HENNESSY ADVISORS (HNNA)·Q1 2026 Earnings Summary

Hennessy Advisors Q1 2026: AUM Decline Hits Revenue, But Dividend Raised for 15th Time

February 5, 2026 · by Fintool AI Agent

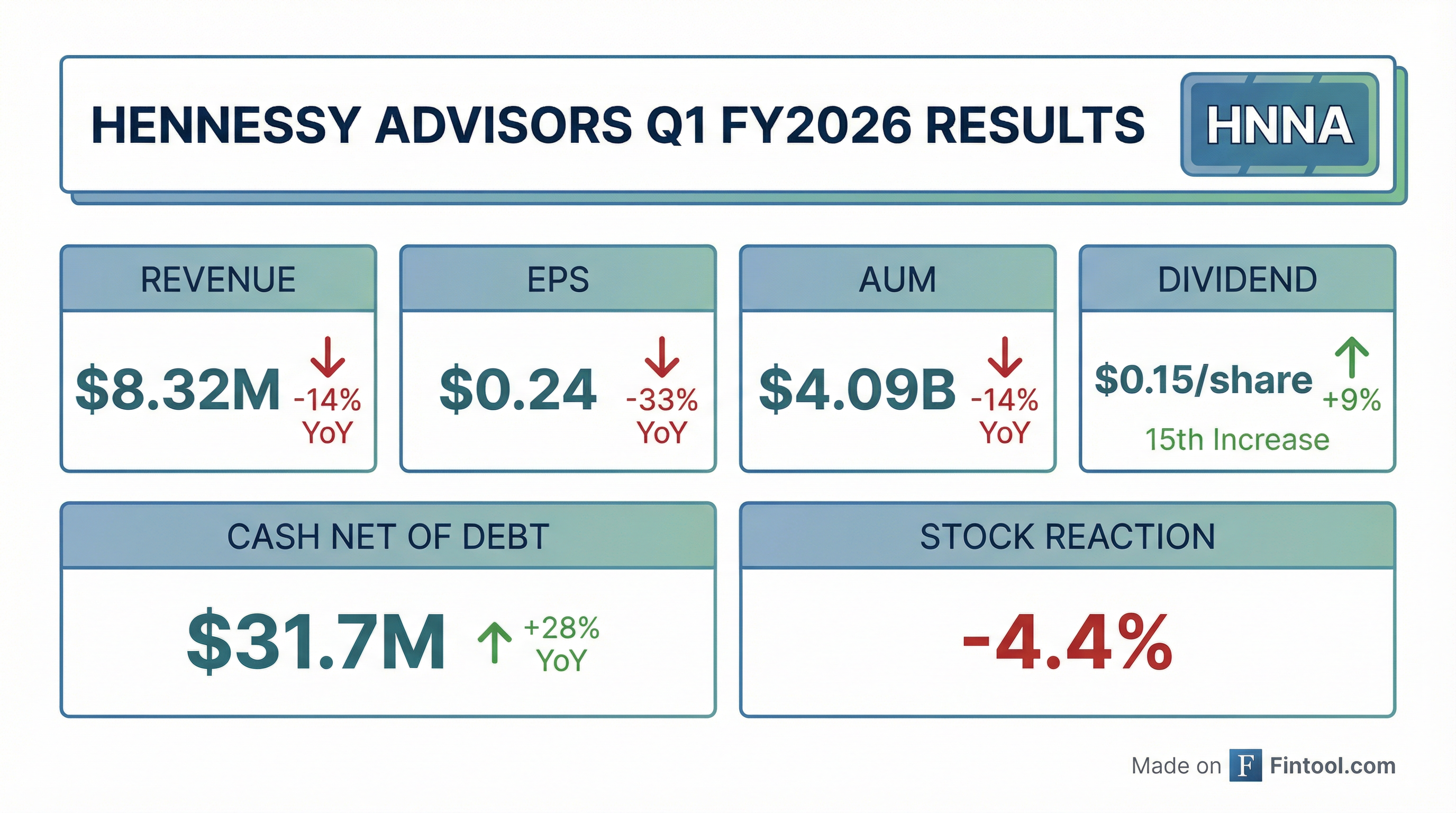

Hennessy Advisors (NASDAQ: HNNA), the Novato-based investment manager, reported Q1 FY2026 results that reflected continued headwinds from declining assets under management. Revenue fell 14% year-over-year to $8.32 million while diluted EPS dropped 33% to $0.24. However, management demonstrated confidence in the company's financial position by announcing a 9% dividend increase—the 15th consecutive quarterly raise—supported by a 28% improvement in cash net of debt.

Shares fell 4.4% on the news, closing at $9.70.

Did Hennessy Advisors Beat Earnings?

No analyst coverage. Hennessy Advisors is a small-cap asset manager ($77M market cap) with limited institutional coverage. There are no quarterly consensus estimates to compare against.

Year-over-year comparison shows notable declines:

The 14% decline in AUM directly drove the equivalent decline in revenue, as Hennessy's fee income is tied to assets under management.

What Did Management Say?

CEO Neil Hennessy struck an optimistic tone on the macro environment despite the challenging results:

"The sentiment I continue to hear is that 2025 was a 'surprisingly strong' year for the U.S. stock market. I would argue the strength of the market speaks for itself and reflects solid underlying economic fundamentals... While concerns remain around inflation, global trade tensions, and interest rates, I continue to believe in the resilience of the U.S. economy. Headlines may create volatility, but I am confident that a soft landing in 2026 remains a reasonable expectation, supported by projected GDP growth, improving earnings, and continued economic expansion."

President and COO Teresa Nilsen highlighted the balance sheet strength:

"Despite lower assets and earnings compared to the prior year, our balance sheet continues to strengthen. Cash net of debt has increased nearly 30% over the past twelve months."

"Our strong cash position is allowing us to make the strategic decision to increase our quarterly dividend to $0.15 per share. This marks our 15th dividend increase and reflects our commitment to returning capital to shareholders, while maintaining the financial strength and operational efficiency needed to act decisively when the right opportunities arise."

What Changed From Last Quarter?

*Values retrieved from S&P Global

Revenue was relatively stable quarter-over-quarter (-2%), but net income compression was more pronounced (-20%) as the company likely faced margin pressure or operating cost headwinds.

The Dividend Story

The headline from this quarter is the 15th consecutive dividend increase:

- New quarterly dividend: $0.15/share (up from $0.1375)

- Increase: 9%

- Annualized yield: 5.9% (based on $10.15 close on Feb 4)

- Payment date: March 4, 2026

- Record date: February 18, 2026

Management's willingness to raise the dividend despite declining earnings signals confidence in the cash generation profile and balance sheet. The company's cash net of debt position of $31.7 million provides significant cushion for a company with a ~$77M market cap.

How Did the Stock React?

HNNA shares fell 4.4% on earnings day, declining from $10.15 to $9.70 on volume of ~31,000 shares.

Key stock metrics:

- Current price: $9.70

- 52-week range: $8.43 - $13.19

- Market cap: $77M

- 50-day average: $9.96

- 200-day average: $10.80

The stock is trading near the lower end of its 52-week range, reflecting investor concerns about the AUM trajectory.

Historical Earnings Trend

*Values retrieved from S&P Global

After strong YoY growth in early FY2025, the trend has reversed with revenue and EPS now declining on a year-over-year basis.

Key Risks and Concerns

-

AUM trajectory: The 14% YoY decline in AUM is the primary driver of revenue headwinds. Continued outflows or market weakness would pressure the top line further.

-

Margin compression: Net income declined faster than revenue (-32% vs -14%), suggesting operating cost pressures or changing business mix.

-

Small scale: With $4B in AUM and $8M quarterly revenue, Hennessy lacks scale advantages enjoyed by larger asset managers.

-

Limited analyst coverage: The lack of institutional coverage makes the stock less visible to potential buyers.

Forward Catalysts

- Market recovery: As a long-only equity manager, rising markets would boost AUM and fee revenue

- M&A optionality: Management mentioned "maintaining the financial strength and operational efficiency needed to act decisively when the right opportunities arise" —possibly hinting at acquisition interest

- Dividend sustainability: 15 consecutive increases with 5.9% yield could attract income-focused investors

Data sources: Hennessy Advisors 8-K filed February 5, 2026, S&P Global Capital IQ