Earnings summaries and quarterly performance for HOLOGIC.

Executive leadership at HOLOGIC.

Stephen P. MacMillan

Chairman, President and Chief Executive Officer

Anne M. Liddy

General Counsel

Brandon Schnittker

Division President, GYN Surgical Solutions

Diana De Walt

Senior Vice President, Human Resources

Essex D. Mitchell

Chief Operating Officer

Jan Verstreken

Group President, International

Jennifer M. Schneiders

President, Diagnostic Solutions

Karleen M. Oberton

Chief Financial Officer

Mark Horvath

Division President, Breast and Skeletal Health Solutions

Board of directors at HOLOGIC.

Research analysts who have asked questions during HOLOGIC earnings calls.

Anthony Petrone

Mizuho Group

4 questions for HOLX

Casey Woodring

JPMorgan Chase & Co.

4 questions for HOLX

Jack Meehan

Nephron Research LLC

4 questions for HOLX

Patrick Donnelly

Citi

4 questions for HOLX

Andrew Cooper

Raymond James

3 questions for HOLX

Puneet Souda

Leerink Partners

3 questions for HOLX

Tejas Savant

Morgan Stanley

3 questions for HOLX

Vijay Kumar

Evercore ISI

3 questions for HOLX

Andrew Brackmann

William Blair & Company, L.L.C.

2 questions for HOLX

Conor Noel McNamara

RBC Capital Markets

2 questions for HOLX

Lu Li

Scotiabank

2 questions for HOLX

Mason Carrico

Stephens Inc.

2 questions for HOLX

Michael Ryskin

Bank of America Merrill Lynch

2 questions for HOLX

Avery Kriss

Wolfe Research, LLC

1 question for HOLX

Dan Leonard

UBS Group AG

1 question for HOLX

Douglas Schenkel

Wolfe Research, LLC

1 question for HOLX

Doug Schenkel

Wolfe Research LLC

1 question for HOLX

Harrison Parsons

Stephens

1 question for HOLX

Jack Melick

Jefferies

1 question for HOLX

Joseph Conway

Needham & Company, LLC

1 question for HOLX

Kevin Joaquin

Evercore ISI

1 question for HOLX

Michael Matson

Needham & Company

1 question for HOLX

Navann Ty

BNP Paribas S.A.

1 question for HOLX

Navann Ty Dietschi

BNP Paribas

1 question for HOLX

Ryan Zimmerman

BTIG

1 question for HOLX

Tycho Peterson

Jefferies

1 question for HOLX

Recent press releases and 8-K filings for HOLX.

- Hologic’s Aptima® HPV Assay received FDA approval for clinician-collected primary HPV screening, expanding options for cervical cancer prevention.

- The test is the only FDA-approved mRNA-based HPV assay, designed to detect infections most likely to lead to cervical cancer.

- With this approval, Hologic’s cervical health portfolio now includes three guideline-recommended screening methods: Pap + HPV co-testing, Pap testing, and HPV primary screening.

- This additional indication follows clearance of the Genius® Digital Diagnostics System with the Genius® Cervical AI Algorithm.

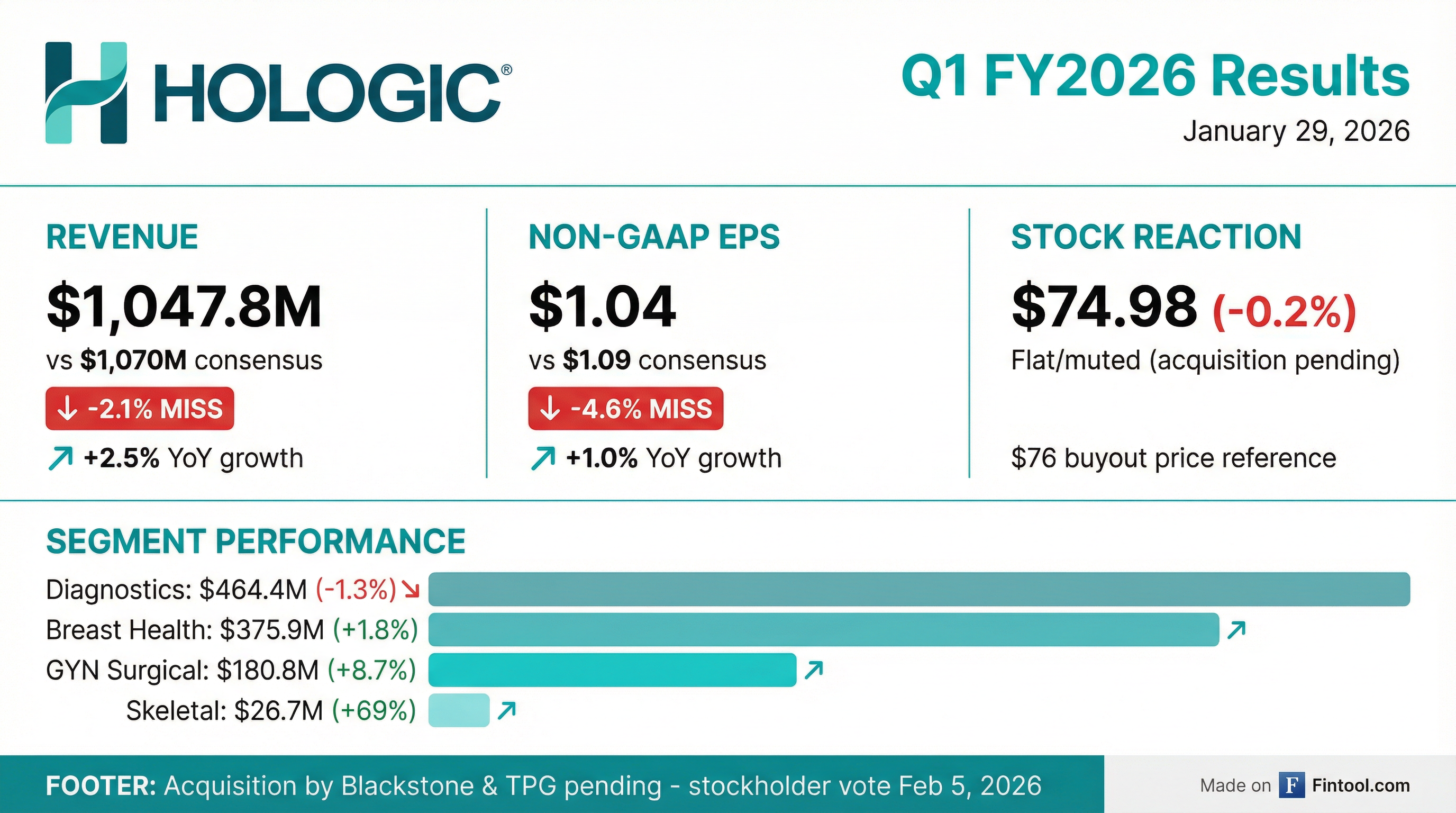

- Hologic reported revenue of $1,047.8 million, up 2.5% year-over-year for Q1 FY2026.

- GAAP diluted EPS was $0.79, a 9.2% decline, while non-GAAP diluted EPS rose 1.0% to $1.04.

- Diagnostics revenue totaled $464.4 million (-1.3%) and Breast Health revenue was $375.9 million (+1.8%).

- The company scheduled a special stockholders meeting on February 5, 2026 to vote on the merger with Blackstone and TPG.

- Cash and cash equivalents at quarter end were $2.17 billion, with an adjusted net leverage ratio of 0.3×.

- Hologic scheduled a special meeting of stockholders on February 5, 2026 to vote on adopting the merger agreement with funds managed by Blackstone and TPG.

- Revenue was $1,047.8 million, up 2.5% year-over-year; GAAP diluted EPS was $0.79, down 9.2%, and non-GAAP diluted EPS was $1.04, up 1.0%.

- Diagnostics revenue declined to $464.4 million (−1.3%), Breast Health rose to $375.9 million (+1.8%), and Surgical reached $180.8 million (+8.7%).

- Operating cash flow increased 21.4% to $229.9 million; the company ended the quarter with $2.17 billion in cash and an adjusted net leverage ratio of 0.3×.

- Hologic is supplementing its definitive proxy statement to address class action lawsuits and demand letters alleging omissions in its merger-related disclosures under the pending Blackstone/TPG acquisition.

- Goldman Sachs’ illustrative DCF analysis, using discount rates of 8.5%–10.5% and perpetuity growth of 2.0%–3.0%, implies a per-share valuation range of $66.67–$99.09.

- The voluntary recall and extended stop-ship of Brevera 9 Gauge Needles, which accounted for ~4.7% of fiscal 2025 Breast Health revenue, may pressure fiscal 2026 results and reduce the CVR net present value below $2.54 per right.

- Hologic reached a product-liability settlement for BioZorb marker claims, fully covered by insurance, resulting in no expected Company liability.

- Former Louisiana Attorney General Charles C. Foti, Jr. and Kahn Swick & Foti are investigating whether the proposed sale of Hologic, Inc. to funds managed by Blackstone and TPG provides adequate consideration and followed a fair process.

- Under the deal, Hologic shareholders would receive $76.00 per share in cash plus a non-tradable contingent value right of up to $3.00 per share paid in two installments of up to $1.50 each.

- KSF is soliciting shareholders who believe the transaction undervalues the company to discuss their legal rights at no cost or obligation.

- Halper Sadeh LLC is investigating Hologic, Inc.’s sale to funds managed by Blackstone and TPG for potential securities-law violations and fiduciary breaches.

- Under the proposed transaction, shareholders will receive $76.00 per share in cash plus a non-tradable contingent value right of up to $3.00 per share in two payments of $1.50 each.

- Shareholders are urged to contact Halper Sadeh LLC promptly to discuss enforcement of their rights; the firm will handle matters on a contingent fee basis.

- The firm may seek increased consideration, additional disclosures, or other relief and benefits on behalf of shareholders.

- Monteverde & Associates PC is investigating Hologic’s $13.4 billion sale to funds managed by Blackstone and TPG, under which shareholders will receive $76.00 per share in cash plus a contingent value right of up to $3.00 per share in two $1.50 payments.

- The alert is offered at no cost or obligation, backed by a Top 50 securities class action firm based in New York City.

- The firm is simultaneously probing related M&A deals for MidWestOne (0.3175 share exchange ratio), Nicolet Bankshares, and American Water’s merger with Essential Utilities (resulting in ~69% ownership).

- Hologic’s Genius™ Digital Diagnostics System achieved expanded CE marking in the EU to image and review both cell and tissue specimens using whole slide imaging.

- The upgrade allows European labs to unify their digital pathology workflows on a single platform, aiming to reduce operational costs and turnaround times.

- The expansion includes new software features—remote support, LIS readiness and advanced review tools—to enhance diagnostic efficiency.

- Whole slide imaging remains unavailable in the United States; commercialization details will be announced by country.

- Hologic reported Q4 revenue of $1,049.5 million, up 6.2% year-over-year; GAAP diluted EPS of $0.83, up 9.2%, and non-GAAP diluted EPS of $1.13, up 11.9%.

- On October 21, 2025, Hologic agreed to be acquired by funds managed by Blackstone and TPG in a transaction valued at up to $79 per share.

- By segment, Diagnostics revenue was $454.1 million (+2.4%), Breast Health revenue was $393.7 million (+4.8%), and Surgical revenue was $172.5 million (+10.2%).

- Operating cash flow was $355.1 million in the quarter and cash and cash equivalents ended at $1.96 billion; the company has withdrawn its FY2026 guidance due to the pending acquisition.

- Hologic recorded $1.0495 B in Q4 2025 revenue, up 6.2% year-over-year, and delivered $1.13 non-GAAP diluted EPS, up 11.9%.

- Non-GAAP operating margin expanded 120 bps to 31.2% in Q4 2025.

- Organic revenue excluding COVID-19 assays reached $998.6 M, growing 6.2% on a constant-currency basis.

- The company announced it will be acquired by Blackstone and TPG for $76 per share in cash plus a contingent value right of up to $3, with closing expected in H1 2026.

- Hologic ended Q4 2025 with $2.2 B in cash and investments and a net leverage ratio of 0.4×, providing strategic flexibility.

Fintool News

In-depth analysis and coverage of HOLOGIC.

Quarterly earnings call transcripts for HOLOGIC.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more