HORACE MANN EDUCATORS CORP /DE/ (HMN)·Q4 2025 Earnings Summary

Horace Mann Beats on EPS and Revenue as P&C Turnaround Delivers

February 4, 2026 · by Fintool AI Agent

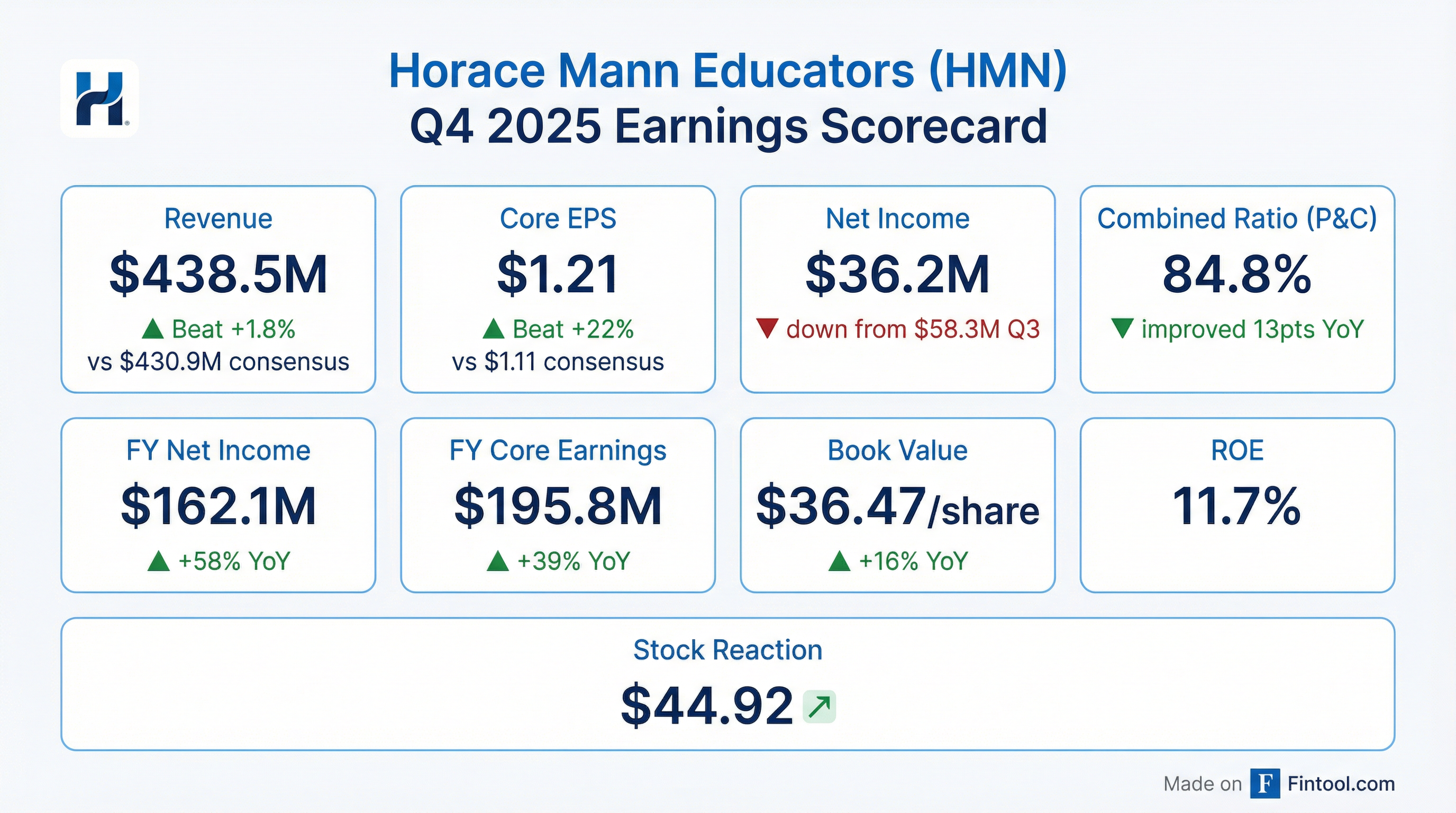

Horace Mann Educators Corporation (NYSE: HMN) delivered a double beat in Q4 2025, with core EPS of $1.21 exceeding consensus of $1.11 by 22% and revenue of $438.5M topping estimates of $430.9M by 1.8% . The educator-focused insurer capped off a strong year with its Property & Casualty segment showing a dramatic turnaround—combined ratio improved 13 points year-over-year to 84.8% .

Did Horace Mann Beat Earnings?

Yes—both EPS and revenue exceeded expectations. This marks Horace Mann's seventh consecutive quarter of EPS beats and first revenue beat after several quarters of modest misses.

The beat was driven primarily by:

- P&C underwriting improvement: Combined ratio of 84.8% vs 97.9% prior year

- Strong investment income: Net investment income of $118.0M, down slightly from $118.9M YoY

- Lower catastrophe losses: Cat impact of just 2.7% vs 2.0% prior year quarter

Full Year 2025 was a record year: Core EPS of $4.71 (+39% YoY) and ROE of 12.4%—the highest earnings Horace Mann has ever reported .

What Did Management Say?

CEO Marita Zuraitis highlighted the record performance: "In 2025, Horace Mann delivered record core earnings and strong shareholder return on equity. While P&C results meaningfully benefitted from lower catastrophe losses, underlying results across all segments are strong and in line with profitability targets. Top-line results increased across all segments, setting the stage for sustained, profitable growth in 2026 and beyond."

Zuraitis emphasized the strategic value proposition: "Our results clearly illustrate Horace Mann's ability to empower all educators to achieve lifelong financial success, while also helping employers attract and retain employees by providing more comprehensive benefits. The diversification of our business reflects our strategy to deliver consistent and reliable value to shareholders with a solid balance sheet and a compelling dividend."

What Did Management Guide for 2026?

Horace Mann provided 2026 guidance of $4.20-$4.50 core EPS, representing ~10% growth on a normalized basis .

Key assumptions in guidance:

- Cat losses normalize: 2025's $62M was unusually favorable (>1 std dev below average), so 2026 assumes a more typical $90M

- Managed portfolio NII: $385-395M, reflecting higher new money yields, 6.5% CML fund returns, and 8% LP returns

- Sound Mark Partners drag: One commercial mortgage loan fund in runoff will continue to modestly pressure CML yields

3-Year Financial Targets (from Investor Day):

- 10% average compound annual EPS growth

- 12-13% sustainable shareholder ROE

- 100-150 basis point expense ratio improvement

Expense Improvement Timeline (CFO Ryan Greenier outlined the phasing) :

What Changed From Last Quarter?

Q4 2025 showed sequential moderation after a particularly strong Q3:

The Q3-to-Q4 decline in net income reflects:

- Pension plan termination: $5.6M after-tax charge in Q4 from terminating the Horace Mann Pension Plan

- Net investment losses: $(7.1)M in Q4 vs $3.3M gain in Q3

- Seasonal normalization after an unusually favorable Q3

Despite the sequential decline, FY 2025 performance was exceptional: net income of $162.1M (+58% YoY) and core earnings of $195.8M (+39% YoY) .

What's Driving the Growth Momentum?

2025 was characterized by record sales across nearly all product lines, driven by significant distribution and marketing investments.

Record Sales Performance:

Distribution Transformation:

- Brand awareness: Rose to 35% unaided from <10% a year ago through partnerships with trusted brands like Crayola

- Points of distribution: Increased 15% across all channels, with record agent count

- Digital engagement: Website traffic and online-originated quotes more than doubled

- Customer interactions: New business customer interactions up 37% in Q4

New Initiatives:

- Get Your Teach On partnership: Reaches 800,000+ engaged educators through email, social, and live events

- Horace Mann Club: New platform offering financial wellness tools, classroom resources, and educator-specific perks

- Foundation donation: $5M to Horace Mann Educators Foundation to support student and educator success

How Did Each Segment Perform?

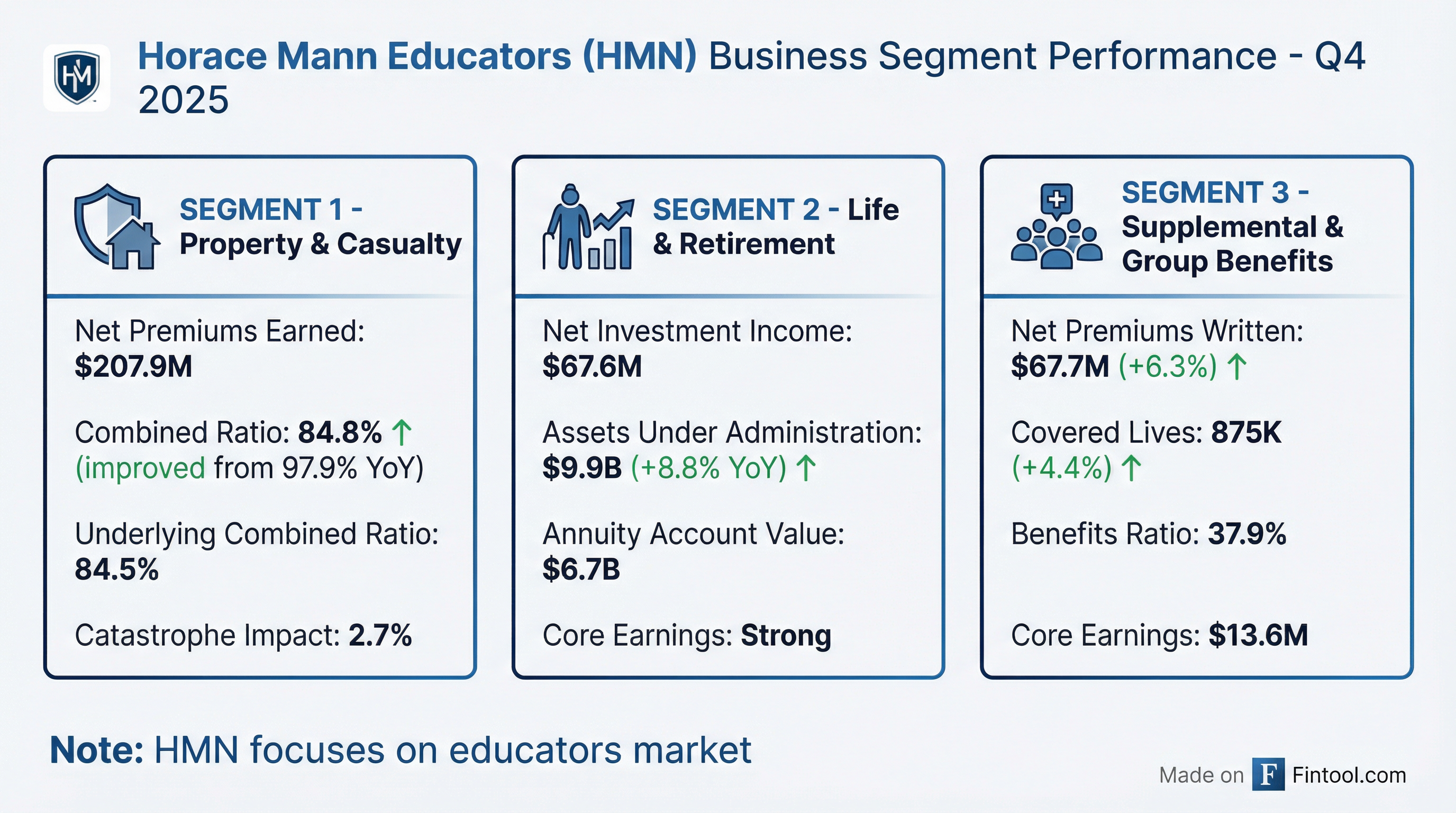

Property & Casualty — The Turnaround Story

P&C was the standout performer with a 13-point combined ratio improvement:

The P&C turnaround reflects:

- Rate adequacy: Continued pricing discipline across auto and property

- Lower catastrophe losses: Benign weather compared to elevated cats in 2024

- Favorable reserve development: 2.4% favorable vs 4.0% favorable prior year

Life & Retirement — Steady Accumulation

The Life & Retirement segment continues to grow assets under administration:

The segment benefited from market appreciation in variable annuities, with Q4 market gains of $110.0M offsetting net outflows .

Supplemental & Group Benefits — Growing Scale

The elevated benefits ratio reflects higher claims experience in group products, though the segment continues to expand its educator-focused distribution.

Full Year 2025 Performance

FY 2025 was a breakthrough year for Horace Mann:

Capital Position and Balance Sheet

Horace Mann strengthened its balance sheet in 2025:

Notable Q4 Capital Actions:

- Completed redemption of 4.50% Senior Notes due December 2025 ($249.9M)

- Terminated Horace Mann Pension Plan with $5.6M after-tax settlement charge

Investment Portfolio

The $7.3B investment portfolio remained conservatively positioned:

Investment yield (excluding LP interests) was 4.67% pretax annualized for the quarter .

What Were the Key Q&A Highlights?

On distribution initiatives (Jack Matten, BMO):

CEO Zuraitis emphasized 2025 as "probably our strongest year" for distribution. "We are at record numbers in our agency force, up over 15% where we were last year across the board. Our traditional EAs, selling our traditional products, and then benefit specialists in the supplemental and group benefits space up record numbers as well."

On accelerating EPS growth trajectory:

CFO Greenier confirmed directional thinking: "When we laid out our financial targets at Investor Day, we said we would achieve a 10% annual earnings per share growth rate, and on a normalized basis, we're on track to do that this year... we would expect accelerating top-line growth as the investments we're making to generate increased sales and revenue growth come to fruition."

On catastrophe assumptions and reserve development:

CFO Greenier was explicit about the conservatism: "We do not include any prior year development, favorable or adverse, in our planning assumptions. We have a prudent quarterly approach. We call it like we see it." He noted the industry is seeing normalization of reserve patterns post-COVID, and 2025's favorable development was primarily in "shorter tail, or physical damage type of coverages."

On early retirement offering:

CEO Zuraitis explained: "The purpose was to allow us to accelerate some workforce planning... As you know, when you think about the future, where we're going, what we've built, the skills required... is going to require us to hire some of those more future skills. This offering allowed us to accelerate some of the retirement plans of our more tenured individuals." About 8% of employees were eligible.

On capital allocation and share repurchases:

"We've put $6 million to work in the month of January alone, and we do believe that is an attractive lever for us to continue to pull as we move through 2026, especially at current multiples, given our confidence in our growth outlook." Free cash flow conversion was 80% in 2025 (exceeding targets), with 75%+ targeted for 2026.

On reinsurance renewal:

"We completed our 2026 reinsurance renewal in January with very favorable results, including a nearly 15% reduction in rate online. We used that improvement to increase the size of our property catastrophe tower, purchasing $240 million of coverage while maintaining a $35 million attachment point... total annual reinsurance spend remains flat year-over-year."

How Did the Stock React?

HMN shares traded down 1.1% to $44.42 on February 4, 2026 following the earnings release, despite the double beat. The stock opened at $43.27, fell to an intraday low of $42.07 before recovering to close near the highs of the day.

The muted reaction suggests the strong FY 2025 results were largely priced in following Q3's exceptional performance. Investors may also be discounting 2026 guidance that normalizes for catastrophe losses, resulting in headline EPS appearing flat-to-down despite underlying growth.

Ratings and Financial Strength

Horace Mann maintains solid investment-grade ratings :

Key Takeaways

- Record year: FY 2025 delivered highest-ever core EPS of $4.71 (+39%) and ROE of 12.4%

- P&C turnaround is real: Combined ratio improved 13 points YoY to 84.8%, demonstrating pricing and underwriting discipline

- Distribution transformation working: Brand awareness from <10% to 35%, distribution points +15%, website quotes doubled

- Guidance implies continued momentum: 2026 EPS of $4.20-$4.50 represents ~10% normalized growth despite cat normalization

- Expense ratio improvement phased: 25bps in 2026, accelerating to 50-75bps in 2028 as scale builds

- Capital return accelerating: $21M buybacks in 2025 (highest since 2022), $49M authorization remaining, 80% FCF conversion

- Reinsurance favorably renewed: 15% rate reduction used to increase cat tower to $240M while keeping spend flat