Earnings summaries and quarterly performance for HENNESSY ADVISORS.

Research analysts covering HENNESSY ADVISORS.

Recent press releases and 8-K filings for HNNA.

Hennessy Advisors, Inc. Reports Q1 2026 Earnings and Announces Dividend Increase

HNNA

Earnings

Dividends

Demand Weakening

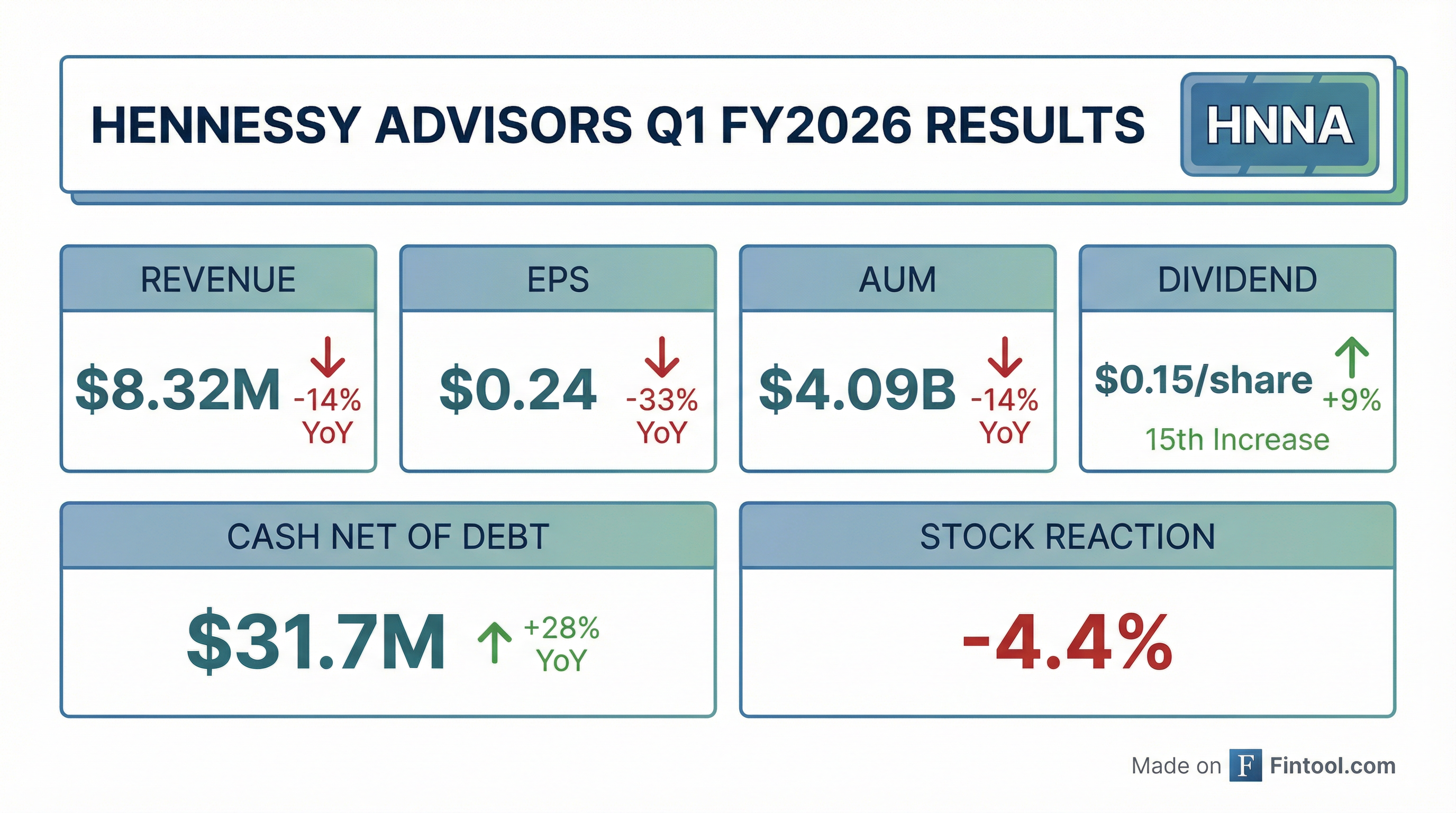

- Hennessy Advisors, Inc. reported financial results for its first fiscal quarter of 2026, which ended December 31, 2025, with total revenue of $8.3 million, net income of $1.9 million, and fully diluted earnings per share of $0.24, representing declines of 14%, 32%, and 33% respectively compared to the prior comparable quarter ended December 31, 2024.

- The company's Board of Directors declared a quarterly dividend of $0.15 per share, marking a 9% increase and the 15th dividend increase for the firm.

- Average assets under management (AUM) were $4.2 billion and total assets under management were $4.1 billion, both down 14% from the prior year.

- Cash and cash equivalents, net of gross debt, increased by 28% to $31.7 million over the past twelve months, contributing to a strengthening balance sheet.

2 days ago

Hennessy Advisors Reports Strong Fiscal 2025 Results

HNNA

Earnings

Revenue Acceleration/Inflection

Dividends

- Hennessy Advisors, Inc. reported total revenue of $35.5 million for the fiscal year ended September 30, 2025, representing a 20% increase from the prior fiscal year.

- Net income for fiscal year 2025 grew 40% to $10.0 million, and fully diluted earnings per share increased 38% to $1.27.

- Average assets under management for the fiscal year increased 22% to $4.5 billion, while total assets under management at fiscal year end decreased 9% to $4.2 billion.

- The company's cash and cash equivalents, net of gross debt, rose 36% to $32.2 million, and management affirmed its commitment to maintaining the quarterly dividend.

Dec 3, 2025, 9:15 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more