HOLOGIC (HOLX)·Q1 2026 Earnings Summary

Hologic Misses on Both Lines as Buyout Vote Looms

January 29, 2026 · by Fintool AI Agent

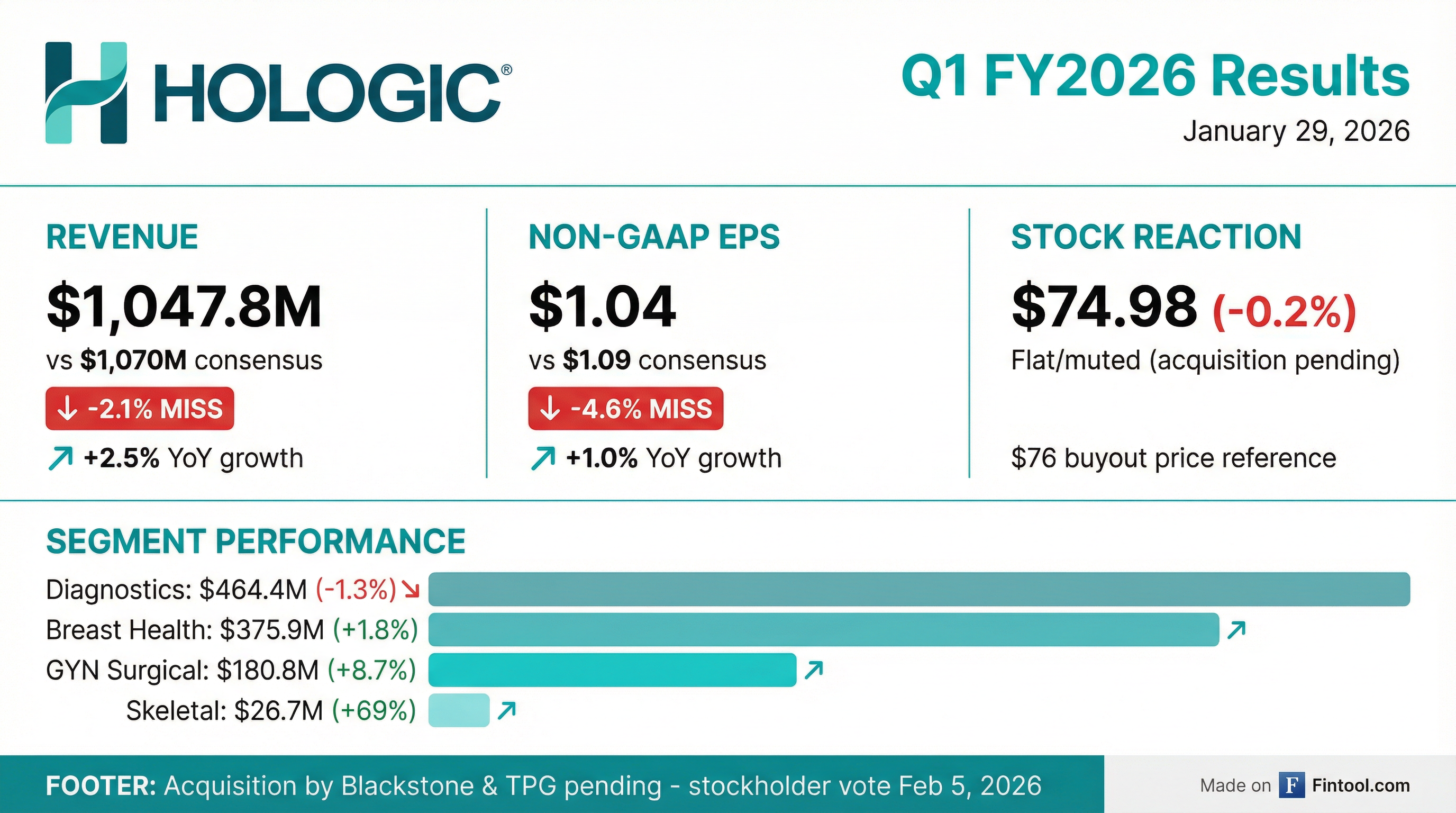

Hologic (NASDAQ: HOLX) reported fiscal Q1 2026 results that missed Wall Street expectations on both the top and bottom line, breaking a seven-quarter EPS beat streak. Revenue came in at $1,047.8 million (up 2.5% YoY), missing consensus of ~$1.07 billion by approximately 2% . Non-GAAP EPS of $1.04 missed the $1.09 consensus by nearly 5%, though it still grew 1.0% year-over-year .

The muted results came with limited investor engagement—the company did not host an earnings call and provided no forward guidance due to its pending acquisition by Blackstone and TPG . The stock closed essentially flat at $74.98, hovering just below the $76 per share buyout price as the market awaits the February 5 stockholder vote .

Did Hologic Beat Earnings?

No. Hologic missed on both metrics, ending its streak of beating EPS estimates:

The miss was driven by $15.3 million in tariff expenses that pressured gross margins, which fell 150 basis points on a non-GAAP basis to 60.1% . GAAP net income declined 10.9% to $179.1 million, primarily due to favorable foreign exchange gains in the prior year period that did not repeat .

How Did Each Segment Perform?

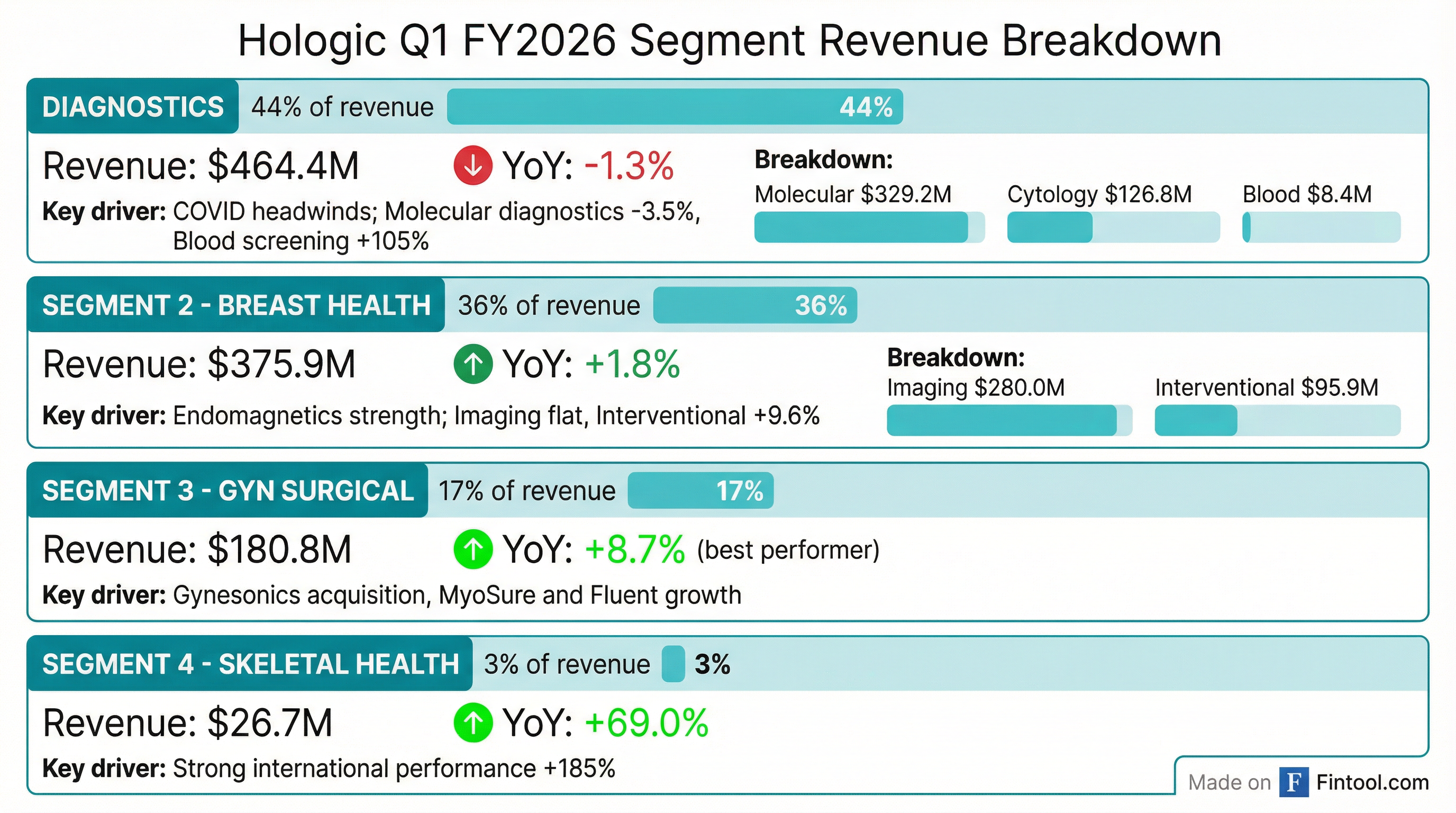

The business segments showed divergent performance, with GYN Surgical leading and Diagnostics lagging:

Diagnostics: $464.4M (-1.3% YoY)

The largest segment continued to face COVID-related headwinds:

- Molecular diagnostics fell 3.5% to $329.2M, dragged by lower COVID-19 test sales and legacy STI assays

- Excluding COVID-19 revenue, molecular diagnostics grew just 1.2% (flat in constant currency)

- Blood screening surged 105% but off a small base at $8.4M

- COVID-19 revenue totaled $28 million (assays + related), down 35.8% YoY

Breast Health: $375.9M (+1.8% YoY)

Mixed performance across sub-segments:

- Breast imaging declined 0.6% to $280.0M on weak international demand

- Interventional breast solutions grew 9.6% to $95.9M on strong Endomagnetics product sales

GYN Surgical: $180.8M (+8.7% YoY)

The standout performer, driven by:

- The acquired Gynesonics business contributing $9.1M

- Strong MyoSure and Fluent product growth

- Organic surgical (excluding Gynesonics) still grew 3.2%

Skeletal Health: $26.7M (+69.0% YoY)

Exceptional growth driven by international markets (+185.5% reported) .

What's the Status of the Acquisition?

Hologic is being acquired by affiliates of Blackstone and TPG Capital in a deal valued at up to $18.3 billion :

With the stock trading at $74.98, there's approximately 1.4% upside to the fixed cash price, plus potential CVR value. The company noted that due to the pending transaction, it is not providing FY2026 guidance and did not host an earnings call .

How Did the Stock React?

The stock closed at $74.98, down just 0.2% on the day—a muted reaction reflecting the acquisition overhang. With the $76 buyout price providing a floor, typical earnings volatility has been suppressed.

Historical Context:

- The stock is trading near its 52-week high of $75.36

- 52-week range: $51.90 - $75.36

- 50-day average: $74.81 | 200-day average: $67.55

Prior to the deal announcement, HOLX had beaten EPS estimates for seven consecutive quarters. This Q1 miss breaks that streak, though with the acquisition pending, the market focus has shifted from fundamentals to deal closing risk.

What Changed From Last Quarter?

Key changes this quarter:

- Tariff impact: $15.3M in new tariff expenses compressed gross margins

- No FX tailwind: Prior year had favorable foreign exchange gains that didn't repeat

- COVID decline continues: COVID-related revenue fell 35.8% YoY to $28M

- No investor engagement: No call or guidance due to pending acquisition

Geographic Performance

International revenue grew 4% on a reported basis but declined 1% in constant currency, highlighting FX tailwinds that partially offset organic weakness .

Balance Sheet & Cash Flow

The company maintains a strong balance sheet with net debt of just $351 million and a 0.3x leverage ratio . Cash generation remained robust with operating cash flow up 21% despite the earnings miss .

What Investors Should Watch

- February 5 stockholder vote: The key near-term catalyst—approval is expected but not guaranteed

- CVR value: Tied to Breast Health revenue targets in FY26-27; performance this quarter was modest

- Tariff trajectory: $15.3M impact this quarter could persist or worsen

- COVID-19 normalization: Now at ~$28M/quarter run rate, nearing a floor

- Deal closing conditions: Regulatory approvals and customary conditions remain

Summary

Hologic's Q1 FY2026 results were a rare miss for the women's health MedTech company, with tariffs and COVID headwinds pressuring both revenue and margins. However, with the $76 Blackstone/TPG acquisition vote just days away, these fundamentals matter less than they normally would. Investors should focus on the February 5 vote and any deal-related developments rather than quarterly operating trends.

Related: HOLX Company Profile | Q4 FY2025 Earnings | Earnings Transcript