Earnings summaries and quarterly performance for HORACE MANN EDUCATORS CORP /DE/.

Executive leadership at HORACE MANN EDUCATORS CORP /DE/.

Marita Zuraitis

President and Chief Executive Officer

Bret Conklin

Executive Vice President, Finance Transformation

Donald Carley

Executive Vice President, General Counsel, Corporate Secretary and Chief Compliance Officer

Jennifer Thayer

Chief Human Resources Officer

Ryan Greenier

Executive Vice President and Chief Financial Officer

Stephanie Fulks

Chief Information Officer

Board of directors at HORACE MANN EDUCATORS CORP /DE/.

Research analysts who have asked questions during HORACE MANN EDUCATORS CORP /DE/ earnings calls.

John Barnidge

Piper Sandler

10 questions for HMN

Michael Zaremski

BMO Capital Markets

5 questions for HMN

Wilma Jackson Burdis

Raymond James

3 questions for HMN

Jack Matten

BMO Capital Markets

2 questions for HMN

Matt Carletti

Citizens JMP

2 questions for HMN

Wilma Burdis

Raymond James Financial

2 questions for HMN

Matthew Carletti

Citizens JMP Securities

1 question for HMN

Meyer Shields

Keefe, Bruyette & Woods

1 question for HMN

Recent press releases and 8-K filings for HMN.

- Horace Mann reported record full-year 2025 core earnings per share of $4.71 and a shareholder return on equity of 12.4%, with total revenues up 7% over the prior year.

- The company established a normalized 2025 core earnings per share baseline of approximately $3.95 for comparison.

- For 2026, Horace Mann expects core earnings per share in the range of $4.20-$4.50, representing a nearly 10% increase from the normalized 2025 baseline.

- All segments met or exceeded profitability targets, with the Property and Casualty underlying combined ratio at 84.3% and significant sales growth in Individual Supplemental (nearly 40%) and Group Benefits (33%).

- In 2025, the company deployed $21 million in share repurchases and has an additional $50 million authorization.

- For the year ended December 31, 2025, Horace Mann Educators Corporation reported total revenues of $1,701.4 million and net income of $162.1 million.

- Core earnings per share (diluted) increased to $4.71 for the full year 2025, compared to $3.40 in the prior year.

- As of December 31, 2025, total assets were $15,266.6 million, with total shareholders' equity at $1,482.7 million and book value per share at $36.47.

- The company generated total net investment income of $464.3 million for the year ended December 31, 2025, achieving an annualized pretax investment yield of 5.00%.

- The Life & Retirement segment held $5,584.1 million in invested assets as of December 31, 2025.

- Horace Mann reported record 2025 full-year core earnings per share of $4.71 and a shareholder return on equity of 12.4%.

- Total revenues and net premiums and contract deposits earned both increased 7% over the prior year in 2025, with strong sales momentum across segments, including Individual Supplemental sales up nearly 40% and Group Benefits sales up 33%.

- The company provided 2026 core earnings per share guidance in the range of $4.20-$4.50, based on a normalized 2025 core EPS of approximately $3.95.

- In 2025, Horace Mann deployed $21 million for share repurchases and has $49 million remaining on its current authorization, with an additional $6 million repurchased in January 2026.

- The company targets a 10% average compound annual growth rate in core EPS and a sustainable 12%-13% shareholder return on equity, alongside a 100-150 basis point reduction in the expense ratio over its three-year plan.

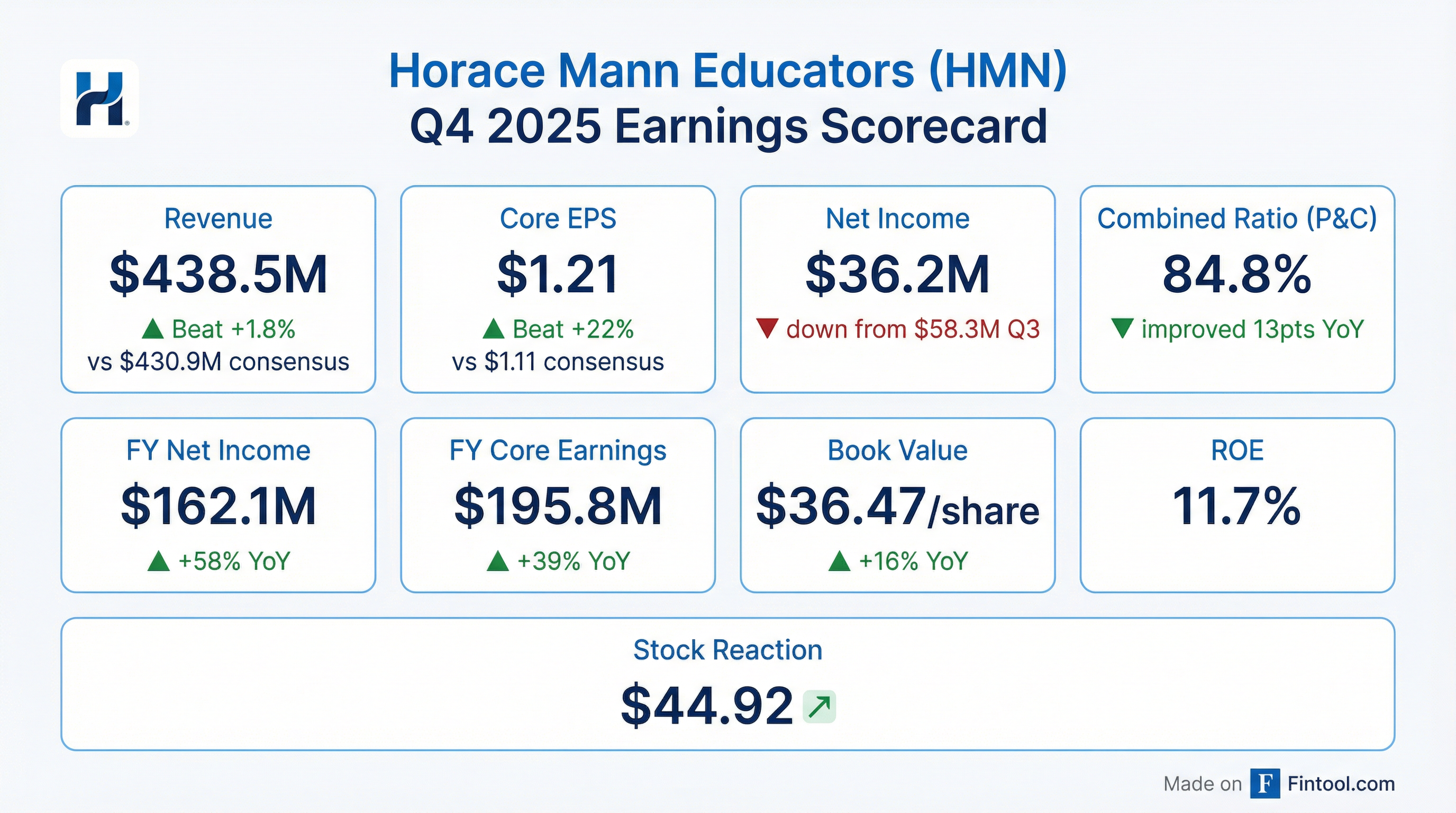

- Horace Mann Educators Corporation reported record full-year 2025 core earnings of $196 million, or $4.71 per share, and net income of $162 million, or $3.90 per share. For the fourth quarter, net income was $0.87 per share and core earnings were $1.21 per share.

- Total revenue rose nearly 7% for the full year 2025 and more than 6% for the fourth quarter, with net premiums and contract charges earned up more than 7% for the year and more than 5% for the quarter.

- The full-year Property & Casualty segment combined ratio improved more than 8 points over the prior year to 89.7%.

- At year-end 2025, reported book value was $36.47 per share and adjusted book value was $40.21 per share, with a Core ROE - LTM of 12.4%.

- Horace Mann Educators Corporation reported full-year 2025 net income of $162 million, or $3.90 per share, and record core earnings of $196 million, or $4.71 per share.

- Total revenue for the full year 2025 rose nearly 7%, and more than 6% for the fourth quarter.

- The Property & Casualty segment's full-year combined ratio improved by more than 8 points to 89.7%.

- At year-end 2025, the company's reported book value was $36.47 and adjusted book value was $40.21.

- Horace Mann reported Q3 2025 core earnings per share of $1.36 and record core earnings of $57 million. The core return on equity for the last twelve months was 13.8%.

- Total revenues for Q3 2025 increased 6% over the prior year to $439 million, with net premiums and contract charges earned up 7%. The Property & Casualty combined ratio improved by more than 10 points over the prior year to 87.8%.

- The company revised its full-year 2025 core EPS guidance to $4.50 to $4.70.

- In capital management, Horace Mann repurchased $20 million of shares year-to-date through October 31, 2025, and executed a $300 million debt offering that was over 5x oversubscribed.

- Horace Mann (HMN) reported record third-quarter 2025 core EPS of $1.36, a 64% increase over the prior year, with total revenues up 6% and a trailing 12-month core return on equity of 13.8%.

- The company raised its full-year 2025 core EPS guidance to a range of $4.50-$4.70, reflecting strong year-to-date performance and continued lower catastrophe losses.

- All business segments performed in line with or above target profitability, with individual supplemental sales increasing 40% and group benefits sales nearly doubling in the quarter.

- HMN is accelerating strategic investments in growth initiatives, including lead generation and distribution expansion, while also focusing on expense discipline and leveraging GenAI for efficiency.

- Through October 2025, the company returned $20 million to shareholders through share repurchases and $43 million through dividends, with approximately $57 million remaining on its share repurchase authorization.

- Horace Mann Educators Corp reported strong third-quarter 2025 results, with revenue of $438.5 million and adjusted earnings of $1.36 per share, both exceeding analysts' forecasts.

- The company's net income for Q3 2025 significantly increased to $58.3 million from $34.3 million in the prior year, and its property and casualty combined ratio improved to 87.8%.

- Management raised the 2025 earnings outlook to a range of $4.50 to $4.70 per share, aiming for double-digit returns on equity.

- Despite underperforming the broader S&P 500, Horace Mann's stock has seen a 12.8% gain year-to-date, driven by consistent earnings beats over the last four quarters.

- Horace Mann Educators Corporation reported record core earnings of $56.6 million, or $1.36 per share, for the third quarter ended September 30, 2025, with net income at $58.3 million, or $1.40 per share.

- Total revenue for the quarter rose 6%, and net premiums and contract charges earned increased 7%.

- The company raised its full-year 2025 core EPS guidance to a range of $4.50 to $4.70.

- The Property & Casualty segment's combined ratio improved by more than 10 points over the prior year to 87.8%.

Quarterly earnings call transcripts for HORACE MANN EDUCATORS CORP /DE/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more