to turn positive in 2026 and 2027, driven by new product launches and operational efficiencies.

- The year 2025 was characterized as a "year of reset," involving the launch of 10 new products, the hiring of over 2,000 engineers for quality, and a commitment of $13 billion over 4 years for U.S. market coverage and manufacturing.

- Stellantis reported full-year 2025 net revenues of EUR 153 billion, a 2% decrease year-over-year, with an AOI margin of negative 0.5% and industrial free cash flow outflows of EUR 4.5 billion. However, the second half of 2025 saw a return to 10% top-line growth and a 50% sequential improvement in industrial free cash flow.

- The company forecasts mid-single digit revenue growth for 2026, expecting industrial free cash flow to turn positive in 2026 and 2027.

- 2025 was a "year of reset" marked by the launch of 10 new products and a $13 billion investment over 4 years in the U.S. to enhance market coverage and manufacturing utilization.

- Key drivers for 2026 profitability include increasing HEMI V8 engine production by 100,000 units, an improved product mix, and operational efficiencies, with North America anticipated to be the largest contributor to profitability.

- Stellantis is weighing the adoption of Leapmotor's EV architecture, software, and advanced battery and powertrain technology for its mass-market European brands to cut costs and boost competitiveness.

- This move would expand the existing joint venture, Leapmotor International, formed in May 2024 with Stellantis holding a 51% stake, following Stellantis's €1.5 billion investment in Leapmotor in 2023.

- The initiative is part of a strategic restructuring, driven by intense competition and efforts to save R&D costs, especially after Stellantis booked €22.2 billion in large asset impairments and charges.

- The plan faces regulatory and security hurdles, including data-protection concerns and U.S. restrictions on connected vehicles using Chinese technology.

- On February 6, 2026, Stellantis disclosed a €22–22.2 billion charge, acknowledging that its electric-vehicle (EV) rollout was premised on "overly optimistic market assumptions".

- Following this disclosure, Stellantis shares declined approximately 28% on the NYSE in a single session, representing the worst trading day in the stock's history.

- The company also suspended the 2026 dividend and placed its dividend policy under review.

- Levi & Korsinsky, LLP is investigating Stellantis concerning whether its public statements about EV programs between the Q3 2025 earnings call (October 30, 2025) and the February 6, 2026 disclosure accurately reflected the company's internal understanding.

- Stellantis has issued a "Do Not Drive" directive for approximately 225,000 older Chrysler, Dodge, Jeep, and Ram vehicles in the U.S. that still contain unrepaired Takata airbag inflators.

- The directive is an urgent safety measure to compel owners to repair these vehicles, as the defective inflators can rupture and have been linked to at least 28 U.S. deaths and hundreds of injuries.

- Stellantis has completed recall repairs on more than 6.6 million vehicles (about 95% of the recalled population) and is escalating outreach efforts to address the remaining affected vehicles.

- Stellantis is exploring a withdrawal from StarPlus Energy, its U.S. battery joint venture with Samsung SDI in Kokomo, as part of a broader effort to scale back electric-vehicle investments and preserve cash.

- This potential exit follows the recent sale of its 49% stake in a Canadian battery JV with LG for US$100.

- Analysts attribute the strategic shift to softer-than-expected U.S. EV demand and intense price competition.

- Separately, Stellantis-backed Automotive Cells Co. (ACC) has also halted plans for battery factories in Germany and Italy, underscoring a wider retrenchment in battery projects.

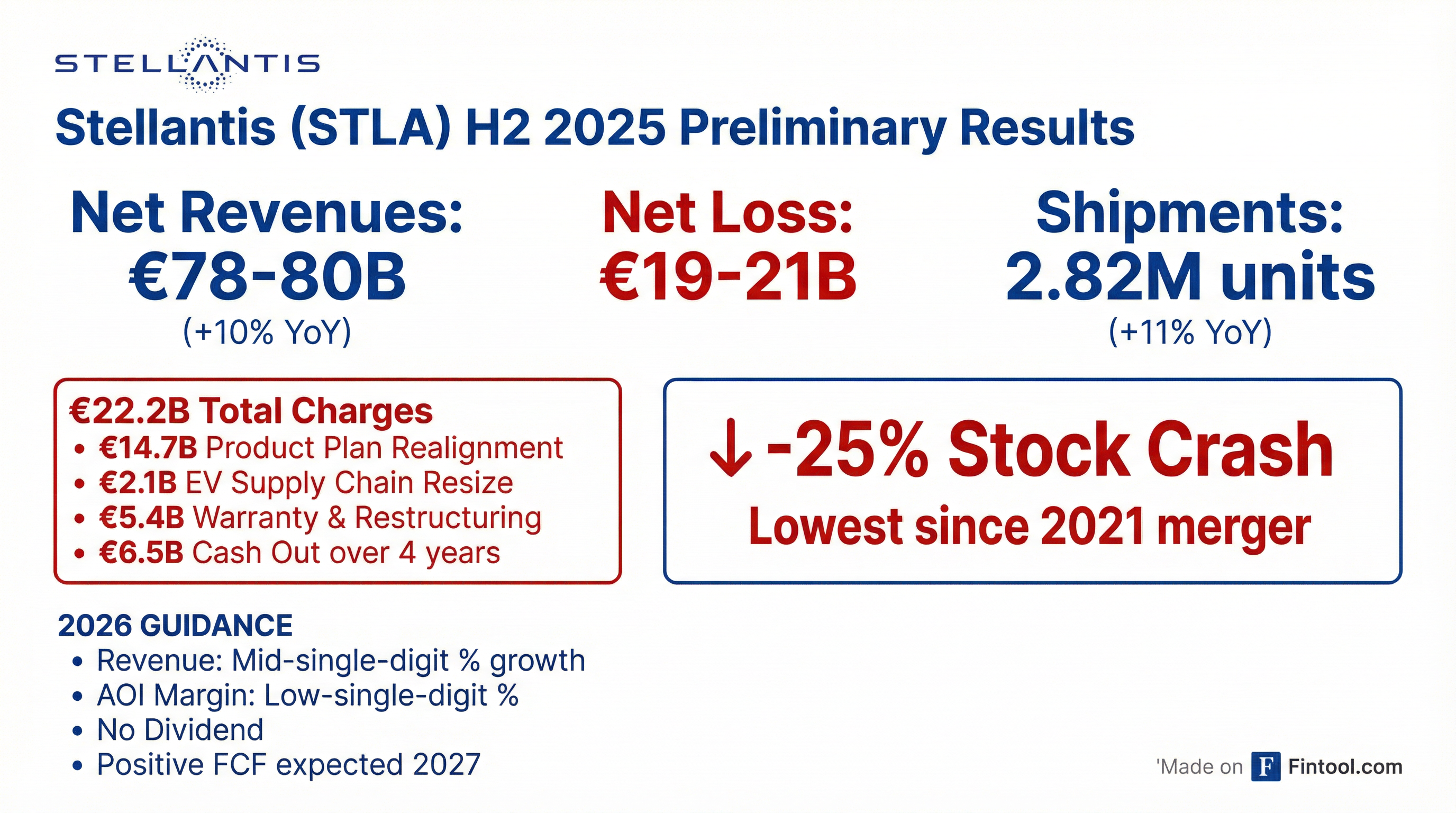

- Stellantis announced a business reset resulting in approximately €22.2 billion in charges for the second half of 2025, primarily due to re-aligning product plans and reduced expectations for Battery Electric Vehicle (BEV) products. This led to a preliminary H2 2025 Net loss of (€19) - (€21) billion, Adjusted Operating Income of (€1.2) - (€1.5) billion, and Industrial Free Cash Flows of (€1.4) - (€1.6) billion.

- Due to the 2025 Net loss, the company will not pay a dividend in 2026 and authorized the issuance of up to €5 billion in non-convertible subordinated perpetual hybrid bonds, while maintaining approximately €46 billion in Industrial available liquidity at year-end 2025.

- The company initiated 2026 guidance, projecting improvement in Net revenues, Adjusted Operating Income margin, and Industrial Free Cash Flows.

- Consolidated shipments for H2 2025 increased by 11% year-over-year to 2.8 million units, with Q4 2025 shipments up 9% year-over-year to 1.5 million units, significantly driven by North America. Additionally, Stellantis will sell its 49% equity stake in NextStar Energy to LG Energy Solution.

Fintool News

In-depth analysis and coverage of Stellantis.

Quarterly earnings call transcripts for Stellantis.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more