Earnings summaries and quarterly performance for Medtronic.

Executive leadership at Medtronic.

Geoffrey S. Martha

Chief Executive Officer

Brett A. Wall

Executive Vice President and President, Neuroscience Portfolio

Harry S. Kiil

Executive Vice President and President, Cardiovascular Portfolio

Michelle Quinn

General Counsel and Corporate Secretary

Que Dallara

Executive Vice President and President, Diabetes

Thierry Piéton

Chief Financial Officer

Board of directors at Medtronic.

Craig Arnold

Lead Independent Director

Elizabeth G. Nabel, M.D.

Director

Gregory P. Lewis

Director

John P. Groetelaars

Director

Joon S. Lee, M.D.

Director

Kendall J. Powell

Director

Kevin E. Lofton

Director

Lidia L. Fonseca

Director

Randall J. Hogan, III

Director

Scott C. Donnelly

Director

William R. Jellison

Director

Research analysts who have asked questions during Medtronic earnings calls.

Travis Steed

Bank of America

9 questions for MDT

Vijay Kumar

Evercore ISI

8 questions for MDT

Joanne Wuensch

Citigroup Inc.

6 questions for MDT

Larry Biegelsen

Wells Fargo & Company

6 questions for MDT

Patrick Wood

Morgan Stanley

6 questions for MDT

Shagun Singh Chadha

RBC Capital Markets

6 questions for MDT

Robert Marcus

JPMorgan Chase & Co.

5 questions for MDT

Matthew Miksic

Barclays PLC

4 questions for MDT

Pito Chickering

Deutsche Bank

4 questions for MDT

Robbie Marcus

JPMorgan Chase & Co.

4 questions for MDT

Danielle Antalffy

UBS Group AG

3 questions for MDT

Lawrence Biegelsen

Wells Fargo

3 questions for MDT

Anthony Petrone

Mizuho Group

2 questions for MDT

Chris Pasquale

Nephron Research LLC

2 questions for MDT

Danielle Antalffy

UBS

2 questions for MDT

Joshua Jennings

TD Cowen

2 questions for MDT

Matthew Taylor

Jefferies

2 questions for MDT

Matt Miksic

Barclays Investment Bank

2 questions for MDT

Matt Taylor

Jefferies & Company Inc.

2 questions for MDT

Christopher Pasquale

Nephron Research

1 question for MDT

David Rescott

Baird

1 question for MDT

Matt Miksich

Barclays

1 question for MDT

Matt O'Brien

Piper Sandler Companies

1 question for MDT

Mike Kratky

Leerink Partners

1 question for MDT

Richard Newitter

Truist Securities

1 question for MDT

Recent press releases and 8-K filings for MDT.

- MiniMed Group, Inc. (Nasdaq: MMED) began trading today on the Nasdaq Global Select Market under the ticker MMED.

- The IPO was oversubscribed and represents the second largest IPO in Medtech history.

- The spin-off positions MiniMed as a standalone company to operate with greater agility and supports Medtronic’s strategy to focus on long-term value creation.

- Geoff Martha, Medtronic’s CEO, highlighted the achievement despite challenging market conditions and congratulated the MiniMed leadership team.

- MiniMed priced its IPO of 28,000,000 shares at $20.00 each, kicking off trading on Nasdaq Global Select Market under “MMED” on March 6, 2026, with closing expected March 9, 2026.

- Underwriters have a 30-day option for up to 4,200,000 additional shares, and Medtronic is expected to retain ~90.03% ownership (or 88.70% if the over-allotment is fully exercised) post-offering.

- Net proceeds will support general corporate purposes, repay intercompany debt, and serve as consideration for assets transferred from Medtronic.

- MiniMed Group priced an IPO of 28 million shares at $20.00 per share, set to begin trading on Nasdaq under the ticker MMED on March 6, 2026.

- Underwriters received a 30-day option to purchase up to 4.2 million additional shares, and Medtronic is expected to hold 90.03% of MiniMed (or 88.70% if the over-allotment option is fully exercised) post-offering.

- The offering is expected to close on March 9, 2026, with net proceeds earmarked for general corporate purposes, repayment of intercompany debt, and additional consideration to Medtronic.

- Medtronic launched its MiniMed Go Smart MDI system integrating the InPen™ smart insulin pen and Simplera™ sensor into a single mobile app, with rollout across Europe beginning February 2026.

- The system delivers real-time actionable insights, missed-dose alerts, an advanced dose calculator and continuous guidance to support multiple daily injection (MDI) therapy adherence.

- New CareLink Clinic MDI reports provide clinicians with clinical and behavioral insights from patient data, enhancing the efficiency of patient consultations.

- The system is CE-marked for insulin-requiring patients aged 7 and older (and ages 2–6 under caregiver supervision); integration with Abbott’s Instinct Go™ sensor is pending CE approval.

- MiniMed Group, a Medtronic subsidiary, launched its IPO roadshow offering 28,000,000 shares at an expected price of $25.00–$28.00 per share, plus a 30-day option for an additional 4,200,000 shares.

- Shares are planned to list on Nasdaq Global Select Market under the symbol “MMED,” with Medtronic retaining approximately 90.03% post-IPO (or 88.70% if over-allotment is exercised).

- Proceeds will fund general corporate purposes and repay intercompany debt to Medtronic, with any remainder as consideration for transferred assets.

- Goldman Sachs, BofA Securities, Citigroup and Morgan Stanley are leading the offering as active bookrunners.

- Medtronic’s MiniMed diabetes unit filed to list on Nasdaq under ticker MMED, offering 28 million shares at $25–$28 to raise up to $784 million, targeting a $7.86 billion valuation.

- Medtronic would retain about 90% of voting power post-IPO (90.03%, or 88.70% if the over-allotment is exercised).

- The IPO is the first step in Medtronic’s strategy to spin off its Diabetes segment via an IPO and split-off, with full separation expected within months to 18 months.

- Lead underwriters are Goldman Sachs, BofA Securities, Citigroup and Morgan Stanley, supported by a broader syndicate of joint managers and co-managers.

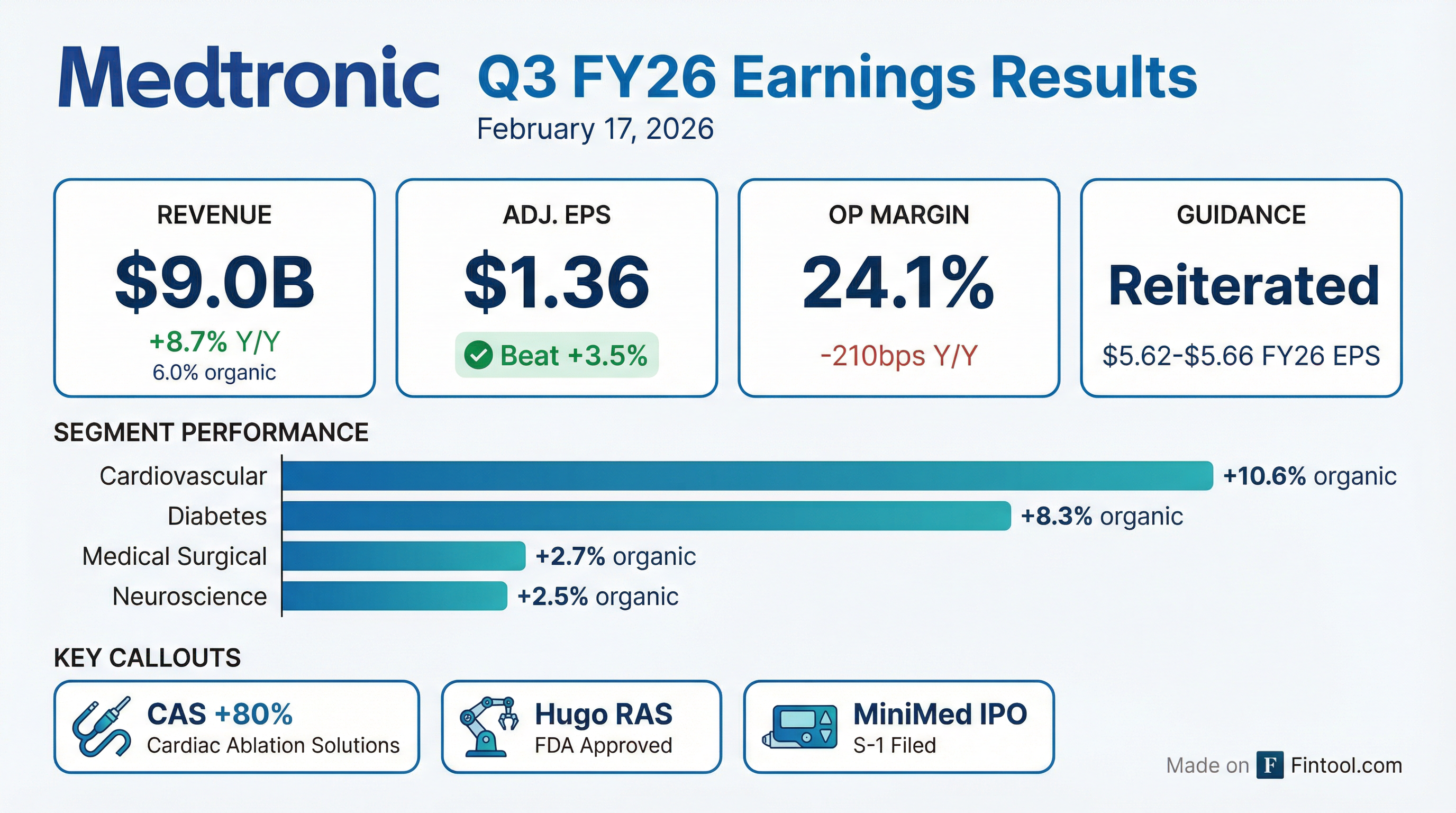

- Medtronic reported Q3 FY26 revenue of $9 billion, up 8.7% reported and 6% organic, with adjusted EPS of $1.36, driven by double-digit growth in CRM and 80% growth in CAS.

- The company continues to advance its pipeline and launches, including direct-to-consumer Symplicity Spyral for hypertension, UltraViva for urge urinary incontinence, the Hugo surgical robot (first U.S. installations completed), and FDA-cleared Stealth AXiS navigation and robotics for spinal procedures.

- It reiterated FY26 organic revenue growth guidance of ~5.5% and maintained EPS guidance of $5.62–$5.66, while targeting high single-digit EPS growth for FY27 despite tariff headwinds and planned investments.

- Medtronic is pursuing targeted M&A and venture investments, highlighted by the CathWorks and CRDN acquisitions and a strategic minority investment in Anteris for structural heart, to bolster its digital and procedural ecosystems.

- Medtronic delivered $9 billion in Q3 revenue, up 8.7% reported and 6% organic; adjusted gross margin was 64.9%, and adjusted EPS was $1.36, beating by $0.03. FY 2026 organic revenue growth guidance of ~5.5% and Q4 growth of ~6%, with full-year EPS guidance maintained at $5.62–$5.66.

- Cardiovascular portfolio grew 11% YoY (13% in the U.S.) with CAS up 80% (PFA representing 80% of CAS revenue); CRM contributed 15% of total revenue and grew 5%, driven by Micra, CSP Lead, and Aurora EV-ICD.

- Key product launches include the PFA Affera Sphere-9 catheter, which gained four points of share in a $13 billion+ market; CE mark on Sphere-360 with a U.S. pivotal trial initiated; and first U.S. cases of the Hugo surgical robot completed in February 2026.

- Executing targeted bolt-in M&A with CathWorks and Anteris to strengthen high-growth franchises; MiniMed diabetes business separation via a two-step IPO and split remains on track for end-CY 2026.

- Medtronic delivered Q3 revenue of $9.0 billion, up 8.7% reported and 6% organic, with adjusted EPS of $1.36, beating guidance by $0.03.

- The cardiovascular portfolio grew 11% year-over-year; cardiac ablation solutions (CAS) revenue surged 80%, with pulsed field ablation (PFA) accounting for 80% of CAS, and cardiac rhythm management rose 5%.

- Key product milestones include nearly 200% PFA growth worldwide, first U.S. installations of the Hugo surgical robot, FDA clearance of the Stealth AXiS navigation/robotics platform, and early launches/submissions for Sphere-9, Symplicity Spyral, and Altaviva.

- Reiterated FY 2026 organic revenue growth guidance of ~5.5% and Q4 growth of ~6%, full-year EPS guidance of $5.62–$5.66, and a target of high single-digit EPS growth for FY 2027.

- Revenue of $9.0 billion, up 8.7% reported and 6.0% organic; adjusted EPS of $1.36 beat expectations by $0.03.

- Strong segment performance: cardiovascular revenue grew 11% (U.S. up 13%) with CAS up 80% and mid-single-digit growth in the rest of the portfolio; CRM + 5%; MedSurg + 3%; MiniMed diabetes business + 15% reported (+ 8% organic).

- Key product milestones: Symplicity Spyral and UltraViva launches are building market with a 50x increase in website visits; Hugo surgical robot cleared and first U.S. installations completed; Stealth AXiS navigation/robotics system cleared for spine.

- Reiterated FY2026 guidance: organic revenue growth ~ 5.5% and EPS of $5.62–$5.66; Q4 growth expected ~ 6%; targeting high single-digit EPS growth in FY2027 with margin expansion ex-tariffs.

Fintool News

In-depth analysis and coverage of Medtronic.

Quarterly earnings call transcripts for Medtronic.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more